Revealing the true strength of various projects—see what's really happening in crypto development?

TechFlow Selected TechFlow Selected

Revealing the true strength of various projects—see what's really happening in crypto development?

More and more developers are enabling cross-chain functionality, with DeFi remaining the primary application scenario.

Author: inpower Wang Jun

Sharing a research report from ELECTRIC Capital—one of the leading venture capital firms in the crypto space.

The original content is quite lengthy, so I’ve selected and summarized some key insights for you:

01 Developer activity lags funding by about a year

Developers are interesting—they tend to react about a year behind capital flows:

By Q4 2023, many believed capital had already bottomed out and entered a bull market. Yet developer numbers were still declining.

Given that most developers build on Ethereum (more details below), let’s examine Ethereum’s price trend:

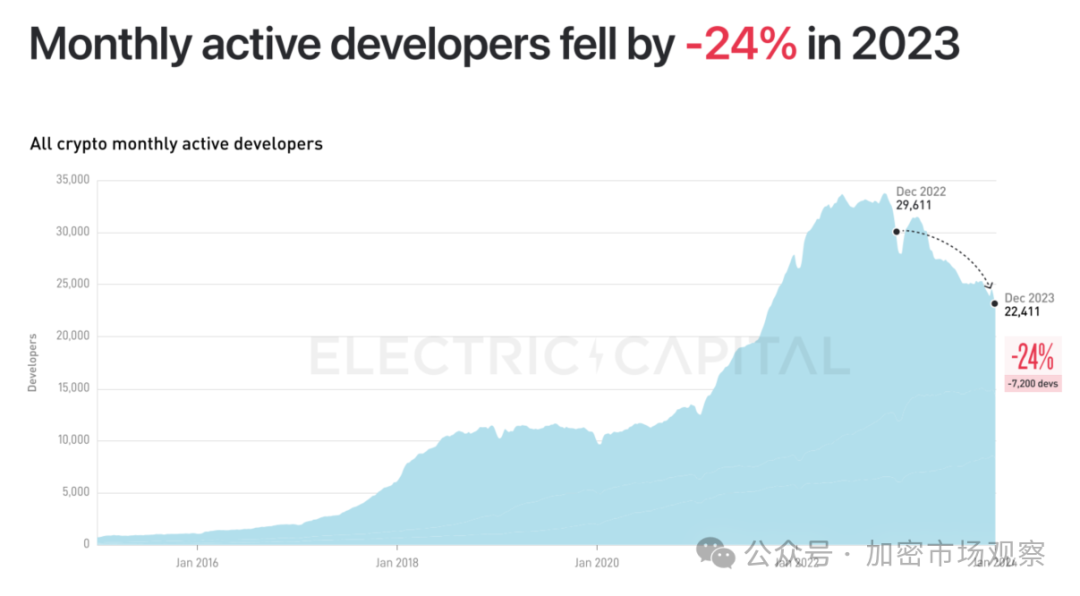

Ethereum’s price peaked in November 2021, but developer count didn’t peak until the end of 2022.

Capital moves faster, clearly.

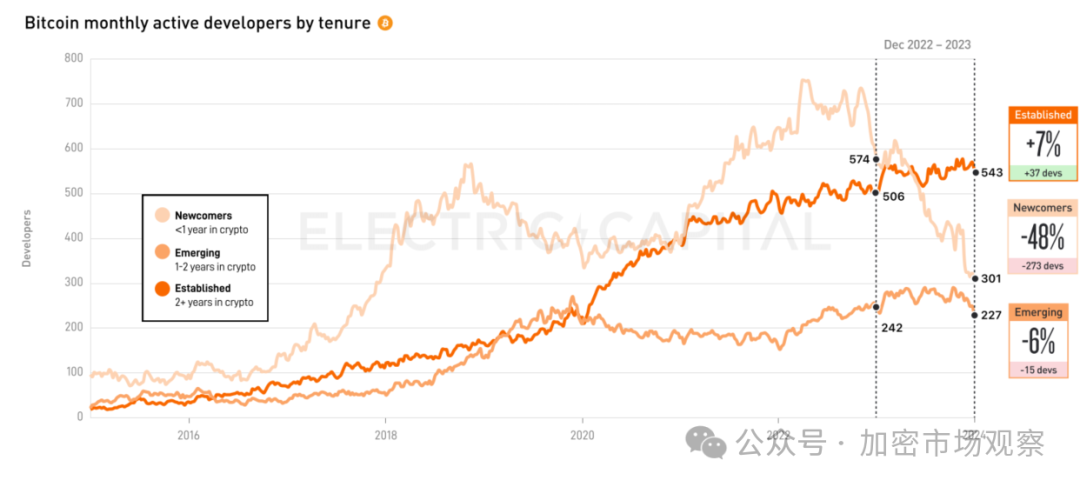

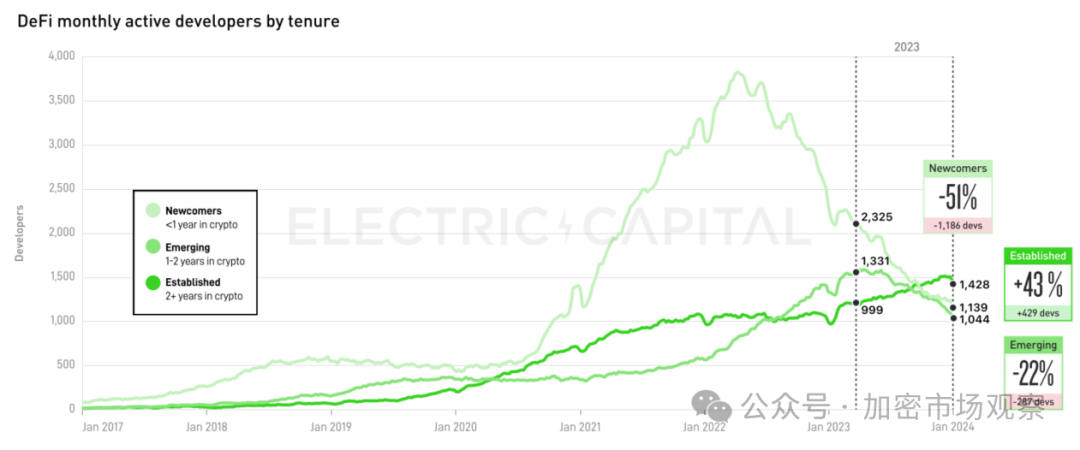

Developers show more persistence—down only 24% from the peak.

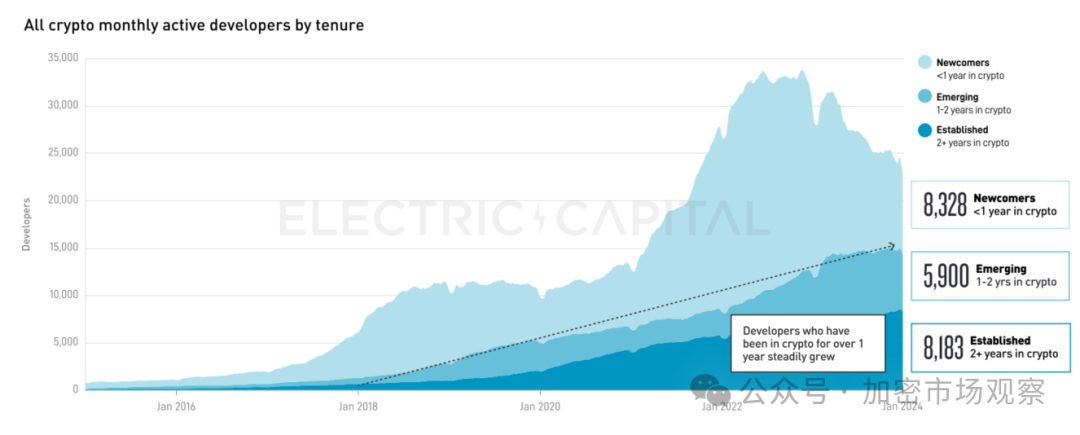

And those who left were mostly newcomers. Seasoned developers continue to grow (writing scripts to farm airdrops is fun too, right?)

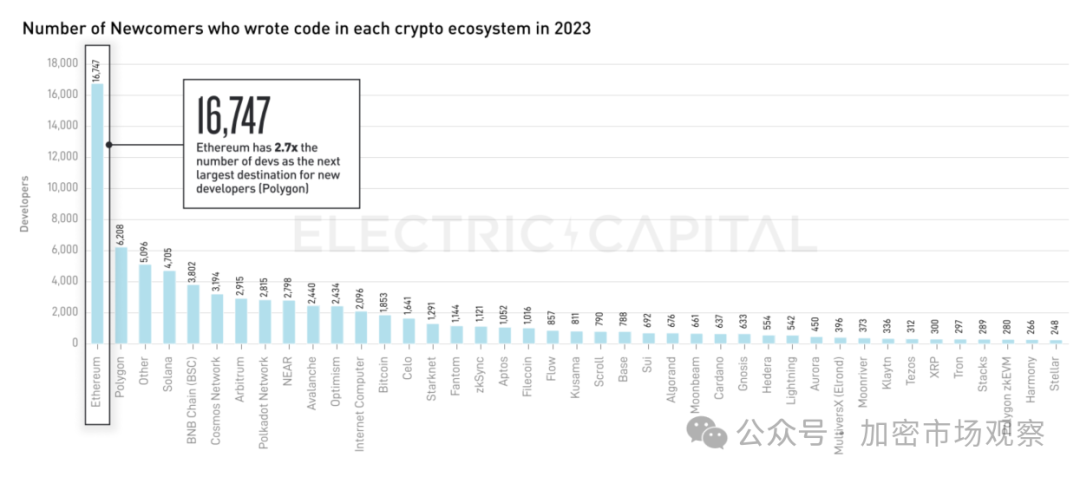

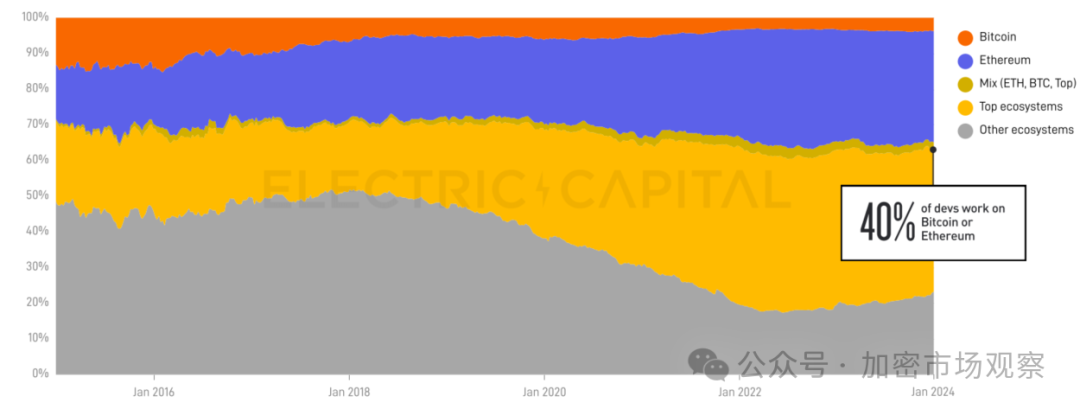

Ethereum remains dominant—most developers still start on the Ethereum mainnet:

Polygon, ranked second, is also part of the Ethereum ecosystem.

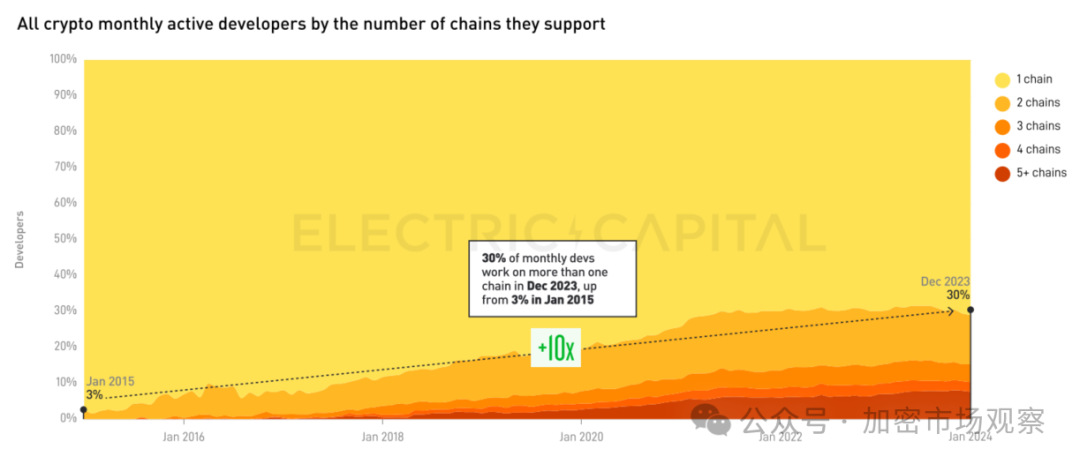

02 More developers are becoming cross-chain capable

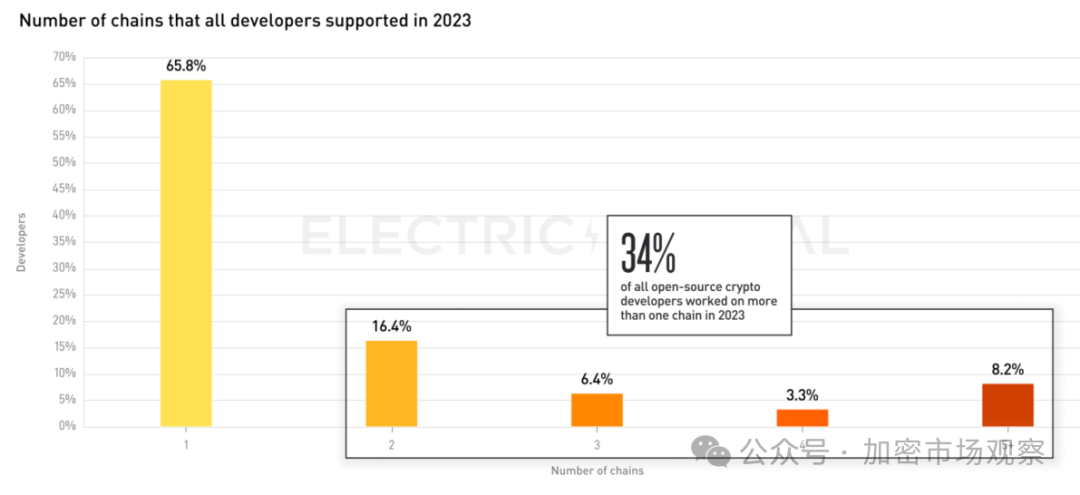

Most developers work on just one chain:

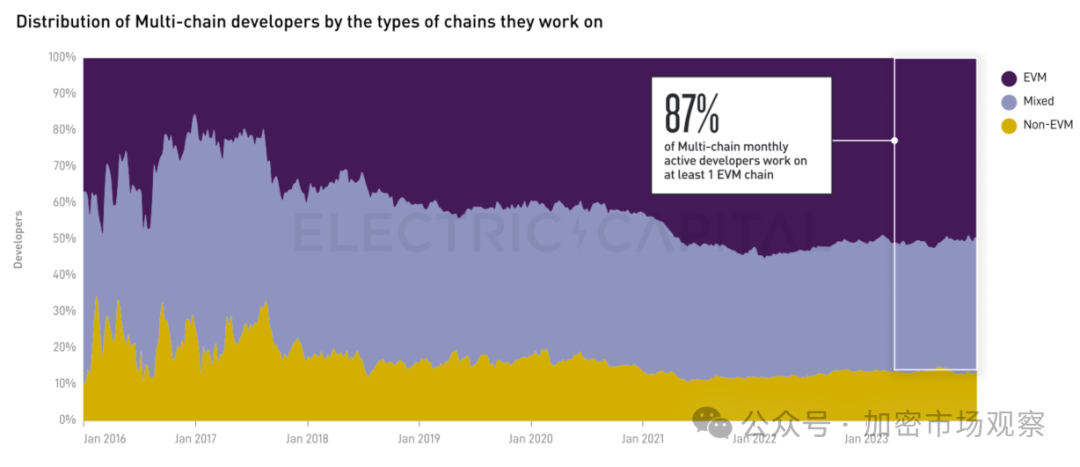

However, the share of cross-chain developers keeps rising—now at 30%.

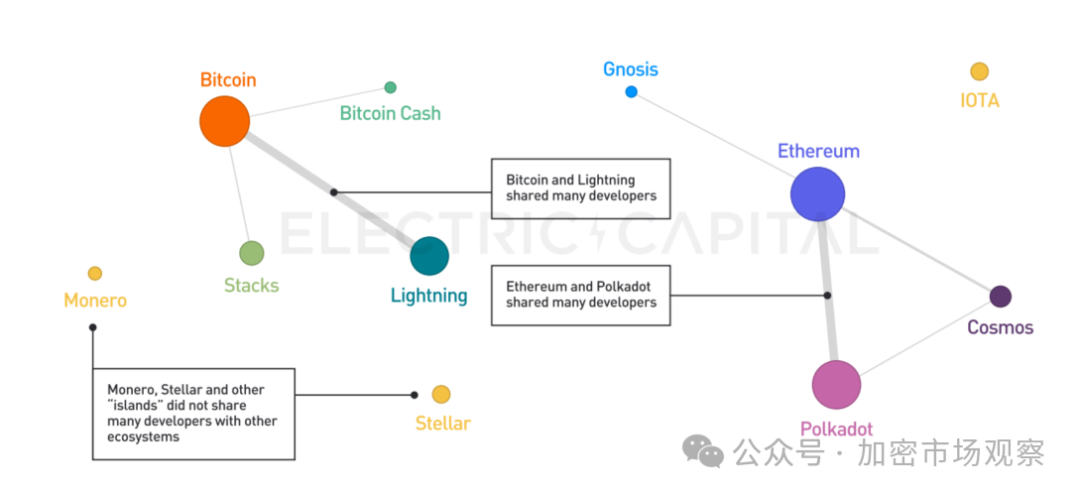

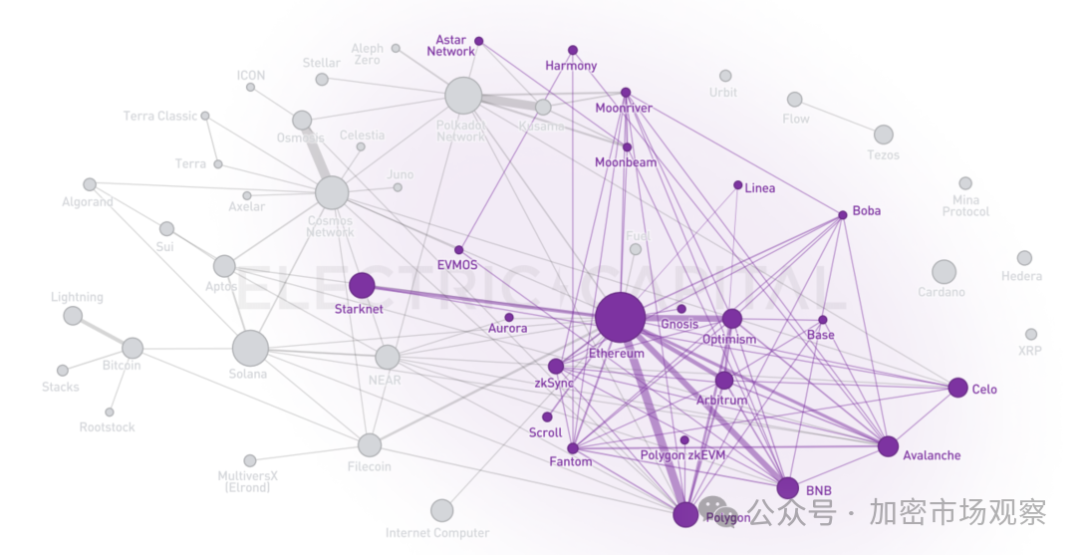

In 2018, the crypto ecosystem was relatively simple:

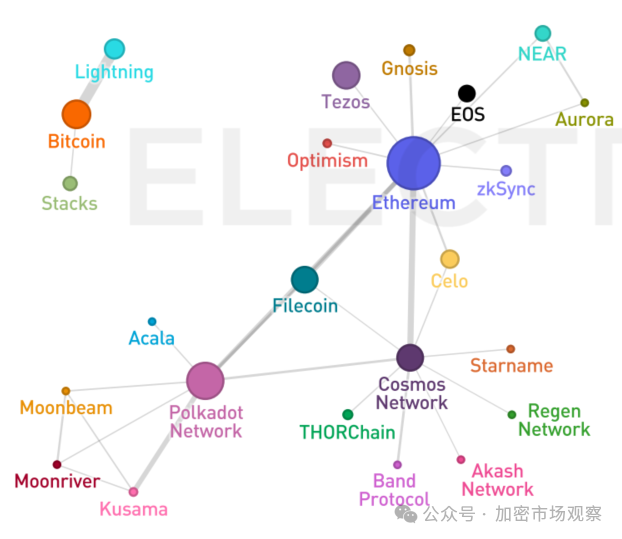

Dot size indicates number of developers; line thickness shows volume of cross-chain developers.

By 2020, Ethereum nearly dominated the landscape:

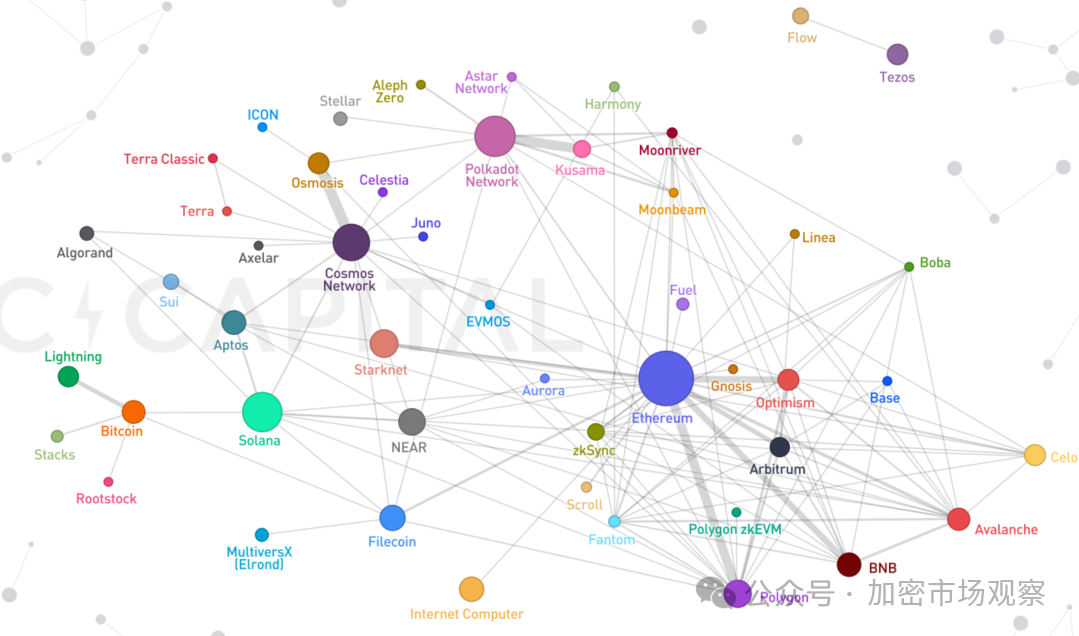

But by 2023, the public chain competition has taken a new turn:

It's hard to claim Ethereum dominates anymore.

Yet on EVM-compatible chains, Ethereum still holds significant influence:

Most developers still prefer the EVM environment:

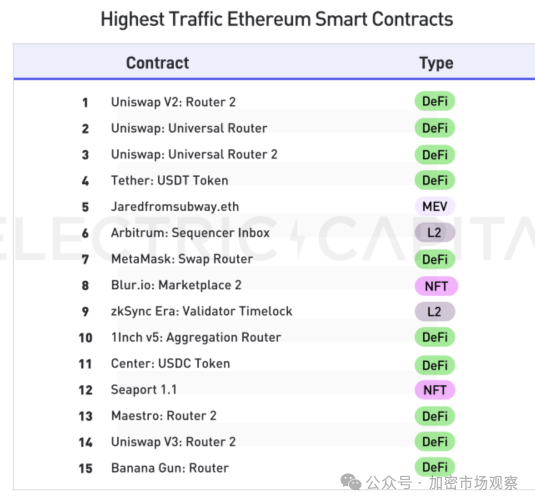

03 Ethereum still dominates at the application layer

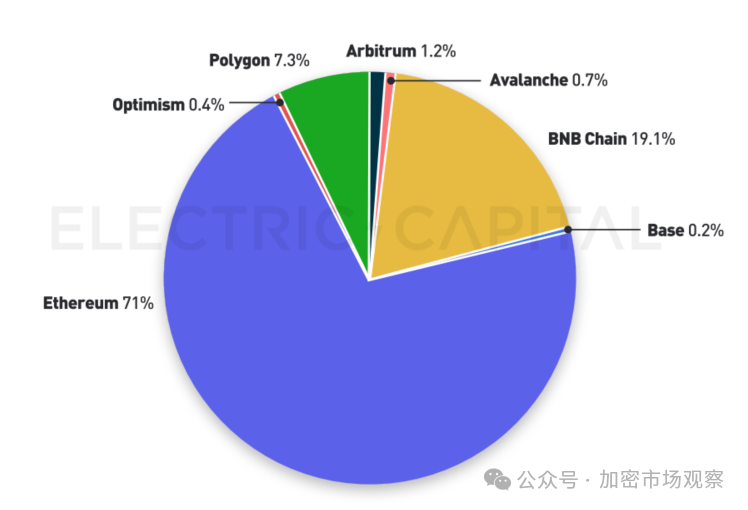

71% of smart contract code is still deployed on the Ethereum mainnet:

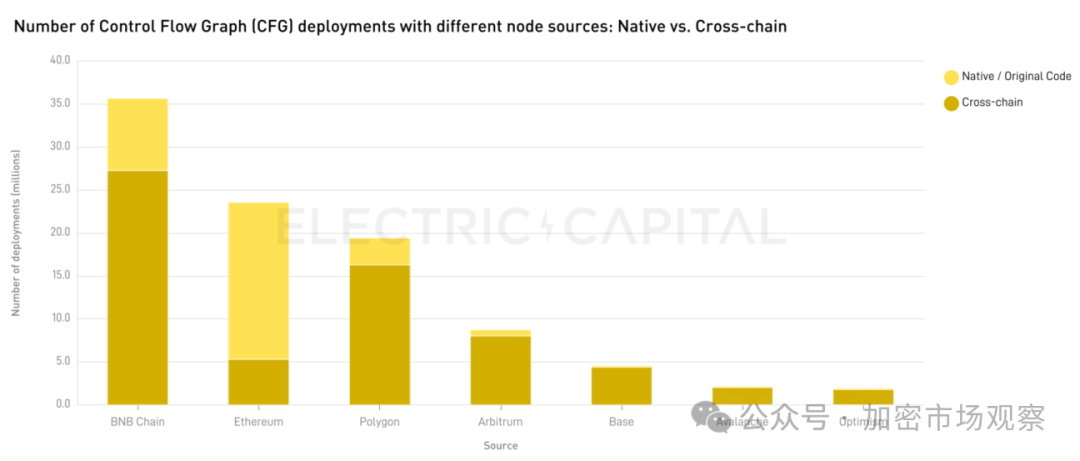

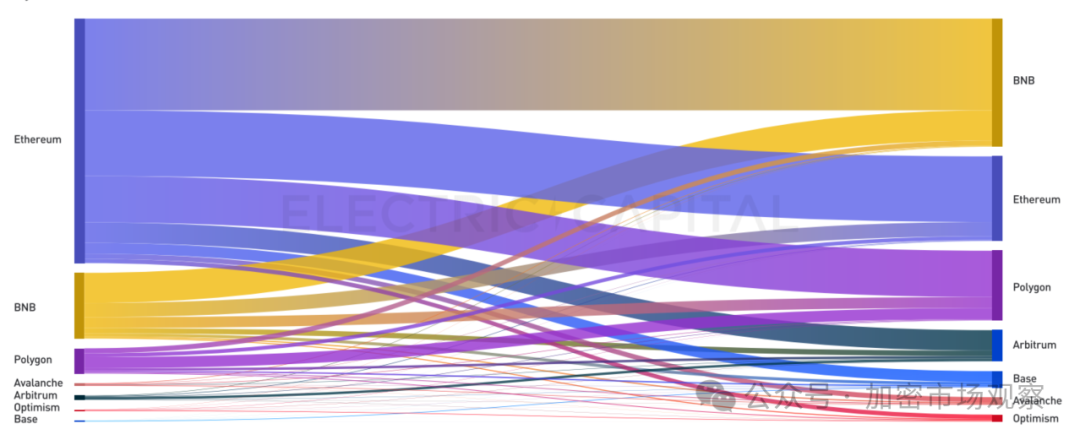

BNB Chain has risen strongly—not much native code, but it's the top choice for cross-chain deployments.

You could say the standard playbook is: launch on Ethereum first, then deploy on BNB Chain:

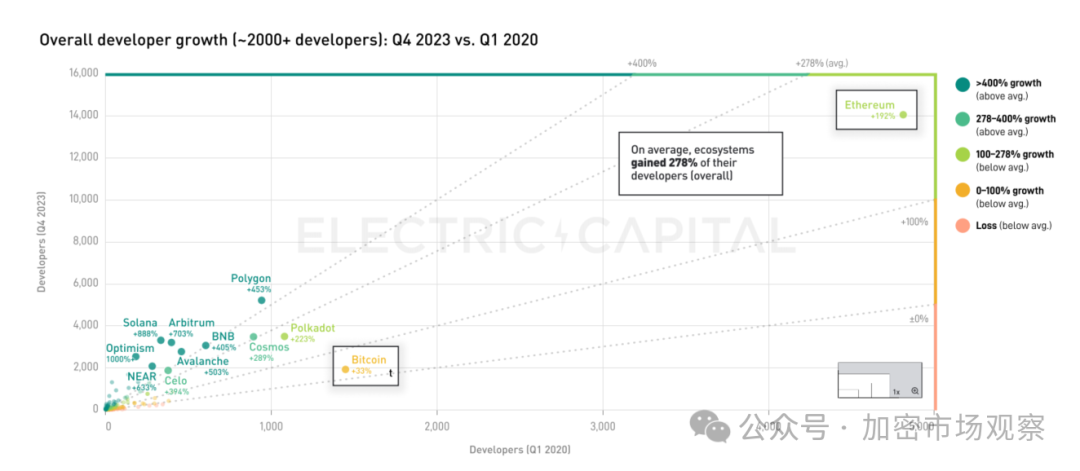

In contrast, despite the hype around Bitcoin’s ecosystem in 2023, developer growth remained modest (probably lagging by a year)

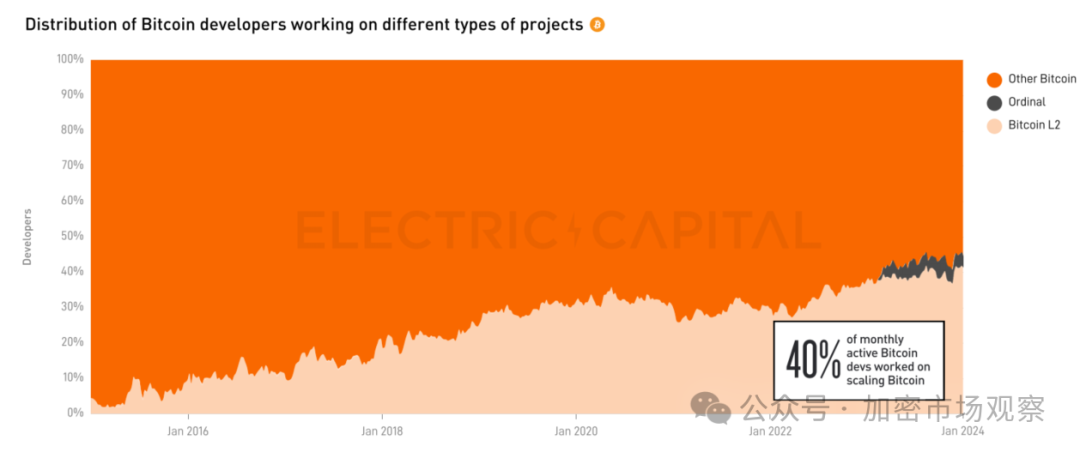

04 Bitcoin’s ecosystem is still immature

Though many investors believe 2024 will be the year of Bitcoin’s ecosystem, most developers haven’t caught on yet.

In fact, new developer additions on Bitcoin’s chain declined throughout Q4 2023.

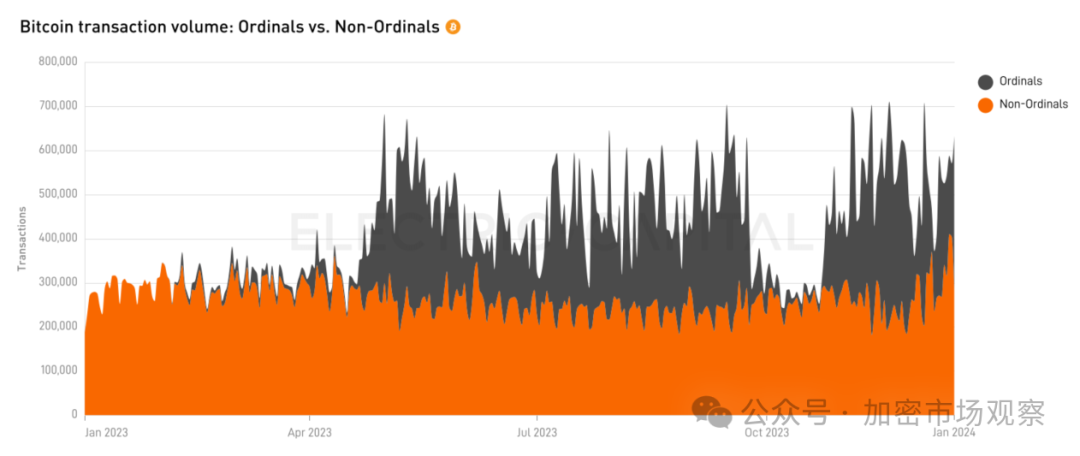

New transaction volume in Bitcoin’s ecosystem is largely driven by Ordinals:

More developers are engaging with Bitcoin L2s, but development around Ordinals themselves remains limited.

It remains to be seen when L2 transaction volume will match the level of developer interest.

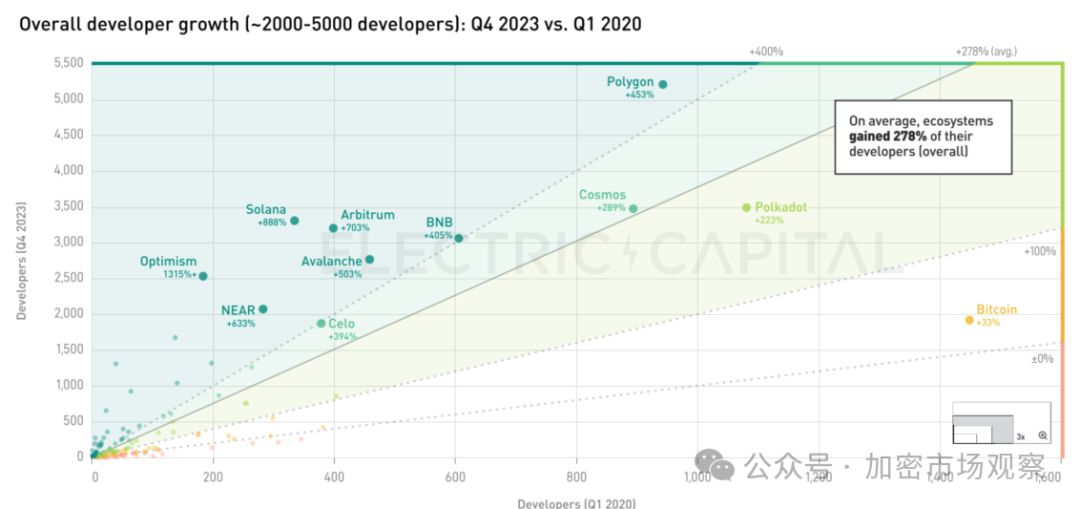

05 New public chain players are rising

In terms of developer count, Ethereum still leads by far.

But other chains are seeing rapid growth in developer numbers.

If we exclude giants like Ethereum, mid-tier chains look like this:

Most are Ethereum L2s, but Solana, Avalanche, and BNB Chain have entered the second tier—with larger developer bases than Bitcoin’s chain.

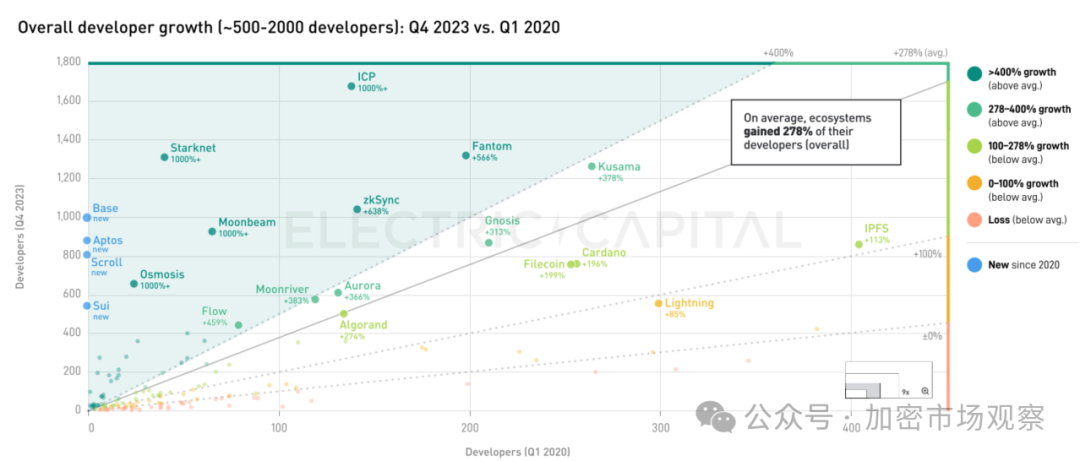

Looking at third-tier projects with fewer than 2,000 developers:

IPFS shows clear signs of stagnation, while ICP persists without revival—still holding decent developer strength.

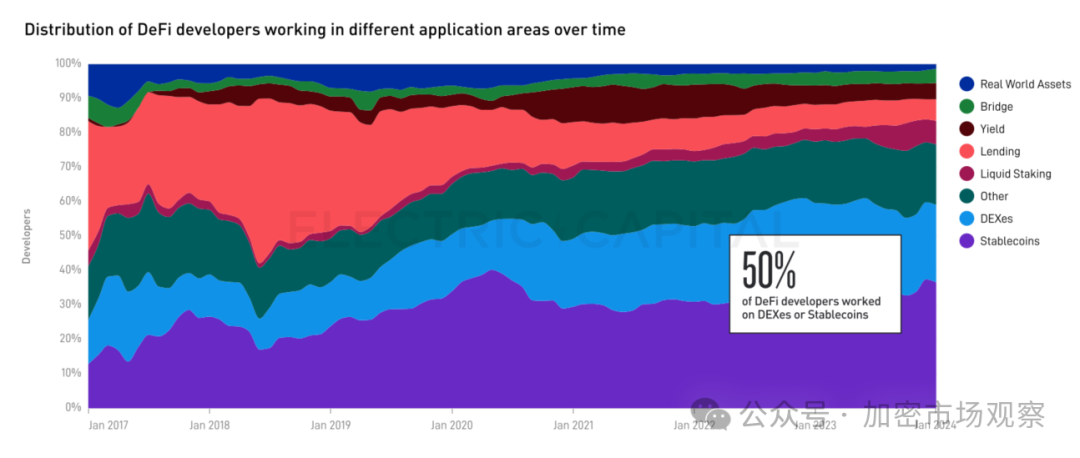

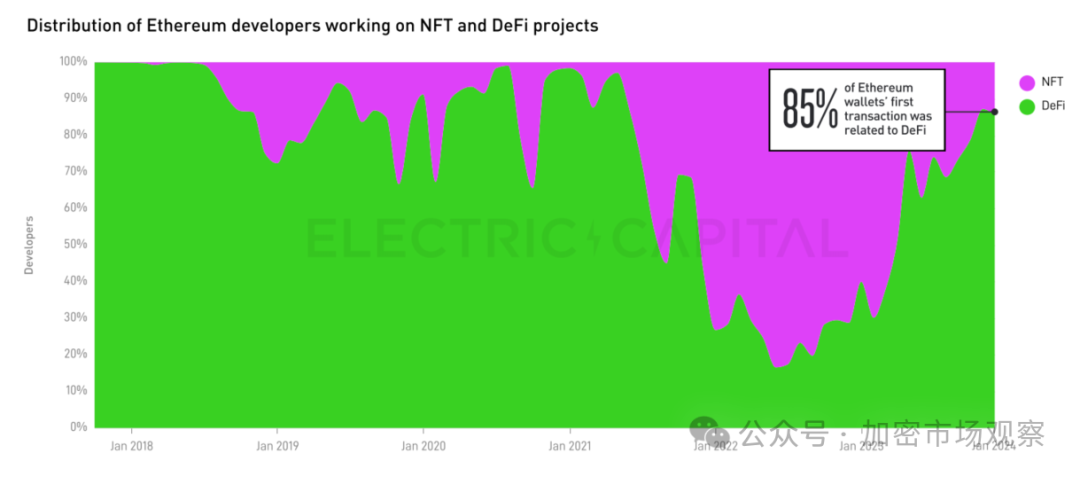

06 DeFi remains the dominant use case

In terms of smart contract usage, DeFi dominates overwhelmingly:

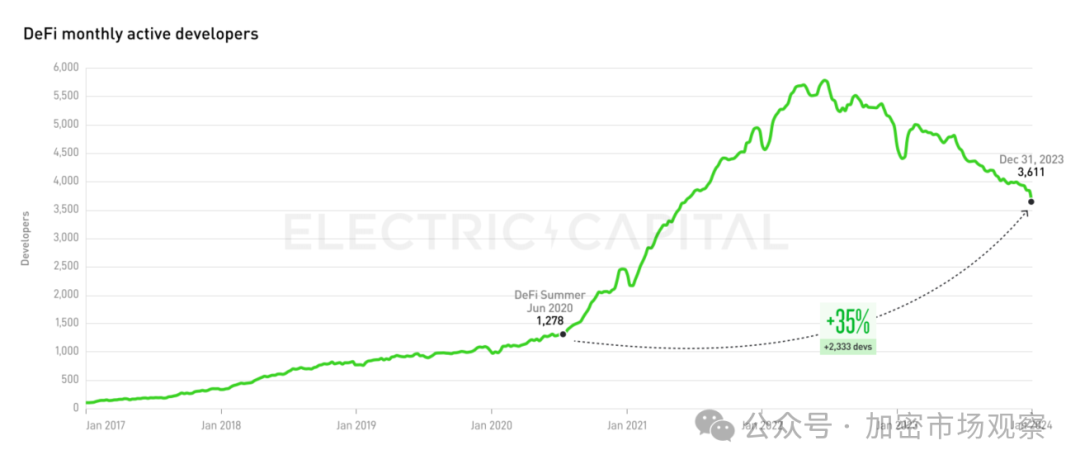

Since DeFi Summer, DeFi has accumulated strong developer momentum—poised for resurgence:

Like public chains, newcomers arrive fast but leave quickly. The veterans who stick around remain solid:

Half of DeFi developers focus on exchanges and stablecoins:

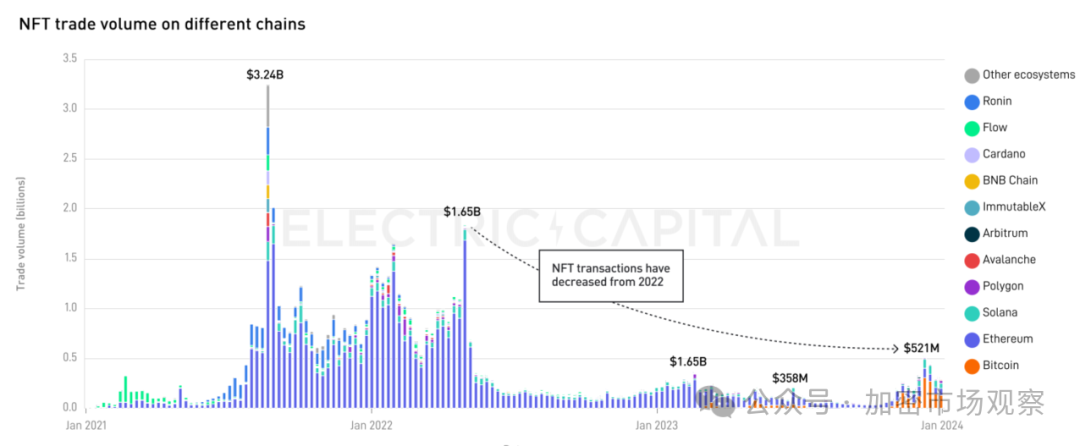

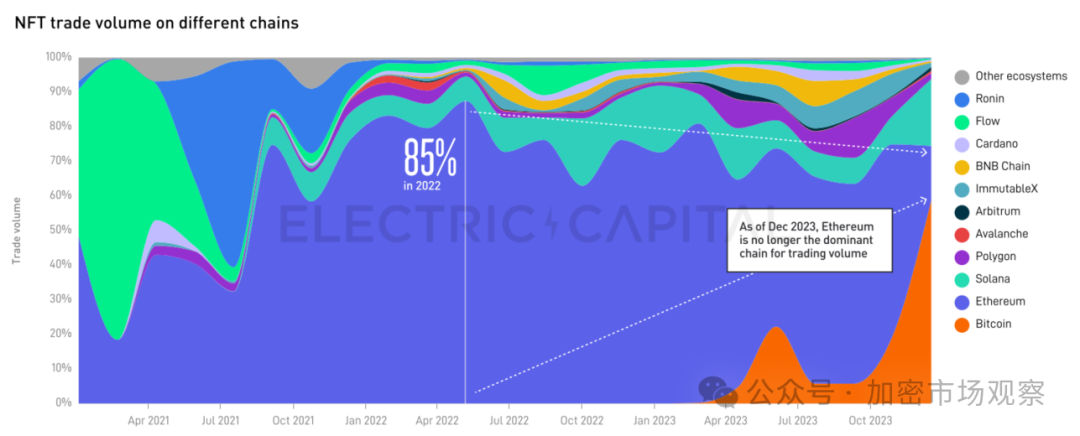

07 NFTs have faded—only sustained by Bitcoin’s ecosystem

NFTs once accounted for 80% of Ethereum’s first-time smart contract transactions—but now only 15%.

They cooled down rapidly after the peak. The slight recovery at the end of 2023 was driven by small NFT images on Bitcoin’s network.

In proportional terms, Bitcoin-based NFTs now account for nearly half the market:

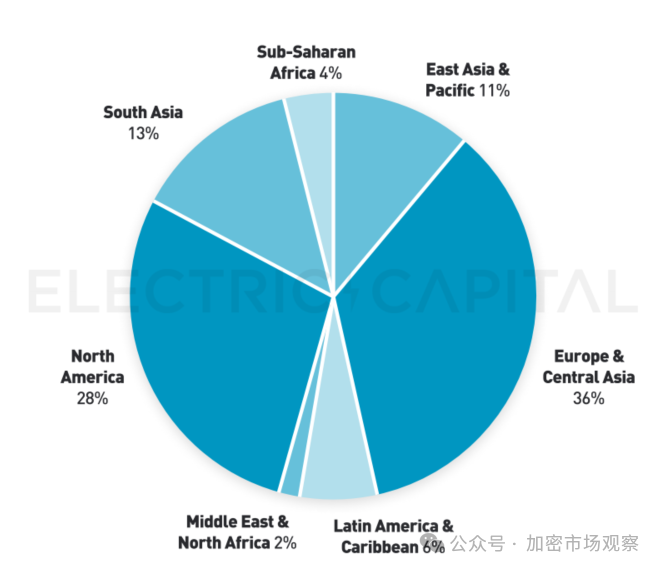

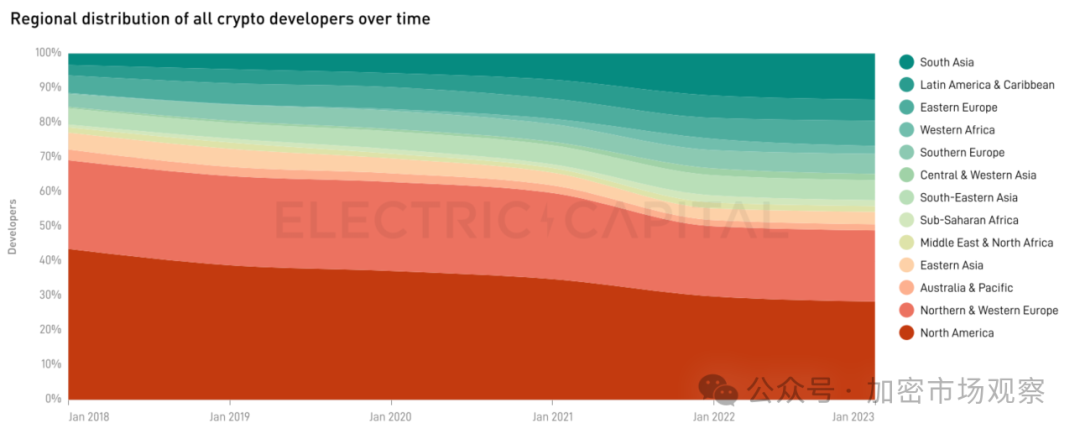

08 Most developers are in the West, with India rising fast

Don’t assume China leads in developer strength:

North America and Europe together account for over 60% of developers—Europe being strongest is somewhat surprising.

U.S. dominance is waning—once near 50%, now down to 30%.

India alone accounts for 13%—more than China, Japan, South Korea, and Southeast Asia combined.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News