The breakthrough moment for consumer-grade crypto applications: infrastructure is mature, which sectors will see opportunities in 2024?

TechFlow Selected TechFlow Selected

The breakthrough moment for consumer-grade crypto applications: infrastructure is mature, which sectors will see opportunities in 2024?

Global remittances remain difficult due to the lack of affordable and user-friendly solutions.

Author: Amanda Young

Translation: TechFlow

In 2018, Dani Grant and Nick Grossman of Union Square Ventures published "The Myth of the Infrastructure Phase." In that seminal article, they argued that applications drive infrastructure development, which in turn enables new applications. As they noted, this pattern can be observed in the evolution of new crypto technologies—from Bitcoin’s creation to early decentralized applications.

Today, we stand at the edge of another wave of breakthrough applications—new consumer experiences built on emerging infrastructure stacks powered by cryptocurrency.

The History of Application and Infrastructure Cycles in Crypto

Over time, we’ve seen the trend articulated by Union Square Ventures play out across the crypto space. From Bitcoin leading to centralized exchanges, to Ethereum powering early decentralized applications, key developments in crypto appear to reflect an application-infrastructure cycle.

Bitcoin → Wallets and Exchanges (Early to Mid-2010s)

As I mentioned in my article on wallets, Bitcoin (2009) leveraged existing asymmetric key-pair technology for writing to a public database, creating the first “crypto wallet.” The first real-world Bitcoin transaction occurred in 2010 on a Bitcoin forum. Coinbase (2012) and other exchanges followed, aiming to make sending and receiving Bitcoin more secure and accessible.

Coinbase homepage circa 2012

However, Bitcoin’s design as a digital currency rather than a general-purpose smart contract platform limited its potential use cases.

Ethereum and ERC-20 → DeFi and DAOs (Mid to Late 2010s)

Launched in 2015, Ethereum aimed to serve as the next-generation platform for smart contracts and decentralized applications. MetaMask (2016), the leading crypto wallet, launched shortly after Ethereum, establishing a new paradigm for interacting with apps via web browsers. Additionally, the 2017 implementation of the ERC-20 fungible token standard allowed developers to create tokens for products and services.

These infrastructures subsequently enabled early decentralized applications such as:

-

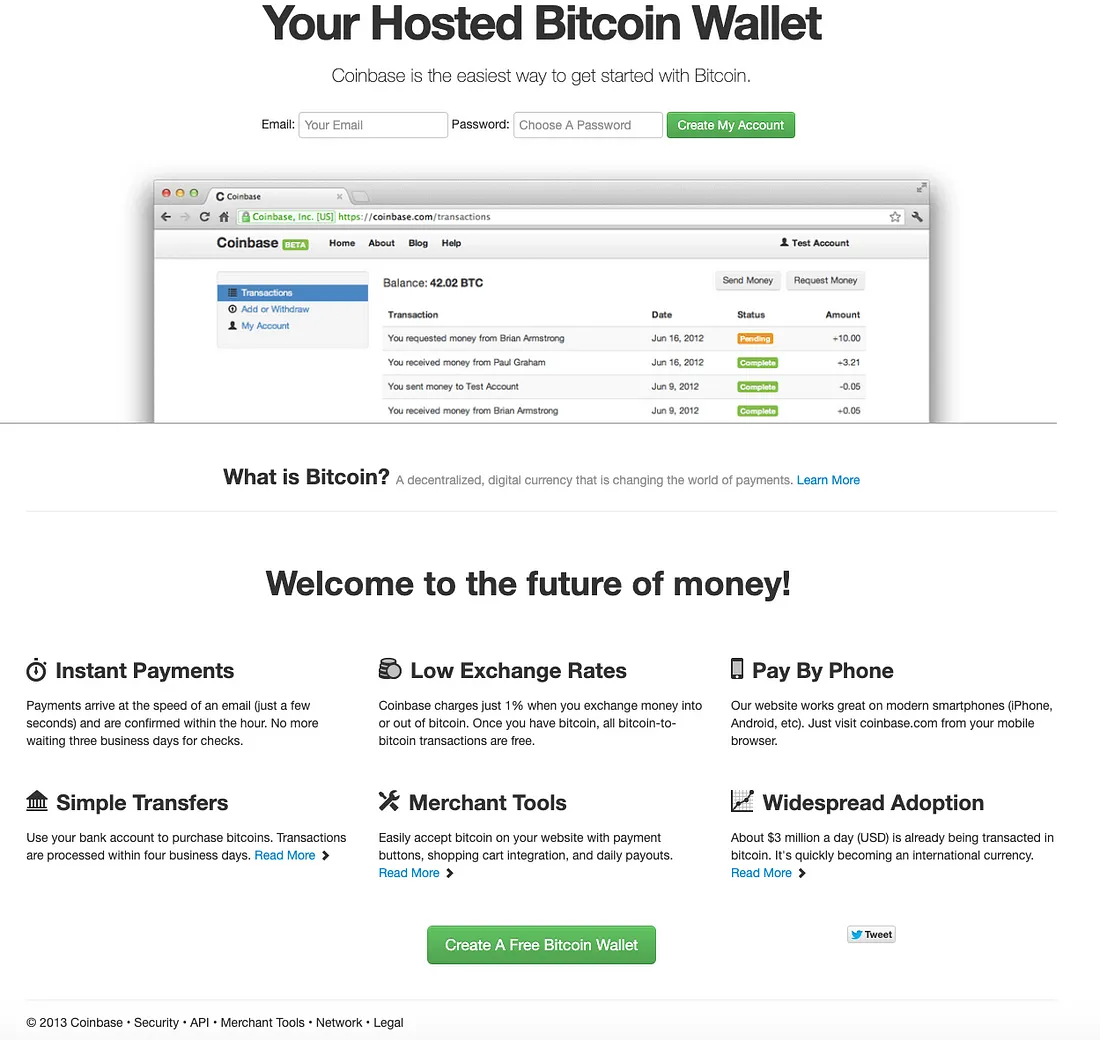

DeFi: Lending protocols and automated market makers like Aave (2017), MakerDAO (2017), Uniswap (2018), and Compound Finance (2018) drove the creation of decentralized finance. Since then, total value locked (TVL) in DeFi has grown to over $50 billion.

DeFi TVL over time

-

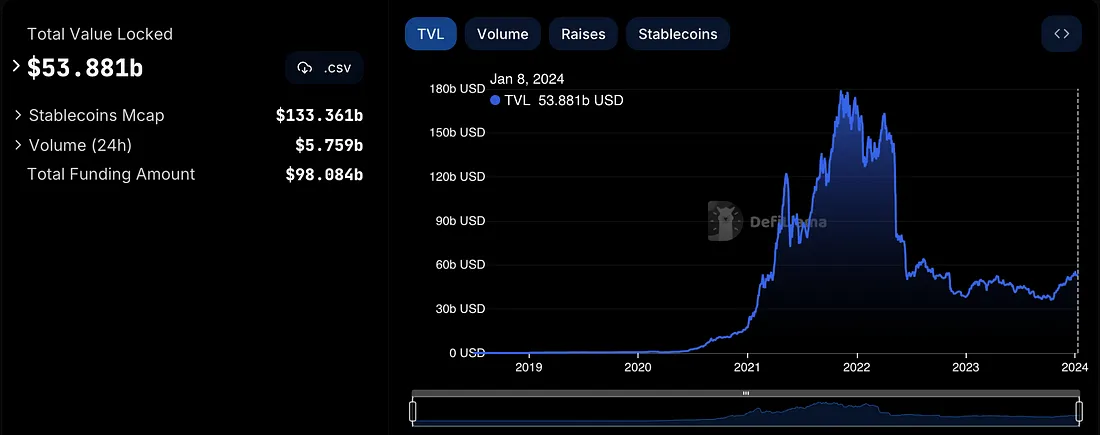

DAOs: Following early attempts like MakerDAO (2015) and The DAO (2016), MolochDAO (2019) integrated the ERC-20 standard into its framework and has since been used to launch over 900 DAOs. After Compound pioneered ERC-20 governance tokens (2020), many top protocols have issued tokens and transitioned to DAO structures. Today, there are over 19,000 DAOs managing more than $30 billion in assets.

State of DAOs as of January 8, 2024

However, the ERC-20 standard only applies to fungible objects. Early NFT projects like CryptoPunks (2017) demonstrated this limitation by modifying enough of the ERC-20 code to generate non-fungible items.

ERC-721 → NFTs (Late 2010s – Early 2020s)

CryptoPunks inspired the creation of ERC-721 (2017), the standard for “non-fungible tokens” or NFTs. The Ethereum-based game CryptoKitties launched in November 2017 and became one of the earliest and most well-known ERC-721 projects. At its peak, the game attracted over 14,000 daily active users—spurring the founding of the NFT marketplace OpenSea (2017). Subsequently, more marketplaces (e.g., Art Blocks and SuperRare), financialization platforms (e.g., NFTfi and Blend), and discovery and tracking apps (e.g., Floor and Gallery) emerged, helping drive widespread NFT adoption.

Beyond ERC-721, other NFT infrastructure standards have unlocked new use cases. For example, the NFT compression technology released in November 2022 by Metaplex and Solana Labs enabled creator platforms like DRiP to cheaply distribute millions of NFTs to over 800,000 wallets. Additionally, ERC-6551, created in February 2023, gave each NFT its own account/wallet address, expanding the scope of NFT utility.

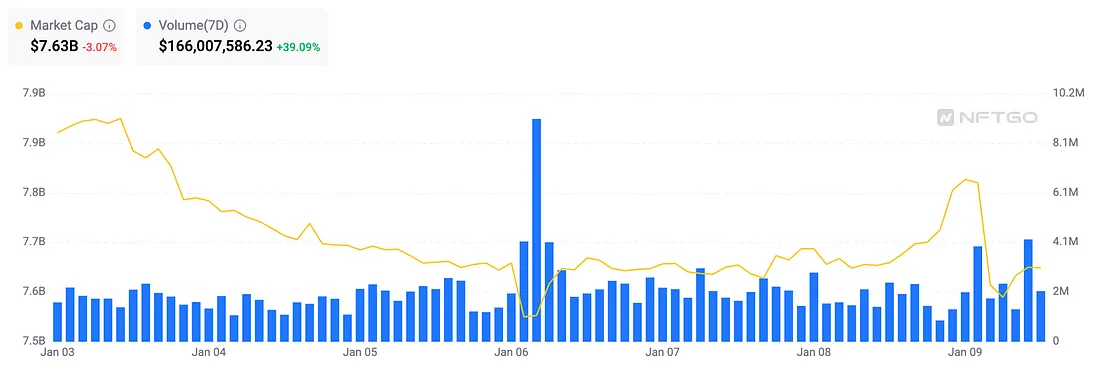

Today, the NFT market has a market cap exceeding $7 billion.

NFT market as of January 9, 2024

While NFTs brought crypto into mainstream consumer awareness, they also highlighted many UX shortcomings: high fees, seed phrases, complex onboarding, etc.

Crypto App Infrastructure Stack → Consumer Apps (Present Day)

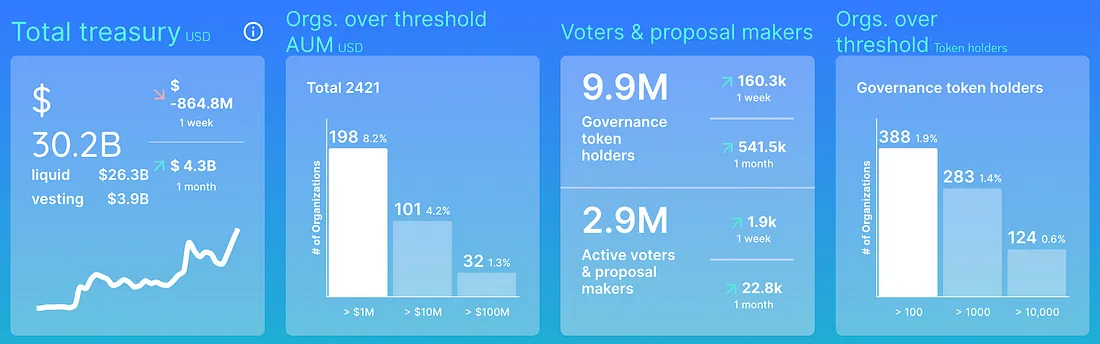

We are now beginning to see the emergence of an infrastructure stack supporting next-generation consumer applications. This includes low-cost blockchains, embedded wallets, bridging solutions, distribution channels, identity protocols, and more.

Emerging Crypto App Infrastructure Stack

Early experiments with consumer apps have prompted developers to build more user-friendly infrastructure. This crypto app infrastructure stack will catalyze the next cycle of consumer app adoption.

Low-Cost Blockchains

High gas fees have discouraged frequent, low-value transactions typical in casual, gaming, and social experiences. Over the past few years, numerous L1 and L2 blockchains have launched—and many more are coming.

Today, Ethereum still maintains over 360,000 daily active addresses and over 1 million transactions per day. However, several competitors are also vying for blockspace, with data as of January 8, 2024:

-

Solana: Nearly 538,000 daily active addresses and 24 million daily transactions

-

Polygon: Nearly 602,000 daily active addresses and 3 million daily transactions

-

Arbitrum: Nearly 141,000 daily active addresses and 972,000 daily transactions

-

Base: Nearly 55,000 daily active addresses and 318,000 daily transactions

Ethereum’s L2s will benefit from EIP-4844: Shard Blob Transactions, a planned upgrade expected in Q1 2024 that could reduce Layer 2 rollup costs by 10–100x.

Embedded Wallets

We’re seeing a shift toward apps owning the wallet experience to:

-

Enable seamless Web3 onboarding for consumers (e.g., passwordless login)

-

Provide financial services (e.g., asset transfers and trading)

Wallet-as-a-service providers are growing to meet this demand, including Magic, Privy, Coinbase Wallet, Dynamic, and others. They are improving user onboarding with features such as:

-

Login via phone number, social accounts (e.g., Google and Meta), or existing crypto app accounts

-

Authentication via passkeys (e.g., FaceID and TouchID)

-

Account recoverability

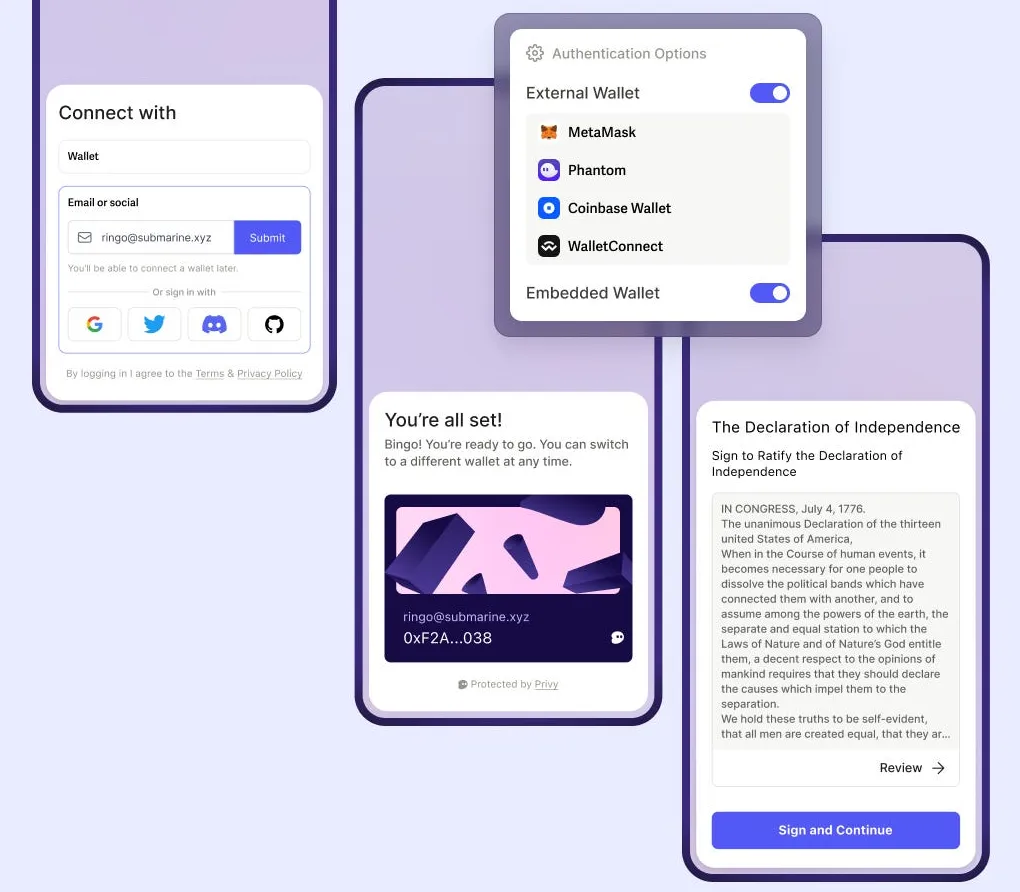

Privy's user authentication flow

Many wallet-as-a-service providers also integrate with account abstraction infrastructure providers (e.g., Biconomy, Zerodev, Stackup, Safe) to offer additional functionality through programmable, self-custodial accounts (“smart accounts”), such as:

-

Gas sponsorship (eliminating the need for users to pay gas)

-

Batch transactions (executing multiple transactions as one, saving confirmation time and gas costs)

-

Session keys (enabling pre-approved transactions in highly interactive apps)

Adoption of these capabilities is still early but growing.

Next is achieving more seamless single sign-on across various applications. One possible solution is embedding private keys natively into phones. iPhones and certain Android devices include Secure Enclave, dedicated hardware for storing cryptographic keys. However, they currently don’t support using it for native crypto key storage. The Solana Saga Phone’s Seed Vault protects private keys via secure hardware and AES encryption, demonstrating broader potential. Capsule is also experimenting in this space with its single sign-on solution, enabling access to multiple apps using a single set of credentials.

Fiat On-Ramps and Bridges

Historically, users struggled to deposit and withdraw funds from their crypto accounts. Over recent years, many solutions have emerged to address this:

-

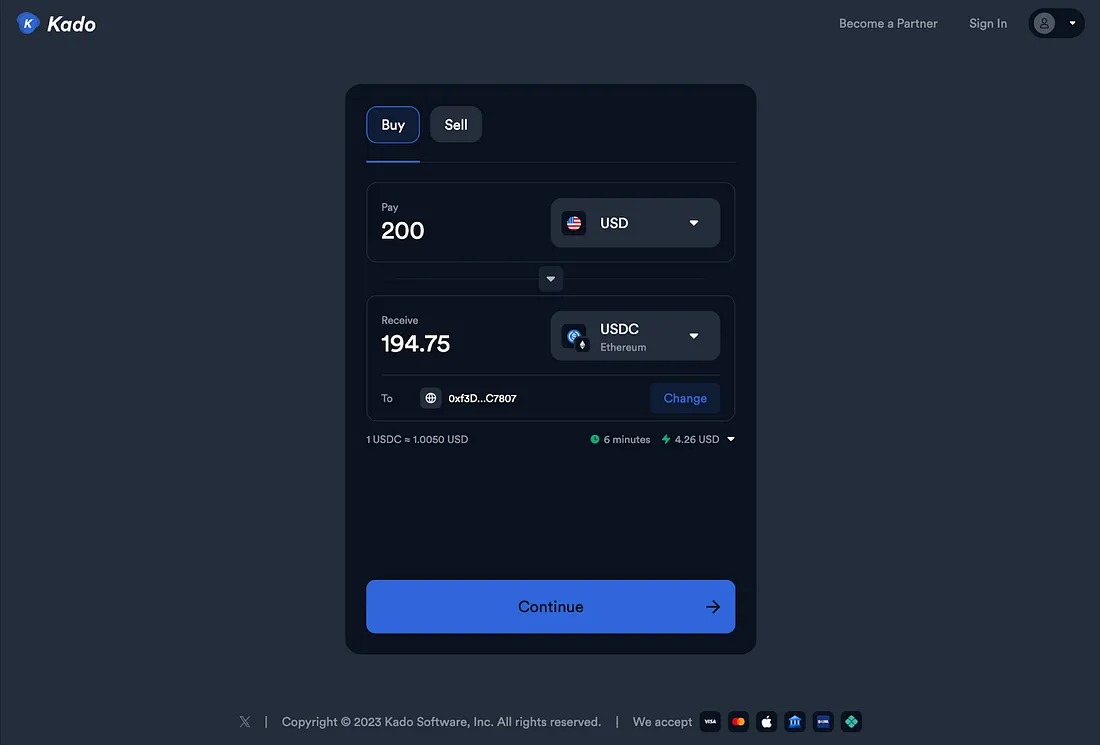

Crypto on-ramps: Kado, Moonpay, Stripe, Ramp, Transak, and others allow consumers to buy crypto using credit cards, Apple Pay, Google Pay, or bank transfers. Providers differ in payment options, asset exchange/slippage rates, and fees.

-

Crypto off-ramps: On-ramp providers like Kado, Moonpay, Ramp, and Transak have expanded into off-ramps, allowing users to convert crypto back to fiat within apps.

-

Fiat checkout: Checkout solutions like Moonpay Checkout and Crossmint’s NFT Checkout let consumers purchase digital goods and NFTs using credit cards.

-

Pay with any token on any chain: Companies like Decent, Reservoir, and Peaze aim to let consumers transact easily in apps without worrying about gas, bridges, or swaps. Additionally, wallets (e.g., MetaMask, Phantom, Trust Wallet) have integrated cross-chain swaps directly into their interfaces. With increasing adoption of intent-centric architectures, users will increasingly express preferences and allow third parties to fulfill them.

Kado's services

Identity Protocols

Over the past few years, we’ve seen the rise of protocols and services around multidimensional Web3 identities:

-

On-chain activity (e.g., quantifying your on-chain skills/expertise via DegenScore)

-

Owned assets (e.g., token-gating via Tokenproof, membership management via Guild)

-

KYC and proof of personhood (e.g., biometric/legal verification via Worldcoin, Proof of Humanity, or Coinbase Verifications using Ethereum Attestation Service)

-

Social roles (e.g., usernames on Lens, Farcaster, or Gallery; ENS domains)

-

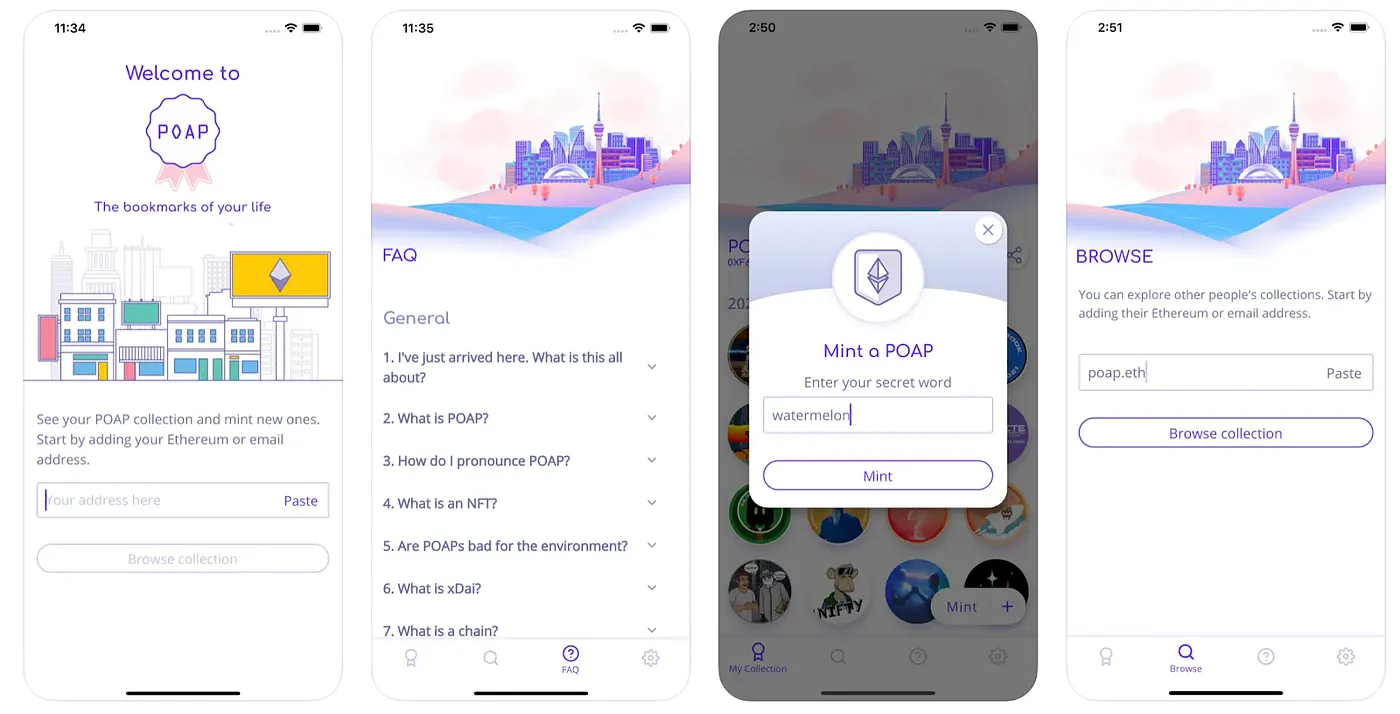

Real-world achievements (e.g., POAPs from attending events, or proving Uber rating or Twitter followers on ZKPass or Clique)

POAP’s curated ecosystem for preserving memories

With the rise of large language models, we’ll see more consumer apps offering personalized experiences based on users’ on-chain roles and activities.

Distribution Channels

Historically, consumers discovered dApps via Telegram, Twitter, or Discord and accessed them through clunky desktop experiences requiring wallet extensions and repeated transaction pop-ups. That’s changing.

First, traditional app store policies are becoming more crypto-friendly, and new approaches are emerging:

-

Historically, one of the biggest barriers to mobile web3 was Apple and Google charging 30% fees on in-app payments. Under the EU’s Digital Markets Act (implemented in 2024), iPhone users will be able to download apps outside the App Store. This opens opportunities for third-party app stores to publish and surface crypto apps more easily.

-

Recently, both Google Play and Epic Games have taken positive stances on integrating NFTs into games.

-

FriendTech showed that Progressive Web Apps (PWAs)—web apps that behave like native apps—can deliver sufficient UX for adoption.

Second, crypto-native discovery platforms have launched in recent years:

-

Quest platforms and protocols (e.g., Rabbithole, Layer3, Galxe, Coinbase Quests, Blaze)

-

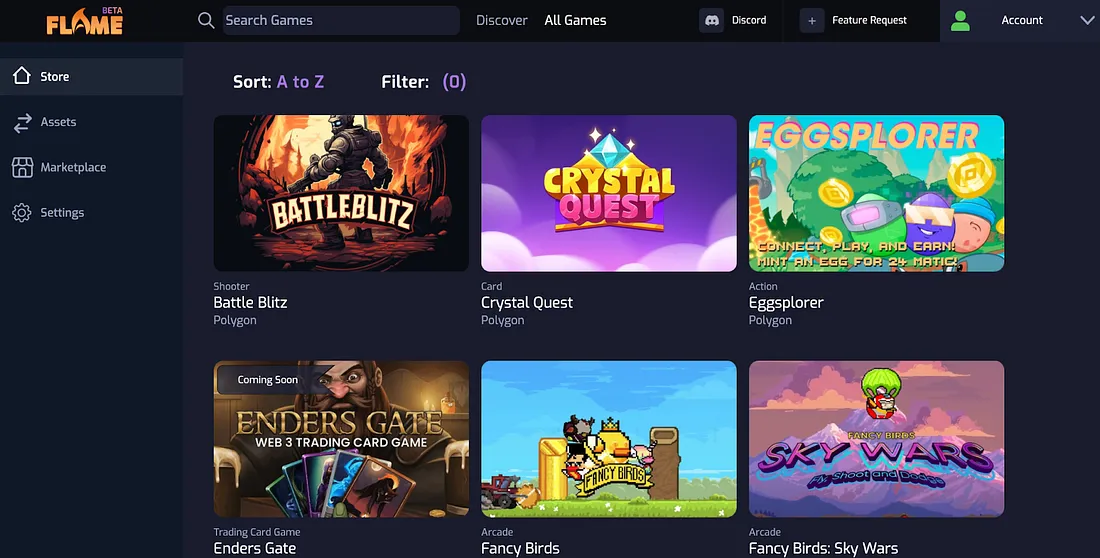

Crypto-native app stores (e.g., Flame for Web3 games, Launcher for consumer crypto apps, Mint.fun for NFT minting)

-

Social discovery apps (e.g., Floor to see what NFTs others are minting or buying)

-

Transaction discovery engines (e.g., Daylight highlighting recommended on-chain actions based on prior wallet activity)

-

Referral rewards (e.g., Sound, Rabbithole, and others offering incentives)

Flame’s Web3 game discovery platform

Third, existing platforms have begun integrating crypto, abstracting technical details and reducing friction. Notable examples include:

-

Telegram: The TON Foundation recently announced native integration and promotion with messaging app Telegram, including a crypto wallet. Additionally, crypto trading bots using Telegram as an interface (e.g., BONKbot, Maestro, Banana Gun) have attracted growing user bases and trading volumes.

-

Reddit: The social media site’s NFT avatars led to over 28 million mints, attracting more than 25 million minter-wallets.

-

Grab: The Southeast Asian super app has been piloting crypto wallets.

Opportunities in Crypto Applications

We’re already seeing early examples of consumer applications that can be built atop this infrastructure stack. Here are some categories to watch in 2024:

Social

The rapid initial rise of SocialFi app FriendTech demonstrates how PWAs, embedded wallets, and low-cost blockchains provide a strong foundation for Web3 social apps. I’m excited to see more social experiments this year:

-

Social speculation games: Tokens (and points) inherently financialize social interactions. From betting features on livestreaming platforms like Unlonely to in-app currencies like Warps on Farcaster, I’m excited about apps that embed speculative behavior into social experiences to engage users, incentivize actions, and monetize.

-

Community-driven memes: The success of tokens like $BONK shows the power of rallying communities around meme coins. I expect we’ll continue to see long-term presence of both team-driven memes and those with historical significance.

-

Web3-native character brands: PFP collections like Bored Ape Yacht Club, Azuki, and Pudgy Penguins, along with other NFT projects, have ambitions to become the next (decentralized) Disney. It will be interesting to see whether these brands “go mainstream,” from games to toys.

Given the difficulty of capturing consumer attention online, the biggest challenge is retaining users’ money and time. An alternative approach may be launching ephemeral apps—casual, profitable experiences from day one that aren’t meant to last forever.

Gaming

Early blockchain games (e.g., NBA Top Shot and Axie Infinity) succeeded in introducing player-owned economies, drawing massive capital into the space. Between 2021 and October 2023, over 16,000 new Web3 games were in development or launched, with nearly 100 funding rounds allocating $19 billion to Web3 gaming. These games are increasingly entering the market supported by infrastructure like embedded wallets, low-cost blockchains, and decentralized identity standards. I’m particularly interested in games that:

-

Leverage emerging tech like AI NPCs (e.g., Parallel’s Colony, Today The Game) and spatial computing (Apple Vision Pro launching February 2024)

-

Bring crypto utilities into multiplayer social games (e.g., Otherside, Pixels)

-

Build casual mobile experiences leveraging the latest onboarding and distribution advantages (e.g., Sleepagotchi, Draw.Tech)

Pixels: A web3 farming game with approximately 330,000 monthly active users

Payments

Global remittances remain difficult due to lack of affordable and user-friendly solutions. Payment leader PayPal announced efforts to bring on-chain payments to its 400 million active users, stating, “Crypto brings us closer to people’s desire for fast, cheap, global payments.” This is made possible by low-cost blockchains that reduce transaction fees to fractions of a cent.

With the stablecoin market projected to grow to $3 trillion in the coming years (from $125 billion as of August 2023), companies like Beam, Sling Money, Code, Coinbase Wallet, and other emerging players are seizing the opportunity to streamline payments using blockchain. Given that core focus areas for these Web3 payment apps are similar, go-to-market advantages—whether in distribution, geography, or use case—will be critical.

Bridging Digital and Physical Worlds

Blockchain technology enables near-frictionless exchange, real-time provenance, global trade, and networked awareness for physical objects.

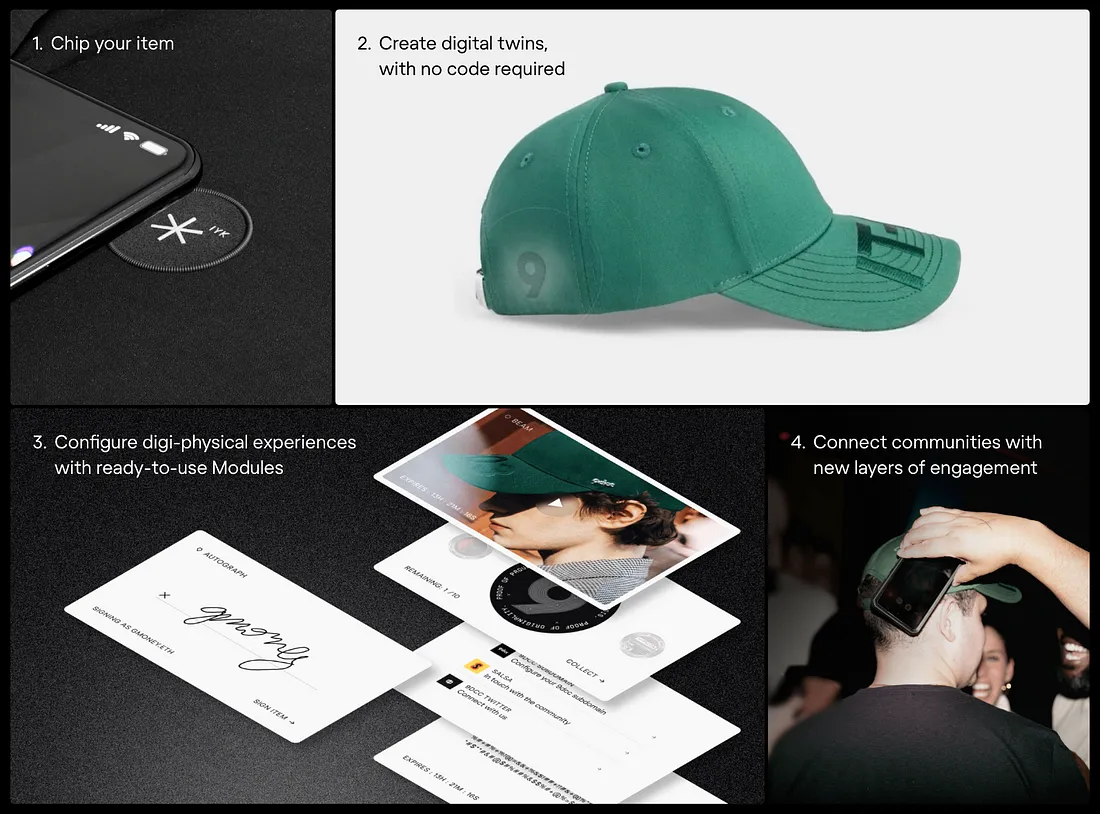

Now that infrastructure has evolved to abstract away crypto complexity, brands are leveraging blockchain and NFC chip technology to launch phygital experiences. For example, IYK’s platform has helped over 100 creators craft immersive experiences bridging the physical and digital worlds:

-

Generative Goods links unique physical crafts and home décor with generative NFT art

-

Pudgy Penguins plush toys come with QR codes linked to NFTs usable in their upcoming metaverse game

-

VÉRITÉ released a crewneck sweater letting fans preview her new song and subscribe to exclusive updates

I look forward to more brands and creators experimenting in this new design space to boost consumer engagement and authenticity.

IYK’s platform for deploying phygital experiences

DePIN

As I’ve written before, consumers are playing an emerging role in driving supply and demand in decentralized physical infrastructure networks (DePIN). We’re starting to see consumer products gaining momentum on both sides of DePIN networks:

-

Helium recently launched 5G cellular service at $20/month, with opportunities to earn $MOBILE tokens by mapping the network. Since its beta launch in May 2023, over 34,000 subscribers have signed up.

-

Since November 2022, the decentralized mapping network Hivemapper has used $HONEY token incentives to motivate over 36,000 contributors to map nearly 7 million kilometers of roads (over 10% of world roads). In contrast, Google collected 16.1 million km of unique road data between 2007 and 2019. By having consumers install dashcams in cars, they can provide fresher, more affordable map data based on daily driving.

-

Over 400,000 consumers are sharing unused internet bandwidth via Grass, a decentralized web scraping network focused on turning public web data into AI datasets.

-

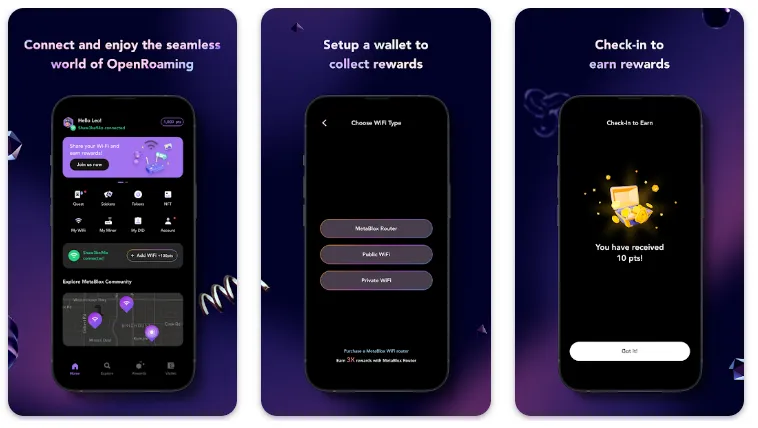

Metablox, an app offering free, decentralized WiFi OpenRoaming, has reached over 12,000 users.

I’m excited about DePIN consumer products that either offer passive income for activities consumers already do (e.g., driving, browsing) or provide cheaper, better alternatives to existing offerings.

Metablox’s app offers free, decentralized WiFi OpenRoaming

Customer Loyalty

Since the NBA launched Top Shot on Flow in 2020, Web3 brands have experimented with:

-

Metaverse initiatives (e.g., Gucci hosting exhibitions in The Sandbox)

-

Digital collectibles (e.g., Nike selling digital versions of Air Force 1 Low)

-

Phygital goods (e.g., Tiffany & Co. selling NFTs redeemable for physical pendants and necklaces)

-

Engagement and rewards (e.g., Starbucks using NFTs in its loyalty program)

-

Community and co-creation (e.g., Reddit engaging artist communities to help design its collectible avatars)

While loyal customers provide the highest value to brands, many current loyalty programs suffer: average redemption rates are only about 14%. As consumer interest in crypto grows, we’ll see more brands develop coherent Web3 strategies to build deeper relationships with their communities.

Additionally, startups like Blackbird, a Web3 restaurant loyalty app, and TYB, a community engagement platform, are experimenting with cross-brand on-chain reward networks. I’m especially excited to see industry-specific solutions unlock new fan experiences and purpose-built products.

Just as every crypto cycle brings new applications and infrastructure, the past few years have witnessed the growth of a consumer crypto app stack: low-cost blockchains, embedded wallets, and more. These advancements are catalysts for a new generation of applications.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News