Revisiting Bearchain and Its Ecosystem: How Can a Meme-Based L1 Make Liquidity Sticky?

TechFlow Selected TechFlow Selected

Revisiting Bearchain and Its Ecosystem: How Can a Meme-Based L1 Make Liquidity Sticky?

This article will delve into the Berachain ecosystem, exploring the unique culture, history, and technology that support its innovative narrative.

Author: PAVEL PARAMONOV

Translation: TechFlow

Introduction

In the crypto space, we encounter several distinct groups: developers, investors, innovators, influencers, degens, and more. The central debate has always revolved around whether people are drawn by technology and innovation or by memes and speculation. However, today these two communities can coexist—and both can find value within the Berachain blockchain.

On one hand, Berachain offers a novel consensus mechanism that optimizes liquidity performance while maintaining EVM compatibility. This is achieved through the Polaris modular EVM framework, which provides the execution environment for smart contracts on Berachain. On the other hand, the project’s anonymous development team has created a bear-themed initiative that recently secured $420 million in funding at a notable valuation—an exciting feat driven largely by meme appeal. While most memes serve only as speculative fodder, Berachain strives to bridge the gap between hype and substance, offering the best of both worlds: memes and meaningful technology.

In this article, we will dive deep into the Berachain ecosystem, exploring the unique culture, history, and technology underpinning this innovative narrative.

Summary

-

Berachain introduces a novel consensus mechanism that optimizes liquidity performance while maintaining EVM compatibility.

-

Proof-of-Liquidity builds upon the classic Proof-of-Stake (PoS) mechanism to address common PoS network issues: staking centralization, limited opportunities to enhance chain security, and insufficient validator incentives.

-

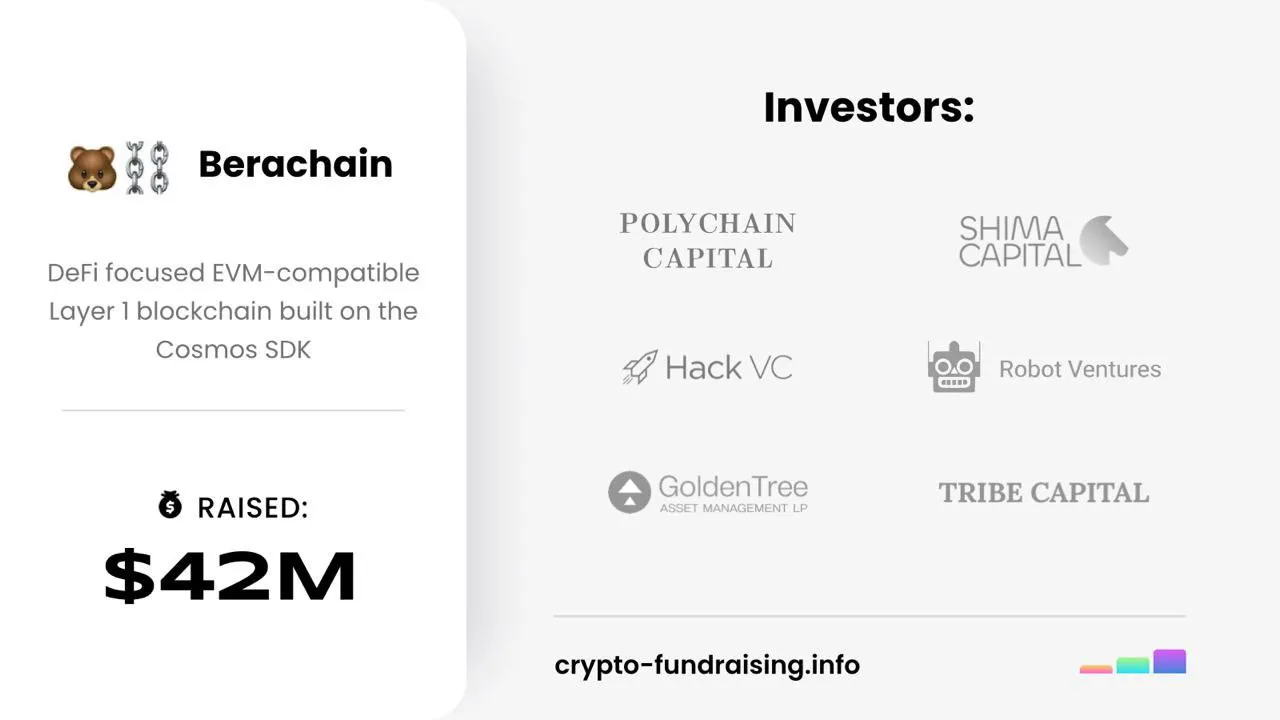

The anonymous development team behind Berachain successfully raised $420 million at its latest valuation. Investors include Polychain, Shima Capital, dao5, Hack VC, Robot Ventures, Tribe Capital, and GoldenTree Asset Management.

-

Berachain leverages Polaris, a custom-built EVM framework designed by the team, enabling easy separation of the EVM runtime layer, development of stateful precompiles, and custom modules for creating more efficient smart contracts.

-

Berachain’s three-token model includes three tokens: $BERA for gas, $BGT for governance, and the native stablecoin $HONEY.

On January 11, 2023, Berachain announced the launch of its public testnet “Artio,” attracting over 300,000 users and facilitating more than 1 million transactions within the first 48 hours. Currently, Infrared, Kodiak, and Beradrome are foundational protocols in the Berachain ecosystem.

The Spirit of the Chain

It's well known that the Berachain community is one of the most recognizable and passionate in the entire space. Nowhere else on Twitter will you find such an enthusiastic group of fans obsessed with Bera, its updates, memes, and more. But how did it achieve this?

The answer lies in the concept of “religion.” In medieval times, religion played a pivotal role in power struggles. Originally, “religion” referred to those who praised saints, but now it refers to ancient or primitive religious practices. There’s a saying that religions thrive during bear markets. Link (Chainlink), with its frog profile pictures, memes, and low entry barriers, exemplifies this. Within the Berachain ecosystem, religious dynamics go beyond JPEG prices, fueling its growth.

Core contributors to Bera promote collaborative intelligence, while the broader community contributes vital collective intelligence through ideas, comments, memes, and unique creativity. This fusion keeps the open-source community vibrant. All members of the religion (community) benefit from the religion’s success; more importantly, they are all financially invested in it. The key is that there is no single archetype of a believer—whether you’re the smartest developer in the world or just someone posting “GM” (good morning), you are part of the religion.

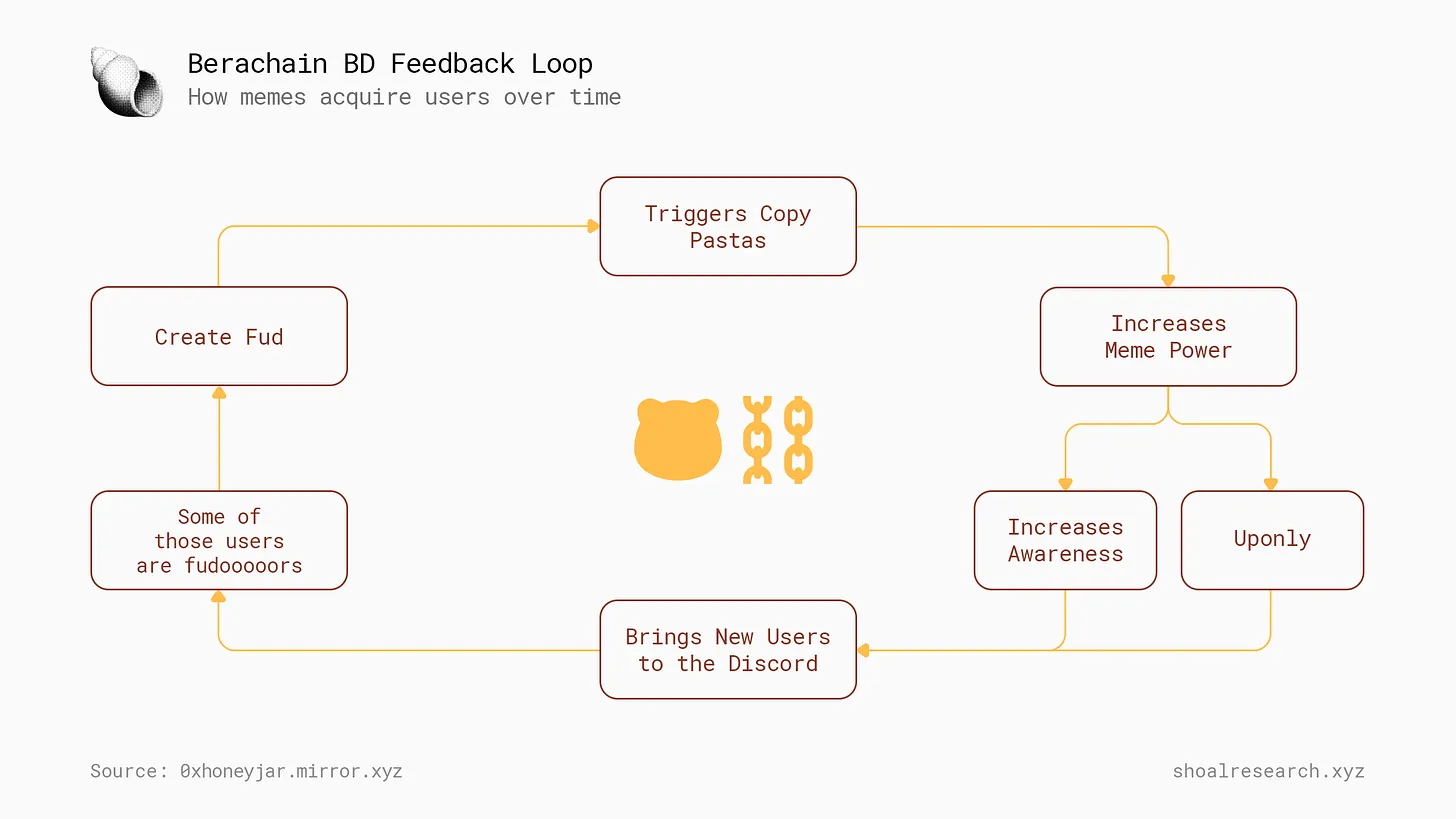

Because Bera embraces meme culture, everything unrelated to technology is seen as a meme. Thus, even when FUD (fear, uncertainty, and doubt) arises, Bera can still benefit from it.

Despite ongoing debates about technical merits, the crypto space tends to favor meme coins. BERA is a token with real use cases and various advantages, entering this space with a unique presence.

Labeling Berachain merely as a meme with a religious following greatly underestimates its significance. Given the narratives favored by crypto Twitter—well, Berachain has it all. Now, let’s delve into the technological innovations unfolding within the Berachain ecosystem.

Technology Behind Berachain

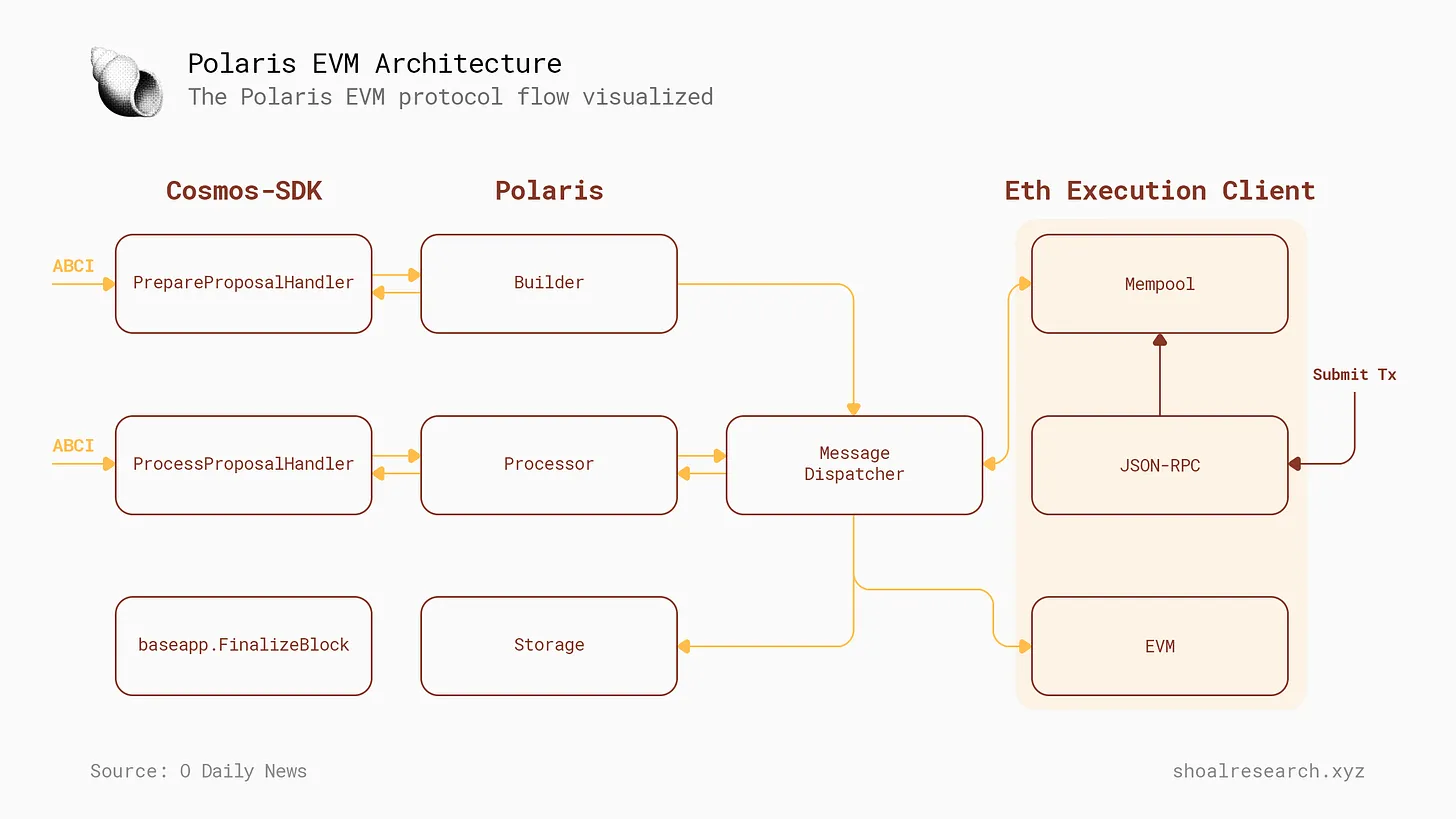

Berachain is a high-performance, Ethereum Virtual Machine (EVM)-compatible blockchain featuring an innovative Proof-of-Liquidity (PoL) consensus mechanism. This consensus model is designed to align network incentives and foster synergy between Berachain validators and the broader project ecosystem. Berachain’s technical foundation is built on Polaris, a cutting-edge blockchain framework engineered specifically for constructing EVM-compatible chains, utilizing the CometBFT consensus engine.

Built atop the Cosmos-SDK, Berachain inherits the same tools and operational mechanisms. Additionally, it integrates chain-specific functionalities optimized explicitly for Proof-of-Liquidity. Moreover, Berachain employs Polaris EVM—a framework custom-designed by the team—to easily decouple the EVM runtime layer, enabling the development of stateful precompiles and custom modules for building more efficient smart contracts.

Precompiles

Precompiles, also known as precompiled contracts, are a class of smart contracts whose functions are directly integrated into the EVM rather than executed via bytecode. Each precompile is assigned a specific address, and the associated gas fee for executing these contracts is predetermined. In the context of Berachain, this mechanism primarily enables enhanced on-chain functionality, allowing direct interaction with various Cosmos modules that would otherwise be inaccessible outside the EVM. Berachain’s precompiles incorporate some standard EVM precompiles from Polaris while adding additional features to further extend capabilities.

Proof-of-Liquidity

Berachain’s economic model represents an innovative approach to blockchain governance, aiming to solve critical challenges faced by decentralized networks. The model centers on three objectives:

-

Building liquidity

-

Decentralizing staking

-

Aligning protocols and validators

Proof-of-Liquidity builds upon the classic Proof-of-Stake mechanism, addressing typical PoS network problems: stake centralization, limited opportunities to improve chain security, and weak validator incentives. Let’s examine this in detail.

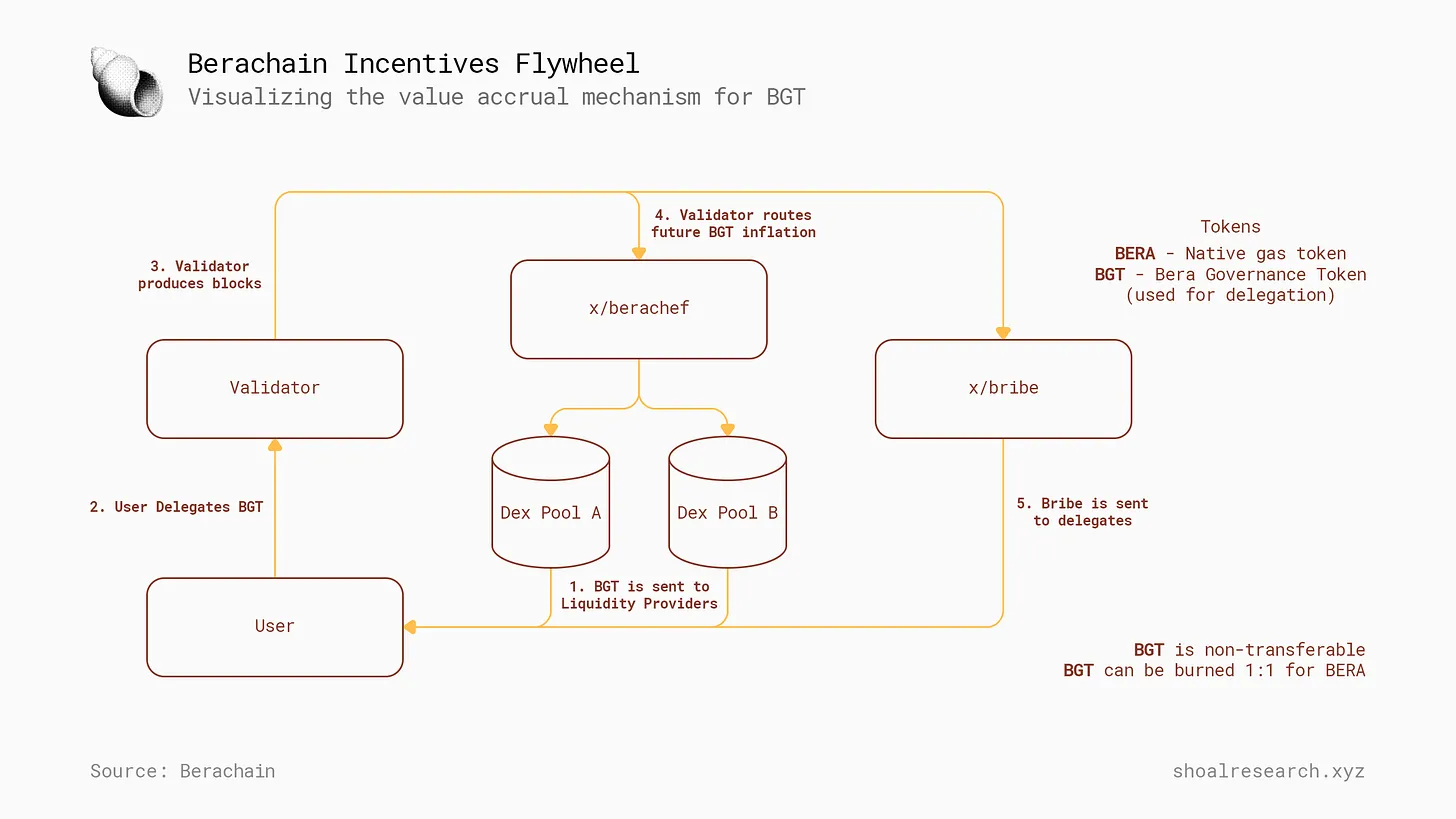

Users can earn BGT—the Bera governance token used in Proof-of-Liquidity delegation—by providing liquidity to BEX liquidity pools. Subsequently, users delegate their BGT to validators. Block production is determined by the proportion of delegated BGT weight, and validators generate rewards on-chain for both themselves and their delegators. Additionally, validators participate in voting on future BGT inflation allocations across various liquidity pools, and any bribes are distributed from validators to their delegators (if initiated by the validator).

From the above diagram and Berachain’s architecture, we can describe how PoL addresses the problems of PoS blockchains.

Proof-of-Liquidity tackles the initial challenges of Proof-of-Stake through two key mechanisms:

-

Separating the delegation token (BGT) from the chain’s gas token (BERA)

-

Restricting the purchase of new BGT to provide liquidity for BEX

This means the token used for various on-chain activities differs from the staking token. Furthermore, the only way to obtain new governance tokens is by contributing liquidity, thereby incentivizing greater liquidity provision.

Proof-of-Liquidity effectively solves the second issue of Proof-of-Stake by distributing newly minted BGT to liquidity providers. Unlike traditional PoS networks where stakers directly receive new tokens, PoL distributes them to different market participants involved in common on-chain activities. This results in a fairer distribution of token inflation.

Finally, Proof-of-Liquidity encourages collaboration between protocols and validators. This cooperation incentivizes validators to promote a protocol’s LP pools via BGT and allows protocols to help validators accumulate BGT stakes through bribes.

Three-Token Model

Berachain’s token model consists of three tokens: $BERA, $BGT, and $HONEY.

-

$BERA: Berachain’s native token, used as the gas token

-

$BGT: Governance token

-

$HONEY: Native stablecoin

While $BERA and $HONEY play relatively straightforward roles, $BGT is more complex. After all, why separate tokens for gas and governance?

BGT Management

BGT is non-transferable and can only be obtained in three ways:

-

Providing liquidity to LP pairs on Berachain’s DEX (decentralized exchange), where those LP pairs receive BGT emissions

-

Borrowing HONEY on Bend (Berachain Lending)

-

Providing HONEY to the bHONEY vault in Berps (Berachain Perpetuals)

Once obtained, users continue to delegate their BGT to validators on the network. A validator’s BGT stake weight plays a crucial role in determining two key aspects:

-

The proportion of blocks a validator produces among all validators

-

Their influence percentage in voting on future BGT emissions

When BGT is delegated to a validator, it becomes eligible to initiate and vote on governance proposals. These proposals may include decisions on allocating BGT emissions to specific LP pools. Delegating BGT also triggers the receipt of various rewards from the network.

Additionally, BGT can be burned at a 1:1 ratio to obtain BERA. Note that this process is one-way; BERA cannot be converted back into BGT.

The amount of BGT inflation controlled by a validator is determined by the volume of BGT delegated to them. Consider this scenario: as a validator, you have 10% of all staked BGT delegated to you. With 10% BGT weight assigned to you, you effectively control 10% influence over the direction of future BGT inflation. Specifically, this BGT inflation targets native BEX liquidity pools, allowing you to decide which LP pools offer incentives for users depositing tokens—typically increasing liquidity in those pools.

Protocol Rewards

Proof-of-Liquidity delivers rewards to BGT holders. These rewards stem from diverse on-chain activities and are distributed to BGT holders based on the amount of BGT they delegate. There are three types of rewards: BGT inflation, block captured value, and gas fees.

New BGT is generated with each block, determined by Berachain’s inflation rate. These newly created BGT units are allocated to liquidity providers in specific BEX pools. Distribution is based on the total new BGT emissions voted on by validators during the current period.

Block captured value refers to fees generated by Berachain’s native DApps such as BEX, Honey, and Perps. Transactions within each DApp may trigger fees designated as block captured value (BCV). Whenever a validator includes a fee-generating transaction in their block, they receive that fee as a reward. Validators receive a portion of BCV as commission, with the remainder distributed to BGT delegators.

History and Fundraising

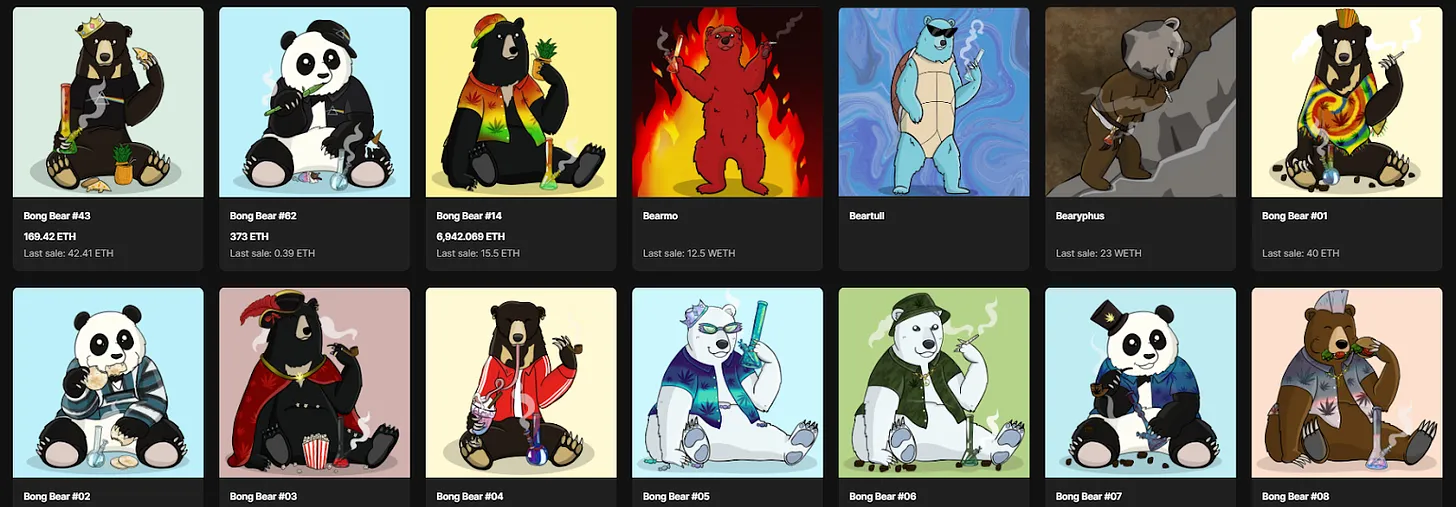

Berachain’s origin story is uniquely compelling, tracing a journey from a meme-driven NFT collection to potentially becoming one of the most distinctive Layer 1 blockchains. It all began in August 2021 with the launch of the BongBears NFT series by three anonymous co-founders: Dev Bear, Papa Bear, and Smokey the Bera. The Bong Bears mint on August 27, 2021 featured 100 Beras, each priced at 0.069 ETH. The minting process was highly distinctive—buyers could view and select specific bears on OpenSea before purchasing.

During that time, the team drew inspiration from OlympusDAO, a protocol rapidly gaining popularity in the crypto community. Drawing from OlympusDAO’s experience, Bong Bears pioneered a unique series of NFTs, paving the way for subsequent collections. These cartoon bears quickly gained attention within the crypto community. The Bong Bears project wasn’t just about art—it was the first phase of a series of bear-themed NFTs, including Bond Bears, Boo Bears, Baby Bears, Band Bears, and Bit Bears. Each iteration built upon the previous one.

-

On October 16, 2021, OG Bong Bear holders received an airdrop of a rebasing NFT—Bond Bear—making Bong Bears the first-ever rebasing NFT.

-

On October 29, 2021, the Boo Bears rebase introduced 271 festive bears celebrating Halloween. Notably, some bears appeared dressed as popular protocols like TempleDAO and Rome.

-

The Baby Bears collection launched on December 16, 2021, just in time for the Christmas holidays, featuring 571 baby bears. Many events centered around Christmas and holiday themes, enhancing the festive atmosphere. However, there was a hidden twist—each bear from previous collections had a corresponding infant version, creating a “family reunion” quest for owners.

-

Band Bears, a collection of 1,175 music-themed bears, was released on April 20, 2022. Each musical bear was styled after a famous musician, giving users strong incentives to acquire bears matching their tastes. Wild over-the-counter trades became commonplace—for example, Johnny Cash for Bob Dylan or Future for George Michael. Each artist had both an OG and a baby version, allowing collectors to pursue both variants.

-

The next rebase came on August 24, 2022, when Berachain surprised the community with the secret launch of 2,355 Bit Bears. This edition featured a unique artistic style, replacing Papa Bear’s design with PixelBera’s pixelated cubs.

Few NFT projects dare to venture into building a Layer 1 blockchain, establishing an ecosystem with a dedicated community—all without marketing expenses. It’s hard to imagine that an anonymous team starting with an NFT series in late 2021 would, just two years later, raise funding at a staggering $420 million valuation, led by industry-leading fund Polychain. Other investors include Shima Capital, dao5, Hack VC, Robot Ventures, Tribe Capital, GoldenTree Asset Management, and more.

Some of the most prominent angel investors include Mustafa Al-Bassam (co-founder of Celestia), Zaki Manian (co-founder of Tendermint), Georgios Vlachos (co-founder of Axelar), and others.

Ecosystem

Berachain is a relatively new player in the blockchain world and, of course, cannot be directly compared to mature ecosystems like Ethereum or Layer 2 protocols. However, certain projects within it play a foundational role in ensuring the proper implementation of the Proof-of-Liquidity consensus mechanism. Let’s explore three of the most promising ecosystem projects.

Infrared

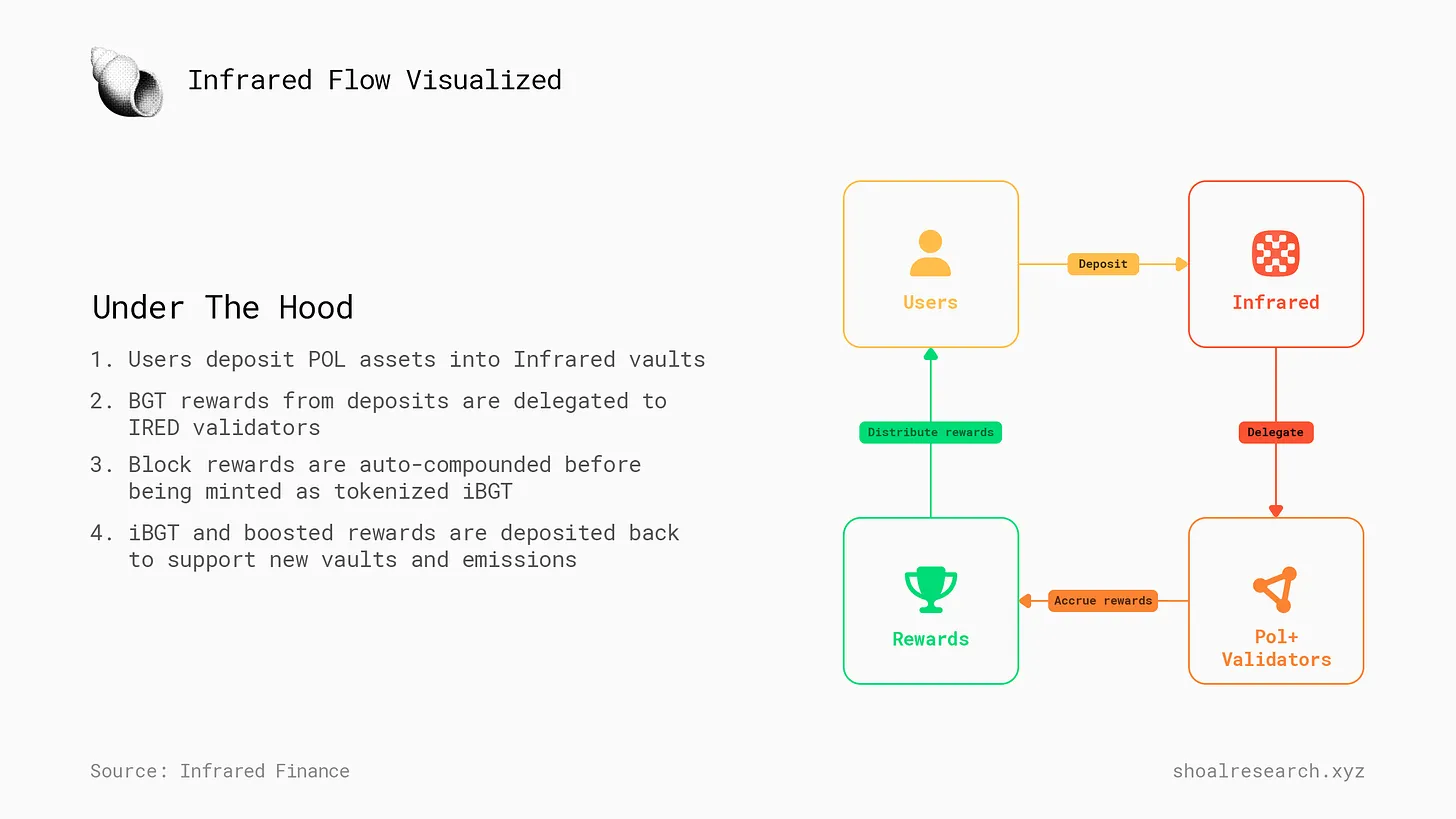

Infrared is a liquid staking solution built on Proof-of-Liquidity within the Berachain ecosystem. Infrared enhances user experience by introducing BGT liquidity, simplifying bribery and validator layers, and streamlining BGT distribution.

Infrared makes the Proof-of-Liquidity (PoL) ecosystem accessible to everyone. Focused on user-friendliness, it offers liquidity providers a simple platform to earn iBGT (Infrared’s liquid version of BGT).

Liquidity providers on Berachain-native DApps and other BGT-eligible venues can earn trading fees, native emissions, and claim liquid iBGT. Infrared charges no deposit or withdrawal fees, only a minimal performance fee distributed to $IRED holders. Through iBGT, Infrared aims to unlock new use cases for BGT that were previously impossible on Berachain. Supported by the Berachain Foundation and the Build-a-Bera incubator program, Infrared aims to become the leading validator network.

Kodiak

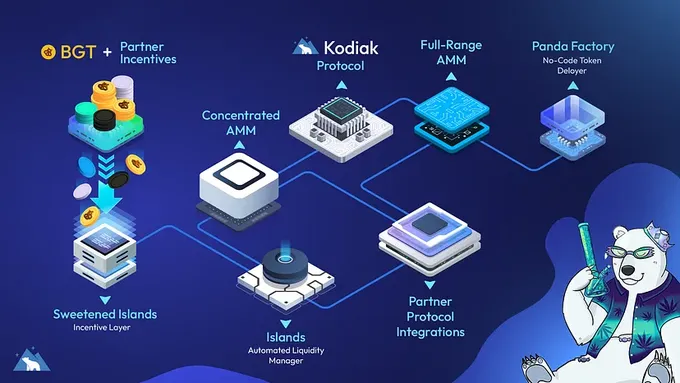

Kodiak is a liquidity hub on Berachain, bringing concentrated liquidity and automated liquidity management to the ecosystem. It caters to both traders and liquidity providers. To better understand Kodiak, it’s important to recognize that its architecture enables vertical integration across different DEX layers.

-

Kodiak DEX is a decentralized exchange leveraging concentrated full-range AMMs to offer users a non-custodial and highly capital-efficient trading and liquidity provision experience.

-

Kodiak Islands are automated concentrated liquidity strategy vaults primarily designed to attract liquidity into the Berachain ecosystem. Kodiak Islands implement automated LP strategies using concentrated liquidity. User deposits create concentrated liquidity positions that automatically rebalance to stay “in range” with price movements. Kodiak Island LP positions are eligible for PoL BGT rewards and use BEX liquidity for rebalancing.

-

Sweetened Islands, an integrated incentive layer, leverages Berachain’s Proof-of-Liquidity (PoL) mechanism to provide sustainable incentives for liquidity on Kodiak Islands.

-

Panda Factory, a no-code token deployment factory, simplifies the permissionless creation of new tokens (such as meme coins) and their initial liquidity on Kodiak’s full-range AMM. This is particularly useful for highly volatile assets that haven’t yet established price characteristics.

Moreover, Kodiak is the only DEX supported by Berachain’s Build-a-Bera program. Working closely with the Berachain Foundation, Kodiak Islands are compatible with Berachain’s Proof-of-Liquidity, ensuring BGT liquidity flows as PoL matures.

Beradrome

Beradrome serves as an incentive coordinator for the Berachain ecosystem, offering a unique approach to liquidity mining, token management, and on-chain governance. The platform introduces a three-token structure: BERO, hiBERO, and oBERO, each providing users with distinct advantages. An algorithmic bonding curve mechanism controls the supply of BERO tokens, ensuring stability and market-driven liquidity.

Beradrome draws inspiration from the Solidly system in terms of liquidity provision, rewards, and token issuance. Solidly focuses on its AMM LP tokens, primarily earning revenue from swap fees and incentivizing veSOLID holders to vote for specific metrics to earn these fees. In contrast, Beradrome is an inclusive version of Solidly, supporting any revenue-generating asset and enabling diversified income streams such as token emissions, swap fees, interest, or gaming revenue.

Key features of Beradrome include:

-

Bonding curve mechanism

-

Call option emissions

-

Token-owned liquidity

-

Single-sided liquidity reserves (eliminating impermanent loss)

-

Deep liquidity and low slippage

-

Risk-free lending backed by hiBERO

Beradrome also created an NFT series called “Tour de Berance.” This is a collection of 6,900 unique Berachain bears cycling competitively in a liquidity race on Arbitrum.

Tour de Berance NFTs will offer exclusive features within Beradrome in the Berachain ecosystem, including:

-

Increased hiBERO allocations through NFT ownership

-

Priority access to events within the Berachain ecosystem

-

NFT rebasing after Berachain goes live

-

Whitelist priority for token sales on the Berage launchpad

-

Access to the upcoming Beradrome video game

Testnet Launch

On January 11, 2023, Berachain announced the launch of its public testnet “Artio.” Developers and users can interact with faucets to receive $BERA tokens while engaging with the network and its applications. Currently, five main types of activities are available on the Artio testnet:

-

Swap tokens on BEX

-

Mint $HONEY, Berachain’s native stablecoin, on Honey

-

Borrow or lend tokens on BEND

-

Trade perpetual contracts on BERPS

-

Delegate $BGT on the BGT station

Within 48 hours of the testnet launch, Berachain successfully attracted over 300,000 users and facilitated more than 1 million transactions.

Conclusion

In this article, we explored Berachain in depth—from the underlying technology to one of the most recognizable communities in crypto. Who could have imagined that a Bong Bears NFT collection would ultimately lead to the creation of a Layer 1 blockchain with a novel consensus mechanism, raising a $420 million valuation?

Currently, we are witnessing a surge of protocols beginning development on Berachain, along with impressive statistics from the testnet launch. Berachain has achieved two remarkable feats: building a robust community of “beras” and implementing a carefully designed architectural framework for protocols. The combination of these two factors makes Berachain one of the most unique Layer 1 blockchains in today’s crypto market.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News