Solana Cross-Chain Bridge Report: A Comprehensive Overview of Cross-Chain Protocols and DApps in the Solana Ecosystem

TechFlow Selected TechFlow Selected

Solana Cross-Chain Bridge Report: A Comprehensive Overview of Cross-Chain Protocols and DApps in the Solana Ecosystem

Now is the perfect time to dive deep into bridging Solana.

Author: Arjun Chand, Researcher at LI.FI

Translation: xiaozou, Golden Finance

Key Takeaways

-

Bridge activity in the Solana ecosystem has significantly increased, especially since November 2023. Bridges like Wormhole, Allbridge, and deBridge—early supporters of the Solana ecosystem—are well-positioned to benefit from this surge.

-

Growing user demand to move funds into Solana has triggered a wave of liquidity bridge expansions toward Solana. In December alone, Synapse, Meson, and Hashflow added support for routes to Solana. Soon, demand for platforms like Jumper to support Solana will become evident.

-

In messaging protocols, Wormhole offers developers the most robust toolkit, while deBridge's DLN is emerging as the preferred liquidity bridge for asset transfers.

-

There are almost no native bridging applications on Solana today, but that is changing. Phantom and Jupiter are leading this evolution by embedding bridging functionality directly into their services.

-

Upcoming projects—such as Circle’s CCTP, Wormhole’s Cross-Chain Queries, and Jumper Exchange’s Cross-Chain Swaps—will enhance Solana’s connectivity with the broader blockchain ecosystem. Additionally, innovations like Tinydancer’s light clients and Picasso’s IBC Guest chain concept promise trust-minimized cross-chain interactions.

Introduction

Discussions around Solana are growing louder, driving more activity within its ecosystem and attracting increasing numbers of developers and users eager to engage. Now is the perfect time to dive deep into bridging with Solana.

This article serves as an authoritative resource for anyone interested in understanding Solana. It aims to serve two primary audiences: developers looking to build cross-chain applications using messaging protocols, and users transferring assets to Solana in search of the next 1000x meme coin—hoping it might be their ticket to early retirement.

The article is structured into three main parts:

-

Part 1: Deep Dive into Messaging Protocols on Solana – This section analyzes the messaging protocols currently operating within the Solana ecosystem. We will examine their technical architecture, operational mechanisms, and inherent trade-offs, aiming to equip developers with critical information to choose the right protocol for their application needs, while also providing users with insights into origins, functionality, and security.

-

Part 2: Applications Supporting Cross-Chain Swaps on Solana – This part explores various applications enabling bridging and cross-chain swaps involving Solana. We’ll discuss how they work, their key features, impact on user experience, and how they contribute to liquidity and accessibility within the Solana ecosystem.

-

Part 3: Exciting Developments in Solana Interoperability – The final section highlights the most promising recent advances in Solana’s interoperability landscape, covering new projects, innovative upgrades to existing protocols, and other initiatives that could positively shape Solana’s future integration with the broader blockchain ecosystem.

Now, let’s explore each section in detail.

1. Deep Dive into Messaging Protocols on Solana

This section examines the design, security, and trust assumptions of various messaging protocols connecting Solana to the broader ecosystem. Through comprehensive architectural analysis, we highlight their unique features and understand their trade-offs.

We will cover the following aspects:

-

Overview: An in-depth look at the project’s product suite, performance data, key network effects, and security information.

-

How it works: Transaction lifecycle – Understanding how user funds are transferred between blockchains via liquidity networks built atop messaging protocols, including the different components of bridge designs.

-

Trust assumptions and trade-offs: Key trade-offs of each messaging protocol and their potential implications.

-

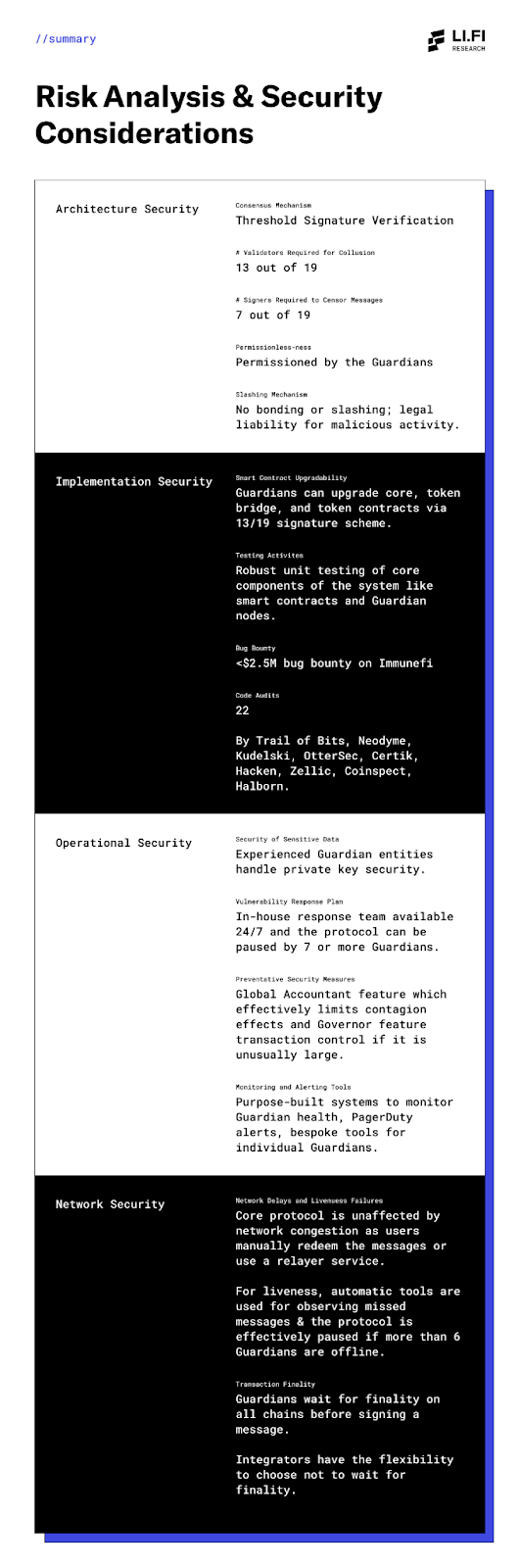

Risk analysis: Architectural design and security considerations – A summary of the protocol’s architecture, implementation, operations, and network security based on the cross-chain risk framework co-developed by LI.FI and Consensys.

-

Community and resources: How to stay updated and access all available resources about the project and its products.

1.1 Wormhole

1.1.1 Overview

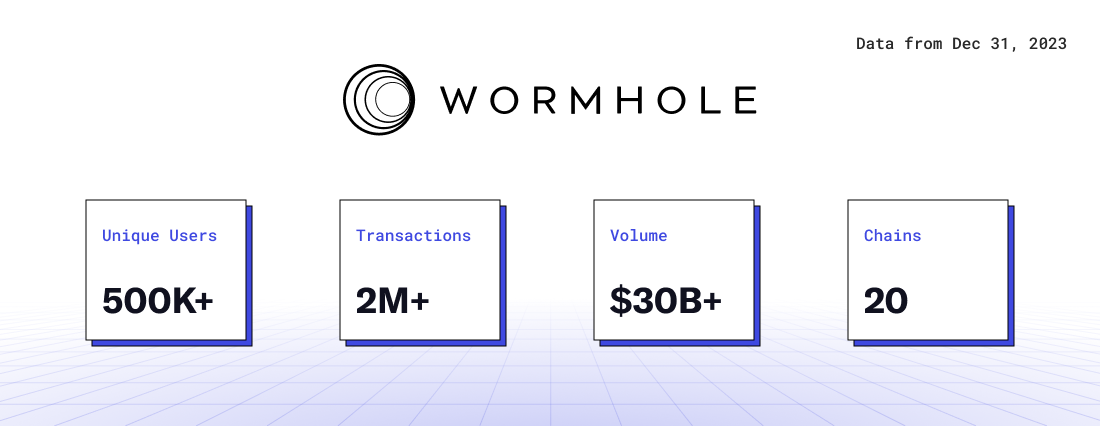

Wormhole is a messaging protocol launched in October 2020, designed to enable developers to build cross-chain native applications across multiple chains. Originally born from a hackathon project aimed at finding a way for blockchains to “talk” to each other, Wormhole was initially incubated and supported by Jump.

Its first version, Wormhole V1, primarily focused on building a two-way token bridge between Ethereum and Solana. As the project evolved, Wormhole transformed into a general-purpose messaging protocol connecting multiple chains across the ecosystem—a shift aligned with its broader vision of becoming a foundational layer for cross-chain development. Wormhole V1 was eventually phased out, and the Wormhole Network officially launched in August 2021.

Product Suite

In response to growing multi-chain demands, several cross-chain native applications have emerged on top of Wormhole, including products developed by the Wormhole team itself:

-

Portal – A lock-and-mint bridge allowing users to transfer tokens and NFTs across Wormhole-compatible chains. One of the earliest applications to use Wormhole’s messaging capabilities, Portal has played a major role in Wormhole’s growth.

-

Connect – A widget enabling developers to integrate Portal-like interfaces into their apps for token bridging. It provides a simple and fast way to add bridging functionality.

-

Gateway – A purpose-built blockchain designed to improve connectivity between Cosmos-based app chains and the broader ecosystem. Using a liquidity router, it acts as a unified liquidity layer across Cosmos chains—beneficial for developers targeting Cosmos app chains and users moving funds into the Cosmos ecosystem. Gateway is currently available for developers and accessible to users via Portal.

-

Queries – A tool for cross-chain data queries, enabling applications to read on-chain data from any EVM chain within the Wormhole ecosystem. Data is verified by a supermajority (2/3) of Wormhole’s 19 Guardians. Still in early development, Synthetix is expected to be an early adopter.

These products are further supported by multiple developer-friendly solutions from the Wormhole team (many now maintained by contributors under the newly established Wormhole Foundation), such as:

-

xAssets – Assets that can be bridged across any Wormhole-supported chain without slippage. For example, Pyth Network recently launched its PYTH governance token as a Wormhole xAsset, available to users across 27 chains.

-

Automatic Relayers – A relayer network that delivers messages across any Wormhole-supported chain. This allows developers to build cross-chain apps on Wormhole without needing to set up and maintain their own off-chain relayers.

-

Wormholescan – A cross-chain block explorer and analytics platform covering the entire Wormhole ecosystem, useful for tracking cross-chain transactions and monitoring network activity.

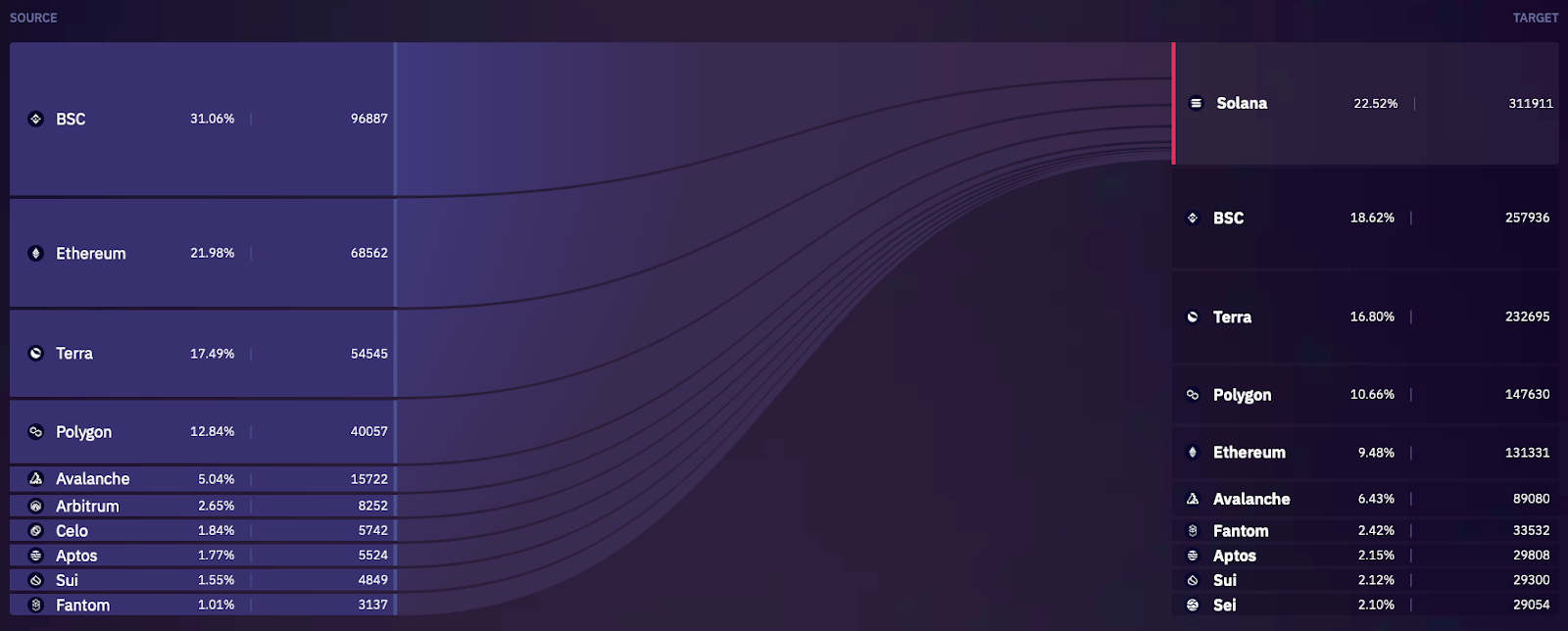

Network Effects

Given Wormhole’s early development and sustained focus on the Solana ecosystem, it’s no surprise that Solana has become the most active chain on Wormhole by transaction volume.

Interestingly, much of Wormhole’s traffic has historically been dominated by flows to and from Terra—an ecosystem that no longer sees significant activity. Currently, volume is concentrated on Ethereum, Solana, and Sui, followed by other EVM L1s and rollups.

Several factors have contributed to Wormhole’s growth and positioned it as one of the leading messaging protocols in the ecosystem:

-

Over 200 projects built on Wormhole – Wormhole has achieved strong distribution across the ecosystem, with numerous applications leveraging it for use cases such as liquidity bridges (Allbridge, Mayan, Magpie), multi-chain tokens (PYTH), token standards (Nexa), in-app bridging via Connect (Astroport, Uniwhale, YouSUI), and cross-chain deposits (Friktion, PsyOptions, Aftermath Finance).

-

Wormhole x NFT – Dust Labs adopted Wormhole’s cross-chain NFT standard to migrate its NFT collections (DeGods and y00ts) from Solana to Ethereum and Polygon, respectively. The standard is also used by the Aptos NFT bridge, enabling developers and users to bridge NFTs to and from the Aptos network.

-

$50 million Wormhole ecosystem fund – Managed by Borderless Capital and backed by prominent investors including Jump Crypto, Polygon Ventures, and the Solana Foundation, this fund provides crucial financial support for developers building cross-chain applications on Wormhole’s infrastructure.

-

xGrant program – Launched in early 2023, the xGrant program supports developers, researchers, and founders with not only funding but also mentorship and resources to foster innovation. Grants cover software development, marketing, team costs, and other expenses related to project growth.

-

tBTC on Solana – Threshold Network launched its tokenized Bitcoin (tBTC) on Solana using Wormhole for minting. This marks tBTC’s first expansion beyond EVM ecosystems and enables users to utilize Bitcoin within Solana’s DeFi ecosystem.

-

Wormhole x Uniswap – After a comprehensive evaluation of six different bridges, Uniswap’s Bridge Assessment Committee approved Wormhole for all cross-chain deployments, significantly boosting its reputation as a secure messaging protocol. Uniswap actively uses Wormhole for cross-chain messaging (especially for chains like Celo), further solidifying its status as a reliable choice.

-

Wormhole x Circle CCTP – Wormhole successfully integrated Circle’s Cross-Chain Transfer Protocol (CCTP), making it accessible to other applications via Connect and to users via Portal. The upcoming launch of CCTP on Solana has generated significant interest, with teams like Jupiter announcing plans to integrate CCTP into their apps through Wormhole.

-

$225 million funding round, $2.5 billion valuation – Wormhole recently achieved a major funding milestone, raising $225 million at a $2.5 billion valuation. This substantial investment underscores the strength of the team, widespread adoption of its products, and overall quality. It has also drawn attention from airdrop farmers, who now closely compare Wormhole to LayerZero, viewing it as "a highly valuable contender in the interoperability space." With Solana’s ongoing airdrop season and strategic moves like offering “early” Discord roles (potentially signaling future airdrops), Wormhole is poised for even greater community engagement.

Security Audit

-

Audits – Wormhole’s architecture consists of several key components, including Guardian nodes and smart contracts tailored to different chains and execution environments. Its tech stack has undergone 22 audits conducted by Neodyme, Kudelski, Trail of Bits, CertiK, Runtime Verification, OtterSec, and Zellic. While each audit is counted separately, many may be part of broader assessments of the Wormhole tech stack.

-

Bug bounty program – Since September 2022, Wormhole has run a $2.5 million bug bounty program on Immunefi, focusing on the security of its smart contracts and Guardian nodes.

-

Security incident – In February 2022, Wormhole suffered a security breach where an attacker exploited a signature verification vulnerability to mint 120,000 wETH on Solana, resulting in losses estimated at ~$326 million. The issue was patched within hours, Wormhole quickly resumed operations, and Jump provided the necessary funds to cover the shortfall.

Following the incident, the Wormhole team announced the following future security measures:

-

Continuous auditing – Comprehensive and ongoing audits of the Wormhole codebase, with proactive planning to prevent future vulnerabilities.

-

Advanced monitoring tools – Features like accounting mechanisms and monitoring systems help isolate cross-chain risks and detect threats early, ensuring effective dynamic risk management.

-

Bug bounty program – Wormhole launched its bug bounty program on Immunefi shortly after the incident.

Recognizing these improvements, Uniswap’s Bridge Assessment Committee noted in their report:

“Post-breach, Wormhole made substantial improvements to its practices, including enhanced deployment processes, clearer incident response plans, and stronger unit testing. These enhancements are commendable and demonstrate the protocol’s evolution and maturity.”

Wormhole has introduced several additional security features into its tech stack:

-

Global Accountant – Monitors the total circulating supply of all Wormhole assets across all chains, effectively preventing any blockchain from transferring more assets than actually exist.

-

Governor – Complementing the Global Accountant, Governor tracks inflows and outflows of assets across all chains. It can delay suspicious transfers and limit the impact of exploits by holding large-value messages for 24 hours. Governor’s thresholds can be adjusted as chain ecosystems mature.

-

Open-source codebase – By open-sourcing its code, Wormhole lowers the barrier for white-hat hackers to identify and report vulnerabilities.

-

Comprehensive monitoring via Guardians – Wormhole Guardians are professional validation firms with expertise in running, monitoring, and securing blockchain operations. They continuously monitor blockchain and smart contract activity, ensuring network security through tools like Governor.

-

ZK (zero-knowledge) integration with Wormhole – Wormhole is actively integrating message ZK verification into its tech stack.

Growth Metrics

1.1.2 How It Works – Transaction Lifecycle

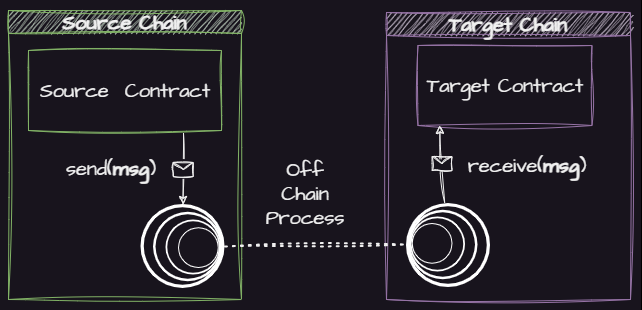

Transferring messages from a source chain to a destination chain via Wormhole’s architecture is highly complex but straightforward at a high level. Here’s a simplified breakdown:

1) Message initiation: Every message originates from a “core contract” on the source chain.

2) Guardian validation and signing: The message is then validated and signed off-chain by 19 Guardians. A message is considered valid only after receiving signatures from at least two-thirds (13 out of 19) of the Guardians.

3) Forwarding to destination chain: Once validated and signed, the message is forwarded to the core contract on the destination chain.

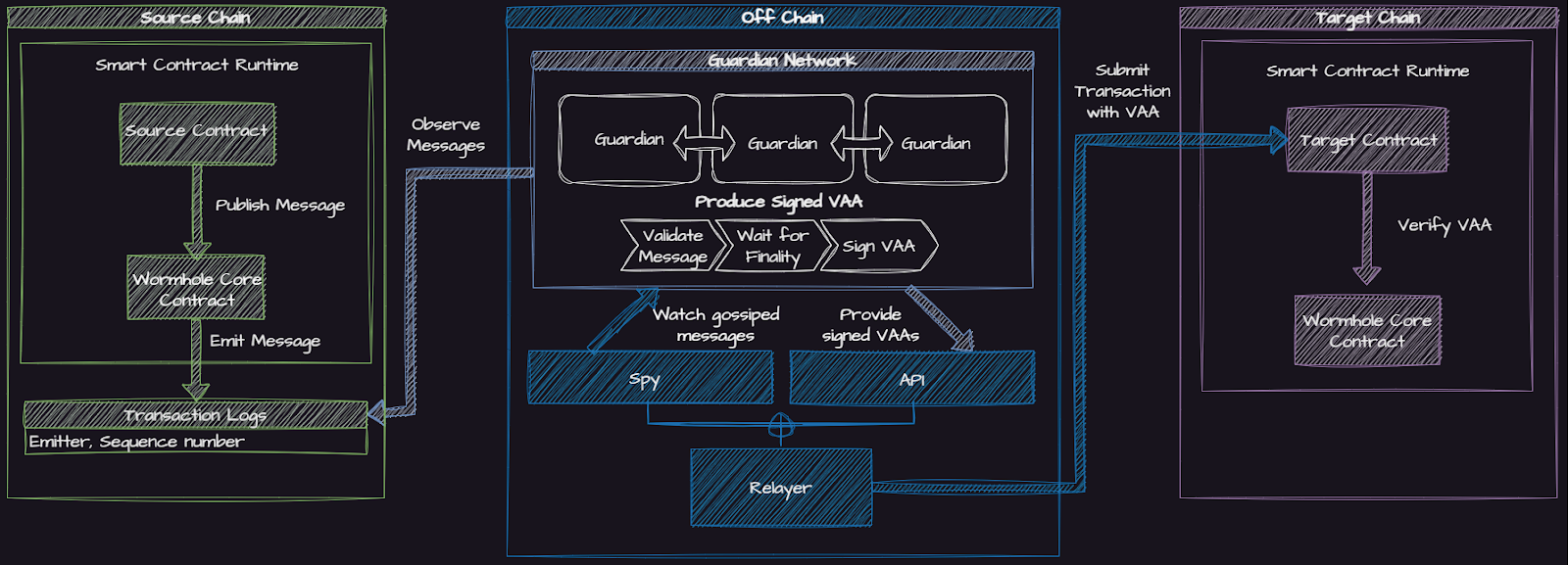

Looking deeper, several key components work together to ensure secure cross-chain message passing:

Let’s dive into how the Wormhole Guardian network validates messages:

-

Step 1: Core contract on the source chain emits the message.

-

Step 2: Guardians observe and validate the message’s authenticity.

-

Step 3: Guardians wait for finality confirmation on the source chain, then sign the hash of the message body to prove validity.

-

Step 4: Individual Guardian signatures are compiled into a multisig file known as a VAA (Verifiable Action Approval).

-

Step 5: Relayers transmit the VAA to the core contract on the destination chain.

Note: “Spies” monitor all messages transmitted through the Guardian network and log them into storage systems (e.g., SQL databases) for analysis and further use.

1.1.3 Trust Assumptions and Trade-offs

Here are some notable trust assumptions and trade-offs associated with Wormhole:

-

External validation by a validator set – Wormhole’s proof-of-authority system relies entirely on trusting Guardians to validate transactions. If more than two-thirds collude within a specific timeframe, user funds could be stolen.

-

Censorship risk – 7 out of 19 Guardians could collude to censor messages.

-

No slashing mechanism for Guardians – Wormhole does not implement a slashing mechanism for Guardians. However, accountability remains a key aspect of the network design. Any malicious activity can be directly traced to a specific Guardian, exposing them to legal liability and reputational damage.

-

Permissioned Guardian set – Adjustments to the Guardian set—whether adding or removing members—are governed by a 13/19 signature scheme.

1.1.4 Risk Analysis: Architecture Design and Security Considerations

1.1.5 Community and Resources

You can learn more about Wormhole through the following channels:

● Website

● Documentation

● Developer Portal

● GitHub

● Explorer

● Medium

● Wormhole Scan

Follow Wormhole on these platforms for community updates:

● Discord

● Telegram

● YouTube

1.2 Allbridge

1.2.1 Overview

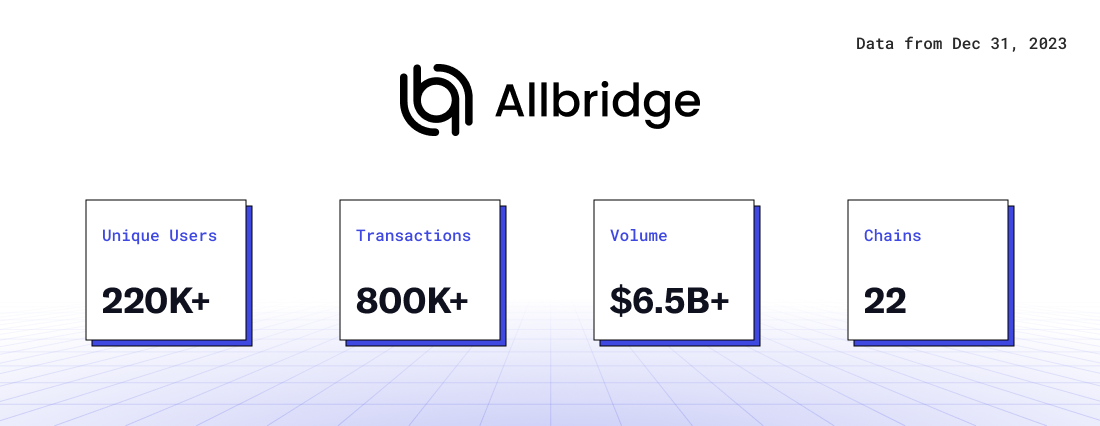

Launched in July 2021, Allbridge is a blockchain bridge within the Solana ecosystem. Initially named Solbridge, its focus was expanding Solana’s utility by connecting it to other chains. Over time, the protocol expanded beyond Solana and rebranded as Allbridge.

Product Suite

Allbridge Classic is the first version of Allbridge. It supports asset transfers across 20 chains, including both EVM and non-EVM chains like Solana and Stellar. This version handles the majority of Allbridge’s transaction volume.

In June 2022, Allbridge launched Allbridge Core, a next-generation bridging platform focused on cross-chain stablecoin swaps. This new version addresses pain points from the original, particularly the cumbersome process of deploying wrapped bridge tokens and converting them into desired assets.

By focusing on stablecoin swaps, Allbridge Core simplifies the bridging experience. Since most bridging activity involves stablecoins, Allbridge Core meets most user needs while maintaining a lightweight, streamlined product. Currently, Allbridge Core operates 11 liquidity pools enabling stablecoin swaps across 7 chains.

Additionally, Allbridge Core introduces unique features such as:

● Support for multiple messaging protocols – In addition to using its own messaging, Allbridge Core supports other protocols like Wormhole. This integration enables access to unique chains via Wormhole and provides alternative routing options.

Recently, Allbridge Core integrated Circle’s Cross-Chain Transfer Protocol (CCTP). This allows USDC transfers across CCTP-compatible chains without requiring liquidity pools on those chains. Users can also choose among three different messaging protocols, each with varying fees and transfer times.

Currently, CCTP support is limited to EVM chains. However, this will soon change, as CCTP already supports Solana on devnet and is expected to go live on mainnet soon.

● Extra gas on destination chain – This feature solves the “cold start” problem when users bridge assets to a new chain. It allows users to easily send extra funds to cover gas fees on the destination chain.

The “extra gas” feature is gradually becoming standard in multi-chain ecosystems. For instance, in the Solana ecosystem, Phantom uses this function as a “refuel” option in its Cross-Chain Swapper, powered by LI.FI and supported by Allbridge Core.

Beyond user-facing products like Allbridge Classic and Allbridge Core, Allbridge offers Allbridge BaaS (Bridge-as-a-Service), a white-label bridging solution. This allows projects to use Allbridge’s cross-chain messaging functionality to launch dedicated bridges for their tokens, for a one-time setup fee of $20,000.

Network Effects

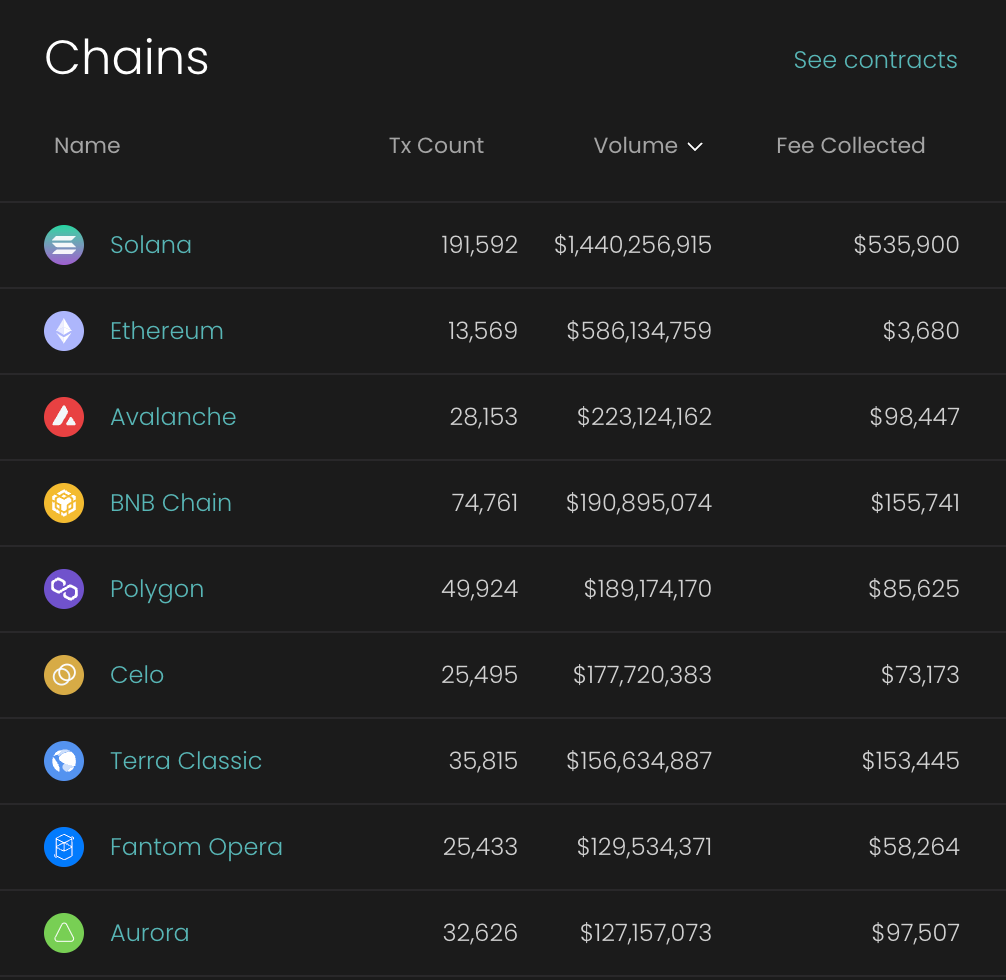

From its initial focus on Solana to winning the Solana Hackathon in 2021, Allbridge’s roots are deeply tied to the Solana ecosystem. This focus has paid off—Solana remains the most active chain on Allbridge. Since launch, Allbridge Classic has processed over 190,000 transactions on Solana, totaling over $1.44 billion in volume and generating $535,000 in fees.

Other major ecosystems contributing to Allbridge’s growth include well-known names across all bridges—Ethereum, Avalanche, BNB Chain, and Polygon. Notably, for Allbridge Core, the Tron network stands out as a compelling ecosystem.

It’s worth noting that popular L2 solutions like Arbitrum and Optimism typically dominate EVM bridge metrics but are absent from the list above. Allbridge does not yet support several major emerging L2s like Base, zkSync, and Linea. Allbridge Core only supports USDC on Arbitrum.

Recently, Allbridge Core integrated with LI.FI, gaining access to over 120 cross-chain swap protocols. Additionally, Allbridge is currently the sole bridge provider supporting EVM <> Solana swaps in Phantom’s Cross-Chain Swapper, giving it exclusive access to high-volume transactions until other providers are added.

Furthermore, Allbridge showcased a testnet demo of its CCTP integration at Breakpoint 2023. Its strategic partnership with Circle to launch CCTP on Solana will further accelerate protocol adoption.

Security Audit

-

Audits – Allbridge’s architecture has undergone five audits: Hacken (September 2021, score: 10/10), Kudelski Security (May 2022), Cossack Labs (September 2022), Hacken again (February 2022, score: 9.8/10), and CoinFabric (July 2023).

-

Bug bounty program – Allbridge runs an open bounty program on HackenProof, with rewards ranging from $100 to $4,000.

-

Security incident – In April 2023, Allbridge Core suffered a flash loan exploit on BNB Chain, resulting in $650,000 in losses. Attackers exploited a logic flaw in the withdrawal function to manipulate pool pricing.

The Allbridge team recovered “most of the stolen funds” and compensated affected users who submitted claims. After the attack, the protocol was relaunched with the following fixes and security enhancements:

-

Corrected liquidity calculations for deposits and withdrawals – Extensively tested.

-

Introduced Rebalancer privileges via a special account – Allows the team to rebalance pools during extreme emergencies without paying fees.

-

Automatic shutdown feature under extreme pool imbalances, such as stablecoin de-pegs.

-

Manual bridge shutdown capability to improve response time during unexpected events.

-

Public code repository, highlighting the team’s commitment to open-source development and inviting white-hat researchers to review bridge contracts.

The L2BEAT team noted that Allbridge Core “contains many unverified core smart contracts,” which could put user funds at risk if malicious code is present.

Notably, after the security incident, Allbridge Core’s contracts were redeployed. Main contracts are now verified. Allbridge Classic contracts are also verified.

However, L2BEAT noted that certain bridge contracts remain unverified. Allbridge explained this stems from overlapping legacy Core and Classic-related contracts predating the incident. The team is actively working to resolve and clarify this discrepancy on the L2BEAT website for greater transparency.

Growth Metrics

1.2.2 How It Works – Transaction Lifecycle

Allbridge Core

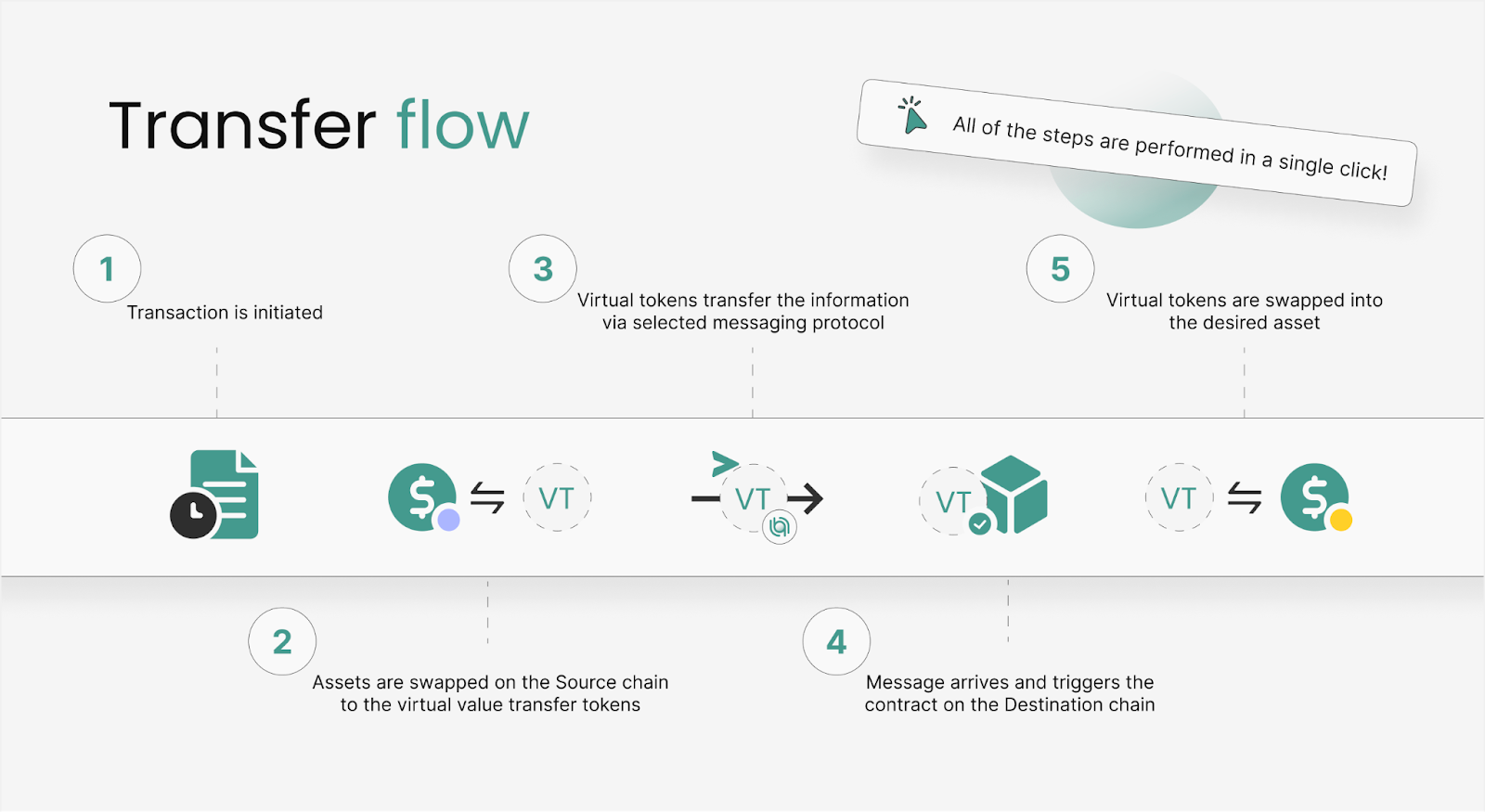

Here’s how assets are transferred from the source chain to the destination chain via Allbridge Core:

-

Step 1: User sends assets to the liquidity pool on the source chain, where they are locked.

-

Step 2: These assets are converted into virtual tokens (VT) representing their USD value. For example, sending 100 USDC converts into VT based on the current exchange rate.

-

Step 3: Virtual tokens carrying transaction data are transmitted to the destination chain via the selected messaging protocol. Validators confirm assets are locked on the source chain and accurately converted to “virtual tokens.”

-

Step 4: Upon arrival, the message triggers the smart contract on the destination chain.

-

Step 5: The smart contract exchanges VTs in the destination chain’s liquidity pool for the desired token and sends it to the user’s address.

Although this appears as separate steps across different chains, it happens in a single click for the user.

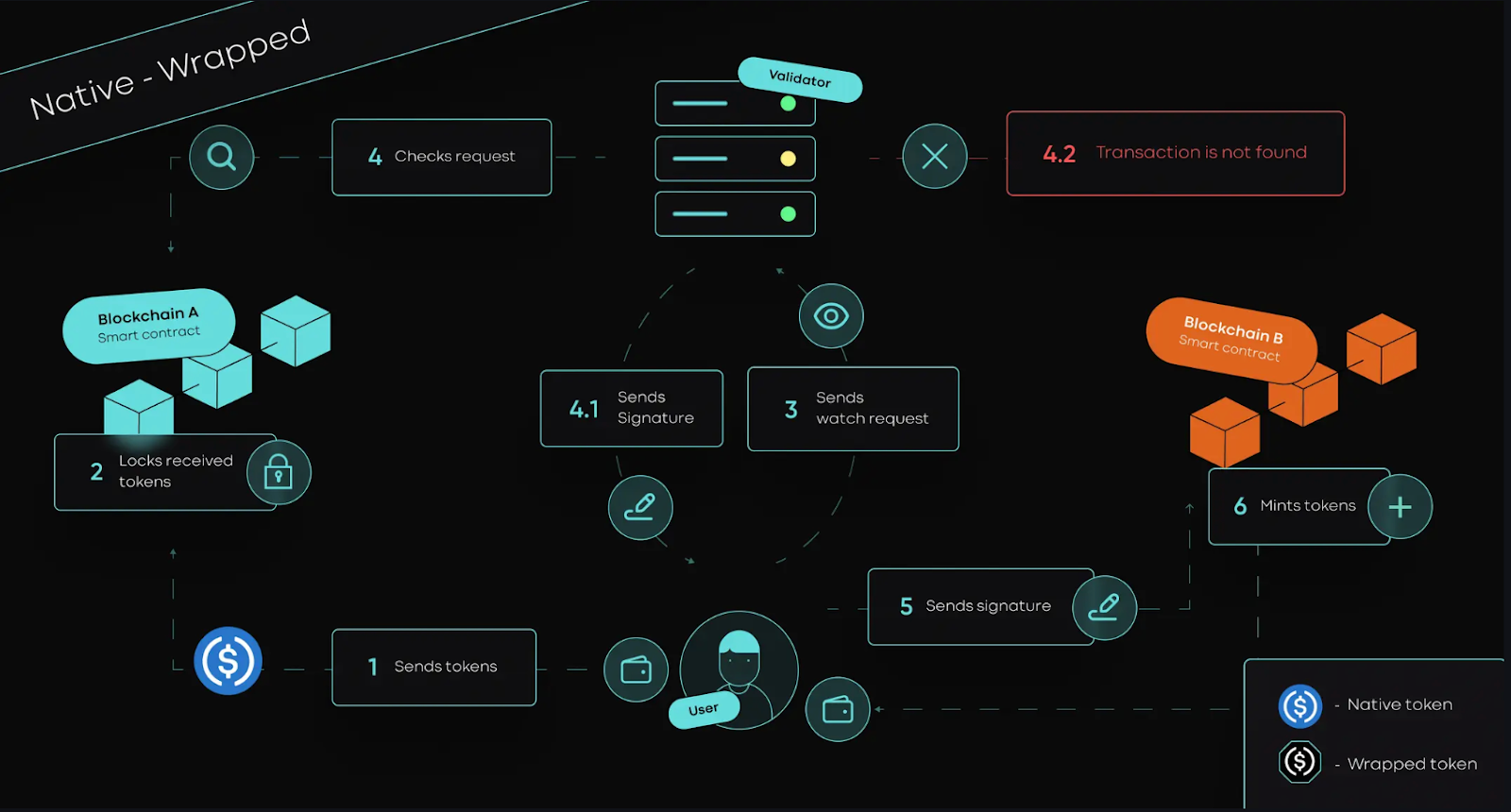

Allbridge Classic

Allbridge Classic widely supports tokens like aeUSDC (Allbridge Ethereum-wrapped USDC), minted by the Allbridge bridge.

Here’s how assets are transferred from the source chain to the destination chain via Allbridge Classic:

-

Step 1: User sends funds to the Allbridge smart contract on the source chain. Two types of assets can be sent: 1) Native assets – locked in the liquidity pool on the source chain. 2) Wrapped assets – burned by the smart contract on the source chain.

-

Step 2: A transaction record is created, requesting validation by Allbridge validators.

-

Step 3: Validators verify the locking of funds on the source chain.

-

Step 4: Once verified, validators issue a signature to the user.

-

Step 5: User forwards this signature to the smart contract on the destination chain.

-

Step 6: Funds are delivered to the user. The process varies depending on the desired asset type on the destination chain:

1) For native assets, they are unlocked from the smart contract on the destination chain and transferred to the user’s wallet.

2) For wrapped assets, they are minted by the smart contract on the destination chain and transferred to the user’s wallet.

1.2.3 Trust Assumptions and Trade-offs

Here are some notable trust assumptions and trade-offs for Allbridge:

-

External validation by a validator set – Allbridge relies on third-party validators to verify user transactions, depending on the underlying messaging protocol used (Allbridge, Wormhole, or CCTP).

-

Small validator set – Allbridge’s validator set includes only 2 validators. These two could collude to relay malicious messages and steal user funds.

-

Censorship risk – A single validator in Allbridge’s set could censor messages.

-

Permissioned validator set – Validators in the system are operated and/or selected by the Allbridge team.

-

No slashing mechanism – There is currently no slashing mechanism to deter collusion or censorship by validators.

-

Allbridge team can censor users – While the special account gives the team more control to respond quickly in emergencies, it could also be misused to wrongly censor user deposits, withdrawals, and transactions.

1.2.4 Risk Analysis: Architecture Design and Security Considerations

1.2.5 Community and Resources

You can learn more about Allbridge through the following channels:

● Website

● Allbridge Core Documentation

● Allbridge Classic Documentation

● Medium

● Messari on Allbridge Core

● Messari on Allbridge Classic

Follow Allbridge on these platforms for community updates:

● Telegram

● Discord

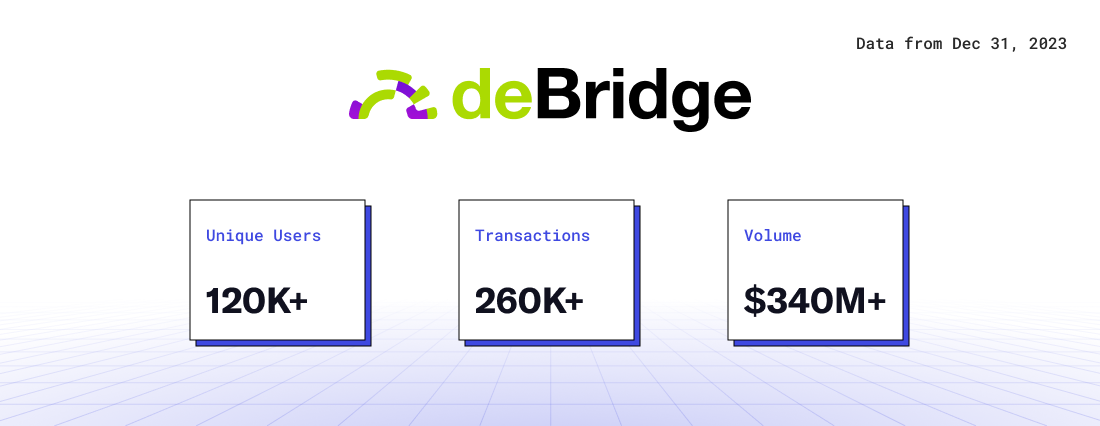

1.3 deBridge

1.3.1 Overview

deBridge is an interoperability protocol launched in August 2021, supporting cross-chain messaging and liquidity transfer. The project began as a hackathon entry at the Chainlink Global Hackathon in April 2021 and secured $5.5 million in funding later that year.

deBridge’s expansion into the Solana ecosystem began with a $20,000 grant from the Solana Foundation in June 2021. Unlike the previously discussed protocols, deBridge was initially focused solely on EVM-compatible chains. It wasn’t until June 2023 that deBridge arrived on Solana, becoming one of the early pioneers.

Product Suite

deBridge’s product suite includes a range of cross-chain applications leveraging its messaging functionality:

-

deSwap Liquidity Network (DLN) – A liquidity network enabling low-cost, fast cross-chain swaps on any deBridge-supported chain. Unlike traditional models relying on liquidity pools, DLN leverages market makers who provide liquidity on-demand, achieving zero TVL asset transfers. To ensure sufficient liquidity for large orders, deBridge partners with established market makers like RockawayX and Fordefi.

-

dePort – A lock-and-mint bridge allowing applications to create debridge-wrapped assets (deAssets) across chains. These minted assets are backed 1:1 by original tokens on the source chain, ensuring network-wide asset integrity.

Beyond direct cross-chain swap applications, deBridge extends these products to other apps—including wallets—through seamless integration APIs. Additionally, bloXroute Labs is developing an SDK to integrate DLN into its blockchain distribution network. This will allow bloXroute users—including MEV searchers, institutional DeFi traders, and various projects—to execute DLN-powered cross-chain swaps.

Moreover, deBridge offers deBridge IaaS (Interoperability-as-a-Service), a subscription service enabling EVM and SVM blockchains to integrate deBridge products into their ecosystems. The monthly fee is $11,000 ($10,000/month quarterly). Neon Labs is the first user of this service.

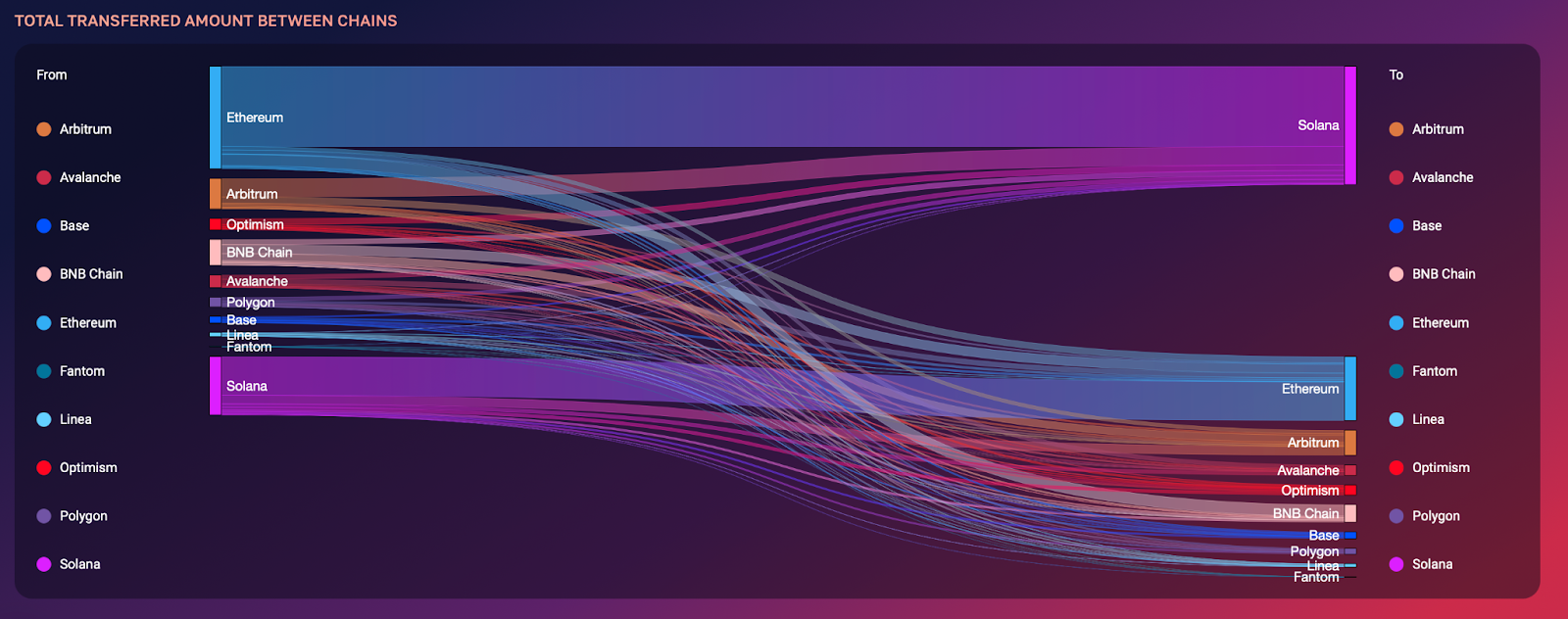

Network Effects

Since launch, deBridge has experienced steady growth. Recently, usage surged, particularly in activity on Solana. The Solana <> Ethereum route has rapidly become the busiest corridor on DLN. Strategic investments in Solana integration are clearly paying off, with significant growth potential ahead.

DLN’s near-instant cross-chain order settlement has quickly made it the go-to platform for users transitioning from other blockchains to Solana. Recently, DLN hit a major milestone—daily trading volume surpassed $10 million for the first time—proving its rising popularity. This achievement may just be the beginning, as the Solana ecosystem continues to accelerate.

Beyond individual users, deBridge is gaining traction in the B2B space, with more Solana-based applications integrating its services. Notable examples include MoonGate, Birdeye, and Jupiter’s bridge comparator tool.

This trend suggests that in the coming cycle, deBridge is strategically positioned to capitalize on the expansion of the Solana ecosystem.

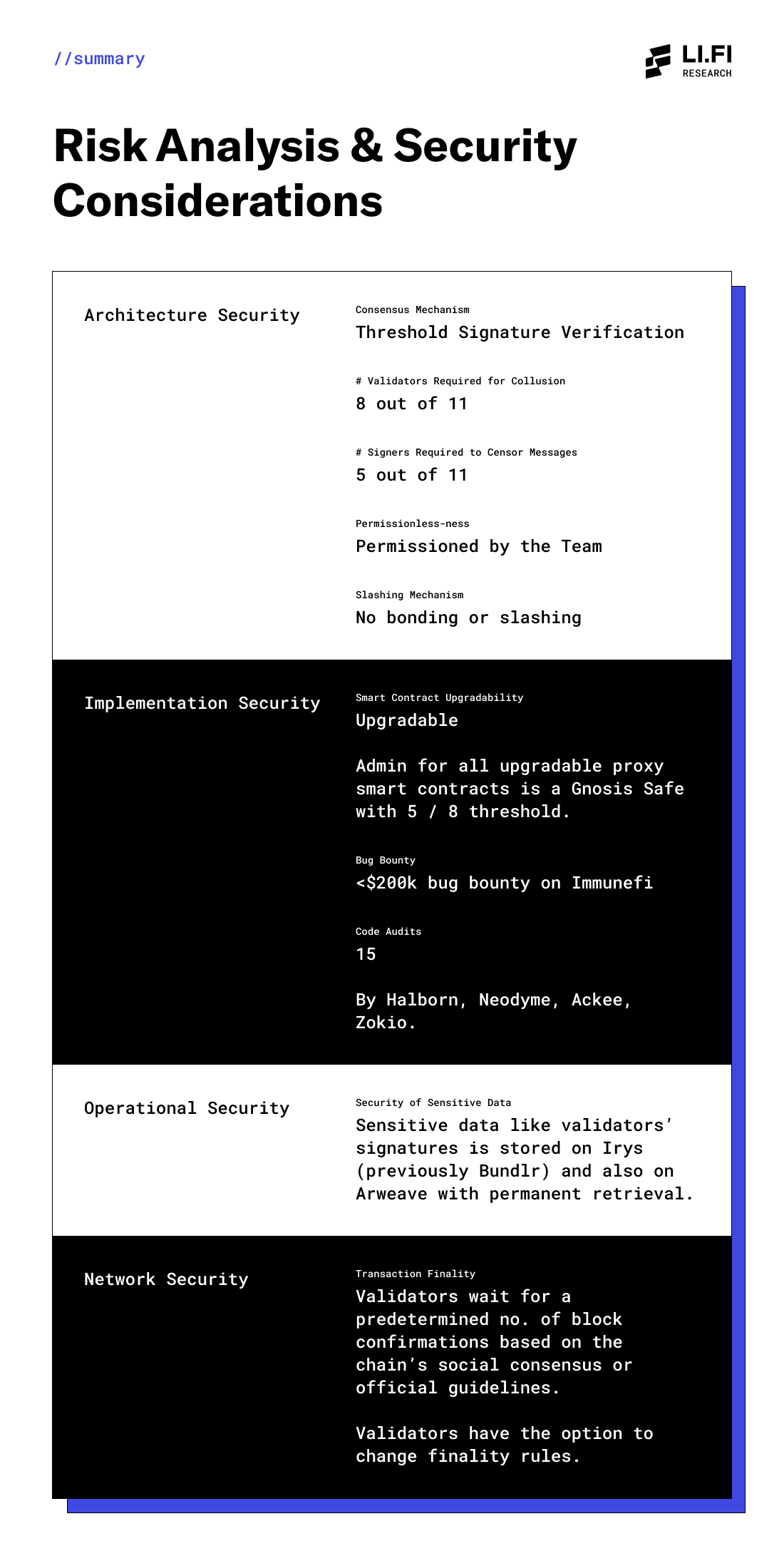

Security Audit

-

Audits – deBridge demonstrates strong security commitment, with its smart contracts on EVM chains and Solana undergoing 15 full audits by renowned firms including Halborn, Neodyme, Zokyo, and Ackee.

-

Bug bounty program – Since January 2022, deBridge has run a $200,000 bug bounty program on Immunefi, focused on securing its smart contracts.

Growth Metrics

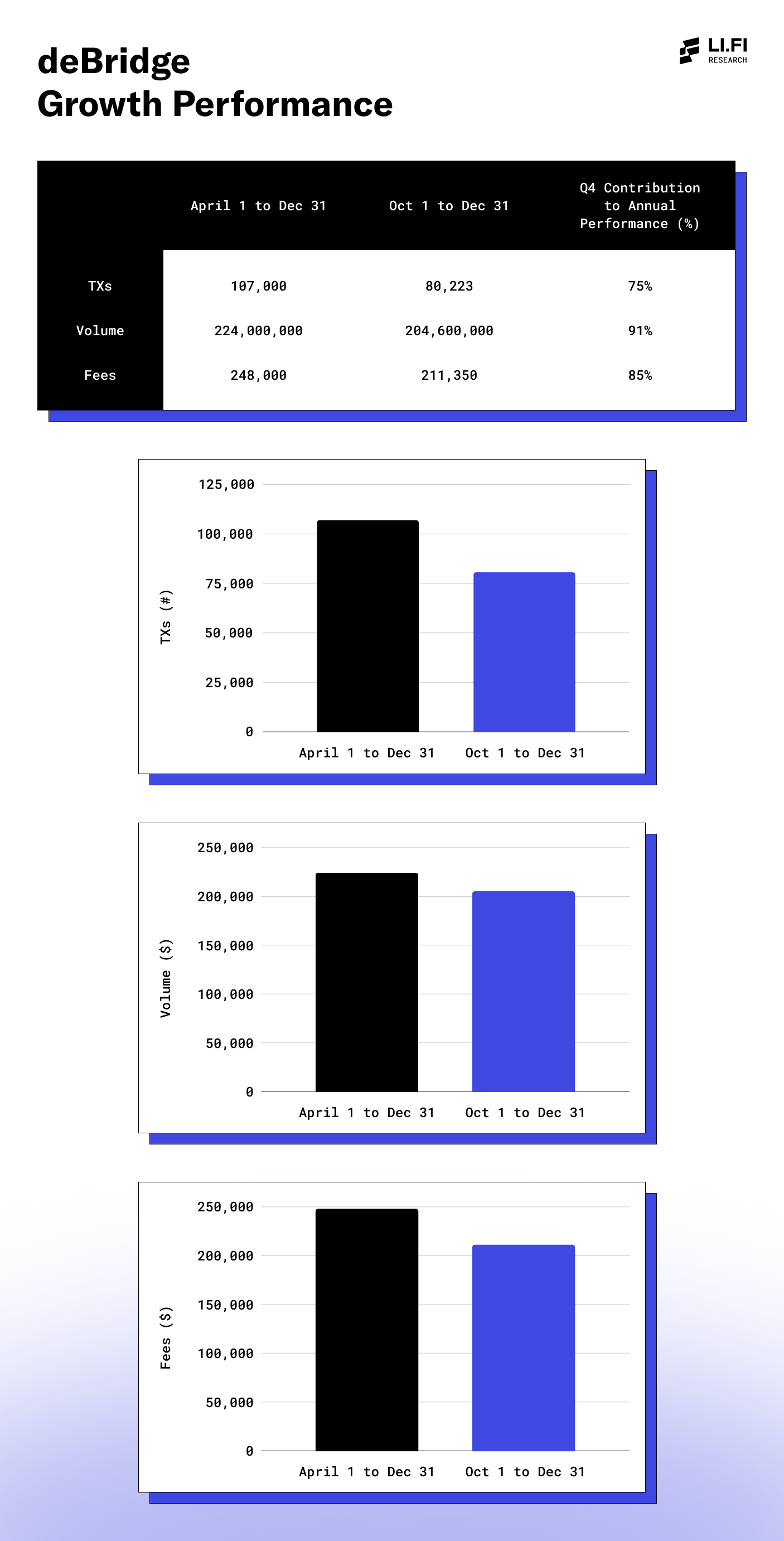

In Q4 2023, DLN stood out among liquidity networks, with growth patterns remarkably similar to Solana’s TVL and transaction volume.

To understand DLN’s performance last quarter, here’s a quick comparison of its Q4 results versus cumulative performance from April 1, 2023 to December 31, 2023:

1.3.2 How It Works – Transaction Lifecycle

Here’s how assets are transferred from the source chain to the destination chain across DLN:

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News