USV: NFTs continue to evolve, NFTs stand the test of time

TechFlow Selected TechFlow Selected

USV: NFTs continue to evolve, NFTs stand the test of time

Mania and bubbles are a natural and indispensable part of the emergence and maturation of major technological transformations.

Author: Nikhil Raman, Investment Analyst at Union Square Ventures

Translation: Luffy, Foresight News

Union Square Ventures (USV) first began exploring the NFT space in 2017. At that time, Rare Pepes were just beginning to gain niche popularity, followed by the breakout blockchain game Cryptokitties. Shortly after this exploration, we invested in the team behind Cryptokitties and wrote:

We believe digital collectibles are one of the many amazing things made possible by blockchain technology—things that were effectively impossible before its emergence.

Since the birth of the internet, digital goods have been synonymous with abundance and oversupply, and the concept of ownership has existed only within closed systems governed by centralized arbiters. The advent of public blockchains unlocked the ability to own unique digital items that are fully controlled by individuals—this idea remains as powerful today as it was six years ago. Ownership and verifiable provenance in the digital world are transformative, and these ideas will profoundly impact our digital existence—a surface we’ve only just begun to scratch.

The Bubble

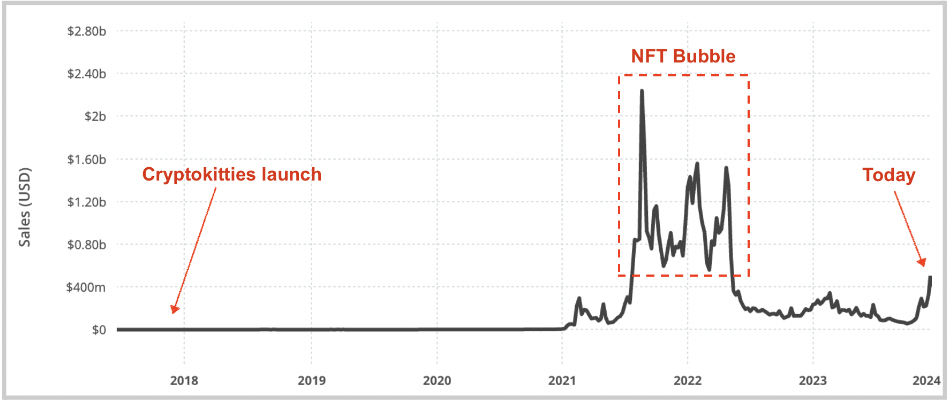

The NFT boom began in 2017, and as many of you have observed, a lot has happened in the years since. Below is a chart showing weekly secondary market sales volume of NFTs across all public blockchains:

Monthly secondary market trading volume for NFTs across all blockchains peaked at around $6 billion in January 2022, dropped to about $300 million by October 2023, and rebounded last month to approximately $1.7 billion. Notably, NFT growth on Bitcoin and Solana ecosystems has been significant.

NFTs, particularly as collectibles, went through a massive hype cycle marked by an asset bubble. The bubble burst, leading to sharp declines in asset prices and secondary market volumes—down 85% and over 95% respectively. The market environment in 2021 was extremely frothy, characterized by near-zero interest rates, resulting in dramatic rises and falls.

If this story sounds familiar, it’s because it closely mirrors the trajectory of nearly every emerging transformative technology. NFTs are a microcosm of the broader crypto ecosystem, both of which recently experienced periods of irrational exuberance. Within Carlota Perez’s framework—a scholar whose pioneering work we often reference—we appear to be in the installation phase of these technologies, where core infrastructure continues to be built.

Despite this “wild” period and the collapse in asset values, the promise of NFTs remains unchanged. They are an innovative substrate—a novel tool for representing non-fungible aspects of our digital lives—and can be applied across numerous use cases such as tickets, memberships, collectibles, receipts, art, media, and even likes.

In our view, the various bubbles we’ve seen in crypto markets—including the NFT craze—are natural and inevitable parts of how major technological transformations emerge and mature. These speculative bubbles also bring direct benefits: they provide capital that helps fund the development of the next layer of supporting infrastructure.

Innovation

The ups and downs of crypto have helped clarify key challenges in the space—such as high transaction costs and poor usability for average consumers—while extreme price volatility has paradoxically funded solutions to these problems, driving relentless innovation and development.

Over the past 24 months, and following years of progress, numerous Layer 2 blockchains have entered the market, creating a more affordable blockspace ecosystem that delivers faster finality while preserving Ethereum’s robust security guarantees. Solana introduced compressed NFTs, enabling developers and users to mint NFTs at a cost of roughly $0.0001. Embedded wallets now offer a way to build low-friction crypto applications without sacrificing trustlessness. New standards like ERC-6551 allow NFTs themselves to act as accounts or wallets, opening up new design possibilities. Additionally, networks like Arweave have matured and largely solved the problem of storing arbitrary content (not just metadata) permanently on-chain.

The end result of these improvements is that the domain of what NFTs can practically represent is rapidly expanding, and interacting with NFTs is becoming cheaper and easier than ever. In many cases, we now have tools to fully abstract away the underlying technology, allowing users to engage with digital experiences powered by NFTs in the background. Art and collectibles are just a small piece of a much larger puzzle—virtually any digital artifact in our lives could be represented as an NFT, and likely will be in the future.

Art and Collectibles

Digital collectibles—including art—were the original way NFTs expressed themselves on blockchains and achieved initial adoption. They remain a core part of the NFT landscape and have so far accounted for nearly all NFT sales volume and market value. Despite the asset bubble, they are here to stay and won’t be going anywhere.

NFTs have created tremendous opportunities for digital artists and creators, who can now monetize their work and meet growing demand for digital creations. Collectors, speculators, and patrons can now truly own—and transfer permissionlessly—unique and scarce digital assets, fostering vibrant markets for such items. Internet-native financial rails provided by blockchains also make it easier for creators to sell directly to global audiences. Blockchain has also catalyzed new forms of art, introducing novel elements like randomness into how we interact with creative works.

Moreover, we live in a digital world where internet-native capital pools are steadily growing (thanks to crypto), and digital creation is becoming ubiquitous (thanks to AI). The logical endpoint of these trends is that more people will store more value in a wider range of digital objects.

Behavioral Shifts

Despite steep declines in trading activity and market capitalization, the pace of creation in crypto remains strong. Every month, thousands of creators continue producing digital art, generative art, or AI-generated art. Each month, new (and existing) crypto users acquire pieces from these collections.

We’re also seeing new NFT behaviors emerge. Open-edition mints (often offered at zero cost, with users only paying gas fees) gained significant popularity in 2023. One example is when projects launch a product and issue an open-edition digital collectible series, allowing consumers to mint freely within a given time window. Users minting these NFTs aren’t necessarily speculating—they’re planting an immutable flag and expressing support—a form of patronage that may also yield potential rewards. In some cases, low-cost or free mints are evolving into a new social primitive, akin to “liking” or “retweeting.”

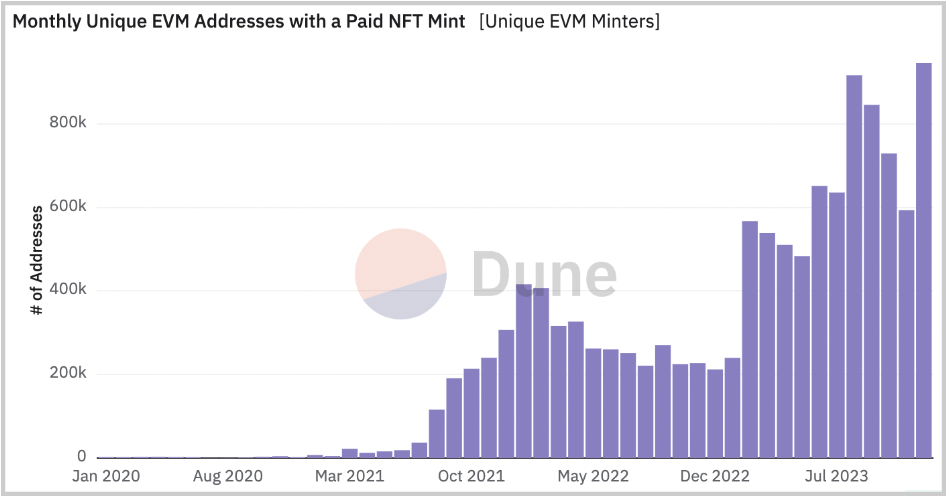

These new behaviors have driven continued growth in low-cost NFT mints. We can observe that despite the collapse in secondary market volume in 2023, more users are minting NFTs than ever before. The following charts illustrate this emerging trend:

Growth in addresses minting NFTs (addresses serve as a rough proxy for user count)

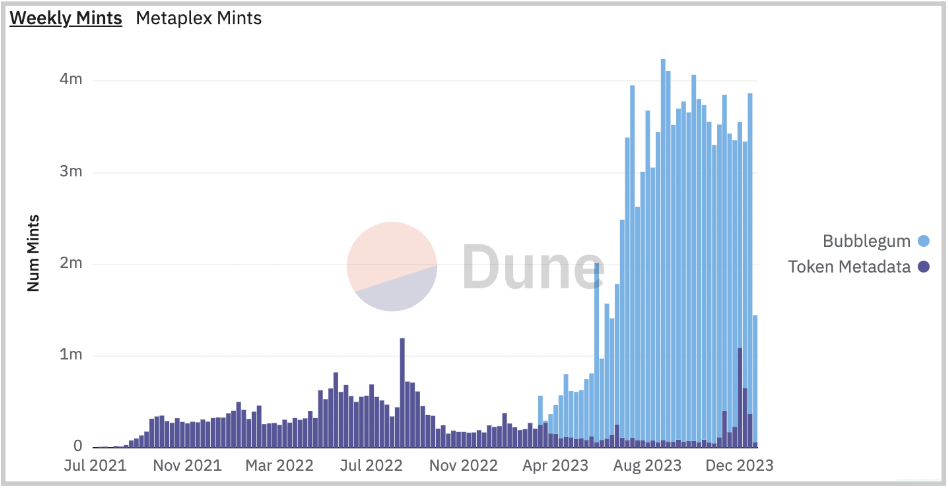

Compressed NFT technology (e.g., Bubblegum) drives minting growth on Solana

Everything is an NFT

Much of this article has focused on specific domains of NFTs and their revival and evolution, but the reality is that NFTs are simply an underlying technology capable of representing almost anything.

The Ethereum Name Service (ENS) uses NFTs to represent identity. Uniswap uses NFTs to represent liquidity provided to pools. Blackbird represents each user's relationship with a restaurant as an NFT. Paragraph represents reader subscriptions as NFTs. Helium represents eligibility for network rewards (e.g., hotspot operators) as NFTs. The list goes on.

We’re also excited to see more behaviors and industrial products represented as NFTs. From concert and movie tickets to airline boarding passes—everything should be an NFT. Anything that benefits from genuine ownership combined with the value of open, permanent systems should be an NFT.

NFTs don’t always need to be transferable—that’s perfectly fine. For example, many reusable KYC providers issue Soulbound Tokens. Moreover, NFTs don’t always have to represent digital objects. In cases where non-fungible real-world assets seek to leverage blockchain technology, NFTs often serve as digital twins, representing everything from trading cards to luxury handbags.

Like other blockchain standards, NFTs benefit from the openness and consistency of blockchain protocols. They are portable and can move with users across applications, which in turn can interpret what the NFT represents and take appropriate actions—further expanding their utility. This also means any issued NFT immediately gains access to all existing tools built for this standard. Generally, this implies that any NFT created can immediately be traded on exchanges, lent out, or donated.

Through extended composability and open ownership enabled by NFTs, blockchain data holds immense potential—but not without challenges. They enable novel experiences and allow apps to gain deeper insights into users, yet we are still in the early stages of building these systems in privacy-preserving ways. They can facilitate value transfer—such as transparent and programmable minting fees or royalties—but they can also allow applications to bypass these rules (royalties were once a boon for creators but later disappeared; we’re now seeing a resurgence as newer ecosystems opt to enforce royalty standards at the protocol level).

Conclusion

Like many previous technologies, we are witnessing the ongoing development and evolution of crypto—especially NFTs. We believe NFTs are an incredibly simple yet powerful primitive, uniquely native to blockchains, and we’re excited about the experiments and new experiences yet to come. If you’re building something that leverages this primitive to create novel experiences, we’d love to hear from you.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News