IPOR: The Leading Interest Rate Swap Protocol in DeFi, Could It Become the Next "Pendle"?

TechFlow Selected TechFlow Selected

IPOR: The Leading Interest Rate Swap Protocol in DeFi, Could It Become the Next "Pendle"?

History does not repeat itself simply, but it rhymes.

Author: TechFlow

With the approval of Bitcoin ETFs, the crypto market is moving faster into the mainstream. This not only attracts attention from traditional finance (TradFi), but also brings unprecedented opportunities to DeFi — as the two worlds gradually converge, new capital inflows and market opportunities are waiting to be tapped.

Among them, opportunities in real-world assets (RWA) are already emerging. What other sectors deserve attention? Interest rate swaps might be an overlooked opportunity.

Most crypto users care about how to pursue high yields in DeFi while effectively managing risks from volatility; interest rate swaps are exactly such a financial tool, allowing people to manage uncertainty in borrowing and lending rates.

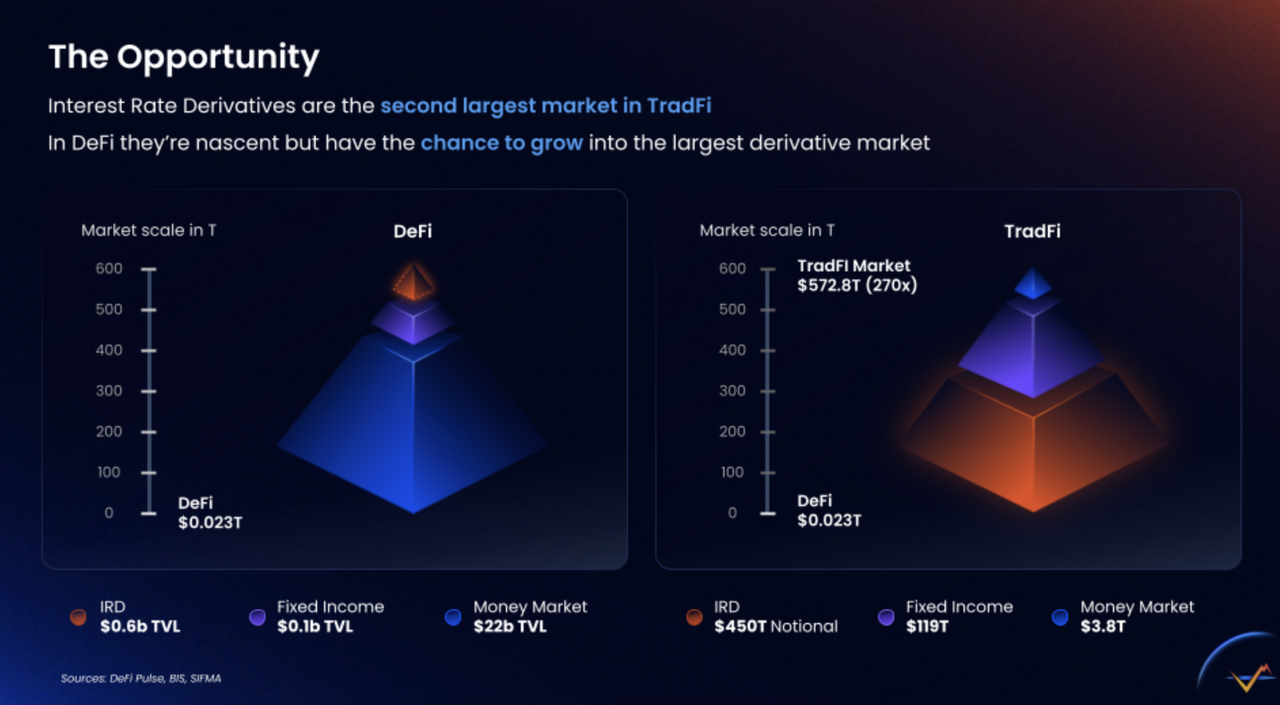

Here’s a lesser-known fact: the interest rate swap market is the second-largest financial derivatives market globally, operating with great maturity; in contrast, this market remains a blue ocean in DeFi.

IPOR is currently the only interest rate swap protocol in the crypto space, bringing a critical market mechanism from traditional finance into DeFi; it provides the IPOR index and related interest rate derivatives, offering stability for fixed-income participants in DeFi and enabling them to effectively hedge against interest rate fluctuations.

Focusing on or participating in leading projects within a sector often allows early capture of greater returns; however, the concept of "interest rate swaps" is a specialized financial term that presents a learning barrier, making it difficult for average readers to quickly grasp, let alone implement or research.

Therefore, in this article, we will break down IPOR and the function of interest rate swaps in simple terms, fully exploring this pioneering financial instrument in DeFi and uncovering its untapped value.

Interest Rate Swap Market: Bringing More Liquidity Into DeFi

So, what exactly is an interest rate swap?

You can simply understand it as a risk management strategy that allows individuals to exchange their borrowing interest rate conditions to cope with uncertain future market rate changes.

If it still seems confusing, consider this more relatable example.

Alice and Bob are both coffee shop owners, but they pay rent differently. Alice's rent fluctuates with the market—soaring during good economic times and possibly dropping during downturns—while Bob pays a fixed rent regardless of market conditions.

Facing potential economic volatility, Alice worries her rent may skyrocket, increasing costs, while Bob fears he won’t reduce expenses if rents fall.

To control the impact of potential rent changes, they decide to perform a “swap.”

In this “swap,” Alice agrees to pay Bob a fixed rent amount, while Bob agrees to pay a variable amount tied to market rent.

Thus, if market rents rise, Alice avoids extra costs because she has locked in a lower fixed price; similarly, if market rents fall, Bob’s total payment decreases since he now bears the variable cost.

Now, let’s connect this story to interest rate swaps in financial markets:

-

Alice and Bob’s “rent” is essentially the “interest rate” in financial markets.

-

Their respective concerns about rising or falling costs reflect market participants’ worries over future interest rate fluctuations.

-

By “swapping” rent, they are effectively conducting an interest rate swap—locking in a stable cash flow to hedge against future interest rate uncertainty.

In traditional finance, interest rate swaps allow borrowers with floating-rate loans to exchange rates with those holding fixed-rate loans. Such agreements enable each party to choose a more suitable interest rate model based on their outlook for market development and risk tolerance.

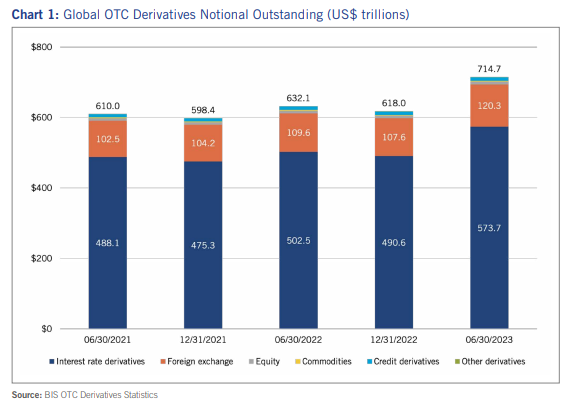

In traditional finance, this market is mature and massive.

According to the Bank for International Settlements (BIS) 2023 report on over-the-counter derivatives markets, the notional amount of outstanding interest rate derivatives reached $573.7 trillion by mid-2023—the largest segment in global financial derivatives—highlighting its widespread adoption.

But in DeFi, the interest rate swap market faces a vast blue ocean.

According to DeFi Pulse, all interest rate swap products combined have a total TVL of just $600 million in DeFi—a relatively small portion. Most current DeFi products focus on fixed income and money markets (short-term lending).

In other words, the interest rate derivatives market in DeFi is still in its infancy. A financial instrument with proven principles widely used in traditional finance has clearly passed market tests; given that DeFi lending rates are more volatile and capital efficiency is paramount, there is a strong need for proper risk management and yield-balancing tools. The interest rate swap market undoubtedly holds immense potential in DeFi.

Therefore, IPOR aims to seize this opportunity, promoting DeFi’s evolution toward a new level of financial maturity.

In the DeFi market, IPOR plays a similar role. It offers a transparent and trustworthy platform where Alice (users seeking stable borrowing costs) and Bob (users willing to take on interest rate risk for potentially higher returns) can conduct interest rate swaps.

Notably, IPOR’s name itself reflects its ability and intention to bring popular traditional financial derivative instruments into DeFi:

The name IPOR (Inter Protocol Over-block Rate) draws inspiration from key traditional financial indices like LIBOR (London Interbank Offered Rate) and SOFR (Secured Overnight Financing Rate), adapting them to the DeFi environment.

The “Block” in IPOR signifies on-chain, block-by-block data collection, reflecting market rates in near real-time.

With IPOR, you can not only deposit, stake, and earn yields, but also use your crypto assets for borrowing, enjoying optimal interest rate combinations ranging from fixed to leveraged rates. Additionally, through IPOR’s natively DeFi-based interest rate derivatives trading, you can effectively hedge, speculate, or arbitrage against DeFi borrowing rates.

From Complex to Simple: Quickly Understanding IPOR’s Product Structure

However, interest rate swaps remain quite complex for general beginners.

IPOR simplifies the complex interest rate swap mechanism into three elements easily understood by DeFi users: market index, AMM pools, and smart contracts.

-

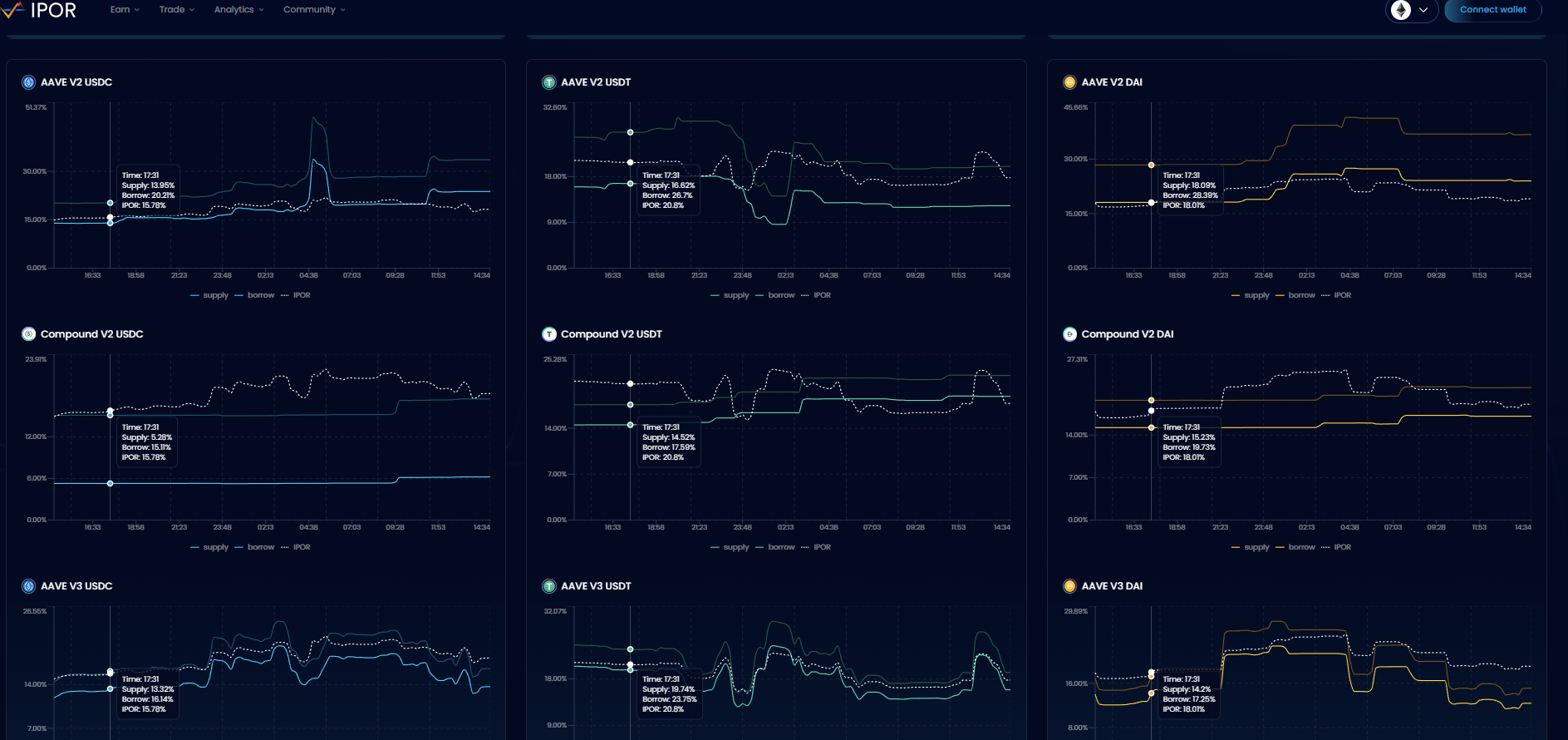

IPOR Index: Creating a “benchmark rate” for crypto assets, capturing DeFi’s “heartbeat”

An interest rate swap requires a “reference point” as a benchmark.

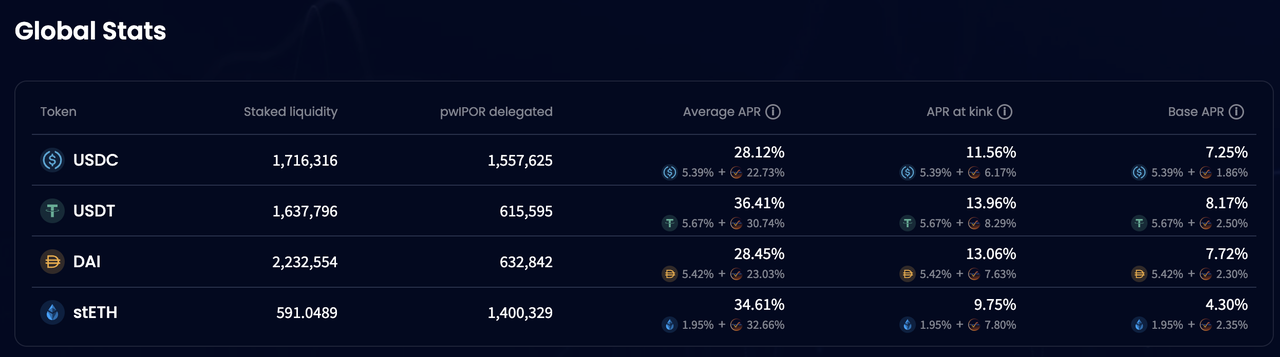

The IPOR index provides a transparent, on-chain data-based benchmark rate, guiding users in lending or derivatives trading. Similar to traditional benchmarks like LIBOR or SOFR, the IPOR index provides risk-free rates for various crypto assets (currently supporting stETH, USDT, USDC, and DAI), with regular updates reflecting the latest market conditions.

Since IPOR index data comes in real time from different DeFi lending protocols like Compound and Aave, its transparency is assured. The IPOR index, calculated from multiple rate sources, acts like a “heartbeat” for DeFi:

Just as a heartbeat reflects vital activity, the IPOR index, as a benchmark rate, captures real-time changes in funding costs across the DeFi market.

It aggregates data from various DeFi protocols, giving users a clear and reliable reference point to make informed lending and investment decisions based on real-time market conditions.

-

Liquidity Pools: Providing an Interest Rate Swap Venue via AMM

With a benchmark index established, the next step is finding a place to conduct interest rate swap trades based on market conditions, earning returns and managing risk.

IPOR provides liquidity pools for crypto assets such as stablecoins and liquid staking tokens to serve this purpose.

To understand how IPOR facilitates interest rate swaps, it’s key to grasp its “Request for Quote” (RFQ) automated market maker (AMM).

Liquidity pools and AMMs together form a collective counterparty for trades. LPs (liquidity providers) earn returns from deposits and liquidity mining by serving as counterparties; meanwhile, users can select whether to receive or pay a fixed rate within specific pools, using quantitative models and fair-value pricing mechanisms that dynamically adjust quotes based on historical data.

In interest rate swaps, “receive fixed” and “pay fixed” represent two fundamental trading positions. Choosing “receive fixed” means receiving a fixed rate while paying a floating rate; conversely, “pay fixed” means paying a fixed rate and receiving a floating rate.

This way, whether borrowers wanting to lock in future costs or investors seeking high-yield opportunities, everyone can find suitable swap options matching their needs, managing risk or pursuing returns.

According to IPOR’s official governance roadmap and proposals, it plans to add eETH and USDM liquidity pools in March, expanding the range of assets available for interest rate swaps; USDe and uniETH are also under consideration.

-

Smart Contracts: Ensuring Automated and Transparent Execution of Interest Rate Swaps

Smart contracts are easier to understand—they create derivative agreements between market participants and liquidity pools based on IPOR rates and AMM pricing, defining rules such as fees, maturity dates, and stakeholders, then distributing corresponding returns upon contract completion.

Overall, the IPOR index provides the benchmark rate, AMM liquidity pools provide counterparties and venues for swaps, and smart contracts ensure automatic and orderly execution—an interest rate swap product in the DeFi world is now fully built.

Continuous Improvement: IPOR’s Path Toward User Growth

Our next key question is: how is IPOR performing so far? What initiatives attract user participation and usage?

-

Attracting Liquidity: Liquidity Mining and Yield Acceleration

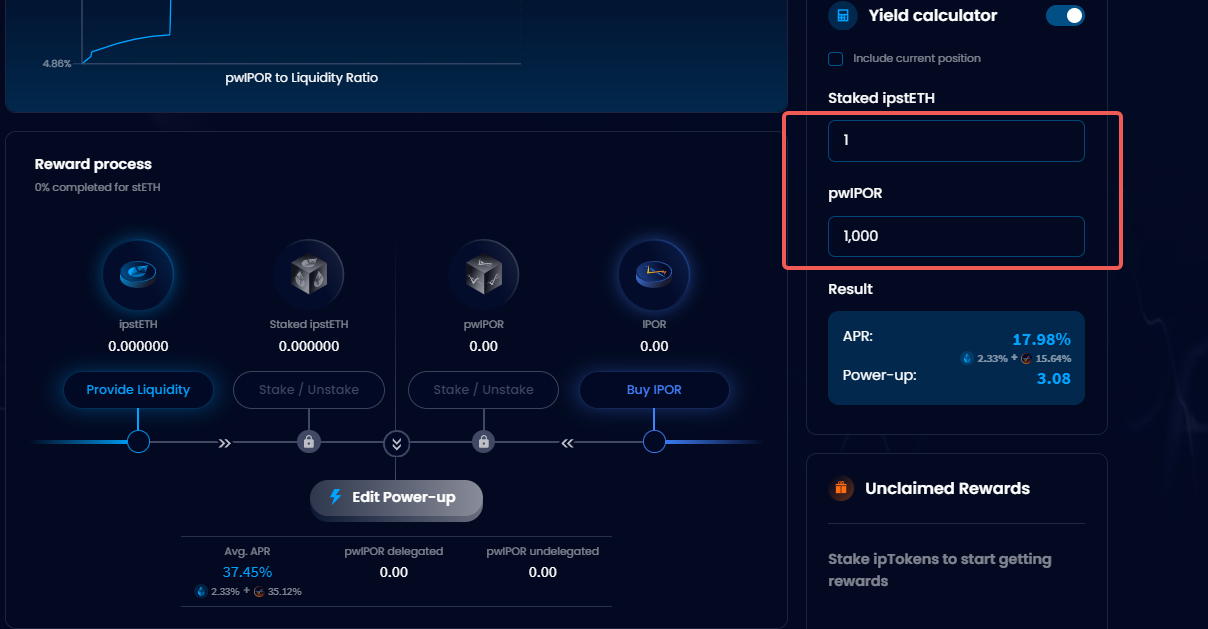

For incentivizing liquidity provision, IPOR follows the classic DeFi approach—liquidity mining.

As early as January last year, IPOR launched its liquidity mining feature.

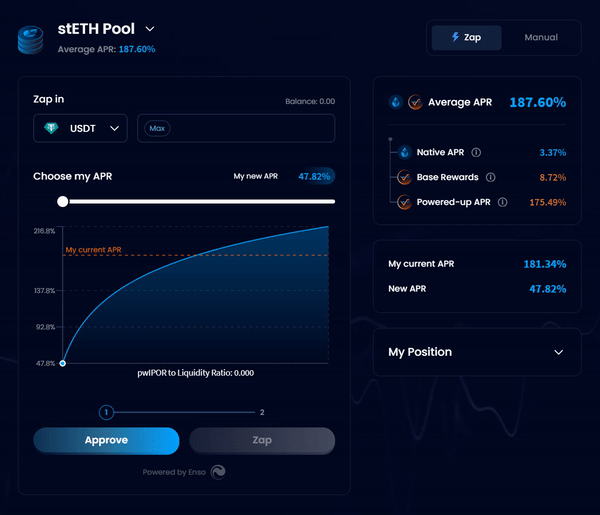

To boost liquidity mining rewards, users can not only supply more crypto assets but also stake the native $IPOR token to obtain pwIPOR, which accelerates yield.

IPOR also thoughtfully provides a yield calculator to quickly estimate returns based on different amounts of pwIPOR and crypto assets held.

-

User Experience Optimization: Transformations Brought by V2

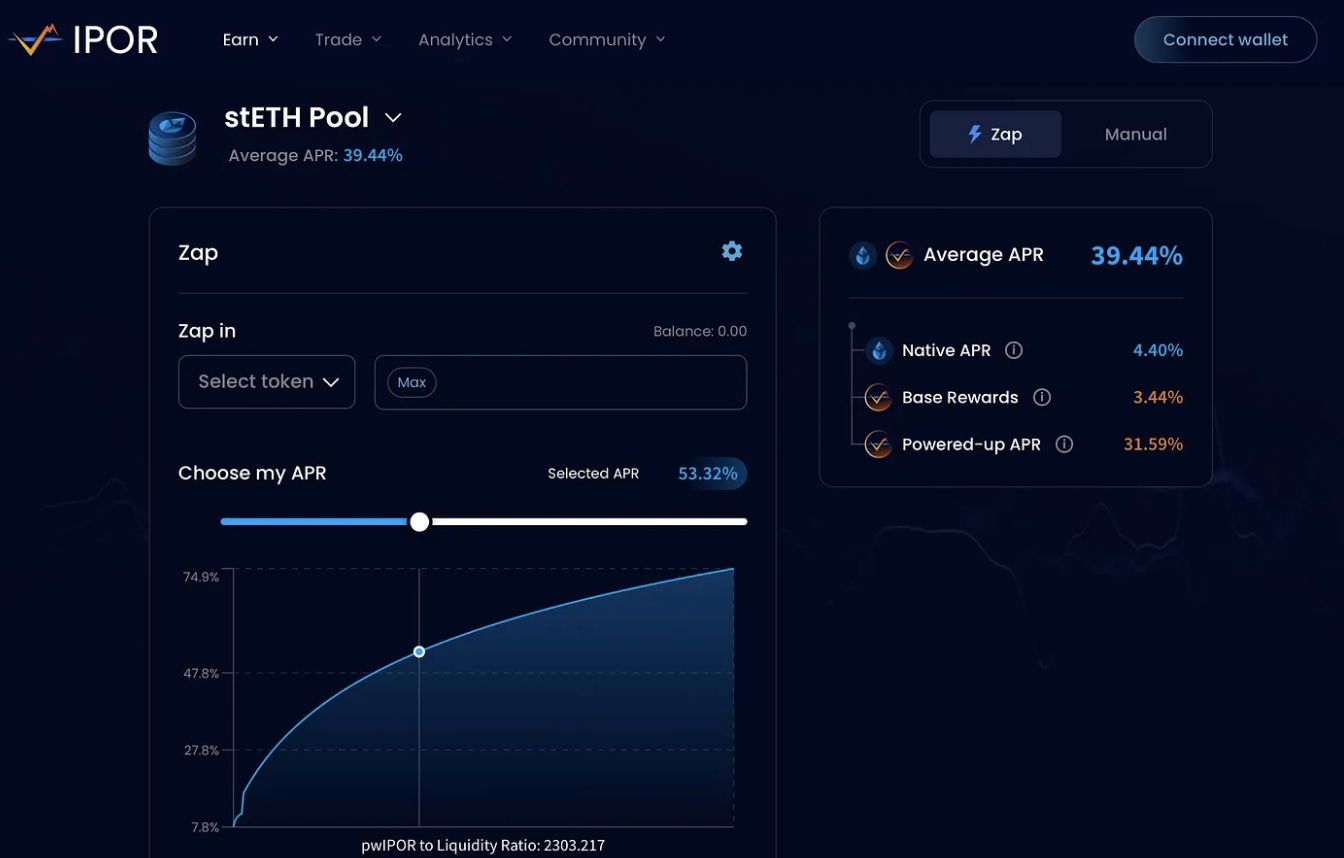

In December last year, IPOR underwent a major V2 upgrade, significantly improving user experience.

As a long-time observer since IPOR’s inception, the most noticeable change post-V2 for me has been “simplification.”

The V2 version completely refreshed the DApp interface. Now users can quickly select annual interest rates matching their yield goals through simplified operations, making entry and interaction more intuitive and convenient.

Meanwhile, behind the scenes, the introduction of a new risk engine, risk oracle, and pool-risk-upgraded AMM pricing mechanism greatly improved trading experience, delivering more accurate pricing and higher efficiency.

Finally, overall, the V2 upgrade completely restructured the interest rate swap smart contract architecture, improving gas efficiency and enhancing product composability, laying the foundation for composable structured products outlined in IPOR’s 2024 roadmap.

-

Expansion to Arbitrum: Introducing Interest Rate Swaps for Liquid Staking Tokens

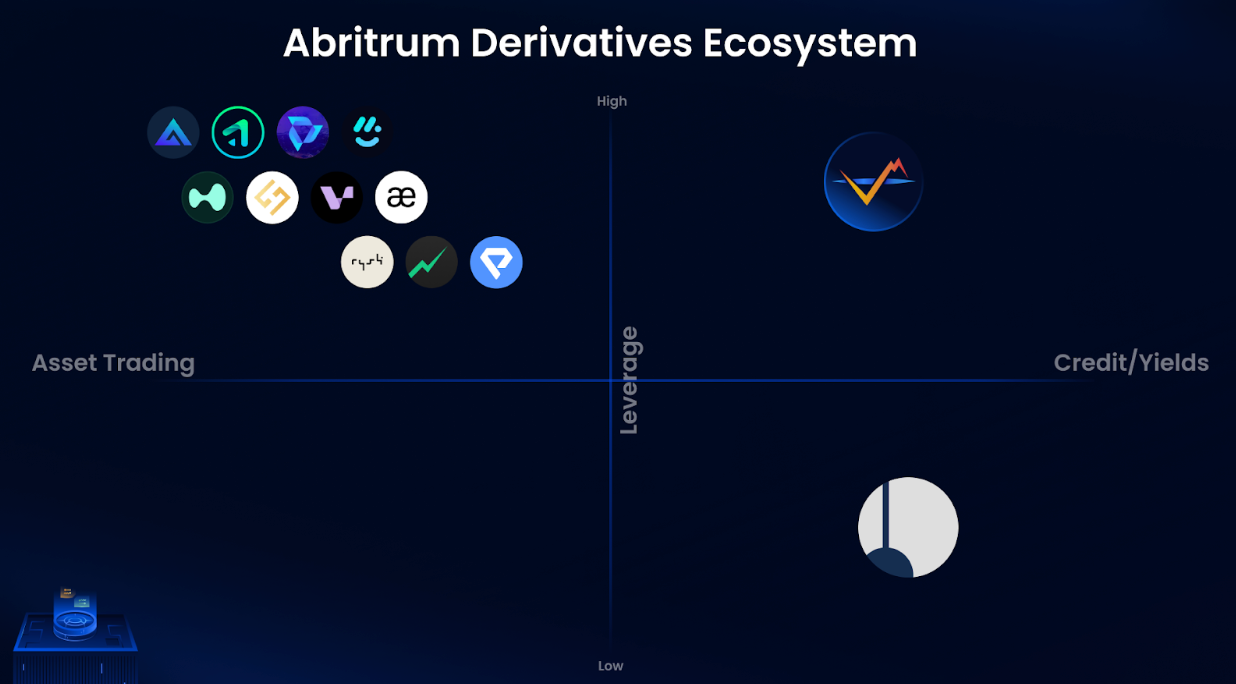

As is well known, Arbitrum has long been a haven for DeFi products.

Thanks to low gas fees and abundant liquidity, Arbitrum hosts numerous derivative exchanges like GMX and GNS, along with active DeFi users; its on-chain derivatives ecosystem is rapidly growing.

IPOR has also expanded to Arbitrum, yet its offerings don’t compete directly with GMX—instead, it complements the derivatives ecosystem by providing interest rate swap products alongside on-chain asset trading.

The composability of IPOR’s interest rate derivatives enables creation of high APR, fixed-rate pools. LPs can deposit and earn substantial returns—clearly differentiating from Pendle, which typically uses lower leverage.

Thus, IPOR cleverly carved out a unique niche on Arbitrum—avoiding direct competition with major DEXs while leveraging its strengths in credit markets to benefit from Arbitrum’s liquidity surplus driven by scale effects.

On the product side, if you hold stETH, you can provide liquidity on IPOR. The relevant pool allows users to customize APR and utilize the “zap-in” feature with two quick clicks, swiftly completing liquidity provision to start earning.

Unique products, combined with strategic positioning on Arbitrum, have placed IPOR on a fast track of user growth, drawing increased attention to the value of its native token $IPOR.

By staking the IPOR token, users receive an equivalent amount of pwIPOR, which not only significantly boosts APR in liquidity mining positions but also grants voting rights on IPOR Improvement Proposals (IIPs), enabling participation in project governance. This mechanism incentivizes user engagement and liquidity provision, further strengthening the vitality and sustainability of the IPOR ecosystem.

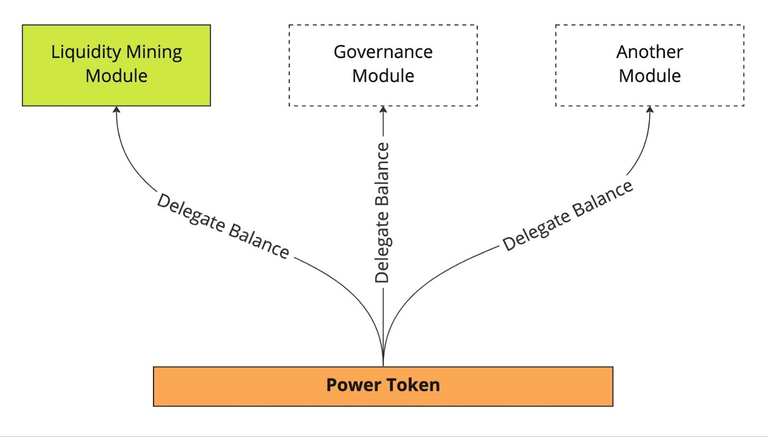

Moreover, thanks to the flexible smart contract architecture of Power Tokens, pwIPOR derived from $IPOR can be easily integrated into various modules—you can use it for liquidity mining, governance voting, or even build secondary markets similar to Convex or Pendle, further expanding the token’s utility and functionality.

This not only creates new value-added pathways for $IPOR holders but also matches liquidity providers with more opportunities, enhancing connectivity and efficiency across the entire DeFi ecosystem.

The market performance of the IPOR token has reflected its value. Key milestones in 2023 show that $IPOR saw liquidity increase 6.5x, trading volume exceed $4 billion, and its year-end price rise 10% from the beginning of the year.

The Next “Pendle”? IPOR’s Narrative Potential

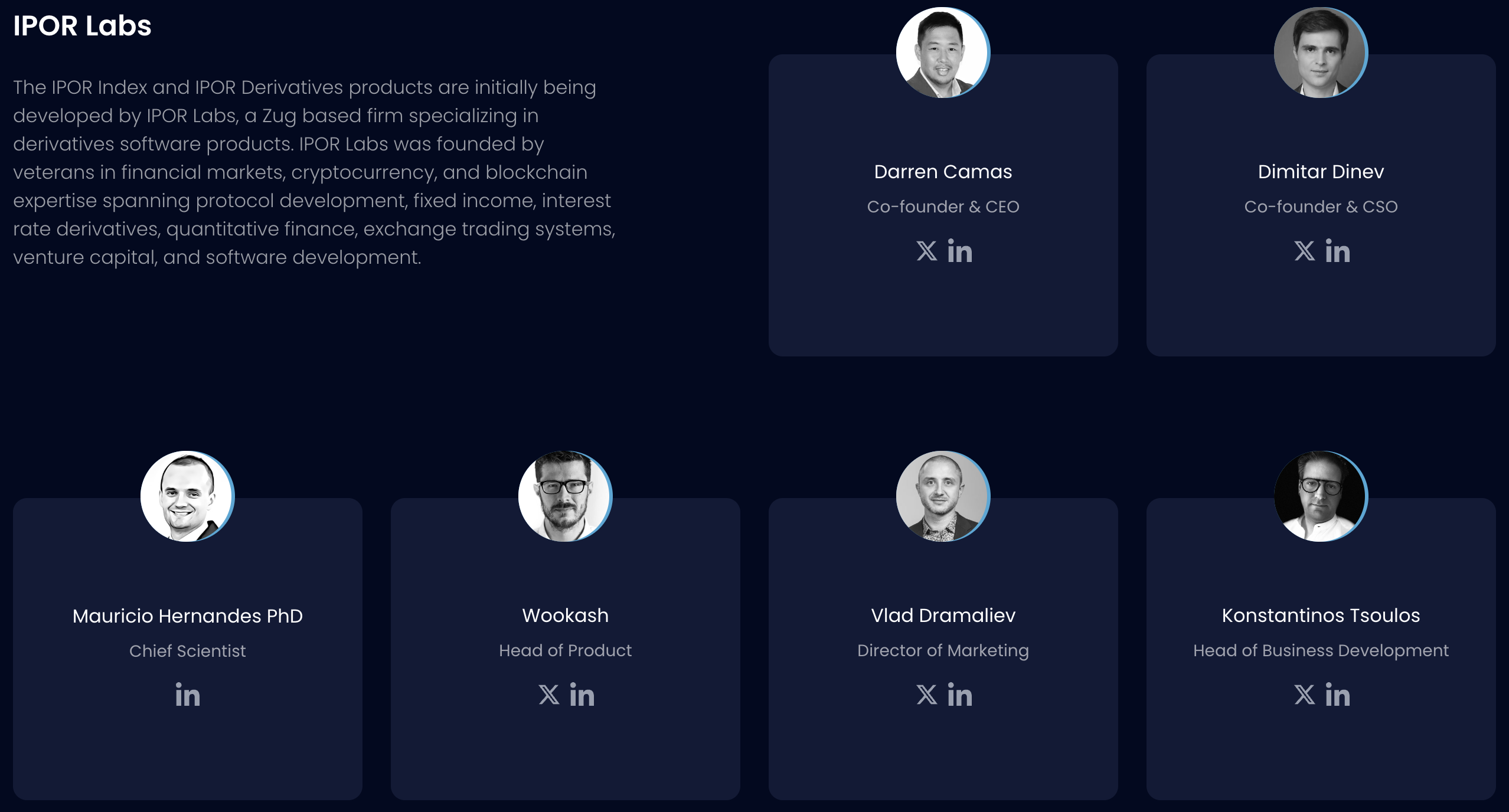

Again, IPOR is currently the only protocol on-chain offering interest rate swaps, and its potential is closely tied to its team.

The team comprises seasoned crypto natives, enterprise-level developers, and several PhDs with deep quantitative analysis backgrounds. Such a transparent and experienced team is key to IPOR standing out in the competitive DeFi landscape.

Beyond the team’s solid fundamentals, we can see IPOR’s trajectory bearing similarities to the previously popular Pendle.

Pendle is a DeFi protocol focused on tokenizing future yields and interest rates, allowing users to trade and manage long-term returns by separating asset ownership from future yield rights.

IPOR’s innovation lies in offering interest rate swaps, enabling users to hedge against interest rate fluctuations—similar in spirit to Pendle’s tokenization of future yields.

When both create value and opportunities through relatively complex financial derivatives, serving sophisticated traders, remember that IPOR also offers interest rate swaps for LST assets on Ethereum and Arbitrum, aligning perfectly with this year’s hot “(re)staking” narrative.

With proper product communication, easy-to-understand features, and relevance to “restaking,” IPOR could once again be discovered and brought to center stage in the current market narrative.

According to public information, IPOR is expected to announce a new product in the coming weeks. Beyond boosting yields and reducing gas fees, the new release will enable “smart liquidity routing” and lightning-fast integration with any DeFi lending protocol, bringing IPOR closer to its vision of becoming a DeFi credit hub.

Finally, for those wishing to learn more about IPOR’s interest rate swaps, you can click here to participate in the official event on Galxe (ends on the 22nd).

The event consists of a series of educational quizzes; completing all tasks allows participation in sharing a 6,000 IPOR prize pool. Meanwhile, IPOR has also launched a trading competition, where users can share a 50,000 IPOR reward by conducting actual interest rate swap trades.

History doesn't repeat itself, but it often rhymes.

Whether IPOR can achieve Pendle’s success in its own way remains to be seen.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News