Rising in the East, Setting in the West: The Turning Point in the Fate of Asia's Builders

TechFlow Selected TechFlow Selected

Rising in the East, Setting in the West: The Turning Point in the Fate of Asia's Builders

The entire industry landscape is undergoing dramatic changes, with market dominance shifting from West to East.

Author: Chris, COO of @Chainbase

From automobiles to smartphones, from chips to manufacturing, Asia’s influence on the global economy and innovation stage is undeniable. In the evolution of the internet, the West dominated Web1, China defined Web2, and after more than a decade of development, the turning point between East and West appears to have arrived at Web3.

Cryptographic technology has always been global from the start. As an Eastern-based project, Chainbase has always aimed to approach its development with a global perspective. Yet the real question remains: What role will the East play in the next crypto cycle? And how should we position ourselves?

Driven by this idea, over the past few months Chainbase has actively participated in various crypto events and developer gatherings in Hong Kong, Vietnam, Japan, Hangzhou, Shanghai, Montenegro, and Stanford. We’ve sought to clarify our own positioning through these activities—and in the process, our thinking about the East’s role has gradually taken shape.

Viewing the Industry Landscape from the Developer Perspective

The sudden collapse of SVB and increased U.S. regulatory pressure were two pivotal events in the first half of 2023. While Silicon Valley Bank may not seem directly tied to cryptocurrency, it's important to recognize that large volumes of fiat and crypto startup capital flowed through SVB.

To contain the spread of risk, regulators launched "Operation Chokepoint 2.0," shutting down two banks friendly toward crypto—Silvergate Bank and Signature Bank. These institutions served major centralized exchanges, lending platforms, and other key players. However, as major clients like FTX and Genesis collapsed one after another, these banks ultimately became casualties amid bank runs.

More importantly, this may be just the first domino to fall, signaling a growing crisis of confidence in the traditional banking system.

In the short term, this could severely impact crypto liquidity. But long-term, it might accelerate broader adoption of blockchain networks across markets.

Starting in Q2 this year, U.S. regulators began targeting prominent industry figures and CEOs—from Justin Sun to CZ, from Binance to Coinbase. No one was spared. The Economic Report also dismissed crypto’s value proposition, explicitly warning that growing crypto activity could pose instability risks to the U.S. financial system. Additionally, Senator Cynthia Lummis emphasized in her latest Twitter post the significance of Judge Analisa Torres’ recent favorable ruling for XRP, noting that this decision underscores Congress’s urgent need to establish a comprehensive and clear crypto regulatory framework.

The anti-crypto movement erupting in the West presents opportunities for the East. As Coinbase CEO Brian Armstrong stated, “Regulatory uncertainty and anti-crypto sentiment are jeopardizing America’s status as the center of crypto innovation.”

While the U.S. remains home to many crypto users, brilliant developers, and projects, they may now reconsider their operational priorities and resource allocations.

Overall, the entire industry landscape is undergoing dramatic shifts, with market leadership transitioning from West to East.

The facts speak louder than words. By the end of 2022, there were 425 million crypto users globally (up from 295 million in 2021). Of these, Asia accounted for 260 million users (60%), North America had 54 million, Africa 30 million, and Europe 31 million.

“The sun rises in the East” couldn’t be more fitting. Each sub-market in Asia has its own unique strengths, driven forward by targeted policies.

Beyond macro data, Asian countries also show immense potential at the micro level. According to Chainalysis’ “2022 Cryptocurrency Adoption Index,” when measuring individual transaction activity, 9 out of the top 20 countries are from Asia. More interestingly, Vietnam ranks first, and most high-ranking nations are middle-to-low income—including five Southeast Asian countries. The U.S. and the U.K. are the only high-income country representatives.

These numbers—in terms of usage, user volume, and activity—are telling us that the Asian market may become the epicenter of the global crypto industry.

In fact, viewed from the angles of CEX trading, ownership, and mining, Asia has already led the global crypto market since the last cycle:

Among the top 5 CEXs, 3 are from China.

In terms of 24-hour trading volume, the top 3 are all Asian.

East Asia’s crypto transaction volume exceeds $750 billion, led by China, South Korea, and Japan.

Moreover, despite leading in trading, each Asian market has its distinct characteristics:

South Korea is the most active CEX trading nation in East Asia, thanks to crypto celebrities like DK, driving widespread active trading.

Japan's thriving IP culture has cultivated a strong base of NFT and gaming enthusiasts. Coupled with notoriously high housing prices, high unemployment, and prolonged economic stagnation, younger generations increasingly view crypto as an alternative investment asset, fueling DeFi activity across East Asia. South Korea and Japan both possess robust grassroots bases of crypto users and investors.

Another dominant force cannot be overlooked: China. Despite policy bans on crypto activities, China still leads globally in metrics such as trading volume, wallet addresses, and end-users. Combined with Hong Kong’s open stance, this further amplifies China’s influence in the industry. Hong Kong has indeed taken proactive steps in crypto regulation, especially regarding relaxed oversight and stablecoin issuance.

Southeast and South Asia are also focal regions.

India, with the world’s largest population and second-largest developer talent pool, is a critical crypto market. Coupled with light regulation, this opens vast room for rapid crypto growth. Whether in regulatory arbitrage or innovation, the potential is enormous.

In Southeast Asia, Singapore stands out, aspiring to become a crypto hub. In recent years, the government has actively attracted crypto projects and executives to relocate headquarters there. But results have been mixed—while trading volume and capital flows have increased, no significant innovation or tangible benefits have emerged. Meanwhile, the fallout from Terra and FTX dealt heavy blows to retail and institutional investors alike.

However, crypto prospects elsewhere in Asia remain highly promising.

In the 2022 Global Crypto Adoption Index (source: Chainalysis), Vietnam, the Philippines, and India occupied three of the top five spots. Vietnam and India led across multiple subcategories.

This is no coincidence. Numerous reports show that these Southeast Asian nations, along with India, collectively dominate crypto data.

Altogether, Southeast Asia’s unique conditions make fertile ground for crypto proliferation: political fragmentation, young populations, unstable currencies, and trade integration create ideal conditions for industry growth. Moreover, single-income structures give people strong motivation for “work-to-earn” and “play-to-earn,” leveraging local users’ abundant resources and intense profit-seeking drive.

Of course, governments also hope crypto can address certain traditional financial challenges. Looking back at Latin America and Africa, crypto has already proven viable as payment and value storage in developing economies. We believe Southeast Asia will follow a similar path.

That’s why Indonesia, Vietnam, and Thai governments take the crypto industry seriously and are actively establishing clear regulations. This provides relatively healthy space for various dApps like GameFi, licensed CEXs, retail investors, and educational initiatives.

Asia’s rising prominence in crypto is also reflected in its strong base of practitioners and high potential for user penetration.

The State of Asian Developers

As an emerging force in the Web2 realm, Chinese developers are poised to play a decisive role in the coming technological revolution—especially in the age of crypto.

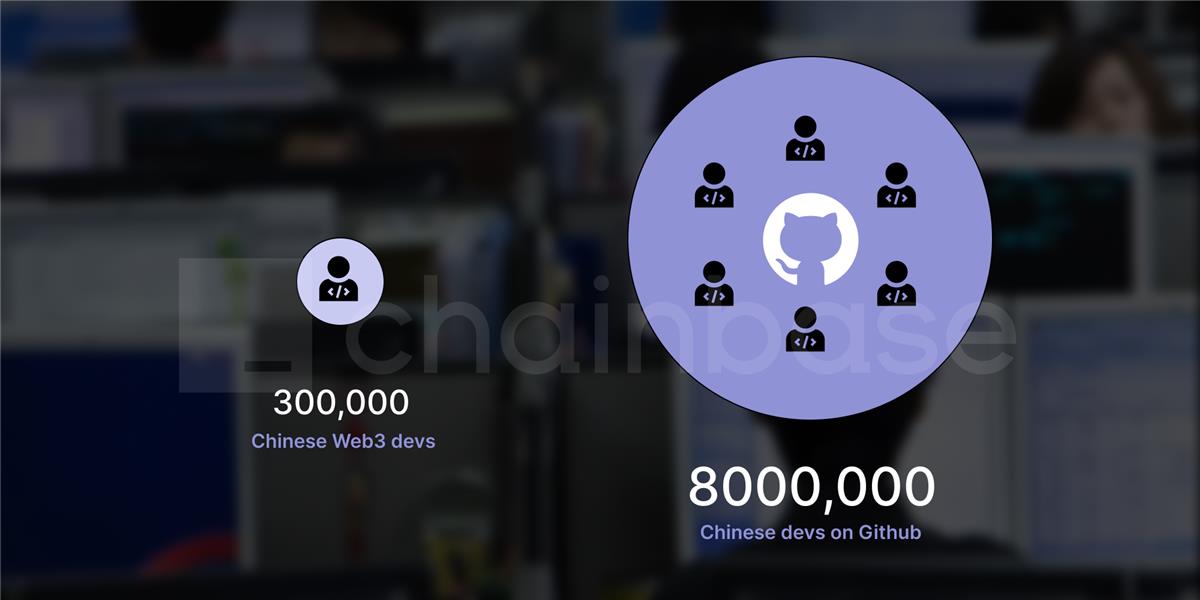

According to estimates from several Chinese Web3 developer communities, there are currently around 300,000–400,000 Web3 developers in China. Meanwhile, the total number of Chinese developers on GitHub has long surpassed 8 million! Most have over two years of development experience and are proficient in languages like Java and Python.

In contrast, Web3 developer penetration in China remains quite low—a situation likely mirrored in other Asian countries.

Comparing these numbers to the global developer pool: as of July 2023, among approximately 190,000 crypto professionals worldwide, about 40% are based in Asia, with India and China ranking first and second.

Yet analyzing the background of these 190,000 professionals reveals that roughly 60% work in CEXs and crypto financial services—actual developers are few.

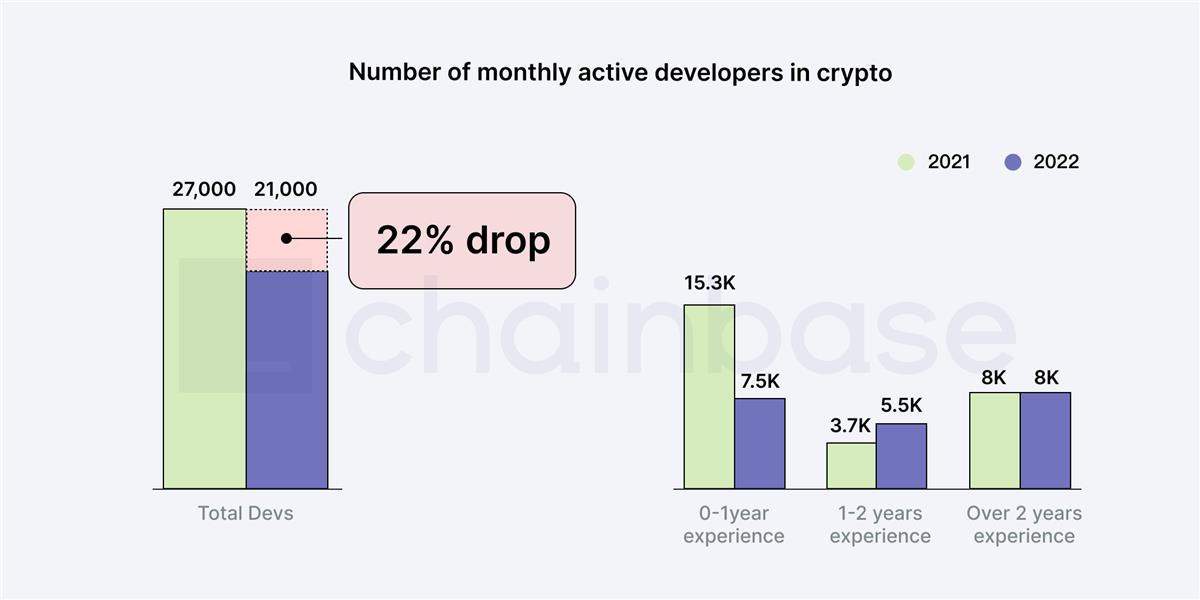

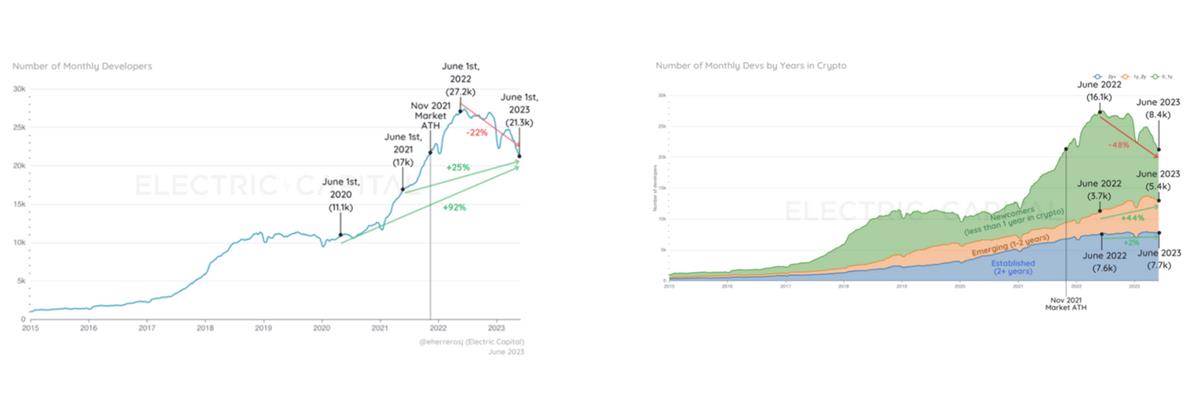

The declining trend in active developers is also telling. In the past year, the number of monthly active developers dropped from 27,000 to 21,000—a 22% decline.

Meanwhile, a closer look at developer community profiles reveals a clear divide: players who entered crypto after June 2022 have seen a 48% attrition rate.

During this period, developers with 1–2 years of experience grew from 3.7K to 5.5K, while those with over 2 years of experience (“veterans”) remained around 8K—this represents the foundational global crypto developer base.

A simple arithmetic problem arises: if just 1% of developers from China and India enter Web3, this number would immediately double—signaling massive potential growth in project and on-chain data demand.

Precisely because the Asian market is so vast and rich in developer talent, the industry’s top priority should be understanding Asian developers better and unlocking their full potential.

As a Web3 data infrastructure platform built for developers, Chainbase has hosted multiple events across Southeast Asia, Japan, Hong Kong, and mainland China over the past four months, while building partnerships with top developers from Silicon Valley.

Our goal remains consistent: First, solve practical problems developers face when building projects. Second, leverage regional developer communities to attract more talented builders and drive industry progress.

We believe that by addressing developers’ immediate needs and widening the funnel, we can foster a more vibrant ecosystem.

Real Insights from Events and Developers

Since the Hong Kong Web3 Conference in April, reflecting on our participation in events across Asia, several clear truths have emerged:

1. First, developers in each region have distinct characteristics and needs.

In Hong Kong and Singapore, we see more fintech, RWA, and trading talent; Southeast Asia leans toward fast payments and gaming; Japan favors content-centric verticals; Mainland China shows balanced capabilities, with skilled platform builders, infrastructure engineers, and dApp developers.

The key is recognizing Asia’s diversity and tailoring outreach accordingly. One-size-fits-all solutions don’t work. We must understand each community on its own terms.

Interestingly, we found a common thread: most developers don’t seek answers via social media or live events—they prefer staying home, searching online, and dislike public speaking. I’m confident that at least 90% of them prefer help through community discussions, online tutorials, and self-research.

2. Second, Asian developers tend to be highly pragmatic—focused on solving real-world problems rather than chasing narratives and hype.

This reflects a shared pragmatism among Asian developers. Given their strong engineering skills and ability to build functional code, it makes sense: they are doers, not talkers.

Western projects often rely on marketing and grand visions, whereas Asian developers stay low-key and focus on delivering usable products. Their humility deserves appreciation. But it also means that to earn their trust, you must help solve practical problems and improve workflows—not just pitch dreams.

3. Third, Asian developers exhibit exceptional work ethic and responsibility.

Asian developers embody a strong “think and act” spirit. It’s common to see them working over 70 hours per week, juggling three projects at once, and willing to push even harder if needed.

At the same time, they deliver high-quality tech at very reasonable prices. Self-motivation, technical skill, and value realization converge uniquely in Asian talent.

These insights aren’t speculative. During events, we had deep conversations with over 100 Asian developers through one-on-one dialogues.

This allowed us to engage many talented engineers—from Web2-to-Web3 switchers, local project founders, multi-cycle veterans, to newcomers—covering nearly every segment.

These candid exchanges were invaluable in understanding the diverse needs and perspectives within Asian developer communities. By listening directly to individuals, we gained meaningful insights that guide our outreach improvements and strengthen cross-market connections.

I’d like to share some representative insights from these builders, hoping to inspire others.

1. GameFi Product Manager @HK: 1.7 billion players, $72B annual revenue, MMORPG + casual mobile games

Asia is the world’s largest gaming market, with 1.7 billion players (55% of global total), generating $72 billion annually. More importantly, it holds immense growth potential. And certain game genres are clearly suited for Web3: MMORPGs (value of ownership) and casual games (lightweight).

Beyond that, as a Web3 game product manager, we must define native Web3 game types—such as games fully built on blockchains.

This involves placing not only game assets but also game logic and governance on-chain. By leveraging Web3’s inherent advantages, we can achieve significant progress in data richness and scalability.

2. DeFi Product Manager @HK: Bullish on Hong Kong, RWA, and DeFi

As Asia’s financial hub, Hong Kong boasts deep talent pools in financial product development and distribution channels.

To create compelling DeFi products, we need to seamlessly blend native crypto innovation with proven real-world product logic.

Our goal is to truly bring blockchain to the masses by solving unmet real-world needs.

3. Local Layer1 CTO @HCMC: “Dare-to-do” Culture + Abundant Developers

Vietnam has the strongest developer community in Southeast Asia, due to several reasons:

a) Developers exhibit unparalleled “dare-to-do” attitudes, constantly tackling challenges and building innovative solutions. They bring an entrepreneurial spirit;

b) The developer community stays tightly connected and developer-focused. They know each other well, easily reach consensus, and collaborate effectively;

c) Developer costs here are moderate—around $15K–20K annually for someone with two years of experience—and they have sufficient English reading and writing skills.

4. Web2.5 Platform CPO @HCMC: Globalization + Regulatory Arbitrage Opportunities

Vietnam has a large diaspora in Europe, giving it a unique advantage in building global teams.

Meanwhile, Vietnam faces potential innovation opportunities in traditional finance—from cross-border payments to inclusive finance.

A global team with strong Vietnamese representation and local funding offers clear advantages for many projects rooted in developing economies.

5. Leading Infrastructure Project @Shanghai: Well-Trained, Experienced Developer Hub

Undoubtedly, Chinese tech giants like Alibaba, Tencent, and Huawei have trained vast numbers of internet, cloud computing, and infrastructure developers. Many have handled peak transaction rates of 2 million per second during events like the Spring Festival Gala and Singles’ Day.

Chinese developers initially aimed to build high-concurrency, high-availability, and high-security systems—directly confronting the crypto trilemma (high concurrency, availability, security)—an impressive pursuit.

Any project assembling a strong Chinese engineering team gains significant advantages in solving complex development challenges.

6. Web2 Game Studio @Shanghai: Surplus Gaming Talent in a $20B Market

Shanghai has decades of experience across PC, web, mobile, and esports gaming, nurturing an unmatched gaming ecosystem. Game development has spawned countless unicorns—37Games, Shanda Games, Giant Network, miHoYo, Lilith Games, Bilibili, and more. In 2022, China’s gaming revenue exceeded $20 billion, cementing its global leadership in game creation, publishing, and marketing.

Looking ahead, Shanghai is poised to lead the transition from Web2 to Web3. A wave of blockchain game launches and ongoing hackathons will drive Web3 innovation and supply.

7. Layer1 Technical Advisor @Hangzhou: Building Public Chains for Global Reach

Chinese developers often excel technically but lag in proactively communicating with overseas teams and mastering PMF. Therefore, building technical bridges is crucial.

For overseas markets, most public chains lack sustained development support—this is where Chinese talent can add tremendous value.

However, Chinese developers must communicate using terms familiar to public chains to access resources and funding. Bridging this communication gap represents the biggest opportunity for Chinese developers to join global tech innovation.

8. Developer Community @Hangzhou: Recruiting Developers from Internet Giants

The most direct reason to build a developer community in Hangzhou is its hundreds of thousands of experienced internet-era developers.

They are well-educated, eager to learn, technically skilled, experienced, deeply knowledgeable in tech and finance, and even possess international vision and openness.

From a Web3 perspective, Hangzhou is also a pioneer in cloud mining, infrastructure, and security projects. Hangzhou and Shenzhen should become frontlines of China’s Web3 evolution.

9. ZK Engineer @Osaka: Limited Supply of Devs & Engineers + Agent Culture

As a Chinese engineer in Japan, I’ve witnessed the country’s historically closed cultural context alongside openness to new opportunities. Due to missing the internet boom, Japan has limited domestic engineering supply. Yet the public strongly identifies with finance and gaming—offering great advantages for acquiring users in key verticals.

Additionally, Japan’s long-standing “agency” and “resale” culture means local partners are vital for market expansion—the best channel for trust. Furthermore, a generally open mindset warmly welcomes overseas projects and talent, creating a virtuous cycle.

10. Web3 Lab at Japanese Mainstream Company @Osaka: ¥100 Trillion Stimulus + Digital Yen

The Japanese government’s support wave for the blockchain industry is unprecedented, with a ¥100 trillion economic stimulus package, where crypto is a key focus.

The Prime Minister announced the establishment of a digital agency to advance digital transformation, with crypto as a top priority. The Liberal Democratic Party released a Web3 whitepaper outlining tax reforms, cross-sector deregulation, and all major Japanese corporations are actively investing in Web3 and establishing dedicated Web3 divisions.

Developers vs. Core Ecosystem

Public chains are another critical ecosystem player beyond developers. As a company providing infrastructure for over a dozen chains, Chainbase maintains frequent dialogue and multifaceted partnerships with these chains. Typically, public chains face the following challenges:

-

How to attract end users before drawing top-tier developers and high-level projects?

-

Most existing developers move freely between chains—how to attract more newcomers?

-

Despite recognizing the importance of Asia, especially Chinese-speaking developers, how to effectively reach them?

Facing these challenges, when advocating for Asian developers, our trump cards are:

-

Millions of Asian developers haven’t yet entered Web3! They need better educational tools.

-

Foundations can adopt more hands-on mentorship approaches to attract developers early. The key is proactively engaging developers (online, offline, or both).

-

BD and tech ambassadors alone aren’t enough. Foundations should partner with established local projects to provide fertile ground for early-stage developer growth.

While pondering these issues, Chainbase’s mission and values remain central. As a Web3 data infrastructure provider, our goal is to make on-chain data open, usable, and accessible, offering developer-friendly experiences for both Web2 and Web3.

In our view, Web3 represents a revolution in data sovereignty and open data platforms—in the future, developers will be both data producers and consumers. We aim to:

-

Demystify on-chain data by providing structured data services to developers.

-

Seamlessly integrate on-chain data into real development workflows through data platforms, boosting efficiency.

-

Cultivate the Web3 developer ecosystem through community events, knowledge sharing, and developer support.

Chainbase’s 12-Month Developer Community Roadmap

As a data infrastructure platform, Chainbase aims to remove barriers developers face, enabling them to create freely and focus on building.

We believe that with the right tools, Asia’s rich developer talent can build the next generation of world-class crypto applications. We’re committed to providing this infrastructure.

By empowering developers across Asia, Chainbase has made significant progress and achieved concrete wins for the developer community.

We have a 12-month plan to grow together with developers and communities. Chainbase sincerely invites developers to join us! What we’re currently building includes:

Progress and Achievements

-

Processed over 300 high-volume datasets and made them readily usable;

-

Achieved real-time data response, resolving data latency issues caused by blockchain reorganizations;

-

Provided complete historical raw data, abstracted data, and smart contract data for seamless data synchronization;

-

Launched Web3 API supporting all data from major EVM chains—with sub-second response times;

-

Introduced Webhook functionality for real-time data subscriptions and push notifications, enabling scalable enterprise-grade deployment;

-

Delivered 99.99% uptime subgraph hosting service, indexing speed over twice the industry average;

And much more to explore!

12-Month Plan – For Developers and Communities

-

Broaden our platform’s vision to become the hub for Asian developers;

-

Strengthen our three core value propositions: Openness, Speed, and Reliability;

-

Actively share standardized datasets we own, and resources provided by partners;

-

Gather top-tier developers, host vertical-specific hackathons and workshops, and maximize rewards for builder achievements

We envision an open, collaborative Web3 world where data flows freely between blockchains, decentralized applications, developers, and users.

Join us, and help drive the Web3 data revolution!

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News