Vitalik Reiterates Distributed Validation Technology: Why You Should Reconsider Lido?

TechFlow Selected TechFlow Selected

Vitalik Reiterates Distributed Validation Technology: Why You Should Reconsider Lido?

Lido's technical changes actually reveal a piece of information: the project has become aligned with DVT, which Vitalik recently emphasized again.

Written by: TechFlow

As narratives rotate, market attention is gradually shifting back toward Ethereum.

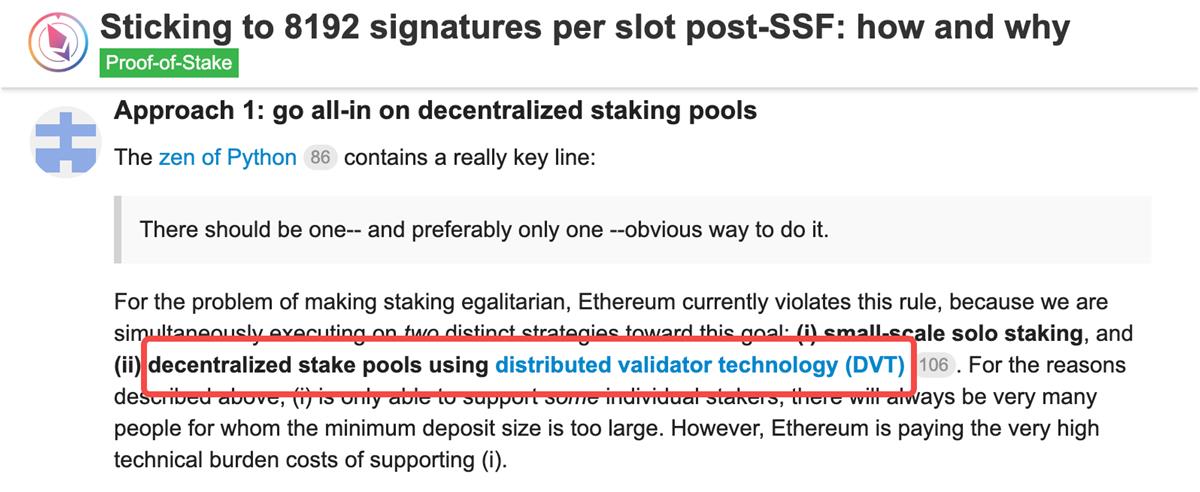

Vitalik's research into Ethereum often holds the potential to spark new trends. On December 28, Vitalik published a research blog post exploring how to handle the massive volume of signature loads on the Ethereum network without sacrificing decentralization.

(Further reading: Sticking to 8192 signatures per slot post-SSF: how and why)

At the same time, Vitalik proposed a solution in his research: using DVT (Distributed Validator Technology) to build decentralized staking pools.

As is well known, after completing The Merge, Ethereum transitioned its consensus mechanism to proof-of-stake with a staking mechanism. Currently, several large staking service providers dominate significant market share, raising concerns about centralization in staking.

High performance load, staking centralization, Vitalik aiming to solve these issues... everything circles back to the familiar narrative of "optimizing Ethereum."

(For readers unfamiliar with DVT, refer to this article: After Ethereum’s Merge, Distributed Validator Technology (DVT) Is Crucial)

Regarding DVT, the first project that comes to mind for the market is SSV—the only project in the liquid staking space currently using distributed validator technology, with a market cap around $200 million.

However, given the relative maturity of Ethereum's ecosystem, once a technical narrative reignites, avoiding crowded investment areas and instead pursuing relatively stable beta returns can also be a solid strategy.

Therefore, beyond SSV—the most directly associated project—Lido itself is also worth paying attention to.

Breaking the Misconception of LDO’s Centralized Staking

A classic logical fallacy: whoever holds the largest market share in the liquid staking sector must be centralized.

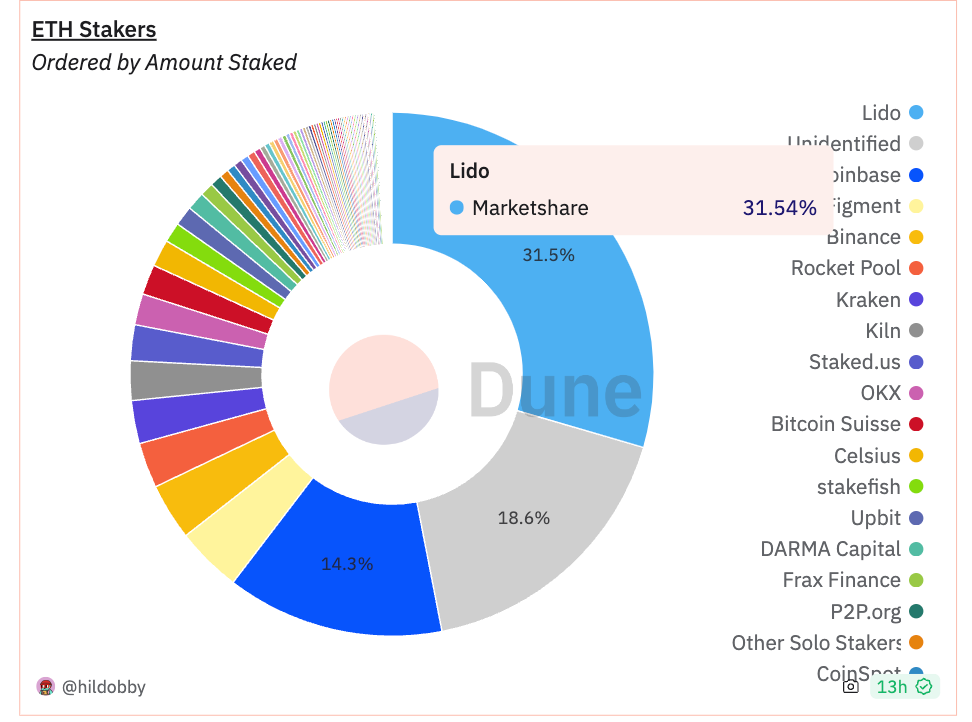

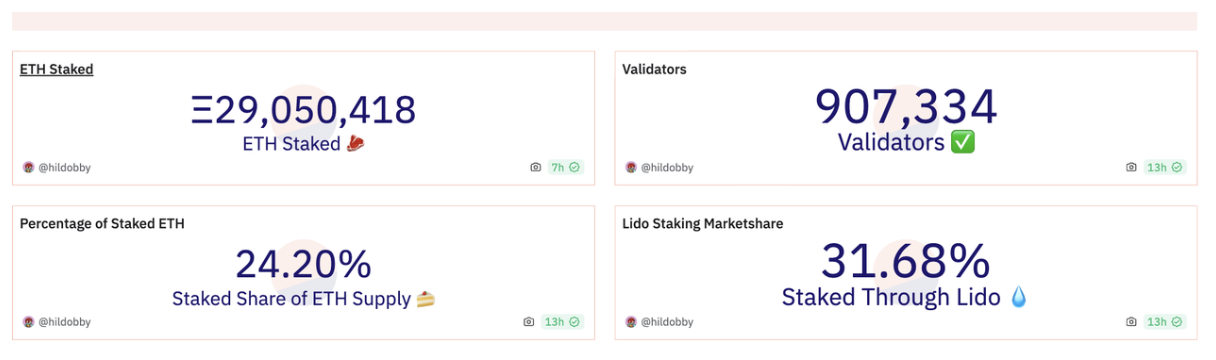

From a data perspective, Lido holds about 30% market share, clearly maintaining a leading position. However, market dominance and whether staking methods are centralized are two different matters.

A high market share merely indicates leadership and possible dominance; but the specific technical approach used by that leader for staking requires deeper examination.

In November last year, Lido actually began implementing the DVT approach emphasized by Vitalik to achieve what’s known as distributed validators. Lido refers to this framework as the "Simple DVT Module," supported technically by ObolNetwork and ssv_network.

Setting aside technical details, in simple terms, Lido now allows multiple node operators to jointly manage nodes and reach consensus to fulfill validator duties. This also broadens participation opportunities for node operators, enhancing the network’s decentralization, distribution, and resilience.

Now, the Simple DVT module enables individual stakers, community stakers, existing node operators, and other staking organizations to participate in Lido’s testnet, with plans to later upgrade the mainnet to include a more diverse set of validators.

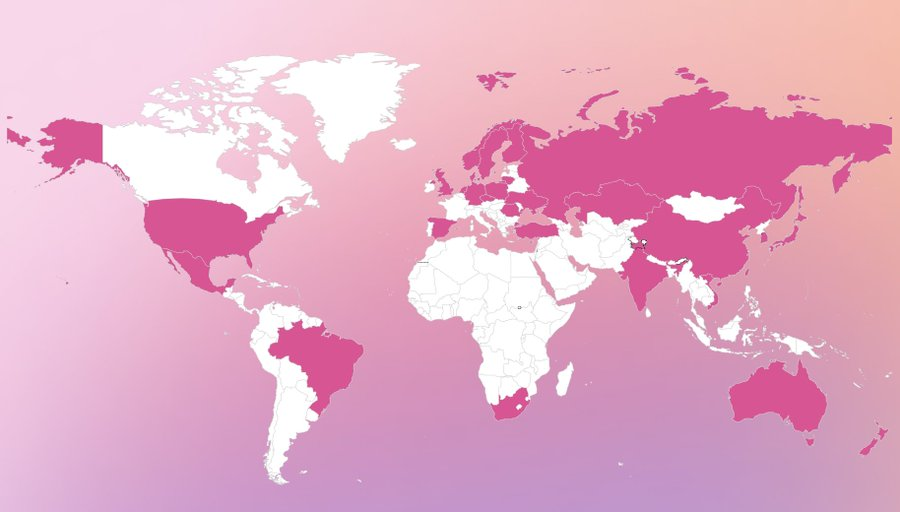

Testnet data shows over 300 participants globally, including more than 175 individual and community stakers, with an increasingly decentralized node distribution.

Thus, Lido’s technological evolution reveals one key point: the project has already aligned with the DVT approach recently emphasized by Vitalik.

Whether market capital will seize this opportunity to drive price momentum depends on analyzing Lido’s other fundamental metrics.

Understanding Data to Capture Beta Returns

Beyond technology, how do Lido’s other fundamentals look?

We all know Lido is the leader in liquid staking, holding nearly one-third of the staking market. But such absolute figures alone don’t reveal its potential or room for speculative capital movement.

However, when making comparative analysis, opportunities become apparent:

-

ETH staked within Lido accounts for approximately 8% of the total ETH supply in circulation. In contrast, the market cap of the LDO token is still less than 1% of ETH’s total market cap—suggesting the token may be undervalued relative to its contribution to liquid staking;

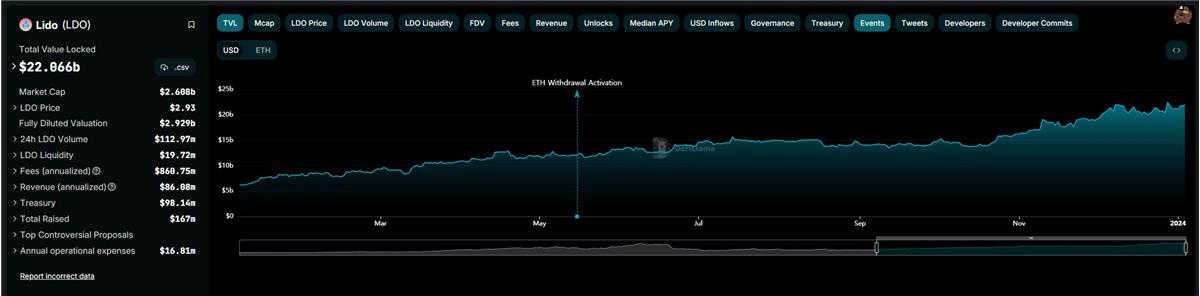

An even more telling comparison: after Ethereum’s Merge upgrade allowed users to withdraw staked ETH, there was theoretical expectation for ETH holdings in liquid staking pools to decline.

Yet data from DefiLlama shows Lido’s TVL actually increased throughout 2023—meaning users deposited more ETH through Lido.

Additionally, technical analyses from overseas analysts and KOLs indicate that LDO is breaking out of a resistance level not seen in the past 18 months and has also broken above a downward trend line lasting nearly 20 months.

While pure technical analysis shouldn't dictate investment decisions, strong fundamentals (rejoining the DVT narrative) combined with improving technical structure provide tangible justification and room for market activity.

Indeed, betting on smaller-market-cap projects like SSV and ObolNetwork could yield higher returns, but it also implies greater volatility.

The renewed focus on DVT, growing market interest in Ethereum optimization narratives (such as parallel EVM), and the upcoming Cancun upgrade in Q1 this year collectively present a visible catalyst and window of opportunity for capital to return to the Ethereum ecosystem.

While monitoring low-market-cap projects, choosing established leaders closely tied to the ETH ecosystem might offer a safer way to capture beta returns.

After all, in crypto markets, older projects often quietly rebound when least expected, only to later be surrounded by countless explanations justifying their resurgence.

Making relatively safe moves before the recovery begins is far better than chasing the tail end after the crowd has piled in.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News