Mobile 7x in 7 days, DePin sector breaks out just before traditional investors enter

TechFlow Selected TechFlow Selected

Mobile 7x in 7 days, DePin sector breaks out just before traditional investors enter

The importance and investment potential of DePin in the crypto development process align with the demand for new narrative-driven capital in the crypto space.

Authors: Yilan, Lisa

I. Breaking Into the DePin Sector Before Traditional Capital Enters

DePin is short for Decentralized Physical Infrastructure Networks. At the end of 2021, IOTEX referred to this sector as MachineFi. By the end of 2022, Messari introduced the new concept of DePin, identifying it as one of the most critical crypto investment themes over the next decade. In the coming ten years, we can expect traditional institutions to inject incremental capital. This influx of institutional funds will shift preferences away from purely on-chain economic speculation centered around native crypto applications toward investment opportunities with stronger off-chain logic and real-world impact. The significance and investment potential of DePin in the evolution of crypto aligns well with the demand for new narratives and fresh capital in the crypto space.

The core idea behind DePin is using token incentives to encourage users to deploy hardware that provides real-world goods and services or digital resources. DePIN can be understood in two parts: Physical Resource Networks (PRN) and Digital Resource Networks (DRN). PRNs involve users providing services such as WiFi, 5G, VPN, geospatial data, and information sharing via distributed hardware devices. DRNs refer to physical infrastructure networks that provide digital resources—such as broadband, storage, and computing power—through hardware infrastructure.

In simple terms, DePIN leverages hardware to deliver resources like software, bandwidth, and computing power, applying token incentives to traditionally centralized real-world services. This enables lighter, more flexible, decentralized node deployment, helping overcome project cold-start challenges. During early stages, DePIN uses a dynamic spiral-up mechanism allowing users, providers, and platforms to participate with relatively low risk. However, hardware involvement means DePIN projects require substantial upfront capital to ensure wide hardware distribution and robust network coverage. Both off-chain and on-chain marketing strategies must also be executed effectively. The full integration of these elements lays a solid foundation for a successful DePIN project.

II. DePin on Solana: Dual Advantage of Strongest Ecosystem and Narrative

On Solana, DePin projects ranked by market cap from smallest to largest are HONEY (Hivemapper), IOT (Helium IoT), Helium Mobile (Helium Mobile), HNT (Helium Network), and RNDR (Render Network). These represent specific applications within the DePin space—including decentralized mapping, IoT services, and 5G services—as well as broader infrastructure such as decentralized wireless and 5G platforms, and peer-to-peer AI rendering compute marketplaces. Among storage-related projects (also considered part of DePin), Arweave has deep integration with the Solana ecosystem, as most Solana NFTs are stored on Arweave. The following sections focus on Honey, DIMO, and the Helium ecosystem (Helium and Mobile).

2.1 HONEY (Hivemapper)

On Solana, Honey (Hivemapper) stands out as a small-cap DePin project with strong backing and promising fundamentals.

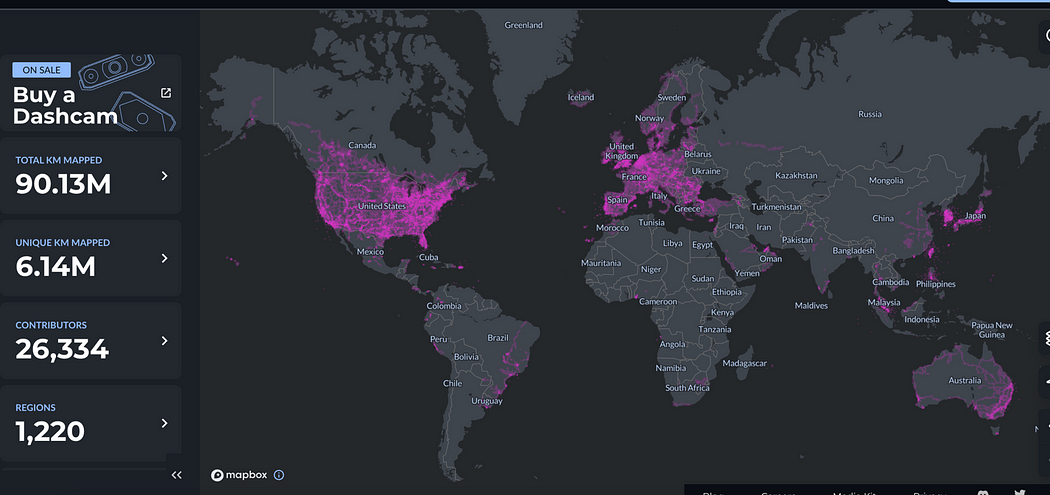

Hivemapper is a blockchain-based mapping network that creates a decentralized global map, rewarding contributors with its native token HONEY. Contributors install Hivemapper dashcams to collect data and earn HONEY rewards. In Hivemapper’s model, dashcams function as “mining rigs.” A seamless mobile app integrates natively with the Hivemapper network, enabling automated mapping and uploads. Simply installing a Hivemapper dashcam allows drivers to mine HONEY tokens while collecting 4K street-level imagery and mapping the world.

The project's incentive design aims to improve map data quality. Data upload quality, freshness, and urban density determine reward allocation. For quality assessment, Hivemapper assigns a reputation score based on data quality. Users who capture higher-quality images—especially when cameras are mounted outside vehicles—earn higher reputation scores. Rewards are tied directly to reputation, with higher rolling averages leading to greater payouts.

Freshness ensures street information remains up-to-date. Hivemapper introduces a “freshness score,” using an increasing function over time. If no one collects data in an area for a full year, the next person uploading new data receives a higher multiplier, thereby encouraging timely updates.

For data density, the project incentivizes dense node distribution across key cities. A large bonus system offers higher reward weights in 35 selected cities.

Source: Hivemapper

In terms of funding and background, Hivemapper raised $18 million in a Series A round led by Multicoin Capital, with participation from Craft Ventures, Solana Capital, Shine Capital, Spencer Rascoff’s 75 and Sunny Ventures. Previous investors include Spark Capital, Founder Collective, and Homebrew. Total funding amounts to $23 million. Amir Haleem, CEO and founder of Helium, joined the project’s board.

Tokenomics: HONEY’s emission schedule closely resembles Helium’s. The maximum supply of HONEY is capped at 10 billion. Initial allocation is as follows:

The Hivemapper network mints and distributes 4 billion HONEY tokens as contributor rewards. The exact number minted weekly depends on global mapping progress. Currently, circulating supply increases by about 1.6 million HONEY per day.

2.2 DIMO

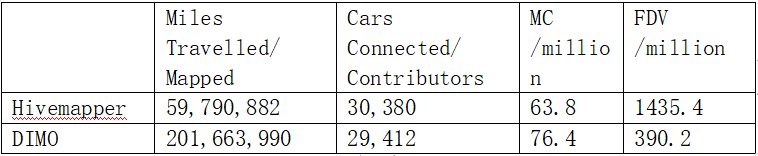

DIMO operates in the same "drive-to-earn" space as Hivemapper and is one of its main competitors.

Compared to Hivemapper, which focuses on vehicle connectivity for B2B use cases (e.g., detailed maps for automakers), DIMO’s design better serves end-user needs. It incentivizes decentralized ownership of driving data, making it easier for consumers to collect and use data (rewarding drivers while enabling features like automatic parking and smart navigation), whereas Hivemapper leans more toward B2B products (providing refined maps for automotive companies and service providers).

Underlying this is a massive monetization opportunity—the global automotive data market is valued between $45 billion and $70 billion (as of 2023). DIMO connects cars and drivers, tokenizing driving data and integrating into the supply chain of 250 million connected vehicles worldwide, enabling users to capture value from their own data.

In terms of usage metrics, user counts for Hivemapper and DIMO are similar, but DIMO has a lower FDV. DIMO is an ERC-20 token on Polygon and Ethereum, lacks strong ecosystem momentum compared to Solana-based projects, and therefore experienced delayed price discovery relative to Honey.

Source: LD Capital

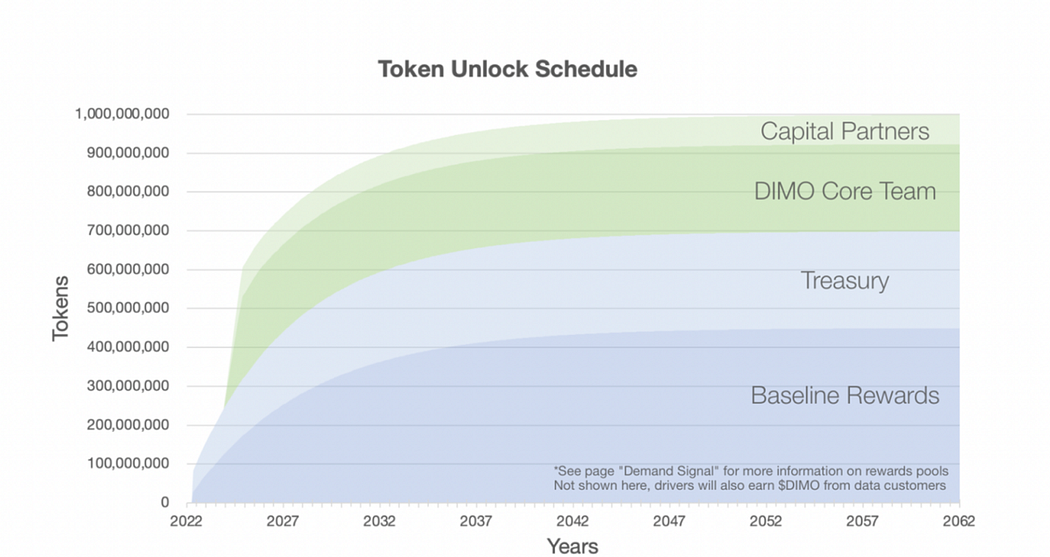

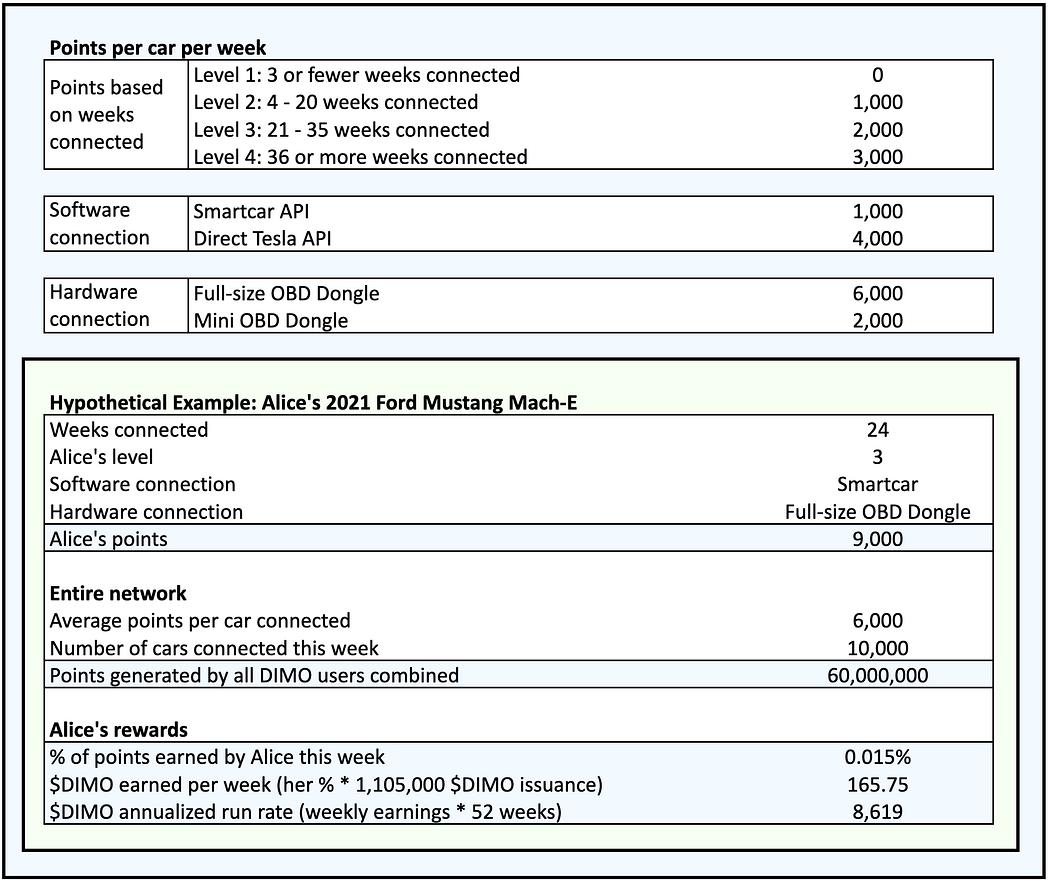

Token distribution: DIMO has a total supply of 1 billion. Baseline rewards account for 38% (380 million DIMO) to be distributed over 40 years, starting with 1,105,000 DIMO issued weekly to users in the first year, decreasing by 15% annually. Treasury allocation is 22%, awarded via bounties or grants to contributors. Team allocation is 22%, locked for two years and then linearly unlocked monthly over three years. Investors receive 8%, under the same lockup and vesting schedule. Airdrop allocation is 7%.

Source: DIMO

Current circulation: 194 million (including 70 million airdropped, 57 million from baseline rewards, and 67 million allocated to treasury). The initial airdrop was essentially a large-scale distribution of baseline rewards (70 million), leaving 382,491,185 $DIMO remaining. This pool will be distributed over 40 years, starting with 1,105,000 $DIMO issued weekly in the first year, declining by 15% annually. The token structure is favorable.

2.3 Helium

Helium is a decentralized wireless network (distributed IoT) launched in 2013, pioneering the DePIN space. As the purest DePin project in the Solana ecosystem, Helium boasts the most mature and robust ecosystem among IoT projects. With Helium’s support, its ecosystem project MOBILE achieved a tenfold return within seven days.

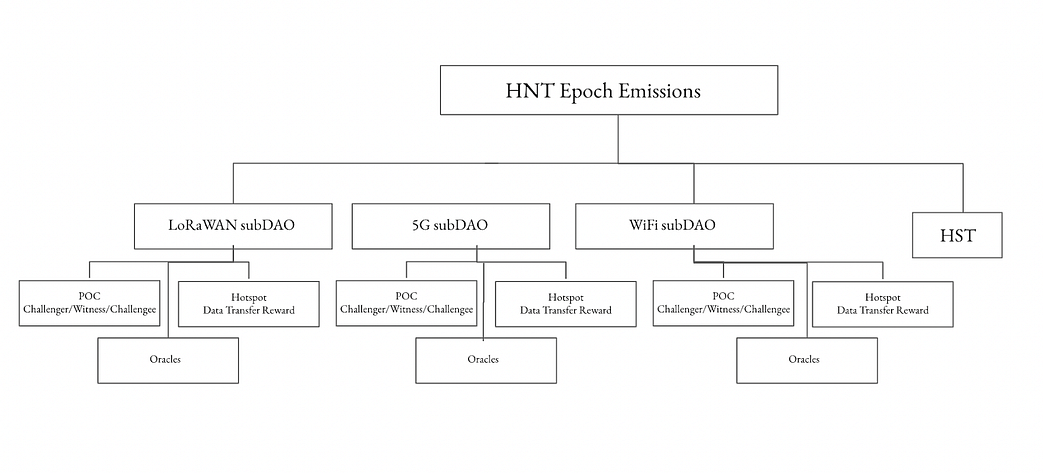

HNT is the primary economic asset in the Helium ecosystem and the only way to pay for data transmission fees on the network is by burning HNT. As HNT prices rose, daily revenue reached $9,000—but demand remains insufficient. This may explain Helium’s aggressive push to launch subDAOs. More subDAOs could drive HNT price appreciation. Phase II of HIP 51 implemented the Helium DAO, which oversees various subDAOs. As more subDAOs emerge (currently only IoT and 5G subDAOs), increased competition will arise over the fixed daily HNT issuance (currently ~1.23 million HNT per month, or ~40,000 per day).

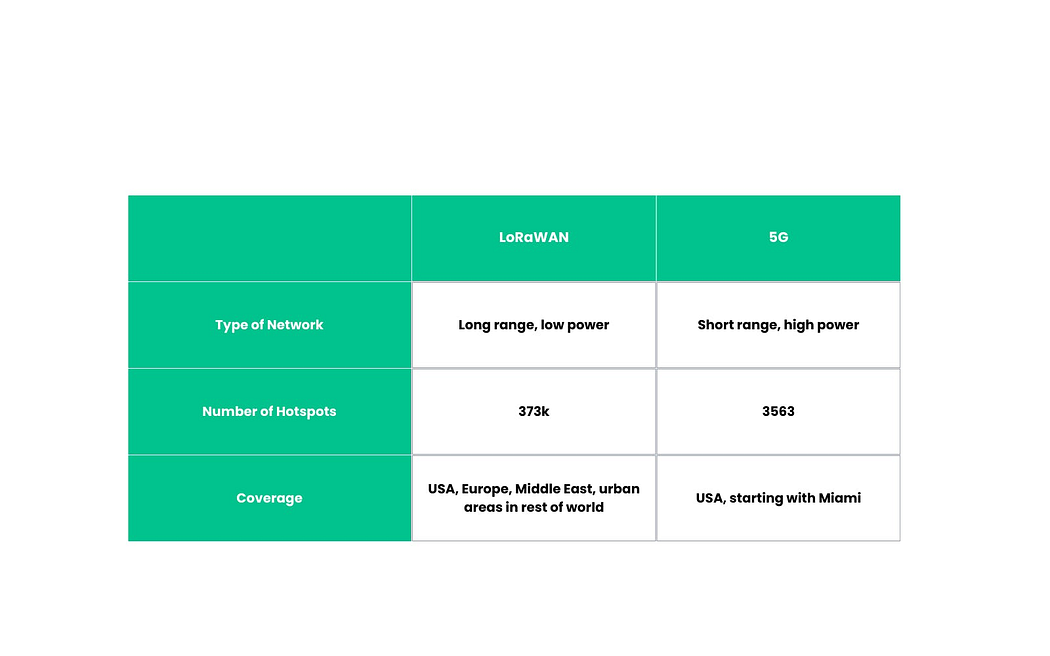

By combining Web3 technology with IoT networks, Helium addresses the high capital barriers in the IoT market (similar to telecom operators like AT&T or Verizon). Expanding into 5G services aims to solve inefficiencies where Wi-Fi and centralized carriers fail to efficiently cover signal gaps. Through community participation, the heavy upfront costs of IoT infrastructure are distributed across individual users, enabling lightweight project launches. Today, indoor/outdoor tracking devices and smart farms like Abeeway and Agulus are adopting Helium. T-Mobile began collaborating with Helium Mobile last year.

The Helium network and its associated tokens operate on a Proof of Coverage (PoC) mechanism, fundamentally different from Proof of Work (PoW). Unlike GPU mining, which consumes vast energy, Helium hotspots require only as much power as a 12-watt LED bulb. Miners’ main cost is the one-time hardware purchase.

The hotspot mining process involves purchasing specialized LoRaWAN routers (e.g., Bobcat 300), placing them on rooftops or balconies, and maintaining network coverage. Miners are rewarded with HNT tokens, which automatically appear in the Helium app connected to the miner. PoC continuously verifies whether hotspots are actually located where claimed and generating proper wireless coverage.

Current Status

Currently, the two subDAOs represent narrowband networks for IoT devices (Helium IoT) and 5G hotspot networks compatible with HNT miners (Helium Mobile).

Source: Swissborg

In the 5G space, despite regulatory and market ceiling constraints, Helium Mobile’s partnership with T-Mobile is helping drive mass adoption. Migration to the high-performance Solana public chain highlights Solana’s growing role as fertile ground for DePin projects.

Regulatory-wise, frequency allocation and licensing in the U.S. are strictly regulated by the FCC. Authorized carriers like T-Mobile use the 600MHz band for 5G, while Verizon uses 700MHz. To reduce deployment costs and navigate compliance hurdles, Helium adopted the unlicensed CBRS GAA band. However, this band offers slightly less coverage than mid-band frequencies, giving Helium no clear advantage over major U.S. operators.

Regarding market ceilings, 5G is tightly regulated by national policies. Most global network operators are state-owned; only a few are private and closely tied to governments. Therefore, from an international perspective, Helium struggles to replicate its U.S. 5G market experience overseas.

Helium’s strategic migration to Solana began in March this year, moving from its own Layer 1 blockchain. Key reasons include: First, Solana’s state compression feature allows massive NFT minting at extremely low cost—nearly 1 million NFTs migrated at just $113, saving significant expenses. These NFTs serve as network credentials for hotspot verification and enable full ecosystem integration, including token-gated access for hotspot owners—efficient and convenient. Second, there are synergies with Solana Mobile Stack and Solana’s planned Saga phone, creating win-win opportunities for Solana (aiming to build phones) and Helium (expanding into 5G services). Third, Helium’s niche programming language and lack of EVM compatibility hinder developer attraction and limit ecosystem growth. Integrating with Solana’s vibrant ecosystem offers a breakthrough path.

Token Overview

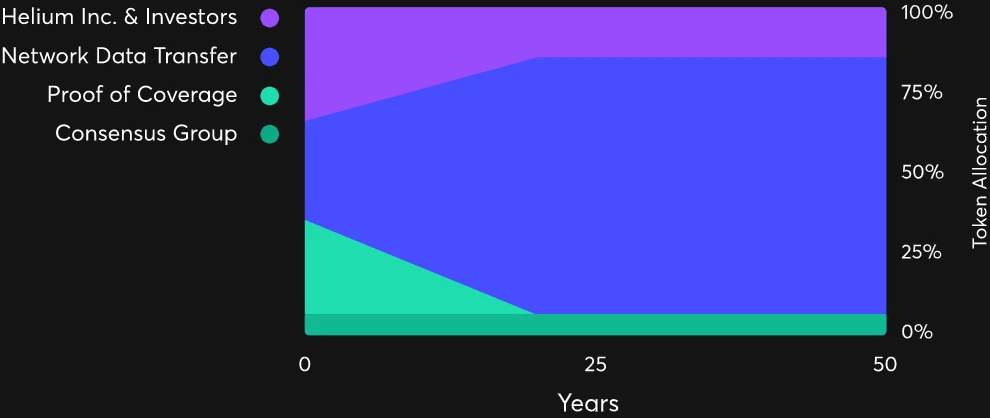

HNT functions as Data Credits, used across subnetworks when users access hotspots (revenue side). Rewards earned from deploying hotspots or transmitting data on the 5G SubDAO or IoT SubDAO—MOBILE/IOT tokens (supply side)—can be burned to obtain HNT.

Specifically, each month: 30% of newly released HNT rewards hotspots for transmitting IoT device data, proportionate to data volume; 35% goes to hotspot infrastructure rewards, primarily miner payouts, ensuring network coverage expansion; the remaining 35% is allocated to team and investors.

Source: Helium

The actual total supply of HNT is approximately 223 million, with 43 million issued in the first year, halving every two years. HNT price fluctuations reflect project cash flow rights and governance power, satisfying speculative demand. The inflation plan below shows current daily issuance at 41,000 HNT:

Source: Helium

HNT can be earned through being a challenger, challenged party, witness, joining consensus groups, or participating in network transmissions (witnesses and transmission yield the highest rewards). HNT meets the needs of two main participants in the Helium ecosystem:

1) Hotspot hosts and operators (supply): Hosts receive network tokens like IOT or MOBILE as rewards for deploying and maintaining coverage. These tokens can be redeemed for HNT.

2) Enterprises/developers/other users (demand): Businesses and developers connect devices and build IoT apps on the Helium network. Data Credits are utility tokens pegged to the dollar, obtained by burning HNT on the network and used to pay for wireless data transmission fees.

However, HNT burn revenue remains insufficient. Instead, device providers receive more token rewards. Previously, Helium faced criticism for lacking real use cases (low demand/revenue), industry-wide standards, and poor developer/user experience. But the rollout of affordable eSIM cards via Mobile appears to be alleviating severe demand-side constraints.

2.3.1 MOBILE

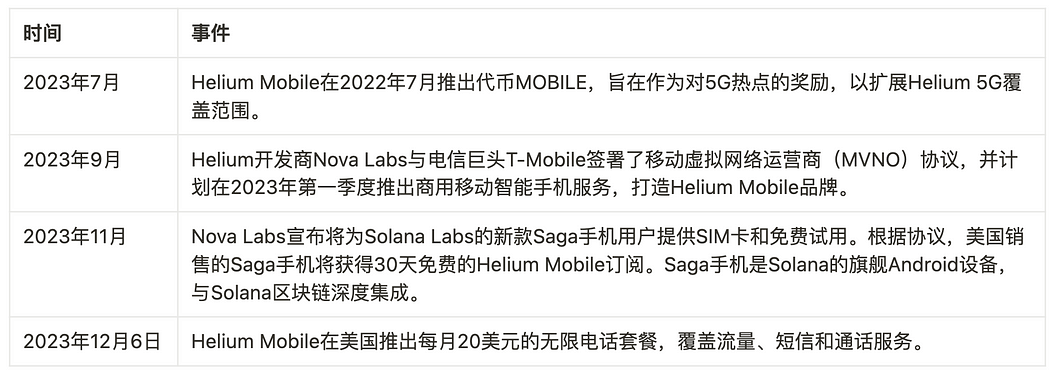

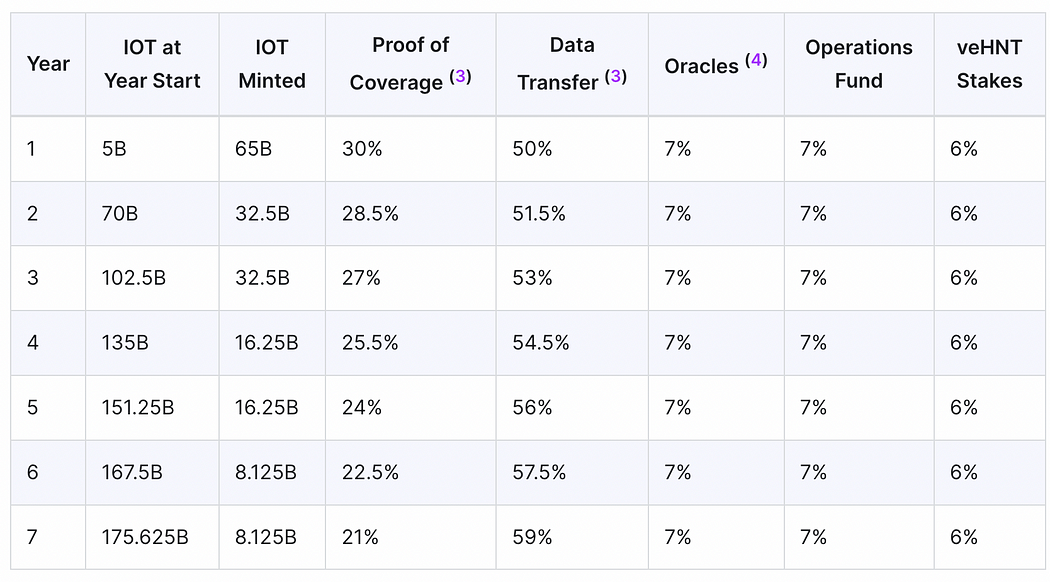

MOBILE is the protocol token of the Helium Mobile Network and a governance token for Helium SubDAOs, enabling governance separation. MOBILE was introduced to the Helium Network via community proposal HIP-53.

Nova Labs, Helium’s developer, initially partnered with T-Mobile to launch commercial mobile smartphone services, starting with a $5/month plan in Miami. Recently, Helium Mobile rolled out a $20/month wireless plan nationwide, along with free SIM card trials integrated with Solana Labs’ new phone—igniting MOBILE’s market performance.

MOBILE is mined via 5G-CBRS and Wi-Fi hotspots, earning rewards through both data transmission and Proof of Coverage. Token distribution follows a minting schedule similar to HNT, with a maximum supply of 230 billion (230B). At network launch, 50B MOBILE were pre-minted and assigned to a Network Operations Fund managed by the Helium Foundation. Part of this allocation was distributed during genesis to active Mobile Network hotspots. MOBILE’s first year began August 1, 2022, with the first tokens minted on August 12, 2022.

Issuance halves every two years, aligned with HNT’s halving schedule.

Source: Helium

MOBILE’s value derives from two sources: First, programmable treasury redemption—SubDAO token MOBILE can be exchanged for HNT. Each subnet in the Helium Network is allocated a portion of the HNT pool based on network utility score. Exchange ratios are set algorithmically by contract. Second, governance utility within the subDAO. Future utilities may include staking to enhance coverage participation in Proof of Coverage.

MOBILE’s redemption price is calculated as follows: All HNT rewards earned by 5G hotspots within a given period are pooled. MOBILE holders can burn MOBILE to claim a proportional share of HNT from the pool. For example, if all 5G hotspots earn 100 HNT and 10,000 MOBILE remain uncirculated, burning 100 MOBILE yields 1 HNT. This structure establishes a floor value for MOBILE, allowing it to trade above this floor based on utility.

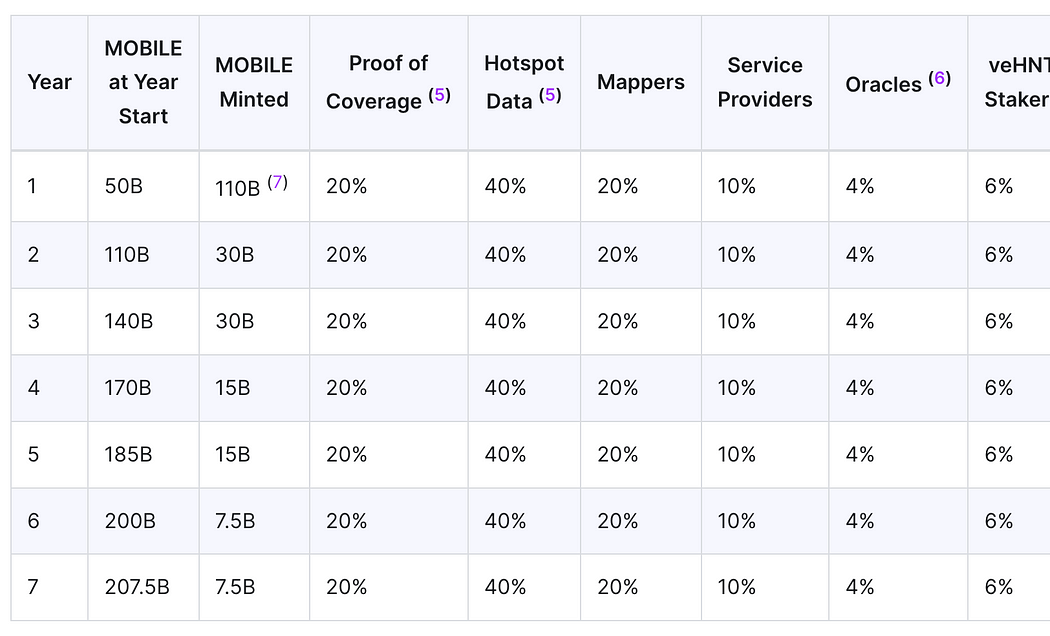

Helium Mobile currently has a 209-day payback period

Source: Depinscan

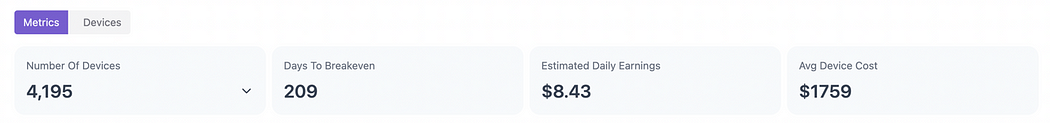

2.3.2 IOT

The Helium IoT SubDAO incentivizes IoT devices connected via LoRaWAN networks and balances relationships between users and device providers. It essentially inherits the original Helium IoT use case.

Currently, IOT has 24 billion in circulation (inflation follows the table below), still in early distribution phase. Market cap: $68 million, FDV: $566 million. Compared to Mobile’s strong expansion, IOT’s use cases remain underdeveloped.

Source: Helium

The SubDAO model emerging from the Helium ecosystem extends longevity beyond HNT’s approaching final distribution phase. Since HNT still captures most value, launching two high-potential subDAO tokens adds compelling narrative depth—benefiting HNT, Mobile, and IOT alike in a win-win scenario.

Helium is the best-funded, most product-complete, and economically robust IoT+5G network. Combined with its strategic move to Solana, it maintains a relatively high market cap and price. As a large-cap leader, it continues to benefit from sector-wide beta. Recent gains confirm Helium’s ecosystem dominance in the DePin space. While Mobile’s token structure slightly outperforms Helium’s, its position at the forefront of mass adoption is increasingly being priced in.

III. What Other DePin Projects Are Worth Watching in the Secondary Market?

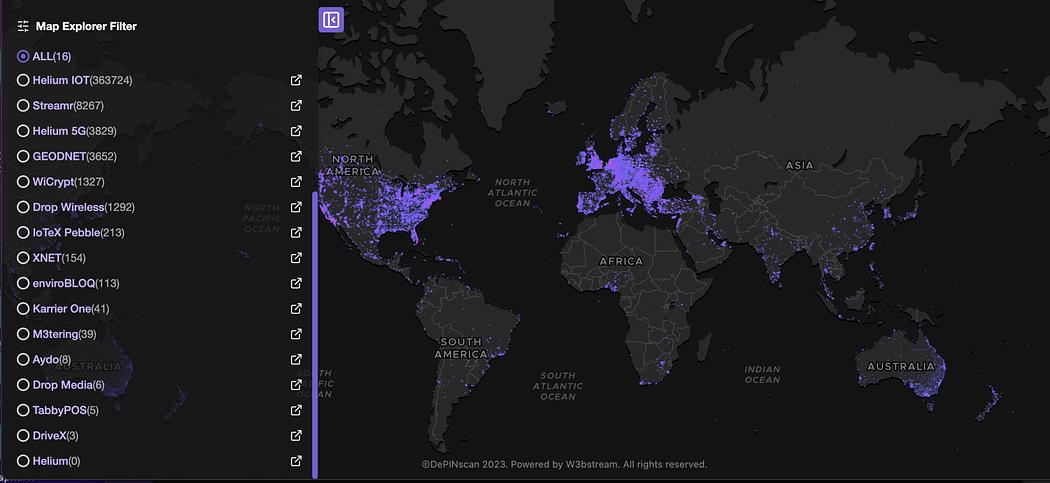

Beyond Solana, other ecosystems host mature DePin projects, including DIMO (compared earlier with HONEY), IOTX (IoTeX), Streamr (DATA), and WiFi Map (WIFI). According to Depinscan’s hotspot distribution map, the Helium ecosystem (IoT, 5G) has the widest reach: Helium IoT has 363k deployed devices, Helium 5G has 38k, followed by Streamr with 83k devices.

Source: Depinscan

Applications in the IoTeX ecosystem haven’t gained as much traction as Helium’s, though IoTeX consistently onboards various DePin apps externally. In contrast, Helium’s subDAOs grow organically to strengthen internal ecosystem development. As Helium migrates to Solana, IoTeX—boasting a unique layered L1 architecture—is seen as a purer DePin infrastructure layer, offering more use cases for its token. Currently, IOTX has a $520 million MC and $523 million FDV, giving it a market cap advantage over Helium. However, IOTX is an old, fully-distributed project whose incentive mechanisms and ecosystem vitality cannot match Helium’s.

In September this year, Drop Wireless (formerly Nesten) transitioned to IoTeX’s DePIN infrastructure. Drop Wireless operates a global LoRaWAN network with 1,000 nodes across 17 countries. Its operations extend to remote healthcare services in India, with plans to expand into Africa to meet major healthcare demands. IoTeX supports Drop Wireless’s native token, launched as an XRC20 on the IoTeX chain, and enables decentralized data storage and transmission via W3bstream. This shift underscores IoTeX’s role as a central hub in the DePIN landscape.

IV. Conclusion

Medium-term, the leading project in this sector will need to reach at least a $3 billion market cap to enter the top 30. Currently, rankings show RNDR at $1.6 billion (#48), Helium at $1.3 billion, Theta at $1.1 billion, IOTA at $860 million, and Mobile at $550 million. The entire sector appears undervalued.

HNT, as Solana’s DePin leader, benefits from a strong ecosystem. Though its token structure isn't as favorable as Mobile’s, it captures more value and will benefit from subDAO growth. IOTX, as an Ethereum-compatible DePin infrastructure play, may lack exposure to current hotspots like Solana, but could gain traction during a potential post-Bitcoin spot ETF Ethereum rally. With a relatively low market cap (~$500 million), it remains attractively priced. DIMO still has room for market cap growth, and the connected vehicle narrative offers broad storytelling potential. Mobile’s partnership with T-Mobile could generate real external revenue, potentially leading the entire sector.

The DePin sector, serving as a pathway to mass adoption and bridging AI, offers expansive narratives and represents a breakout theme likely to attract institutional capital. Over the next decade, we can expect traditional institutions to inject incremental capital, shifting preferences from purely on-chain economic speculation around native crypto applications toward investments grounded in off-chain logic and tangible real-world impact. DePin’s importance and investment potential in the crypto evolution perfectly align with the search for new narratives and fresh capital in the crypto world.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News