Looking back at Yuga Labs over the past year, is APE still a good bear market bottom-fishing opportunity?

TechFlow Selected TechFlow Selected

Looking back at Yuga Labs over the past year, is APE still a good bear market bottom-fishing opportunity?

Under the inaction or ineffectiveness of the ApeCoin DAO, only staking rewards have been realized—purely token-for-token mining. Even if users achieve some profit, is this truly beneficial for Yuga Labs' brand?

Author: Scarlett Wu

It has been a year since the last review of the Yuga ecosystem (see "Revisiting ApeCoin Value Amid Regulatory Pressure and Staking Rollout: Critical Assessment of Yuga Labs' Ecosystem Value"). A year ago, Yuga Labs was placed on a pedestal—and it continues to deliver products mostly in line with, and occasionally exceeding, expectations. However, prices for its ecosystem tokens and NFTs have already shattered market illusions about the inflated valuations once associated with the metaverse/crypto IP narrative. With AK's pinned tweet promoting $APE, coupled with refreshed fundamentals and delivery updates within the Yuga ecosystem that invalidate previous research conclusions, I—having long tracked and participated in Mint Ventures’ coverage of gaming and metaverse sectors across primary and secondary markets—will reassess Yuga Labs and its broader ecosystem.

https://twitter.com/Rewkang/status/1679643703751876609

This report seeks to answer the following questions:

-

Has Yuga Labs or ApeCoin DAO delivered enough over the past year to warrant community trust? (This directly relates to whether there is sufficient support for NFT and $APE prices, which will be elaborated below.)

-

What are the potential upside and downside scenarios for the ecosystem going forward? Is AK’s argument reasonable?

1. Annual Review of the Yuga Labs Ecosystem

The previous Yuga Labs ecosystem review was published in October 2022. Over these nine months, changes in Yuga Labs’ fundamentals can be summarized as follows:

1.1 Yuga Labs Mainline: MDvMM Arrives Late

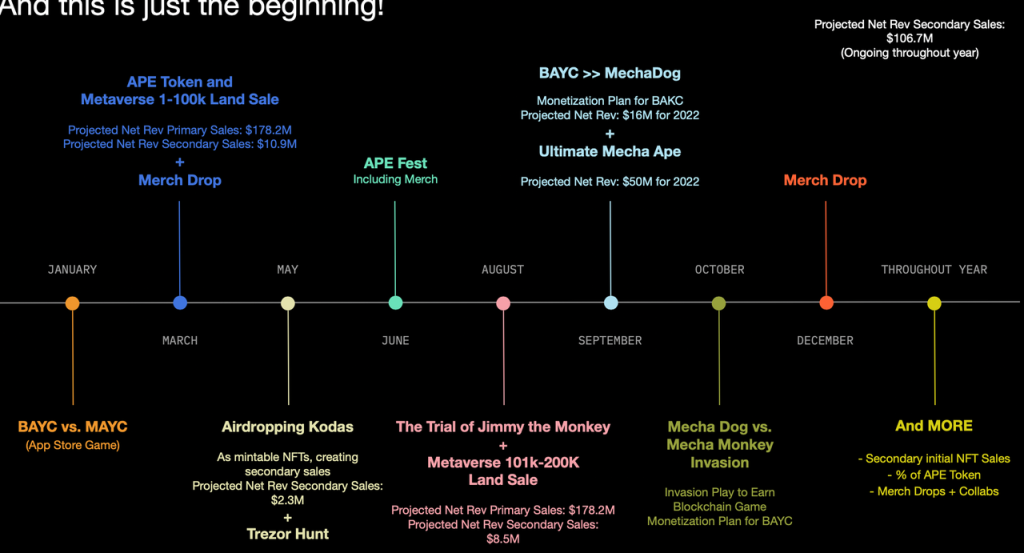

According to early pitch decks circulated from Yuga Labs, the MDvMM (Mechanical Dog vs. Mechanical Monkey) storyline was originally meant to be a three-month-long event starting in August 2022 and concluding by October 2022.

Screenshot from leaked Yuga Labs pitch deck

However, possibly due to significant internal personnel changes, MDvMM did not officially launch until November 25, 2022, when the first message—"The Trail begins this Christmas"—was released.

https://twitter.com/BoredApeYC/status/1595864347355537408?s=20

This marked the beginning of the recent price rally for Yuga-related NFTs. Taking BAKC as an example, key milestones such as the release of major narratives and gameplay rules became pivotal moments for shifts in BAKC pricing.

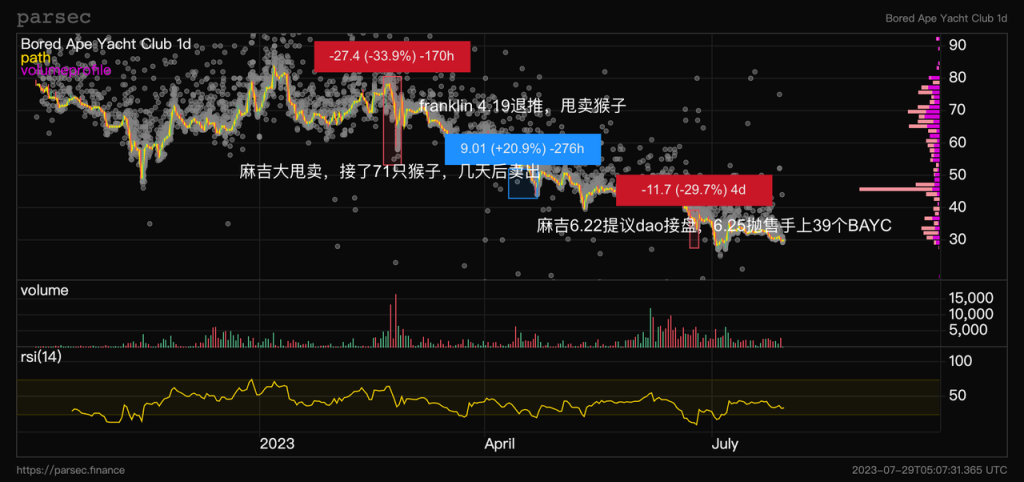

Parsec, Charted by Mint Ventures

MDvMM Timeline Overview

There are several notable aspects within the MDvMM narrative. These points are not only highly relevant to the pricing of Yuga’s NFTs and FTs but also touch upon how the broader NFT community constructs narratives. After all, Yuga Labs pioneered the concept of narrative universes in NFTs—can it now carry the burden of reviving the NFT market through new storytelling?

1.1.1 Incentivized Games’ Common Problem—Criticism Around Web2.5 Anti-Cheat Mechanisms

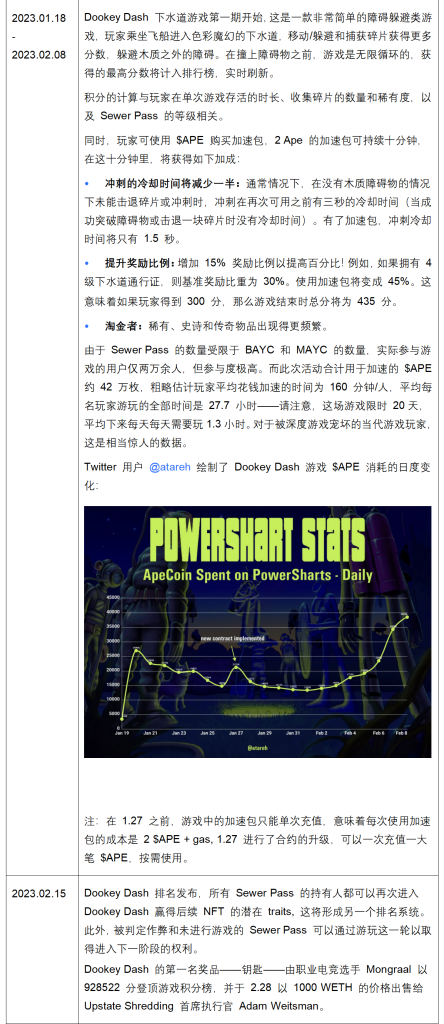

Since the first phase of Dookey Dash began, there was widespread market anticipation that higher-ranked Sewer Pass holders would later upgrade into more valuable NFTs. This led to black-market farming and proxy playing services fetching hundreds or even thousands of USDT per account. (In fact, this speculation proved accurate—at the time of writing, high-tier HV-MTL HOLO NFTs have a floor price of 6.5 ETH, while basic-level HV-MTLs sit at just 0.6 ETH.) The existence of such a profitable trading market reflects both market expectations toward Yuga Labs games and underlying trust in their fairness.

Unfortunately, despite having a “suspicious” activity detection system during gameplay, bypassing anti-cheat systems remained relatively simple:

The core issue lies here: Although Dookey Dash appears random and cyclical, the actual path choices are limited and determined by a fixed "course seed." As long as players locally input the same seed, they can reproduce identical game runs—including rewards and obstacles. Yuga Labs’ anti-cheat logic assumes legitimacy if the “locally generated course” matches the player’s inputs sent to the server. Once cheaters obtain a deterministic map, they can either design rule-based bots or apply optimal pathfinding algorithms to efficiently collect fragments while avoiding obstacles. Since bots can simulate mouse movements and clicks perfectly, distinguishing them from real users becomes nearly impossible—even if a player streams themselves live on Twitch seemingly engaged in intense gameplay, they might simply be randomly moving a locked cursor while the monkey avatar flawlessly dodges every obstacle and collects maximum fragments, fooling viewers into believing in genuine skillful play.

Regrettably, author @xClearHat argued that Yuga could have avoided or delayed full-scale cheating via the following measures:

-

Server-side generation of course maps and data: While costly due to bandwidth demands and infrastructure requirements—especially given Dookey Dash’s global user base—this would prevent local manipulation entirely.

-

Encrypt game logic: Two days before the end of the first Dookey Dash round, perform maintenance and recompile JavaScript files into obfuscated versions. Previously, the code was almost plaintext, making reverse engineering trivial. Given the time-limited nature of the game, increasing complexity and effort required to crack it would help preserve fairness.

-

Implement dynamic seeding at random intervals: Prevent players from freely using any known seed at any time; instead require synchronization with dynamically issued seeds—significantly raising the difficulty of automation.

Despite widespread circulation of this analysis thread, Yuga Labs ultimately announced results where the top esports player wasn't actually first—but after disqualifying cheaters via video evidence, he still received a valuable key. But how many others who didn’t aim for #1 but aimed for stable high rankings remain undetected? We may never know. In blockchain-based games, outcomes aren't always absolutely fair—especially in web2.5-style hybrids.

@xClearHat’s demonstration of a bot playing Dookey Dash

Perhaps due to the wide reach of this critique—or perhaps because Yuga had already planned a strategic shift—the HV-MTL Forge introduced a clever mechanism to mitigate botting and boosting impacts: voting. Across six phases, AMP levels are ranked based on community votes, allowing users to upvote or downvote entries. Even if someone uses bots to inflate their vote count, poor visual quality or implausible growth patterns could lead to mass downvotes and low final rankings.

https://forge.hv-mtl.com/preview/1

Community self-policing is indeed a promising solution, shifting some verification burden from project teams to players. Reaching top ranks now requires not only technical prowess (though semi-automated actions like periodic mouse clicks persist, albeit risky), but also strong social networks (mutual voting groups) and capital (more wallets mean more votes, or buying votes OTC at ~$1 per vote). But why invest so much time and energy into a game with mediocre gameplay focused solely on leaderboard climbing? Currently, main tactics include mutual voting and owning multiple mechs for self-voting. While Yuga allows non-holders to bind Twitter accounts for voting, this mainly serves to differentiate rankings among tied scores rather than act as a primary ranking factor (though in practice, many do tie, so Twitter binding remains useful).

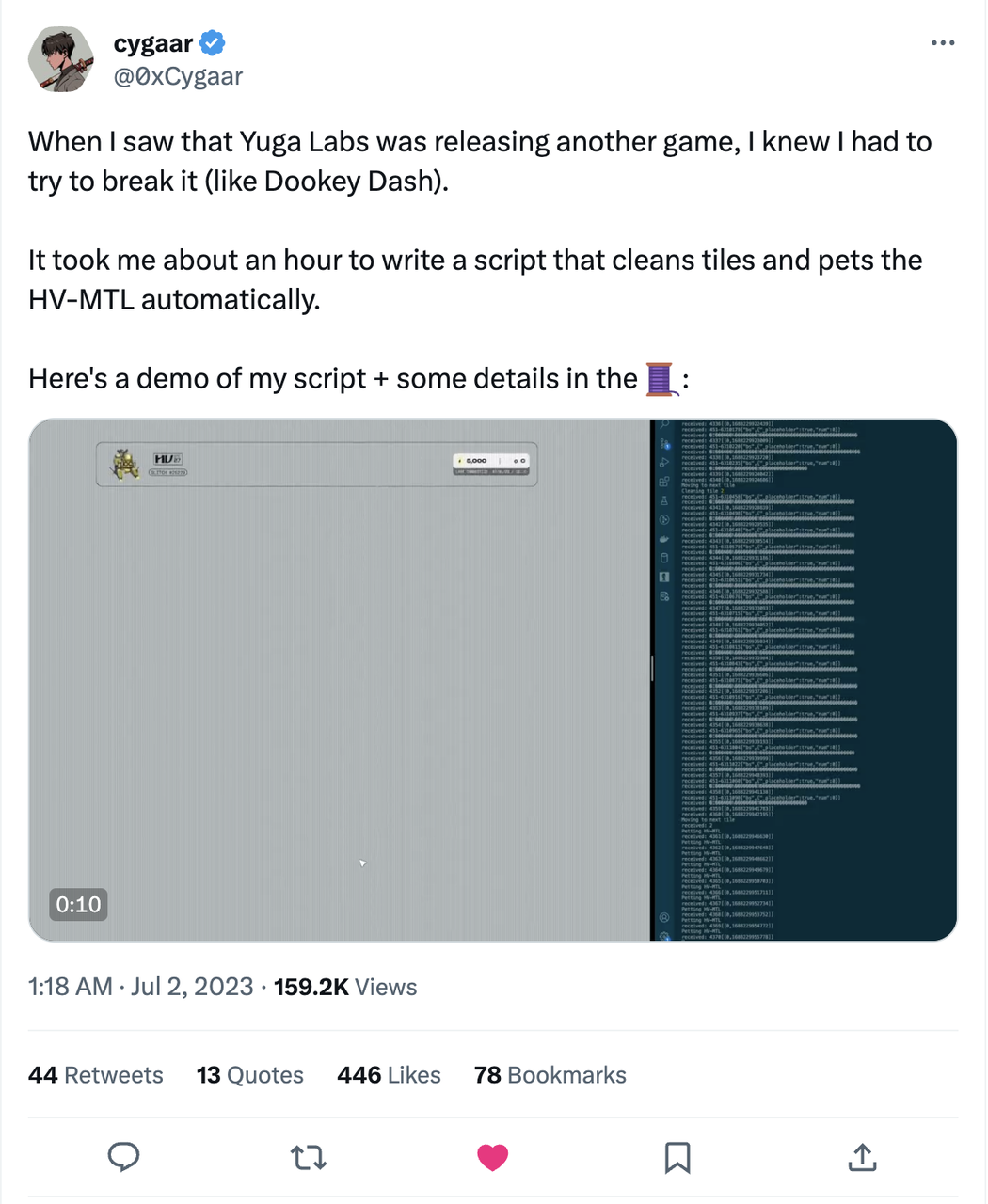

@0xCygaar

The recently concluded Season 1 revealed early trends: out of over 20,000 HV-MTLs, only 133 achieved the highest AMP tier. Season 1 AMPs correspond to mech heads, and ongoing Season 2 focuses on weapons—if Yuga meets or exceeds expectations, six AMP parts should form an impressive mech. But will we see another wave of thousand-ETH golden ape purchases or legendary key sales?

AMP Concept Art

Cheating has always disrupted the magic loop in traditional gaming. Web3 games face even greater challenges due to richer incentives attracting large-scale farmers and bot armies. Community-driven oversight may offer one viable countermeasure; another might be embracing bot-friendliness—auto-battler modes are increasingly integrated into legacy game designs. When auto-chess mechanics reduce most player interactions, we must ask: what kind of experience do players truly seek? Is it the balance-sheet thrill of play-to-earn, the emotional satisfaction of experiencing a compelling story, the mastery rush of defeating bosses, or the social status derived from showing off rare achievements?

From Dookey Dash and HV-MTL, the core motivation seems clear: acquire scarcity, i.e., potentially higher-value NFTs. Social value and experiential engagement exist—but minimally.

1.1.2 Token Release and Economic Consumption—Minimal Value Capture

To discuss $APE consumption and value capture, we must clarify one point: where does consumed $APE go?

Since players spend $APE directly, it isn't buyback; $APE supply won’t increase beyond 1 billion nor undergo deflationary burns—it simply flows into Yuga Labs’ wallet. For Yuga, this constitutes direct game revenue.

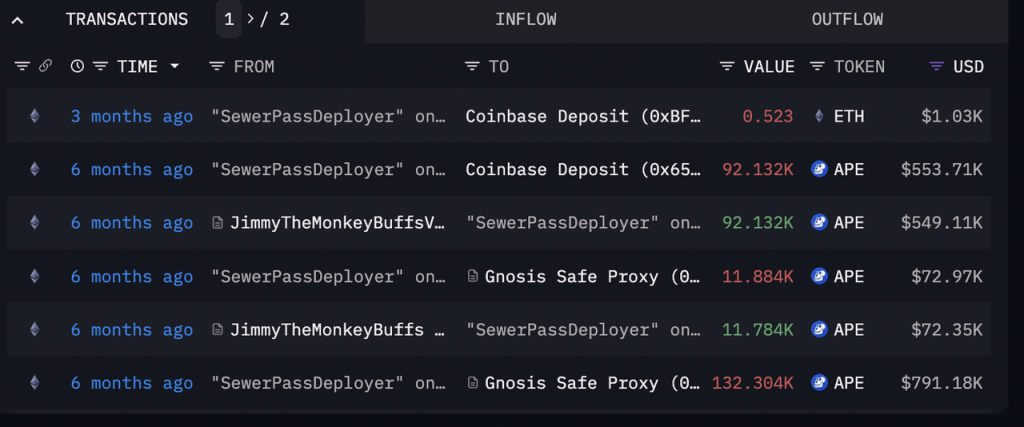

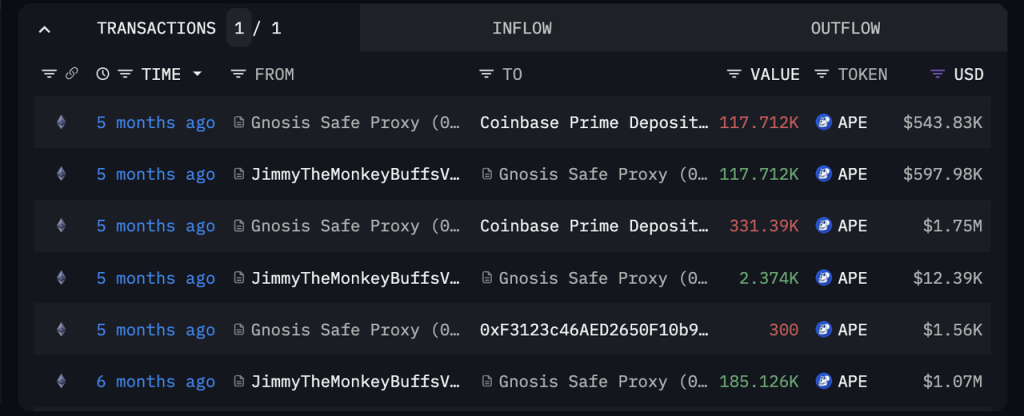

According to Arkham Intelligence, shortly after Dookey Dash ended, portions of collected $APE flowed into Coinbase—one part directly, another briefly passing through a multisig before arriving at Coinbase.

https://platform.arkhamintelligence.com/explorer/address/0x9223abD716FF22C62Db2c6760eB6A59a33AF729E

https://platform.arkhamintelligence.com/explorer/address/0xDa7a4a45cE9c5b42102fcb456AE2532beD252a24

In other words: Consumed $APE does not permanently reduce circulating supply, but creates short-term buying pressure and temporary lock-up—the duration of which depends entirely on Yuga Labs’ discretion. Moreover, if Yuga holds substantial $APE reserves, concentrated dumping risks emerge.

With this context, let’s analyze $APE consumption from Dookey Dash and HV-MTL separately:

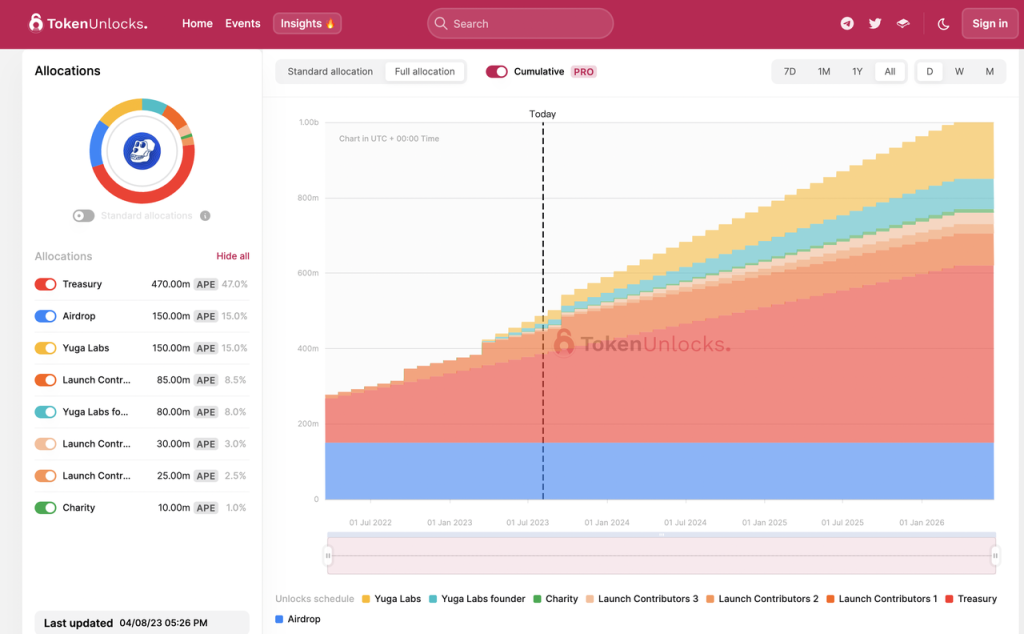

Even assuming Yuga Labs refrains from selling received tokens (which they're free to do), the amount captured pales in comparison to concurrent staking rewards distribution and unlocks from investors and team allocations.

1.1.3 NFT Utility vs. Narrative—Why Has BAYC Lost Its Glory?

After BAYC fell from its “stable floor around 50 ETH” peak, confusion persists: why has BAYC lost its former price momentum and consensus?

The answer may be straightforward: past glory came from retail riding whales’ coattails—once major accumulators exited, liquidity and value consensus collapsed. Key figures include machibigbrother.eth (“Machi”) and Franklin.

Machi was an early core holder and evangelist of BAYC, amassing dozens to over a hundred apes. Franklin famously used “Franklin has 61 Apes” as his Twitter handle to signal status, and staged dramatic liquidations via BendDAO, earning him the nickname “monkey market maker” (see Jessica’s earlier piece: “BAYC Price Drop Revisited: Comprehensive Analysis of Risks and Opportunities Facing NFT Lending Leader BendDAO”).

During the bear market, Machi trusted Blur’s bidding wall too much, inadvertently accumulating 71 BAYCs at a loss and later dumping them all at once, triggering a crash. On April 19, Franklin announced a Twitter hiatus and dumped all remaining BAYCs, further reducing the number of capable large buyers able to absorb sell pressure.

On June 22, after accumulating BAYCs again, Machi proposed an ApeCoin DAO draft suggesting treasury-funded NFT buybacks to stabilize prices. As news spread, on June 25 he dumped 39 BAYCs—revealing clearly that what small holders view as faith and narrative, big players treat purely as tools for manipulation and profit. (In reality, DAO proposals take considerable time to vote on; Machi’s prior drafts never reached formal voting stages, yet mere rumors suffice to mislead uninformed audiences and trigger market reactions.)

This reminds me of a past conversation with Shim: initial narrative consensus in an NFT project often manifests first as price consensus—not unlike luxury goods in traditional markets. Looking back over the past year, it’s evident that Yuga Labs’ price consensus has declined, while product credibility has risen. Its NFTs are transitioning from unpriced, moonshot-status luxury items to consumable goods with comparable market benchmarks.

As BAYC evolves from pure narrative-driven mystique to cash-flow modeling via retroactive airdrop calculations, and further integrates into gameplay as functional assets, it shifts increasingly toward utility. Utility raises baseline valuation but caps upside potential. Holders transition from “HODL and show status” collectors to “farm pre-airdrop, sell post-airdrop” speculators. Even if Yuga attempts psychological differentiation between BAYC, MAYC, BAKC, HV-MTL, and $APE, the interconnectedness drags BAYC down from its luxury pedestal.

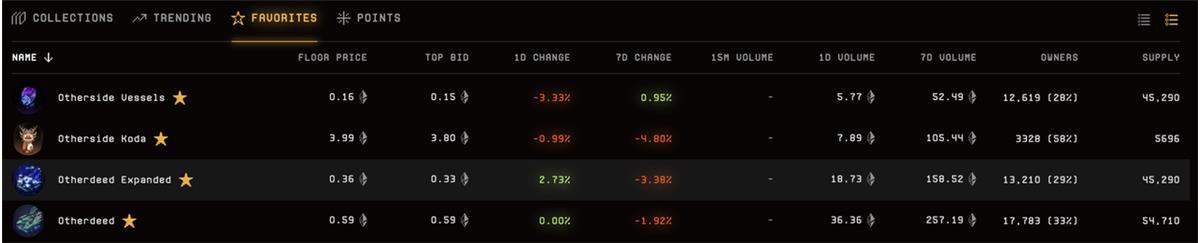

1.2 Otherside Side Line: Weak Prices, But Promising Game Quality

In March 2023, Otherside’s Second Trip launched, dividing players into four teams led by streamers and KOLs from gaming and NFT communities competing for scores. Unlike the first trip, this version achieved true 1) synchronized interaction and data upload for thousands, and 2) experimental gameplay with thousands visible simultaneously.

Although I was blocked outside due to capacity limits (over 50k holders, only ~8k entered), watching livestreams allowed me to appreciate UE5’s stunning visuals and the excitement of fighting alongside thousands. From single-player games to MMOs, from small-scale MMOs to massive concurrent experiences, technological advances open new gameplay possibilities—and Otherside may pioneer the latter.

Otherside’s execution exceeded expectations, yet failed to lift Otherdeed prices. Winners received a helmet-like relic—Otherside Relics (2,220 total), airdropped to members of winning teams. On airdrop day, Relic prices peaked at 0.7 ETH and still maintain a 0.2 ETH floor today.

But Otherdeeds weren’t so lucky. Markets interpreted the realization of airdrop expectations as negative—each new NFT distributed reduces future yield potential per Otherdeed, lowering expected cash flows and thus NFT valuations.

Subsequent splitting of Otherdeeds accelerated price declines:

-

Otherdeed (without Koda): Split into Otherdeed Expanded and Otherside Vessel; Vessels evolve into Maras in upcoming mini-games and combine with Koda into Kodamara;

-

Otherdeed (with Koda): Split into Otherdeed Expanded, Otherside Vessel, and Otherside Koda;

Clearly, Otherside aims to maximize NFT gamification. But from an investment standpoint, overly complex nesting confuses casual players, and fragmented liquidity makes recovery unlikely—hence the continuous decline in Otherside series floor prices.

On July 28, 2023, Otherside’s official Twitter shared behind-the-scenes footage from offline playtests. Instead of coloring robots exploring static scenes, real avatars now explore jungles, mountains, lakes, bars… Suggesting a full release isn’t far off, potentially delivering the immersive experience expected of Web3’s flagship game.

https://twitter.com/OthersideMeta/status/1684756832265621504?s=20

1.3 ApeCoin DAO Side Line: Lackluster Ecosystem Growth, Persistent Inflation

Over the past half-year, ApeCoin DAO passed barely two dozen proposals. Most related to governance processes or improving staking efficiency (which seems absurd—imagine a traditional company spending over a year refining departmental roles and management workflows). Others rewarded $APE contributors (naturally aligned with voter interests), while the rest focused on BD and narrative-building efforts—films, games, comics centered on Ape themes. One somewhat promising proposal involved Forj leading an incubator for Ape ecosystem projects—though tangible outputs remain premature.

From an investor-led council to one elected by the community, innovation and boldness have visibly waned. DAO participation remains minimal—despite hundreds of millions in circulation, total votes rarely exceed 10 million. Clearly, $APE holders care little about governance; for most, the sole utility of $APE is staking.

Recalling earlier stated use cases for $APE under ApeCoin DAO:

-

Ecosystem token: Yuga products accept $APE payments, but actual demand is disproportionate to supply (see 1.3); no significant ecosystem expansion suggests mismatch between currency value and utility.

-

Payment method: Though Gucci/Times/OpenSea accepted $APE for select NFTs, these were largely gimmicks. Few willingly hold a volatile asset for daily transactions.

-

Staking rewards: $APE price dropped from $5 at staking launch to under $2—meaning unstaked stakers likely incurred heavy losses. If everyone hedges—do stakers really believe in $APE’s long-term?

It appears that, under ApeCoin DAO’s inaction or ineffectiveness, only staking has materialized as a real use case—pure token mining. Even if users profit, does this truly benefit Yuga Labs’ brand? Staking + rewards merely buys time for ecosystem development. Without meaningful growth during this window—and given rampant inflation—token prices face inevitable collapse, leading to repeated halvings.

2. Potential Upside and Downside Scenarios

Reviewing Yuga Labs’ challenges, problems, and achievements, we summarize potential Upside & Downside scenarios below:

2.1 Potential Upside

- Otherside launches and is genuinely fun

- We’re currently at Second Trip stage, but offline playtest leaks suggest progress. Yuga’s track record in game delivery remains solid.

- Mass-market breakout

- Deep brand collaborations (e.g., adidas/Gucci)—dependent on team BD skills and macro-brand partnership trends

- Spin-off games/films

- Regulatory narrative reversal

- SEC investigated Yuga Labs in October last year, but $APE was absent from its June 2023 lawsuit list

- $APE consumption

- Value capture from mech game (so far, consumption negligible relative to inflation)

- Ape Fest (next event in HK—could drive high-net-worth individuals in Hong Kong to purchase NFTs)

2.2 Potential Downside

-

Narrative and price anchor erosion + illiquidity

-

Lack of market makers (like Machi and Franklin); community heavily reliant on Yuga Labs. Prices will fluctuate with Yuga’s activity performance—but in today’s low-liquidity environment, positive news yields muted gains, while negatives cause sharp drops. Unlike Punk’s decentralized art collector model, where owners don’t care about short-term prices and lack urgency to sell, preventing collapse from illiquidity.

-

-

Token inflation

-

$APE faces continued inflation, and investors may dump further (current price already below earlier private valuations—$2B FDV vs. original VC $4B estimate, though VCs held not just token rights but equity/IP in Yuga Labs)

-

Source: Token Unlock

- Near-zero token utility

-

Payment usage – Almost no one uses $APE on OpenSea; purely symbolic

-

Ecosystem development – ApeCoin DAO extremely inefficient over past six months; DAO structure proves slow and poorly incentivized, dragging down Yuga’s momentum

-

Staking – Currently the only real use. APR dropped from initial >300% to ~50% (pure $APE) / 140% (NFT-staked pair). Hedged miners may profit, but naked stakers suffer severe losses

-

Currently, downside forces outweigh upside. Of course, Yuga Labs’ delivery capability ensures it won’t disappear—but may be surpassed. For the foreseeable future, “deflation of hype” may remain the dominant trend for Yuga Labs’ assets.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News