Inscriptions Spark a "Stamp Collecting Craze" in the Crypto World — What Stage Are We At Now?

TechFlow Selected TechFlow Selected

Inscriptions Spark a "Stamp Collecting Craze" in the Crypto World — What Stage Are We At Now?

If we must compare cryptocurrencies to stocks, today's inscriptions are at least as strong as the stamp-collecting craze thirty years ago.

Author: Wang Jun, Founding Partner at inpower

Almost the entire crypto world is "minting inscriptions"!

The Filecoin inscription launched last night—by morning, they were all gone.

People outside the crypto space are frustrated—they don't even know how to buy them.

1. What exactly are inscriptions?

For technical details about inscriptions, feel free to search online.

If Bitcoin was originally defined as a peer-to-peer payment system, then inscriptions are more like notes attached to payments.

Due to certain updates, these notes can now carry significantly larger data—large enough to embed small images.

This has even sparked some controversy with core developers.

But none of this has stopped inscription prices from skyrocketing.

Hegel said, "What exists is rational," but I prefer the Bible's saying: "There is nothing new under the sun."

Finding similar historical parallels helps us seize opportunities (or avoid pitfalls).

If we must compare cryptocurrencies to stocks (Don’t compare crypto to stocks—it’s an insult to crypto), today’s inscriptions are even hotter than the stamp-collecting craze 30 years ago.

Using this analogy, we might understand it as follows:

Bitcoin ecosystem – A national market

Ordinals protocol – The national postal service

BRC-20 inscriptions – Various series of national stamps

Inscriptions on other blockchains – Stamps from other countries

2. There are countries that treat stamp issuance as their main industry

I don’t know if inscriptions can sustain an entire blockchain, but stamp issuance can sustain an entire country.

The Principality of Liechtenstein is a legitimate European nation where German-speaking Germans live.

Stamp sales are one of its key economic pillars—during peak periods, they accounted for up to 10% of national revenue.

Based on Liechtenstein’s experience, successful stamp issuance requires several key principles:

First, stamp designs must be fresh, visually harmonious, and exquisitely printed. (Design quality matters)

Second, print runs are limited—typically under 1 million per design, with 80% going directly into collectors’ albums. By contrast, other countries often print 20–100 million per stamp, most used for postage. (Limited inscription supply)

Third, only a small number of stamp sets are issued annually—around 12–25 stamps. Each has a print run over 500,000, but only 20% are used for mailing, making them accessible and affordable for most collectors. (Few inscription types)

3. The old stamp market boom dwarfed today’s inscriptions

Of course, some countries succeed without strictly following the above rules.

They usually rely on a unique advantage:

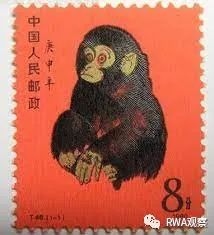

In 1980, the “Monkey Stamp” was released—the first zodiac-themed stamp issued by the People’s Republic of China.

These stamps were clearly intended for collectors—analogous to this year being the “Year One” of inscriptions.

The Monkey Stamp’s face value rose from ¥0.08 to over ¥2,000 at its peak—a surge of more than 20,000x.

The stamp-buying frenzy looked like this:

In April 1985, when the “Plum Blossom” miniature sheet was released, buyers rushed in droves. A line stretching over a kilometer formed from the China Post headquarters near Beijing’s Hepingmen all the way to Xuanwumen—about 30,000 people. Police deployed over 100 officers to maintain order. In cities like Shanghai and Nanjing, post office windows were broken and counters overturned due to crowds. (High gas fees for inscriptions)

Later, the postal authority dramatically increased print runs—tens of millions became common, sometimes exceeding 100 million. For example, the 1985 “Panda” miniature sheet had 12 million prints—huge compared to earlier issues of just hundreds of thousands. And compared to the 50+ million “Hong Kong Reunification” sheets issued in 1997, even that seemed small. (Mass issuance of inscriptions)

Meanwhile, the number of stamp collectors exploded. In 1980, there were only around 100,000 philatelists nationwide. By 1985, it reached 5 million; by 1990, 8 million; and by 1994, surged to 15 million. (User base grew 100x)

At its peak, the stamp market was so intense that early stamps (like Republican-era issues or used envelopes) were nearly impossible to obtain. Professional collectors described the market as a “wholesale hub,” dominated by bulk trading of new stamps—sold by the hundred or thousand like vegetables. This phenomenon was unprecedented globally! (Get used to it)

During this time, the postal authority conducted four major stamp destruction campaigns. In 1996, China Post destroyed stamps for the first time, sparking a bull market in 1997. In 2001, another large-scale destruction occurred, though exact figures weren’t disclosed. In early 2003, a third round destroyed stamps worth ¥1.19 billion face value. In 2004, an unprecedented ¥3 billion worth of commemorative and special stamps were destroyed—the largest such action in Chinese postal history. (Destruction mechanisms existed long ago)

Yet collectors noticed a trend: despite ever-larger destructions, each subsequent market boost was weaker than the last. Some argued the destruction wasn’t truly for the benefit of philately, but merely a way for postal authorities to prop up a failing “cash machine.” (Retail investors wake up)

Today, stamp collecting still exists—but the domestic stamp market has largely collapsed.

4. How do inscriptions compare to stamps?

From the above, the key pain points of the domestic stamp market were:

- Excessive issuance volume

- High-quality stamps (Republican-era/used covers) were unobtainable

- Lack of transparency in destruction/inventory

- Management focused solely on profiteering, not philatelic development

Inscriptions fare better in several aspects:

- Top-tier inscriptions are publicly visible—no scarcity due to access barriers

- Destruction and inventory are transparent

- Free competition among inscriptions—no central authority (like being able to collect stamps from any country)

5. What stage are we at now?

Let’s speak plainly—when it comes to speculation, it’s all about mobilizing the masses.

The stamp market boomed when it transformed from a niche hobby of tens of thousands into a nationwide phenomenon involving tens of millions—what we might call today a “social experiment.”

Although the inscription market is hot now, top inscriptions are held by only around 10,000 people—there’s still massive room for growth.

We probably need at least ten times more holders before this bubble truly “succeeds”—otherwise, it’s just insider hype.

By comparison to the stamp market, we’re barely in the early 1980s.

Minting inscriptions is still somewhat difficult, and buying them isn’t straightforward either.

The establishment of a mature trading market is essential for a bull run.

P.S. Someone might ask: Why compare with stamps instead of NFTs?

Uh…

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News