DWF investor Fiona: In 2024, we can expect to see more DeFi projects focusing on BRC-20.

TechFlow Selected TechFlow Selected

DWF investor Fiona: In 2024, we can expect to see more DeFi projects focusing on BRC-20.

BRC-20 transformed Bitcoin's DeFi landscape by making tokens fungible.

Author: Fiona

Translation: TechFlow

Fiona, an investor at DWF Ventures, shared a Twitter thread explaining how Ordinals work, the market size of BRC-20, and its advantages and disadvantages. She argues that BRC-20 has transformed Bitcoin's DeFi landscape by making tokens fungible, and despite being in early stages, it holds significant potential.

Ordinals Inscriptions

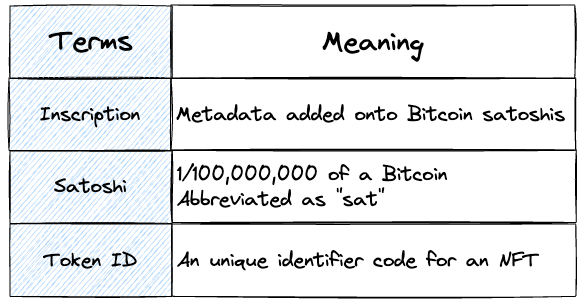

Before diving into BRC-20 tokens, it's important to understand how Ordinals work. By default, 1 satoshi is a tiny fraction of one bitcoin, with 100 million satoshis equaling 1 bitcoin.

Ordinals can assign a serial number to individual satoshis, enabling them to be tracked and traded via inscriptions. Each satoshi can have data etched onto it through Bitcoin transactions—such as images, text, or videos.

Once the transaction is mined, the written data becomes permanently stored on the Bitcoin blockchain. This makes each satoshi unique and therefore non-fungible.

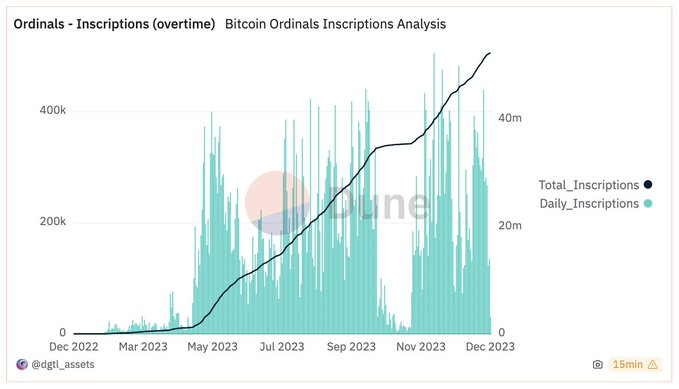

The competitive advantage of Ordinals NFTs lies in their ability to be created directly on the Bitcoin blockchain. Since the launch of Ordinals in January 2023, inscription activity has surged dramatically, leading to a notable boom in Bitcoin-based NFTs.

BRC-20

In March 2023, @domodata laid the foundation for a new token standard called BRC-20 using Ordinals. BRC-20 is an experimental token standard for fungible tokens on the Bitcoin blockchain.

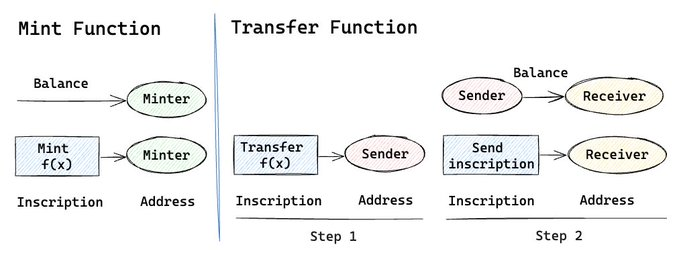

Unlike the ERC-20 standard, BRC-20 does not rely on smart contracts but instead leverages Ordinals inscriptions. BRC-20 tokens can be deployed, minted, and transferred by directly writing JavaScript Object Notation (JSON) data into satoshis.

While BRC-20 is a type of Ordinals inscription, not all Ordinals are BRC-20 tokens. Standard Ordinal inscriptions can contain any information, whereas BRC-20 tokens always include JSON data. In short, unlike standard Ordinals, BRC-20 enables token fungibility.

BRC-20 Market Size

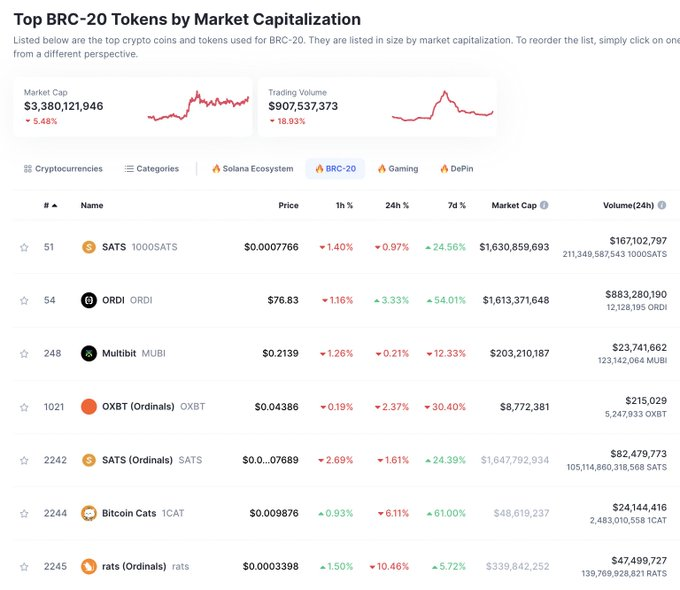

According to CoinMarketCap, the current market cap of BRC-20 is approximately $3.4 billion, representing a 3.4x increase over seven months. Leading tokens include $ORDI (the first BRC-20 token ever minted), $SATS, and others.

Advantages and Disadvantages of BRC-20

BRC-20 offers several advantages:

-

Enhanced Bitcoin tokenization that goes beyond the "digital gold" narrative

-

Inherits the security of Bitcoin’s Proof-of-Work system, making it technically more secure than Ethereum

-

Fully on-chain; does not require additional file systems like IPFS

-

Ability to gain traction from Bitcoin’s large and diverse network of users

-

Interoperability with existing Bitcoin infrastructure, including wallets and exchanges

Of course, BRC-20 also has some disadvantages:

-

Scalability issues due to Bitcoin’s limited block size and transaction throughput, potentially leading to higher fees and longer processing times

-

Limited smart contract functionality compared to ERC-20, restricting the implementation of advanced features

-

Challenges in interoperability with other blockchain networks, as BRC-20 is designed to operate within the Bitcoin ecosystem

-

Still in an early, experimental phase with limited developer tools and support, thus carrying certain risks

Final Thoughts on BRC-20

By enabling token fungibility, BRC-20 has reshaped the Bitcoin DeFi landscape. As the Bitcoin Layer 2 ecosystem evolves, we may see more DeFi projects focused on BRC-20 emerge in 2024.

Although BRC-20 remains experimental and underdeveloped, the growing interest in research, development, and projects serves as a reminder of Ethereum’s early trajectory. The increasing attention from users, projects, developers, and investors demonstrates the potential of BRC-20.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News