Will asset management, with its scale exceeding tens of trillions, be revolutionized by DeFi?

TechFlow Selected TechFlow Selected

Will asset management, with its scale exceeding tens of trillions, be revolutionized by DeFi?

More than 30% of global assets are managed by various asset management companies.

Author: inpower Wang Jun

With the development of DeFi, is it possible for a new BlackRock or Vanguard to emerge within the crypto industry?

As of 2022, global assets under management (AUM) were approximately $126 trillion. Given that total global financial wealth stands at $329.1 trillion, about 38.3% of all wealth is managed by the global asset management industry.

However, the current scale of crypto asset management is only in the tens of billions of dollars—perhaps around 3% of the total crypto market?

Traditional Asset Management Heavily Relies on Trust

Like many other financial sub-sectors, the asset management industry fundamentally relies on trust as its foundation.

Asset management refers to investors entrusting their funds to professional asset management firms, which then manage those funds—investing in stocks, real estate, bonds, etc.—and charge management fees and performance-based incentives.

In traditional asset management, investors transfer money to asset managers through complex contracts and compliance procedures, which—at least formally—provide clients with a sense of security: their money remains safe and under control.

In traditional asset management, well-established, long-standing firms enjoy significant advantages over newer players in fundraising and brand reputation.

Although high-profile scandals like Madoff have occurred, giants such as BlackRock and Bridgewater (despite recent rumors) are still largely trusted by investors.

Crypto Asset Management Has a Troubled Track Record

Given how large the asset management sector is, the crypto space naturally hasn't stayed away.

A few years ago, Yearn gained popularity by promising annual returns as high as 1200%.

Investors could engage in yield farming, liquidity mining, staking, and various leveraged contract strategies—all automatically executed via smart contracts...

Yet, most of these turned into nothing more than "who can exit first" games.

It's not just asset management that lacks trust—the entire crypto ecosystem suffers from a lack of credibility.

From the ancient days of MtGox to recent massive collapses like FTX and Terra, the crypto industry remains a chaotic mix of good and bad actors (with fish clearly outnumbering dragons). For examples, see See how aggressively the SEC enforces regulations in crypto.

DeFi’s original vision was to create a financial system free from intermediaries, using blockchain and smart contracts to give users full control over their assets.

Yet, despite being built on the premise of “technology ensuring trust,” the crypto world is rife with distrust—so much so that outsiders often equate it directly with “scam groups.”

Within the community, the mantra “not your keys, not your coins” is widely embraced by professional investors as a core investment principle.

Aside from rare losses due to technical vulnerabilities, most major losses stem from centralized entities exploiting the DeFi label while operating opaque, risky schemes.

Traditional and Crypto Finance Are Accelerating Toward Convergence

Over the past few years, DeFi-based asset management has undergone significant transformation.

Initially focused on maximizing individual asset returns, the emphasis has now shifted toward building robust, risk-resilient asset pools that cater to traditional user needs.

Traditional financial giants like BlackRock are actively expanding into crypto, while Grayscale launched its Bitcoin Trust Fund early on. (For more details, see What moves have other financial giants made besides BlackRock?)

Barring any surprises, after the approval of spot Bitcoin ETFs, many other token-based ETFs will likely follow. With traditional financial institutions’ distribution power, a significant portion of crypto assets will come under institutional management.

However, these ETFs offered by traditional institutions remain centralized financial products. When reviewing their underlying assets, investors will likely place more trust in verifiable on-chain custodial addresses than in audited reports from financial institutions.

But true integration requires breakthroughs at the settlement layer.

The biggest difference between blockchain transactions and traditional finance is:

On-chain transactions settle in real time, whereas traditional transactions rely on central authorities for settlement.

Regulatory bodies are rapidly adopting distributed ledger technology (see The U.S. Strategy? Explained: Fed and Swift Tokenization Plans) to close technological gaps. If settlement can also be verified on-chain and tokenized assets become widespread, the boundary between traditional and on-chain crypto asset management may eventually blur.

Crypto Has Its Own Cultural Identity

Currently, the crypto space is filled with stories of overnight riches. Compared to other markets, cryptocurrency investors have a distinct mindset and culture.

Warren Buffett, a legendary traditional investor, is hailed as a “stock god” for delivering average annual returns in the teens. In contrast, crypto investors and enthusiasts often feel satisfied only when their investments double—or more.

This preference for high returns complicates matters, as it conflicts with the long-term engagement essential for sound asset management.

(To be honest, I bought LINK and CFG near the bottom, and seeing them double repeatedly has been a bit intoxicating. Jumping on board after reading Dogim NFTs surge—up to 50x overnight! Did you join in? gave me deep insight into crypto investor psychology.)

Thanks to various smart contracts, automated yield strategies, and an endless stream of new ecosystem innovations, crypto has effectively created a more exciting casino than Wall Street. Beyond profits and novelty, people are drawn to crypto because it’s fun—it has its own culture.

When big figures enter the space, it triggers collective euphoria, positioning the crypto community as a force against financial hegemony.

In a way:

The U.S. Treasury issuance model isn’t fundamentally different from liquid staking;

Modern banking operations are far less transparent and reliable than stablecoin issuers;

The fiat money printing mechanism has long been criticized by Bitcoin advocates...

Something like Dogecoin started as a joke, but with enough participation, it evolved into a cultural belief.

Even Doge’s creators didn’t expect it to reach this point.

You could say it’s a decentralized version of “Occupy Wall Street.”

Non-custodial, permissionless DeFi asset management seems better aligned with crypto’s ethos.

If led by reputable KOLs, it might usher in the next paradigm shift toward democratizing financial markets. (Sounds a bit like MakerDAO?)

This shift would grant broad global access to financial markets.

Yearn currently manages around $300 million and still uses permissioned fund models—perhaps this is the short-term direction for Web3 asset management.

Are “Non-Custodial Funds” the Key to the Breakthrough?

Non-custodial means that during any transaction or service, neither the platform nor any third party holds or controls the funds or assets. The process typically occurs entirely via smart contracts.

This contrasts with custodial services, where user funds or assets are held by a third party for safekeeping and management.

Custodial services currently have advantages in recovery and security, allowing reputable centralized providers—with insurance—to better assist users in cases of theft or malicious activity.

Non-custodial services carry smart contract risks—vulnerabilities or bugs in code can be exploited to steal funds. Additionally, if users lose their private keys or access credentials, they usually cannot recover their assets.

If asset management firms could technically manage user funds without holding custody, many regulatory issues could be resolved.

For example, smart contracts could execute investment strategies via oracles or predefined logic, automatically distributing generated profits fairly between depositors and managers according to agreed terms.

As self-sovereign identity (SSI) gains traction among regulators, established managers could even create exclusive strategies accessible only to verified clients—benefiting from crypto’s advantages without increasing regulatory exposure.

In practice, decentralized exchanges like 1inch and Uniswap, lending platforms like Maker and Compound, and earlier-mentioned projects like Yearn and Solv all use non-custodial models.

However, in asset management, the biggest barrier to non-custodial solutions remains regulation:

In the 1940s, the U.S. passed the Investment Company Act, requiring fund managers to use third-party custodians that meet SEC standards—managers cannot hold custody themselves.

The eventual breakthrough may come either from SEC-approved custodians offering non-custodial solutions, or from regulators recognizing certain non-custodial technologies as compliant.

But regulatory battles like these? Let the U.S. tech giants lead the charge for now~

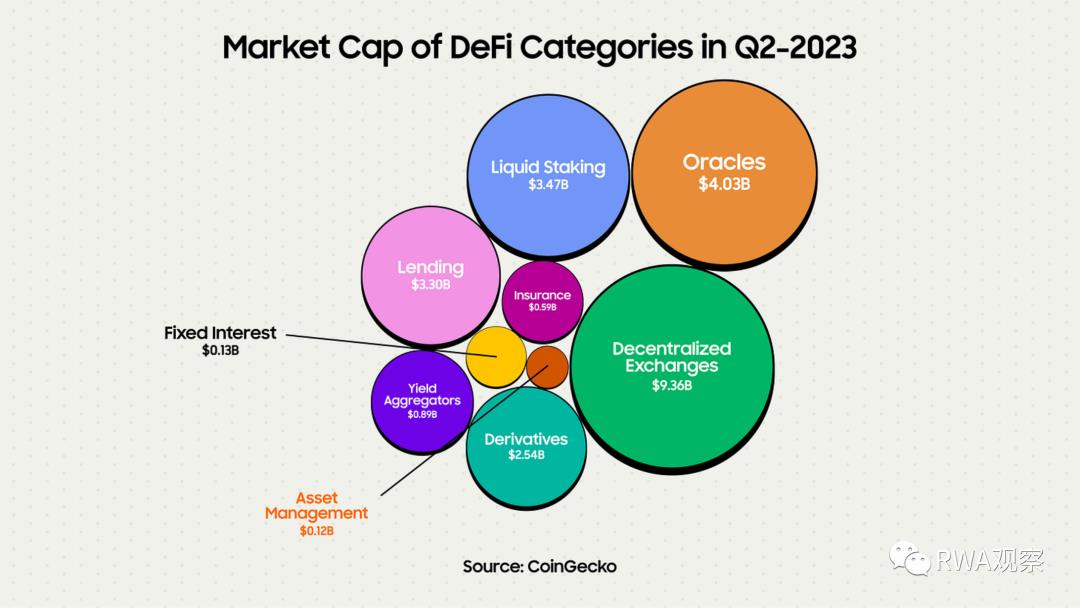

Perhaps influenced by this, crypto asset management currently looks like this:

Compared to the scale of traditional asset management, does the smaller current market size imply greater future opportunities (or risks)?

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News