Dreaming of Auction Prices, Mass Liquidation of NFTs Under Its Belt, Yuga Labs Struggles to Avert Crisis

TechFlow Selected TechFlow Selected

Dreaming of Auction Prices, Mass Liquidation of NFTs Under Its Belt, Yuga Labs Struggles to Avert Crisis

The underwhelming price performance of BAYC and MAYC reflects a broader trend in the Ethereum NFT market.

By: Nancy

While Bitcoin NFTs are experiencing a surge in popularity, Yuga Labs is facing its darkest hour, leaving many NFT holders devastated—not only due to the relentless decline and liquidation of top-tier NFTs but also reflecting the broader reality that Ethereum's NFT market struggles to reverse its prolonged downturn in the short term.

NFTs on the Brink of Breakdown, Facing Mass Auction Liquidations

With emerging NFT ecosystems on Bitcoin and Solana drawing user attention and capital, blue-chip Ethereum NFTs have recently seen widespread price declines. According to Blur data, over the past seven days, NFTs such as MAYC, Pudgy Penguins, Azuki, DeGods, CloneX, and Moonbirds have experienced varying degrees of depreciation—some nearing 30%. As leaders in the Ethereum NFT market, BAYC and MAYC find themselves stuck in an ongoing downward spiral.

Data from NFT platform Blur shows BAYC’s floor price has dropped to 17.6 ETH, hitting a nearly two-year low with a 7-day decline exceeding 24.03%. Meanwhile, MAYC’s floor price has fallen to 2.93 ETH, down 28.33% over the same period. Notably, MAYC has already dipped below its Dutch auction starting price and is now within just 5% of its final auction price of 2.79 ETH.

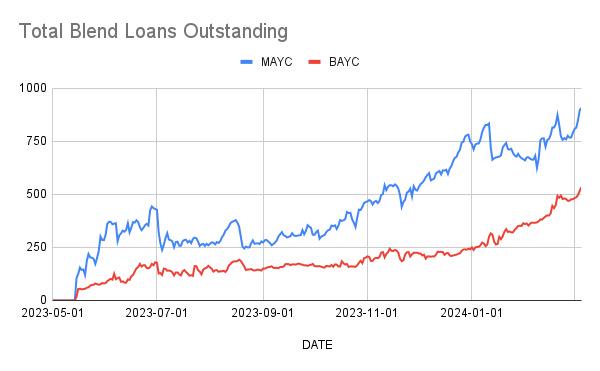

Amid this broad selloff, more than 75 BAYC and hundreds of MAYC tokens are currently undergoing Blend auction liquidations. Additionally, according to the latest Flipside Crypto data, as of March 5, loan balances for MAYC and BAYC on Blend reached an all-time high, with over 50% of MAYC loans underwater (i.e., the highest bid value is lower than the outstanding principal).

The continued decline of Yuga Labs' NFT series has sparked heated discussion in the community. Some users expressed relief after selling early to cut losses, while others criticized Yuga Labs for inaction. A number of holders threatened to exit the space entirely if prices fail to recover, and some mocked, “Yuga Labs is giving everyone another chance to rejoin this great club.”

Co-Founder Takes Reins Again, Strategic Shift Fails to Win Community Approval

Once at the peak of success—securing the largest single funding round in the NFT sector and commanding dominant positions across the NFT landscape—Yuga Labs began its descent after shifting focus toward a metaverse development roadmap. Recently, however, the company has started taking new actions.

On the team front, Yuga Labs co-founder Greg Solano announced last month on X (formerly Twitter) that he would succeed former Activision Blizzard executive Daniel Alegre as CEO. He also revealed the formation of a new subsidiary, BAYC LLC, dedicated exclusively to managing all matters related to BAYC, aiming to free up the BAYC team. Solano added that beyond focusing on developing more engaging games, Yuga Labs plans to position Otherside as a gateway into Web3. It’s worth noting that Otherside’s competitors, Fortnite and Roblox, have generated a combined annual revenue of approximately $8 billion in recent years.

In terms of products, Yuga Labs recently partnered with NFT marketplace Magic Eden to launch an Ethereum-based market enabling users to access top creators’ minting platforms and earn rewards through Magic Eden’s incentive program. In February 2024, Yuga Labs also announced a collaboration with game studio Faraway to release the game *Dookey Dash Unclogginged* in Q1 2024, offering token benefits to NFT holders. Unlike the original solo version of *Dookey Dash*, this is a free-to-play edition open to all users.

On the revenue side, Yuga Labs formed a Creator Collective with Magic Eden and others to promote a sustainable royalty framework, collaborating on NFT creations for random airdrops and rewarding top royalty-generating users. The company also launched a 69-day royalty reduction campaign: collections with enforced royalties saw a 2.5% cut, while traditional collections received a 1% reduction. However, this temporary approach to lowering royalties hasn’t gained wide acceptance. In contrast, another NFT project, y00ts, has drawn market attention by using mandatory royalties to repurchase NFTs and award X badges to creators.

Regarding market expansion, Yuga Labs hasn’t slowed its acquisition pace, announcing last month the purchase of PROOF—the parent company of Moonbirds—including its team, intellectual property, and art portfolio. However, given PROOF’s poor reputation, this move has stirred controversy within the community.

Overall, the disappointing performance of BAYC and MAYC reflects the broader challenges facing the Ethereum NFT market. Although Ethereum-based NFTs still hold a dominant position after multiple market cycles, they now face rapidly rising competition from Bitcoin and Solana ecosystems. Whether Yuga Labs can maintain its leadership remains uncertain, but its flagship NFTs like BAYC and MAYC are confronting the most difficult phase since their inception due to ongoing price declines.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News