Explaining 6 NFT Trading Strategies: How Do Whales Make Profits?

TechFlow Selected TechFlow Selected

Explaining 6 NFT Trading Strategies: How Do Whales Make Profits?

19 NFT trader addresses to watch.

Author: NFTGo Research

Newcomers to NFT investing often face risks—and even potential financial losses—due to a lack of domain knowledge and data analysis skills. However, following experienced NFT degens can lead to vastly different outcomes. GoAlerts offers a copy-trading-like experience in the NFT space, allowing users to track real-time activity and seize opportunities ahead of the curve.

According to NFTGo.io, 288 whales collectively hold NFTs worth 686.33K ETH, accounting for 7.44% of the total NFT market value of 9.22 million ETH. These whales typically hold large NFT positions, act as early market movers, and influence overall market sentiment.

After studying these profitable whales, we’ve distilled six key strategies they use to generate profits during bear markets. These include strategic bulk buying and dip accumulation, bottom-feeding undervalued NFTs, strategic selection and diversification, multi-platform exploration, batch minting, and prioritizing project characteristics. Based on this, we analyzed 19 trader addresses to identify actionable trading cases that may benefit users.

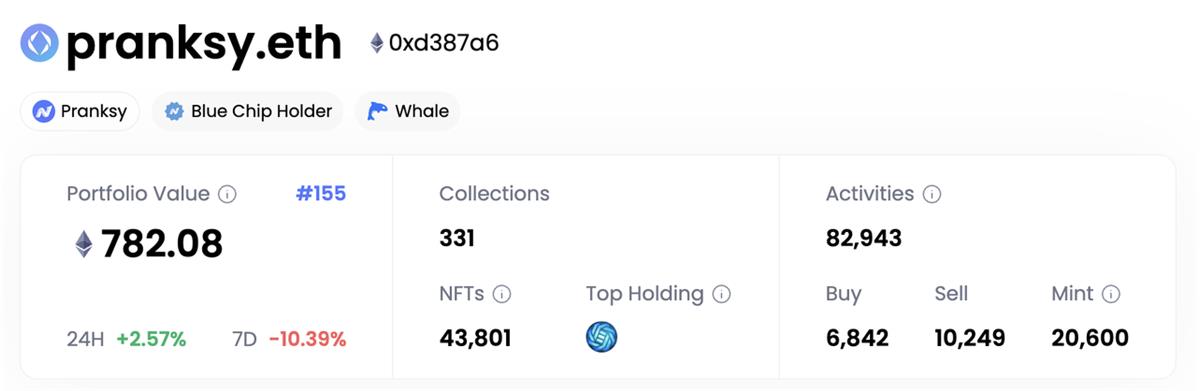

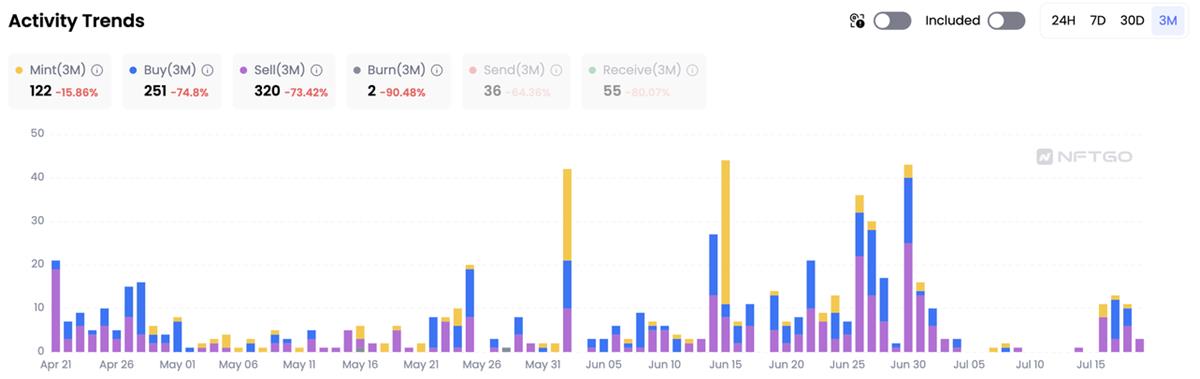

Pranksy.eth frequently mints NFTs in batches, ensuring portfolio diversification.

Over the past three months, pranksy.eth has minted approximately 1.1K NFTs, including 121 Ether Avatars, with the rest coming from lesser-known projects. His collection is highly diversified, comprising 331 unique collections, 90% of which are mid- and small-cap NFTs.

This approach helps reduce volatility risk from any single project while increasing the likelihood of holding high-value assets. Through these strategies, pranksy.eth has generated a total profit of 7.23K ETH while maintaining a balanced portfolio.

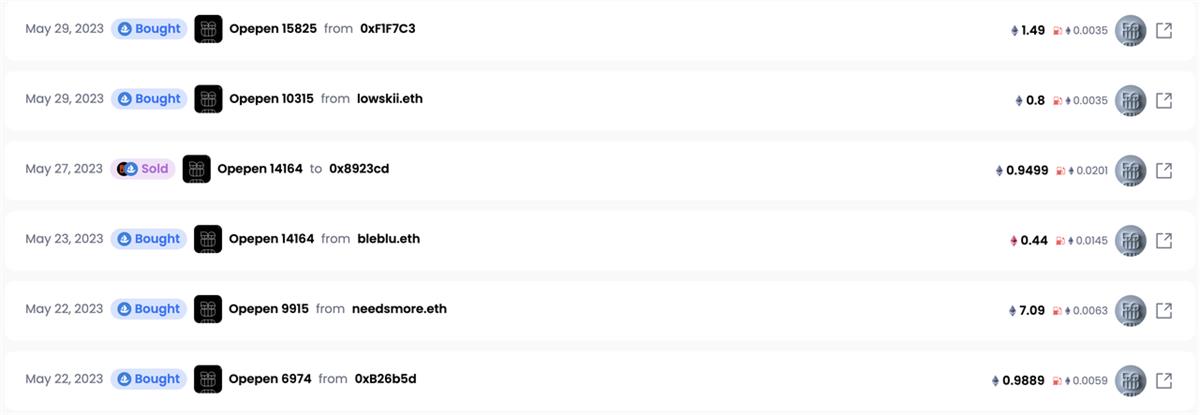

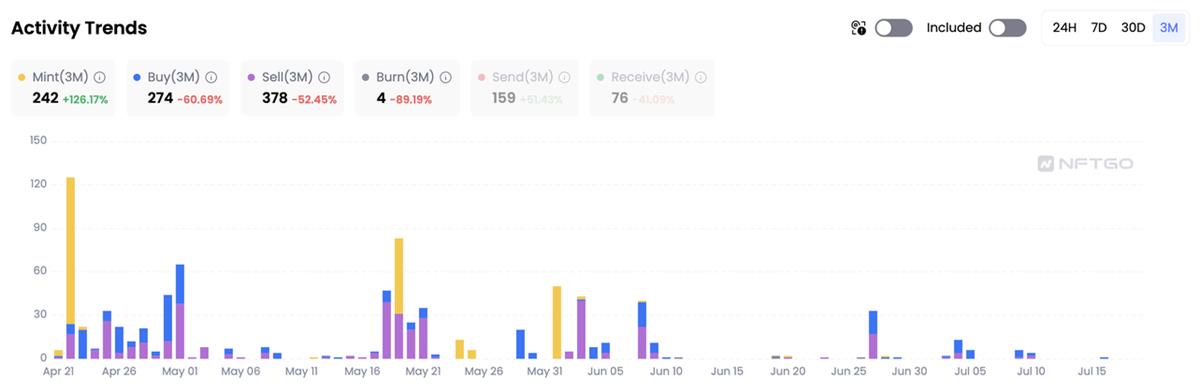

Chungster.eth demonstrates a sharp eye for identifying promising NFT projects, reflecting deep insight into the NFT market landscape. His trading behavior aligns with evolving trends, including popular collections such as Opepen, Ether Avatar, and Azuki Elementals.

Chungster.eth trades across multiple platforms, including Blur and OpenSea, and also employs niche tactics—such as using OpenSea Pro via Blur or LooksRare Aggregator via OpenSea. This multi-platform exploration expands his access to potential profit-generating opportunities.

Jklaub.eth adopts a calculated risk allocation strategy, focusing on batch trading and minting obscure NFT series.

When balancing profit and loss, he strategically sells some holdings while waiting for returns from other portfolio assets. For example, on July 2, he bought three Wooonen at 0.0185 ETH each, then sold two at 0.0155 ETH and one at 0.0222 ETH on July 3.

This method reflects both diversification and market sensitivity, helping him achieve a total profit of 474.53 ETH amid volatile NFT market conditions.

Drewaustin.eth has achieved up to 20x returns from various projects such as FLUF World.

Notably, he shows strong judgment on both well-known and emerging collections—for instance, starting in May, he invested timely in the Opepen series and has continued to profit from it.

As a savvy investor, drewaustin.eth understands the benefits of multi-platform trading and strategically selects promising yet under-the-radar projects.

Nyax.eth employs a fast-paced, volume-driven trading strategy, precisely targeting NFTs during price dips and quickly flipping them for small profits.

His trading patterns in series like OCB, Milady Maker, and Sproto Gremlin show deep familiarity with NFT traits and market values. For trending collections like BEANZ, he opts for bulk purchases to rapidly drive up prices and ensure quick turnover, demonstrating exceptional market navigation skills.

One of Nakiri.eth’s strategies involves consistently trading Otherdeed for Otherside. He turned a 6.9 ETH investment into a 5x return.

Additionally, Nakiri.eth flipped Milady Maker for a 3x profit, with an average cost of 3.13 ETH and an average sale price of 3.53 ETH.

Beyond holding blue-chip collections like Azuki, DeGods, and MAYC, Nakiri.eth capitalizes on short-term meme trends by batch-trading series such as Fatzuki.

Coodi.eth uses a high-frequency trading strategy focused on micro-series and batch transactions.

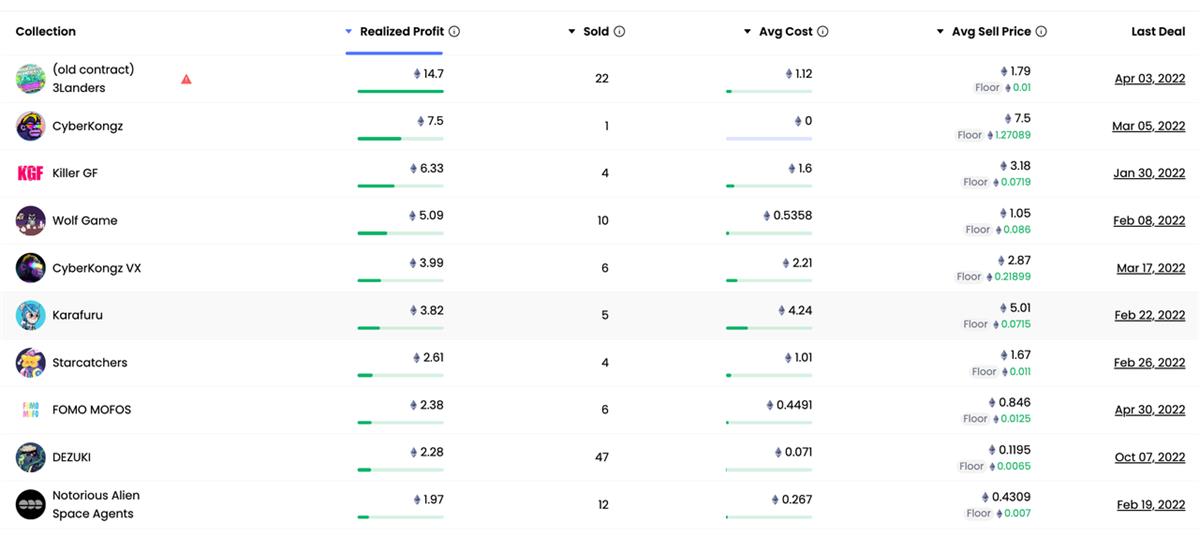

Although he typically targets lower-margin projects, he successfully flipped Killer GF, Wolf Game, and Karafuru, generating over 15 ETH in profit.

While Coodi.eth earned only 17.64 ETH, he exemplifies how small-budget traders can uncover significant opportunities.

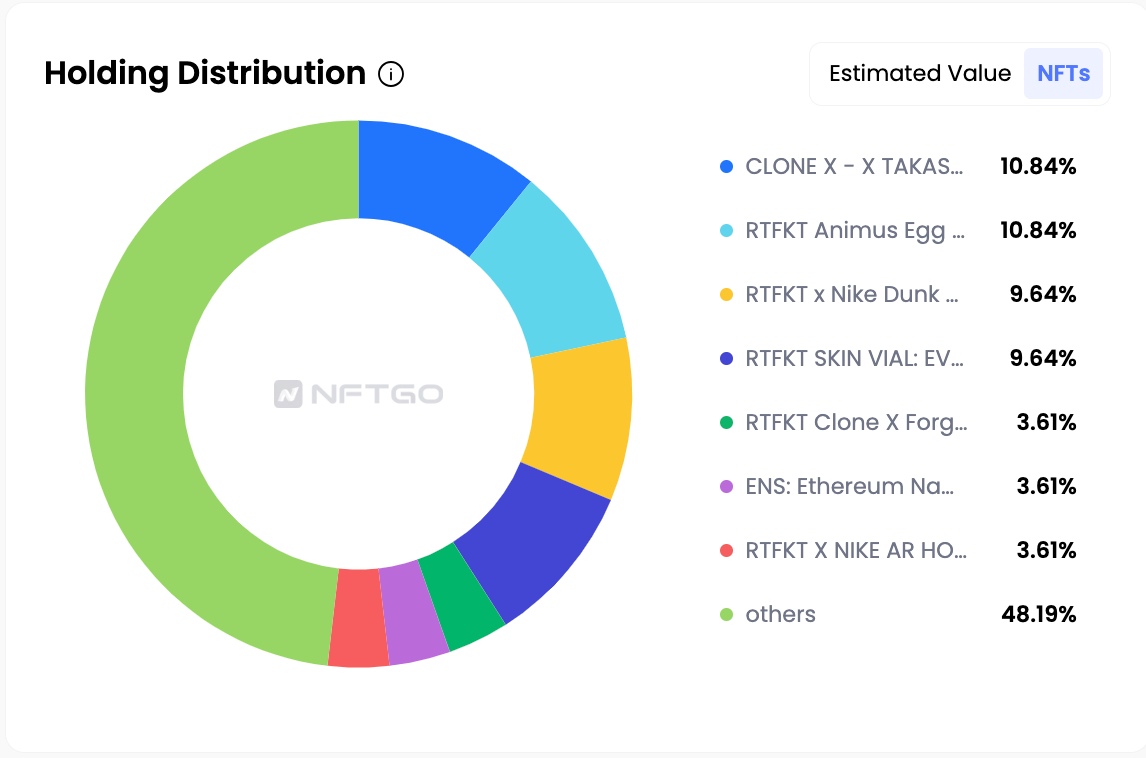

Samuelcardillo.eth is the CTO of RTFKT, and his Twitter handle is @CardilloSamuel.

Notably, nearly half of samuelcardillo.eth’s portfolio consists of RTFKT holdings. If you’re also an RTFKT holder, tracking this address allows you to stay updated on the latest developments and data changes within RTFKT, giving you deeper insights and more opportunities.

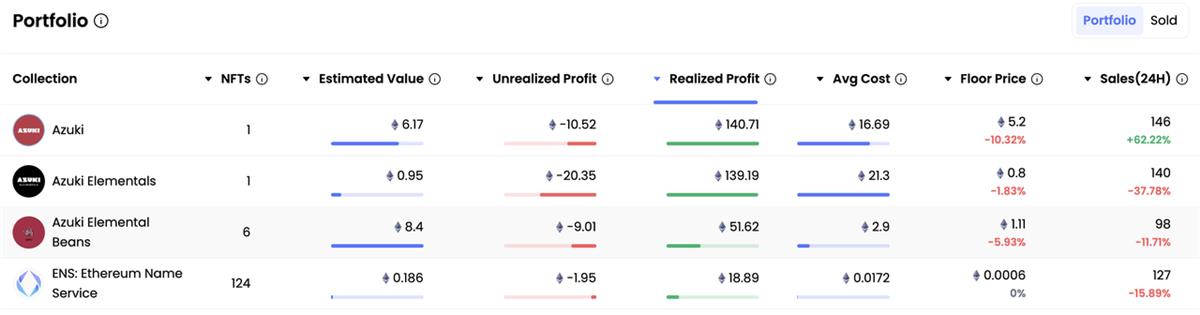

Died.eth buys well-known collections in bulk during price drops, holds through recovery, then sells in bulk for profit.

For example, with Azuki Elemental Beans, he bought in bulk around 1.3 ETH per unit on July 2 and sold around 1.65 ETH on July 9.

With Otherdeed for Otherside, he made a profit of 295.51 ETH, purchasing at an average cost of 35.4 ETH and selling at 50.95 ETH.

In addition, died.eth trades across multiple platforms, including LooksRare, OpenSea, and Blur.

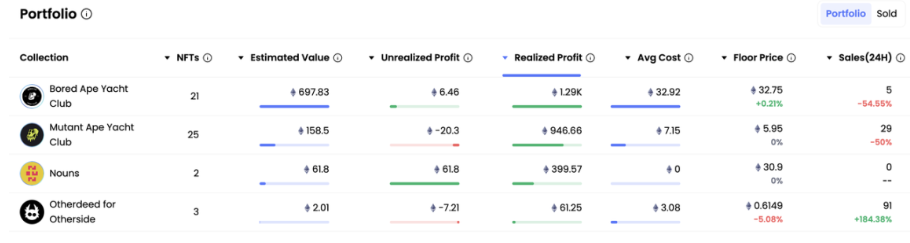

This trader skillfully applies strategies such as bulk buying, bottom-feeding, and diversification.

He purchases similar NFTs in bulk—for example, acquiring 8 DeGods, 6 Azukis, and 8 MAYCs simultaneously.

During dips, he bought Fatzuki NFTs at 0.2 ETH and quickly flipped them at 0.3 ETH.

Although his portfolio includes only four main projects, his trading activities span over ten collections, primarily BAYC, MAYC, Azuki, and Azuki Elementals, but also including mid-tier projects like Moonbirds, Milady, and Captainz.

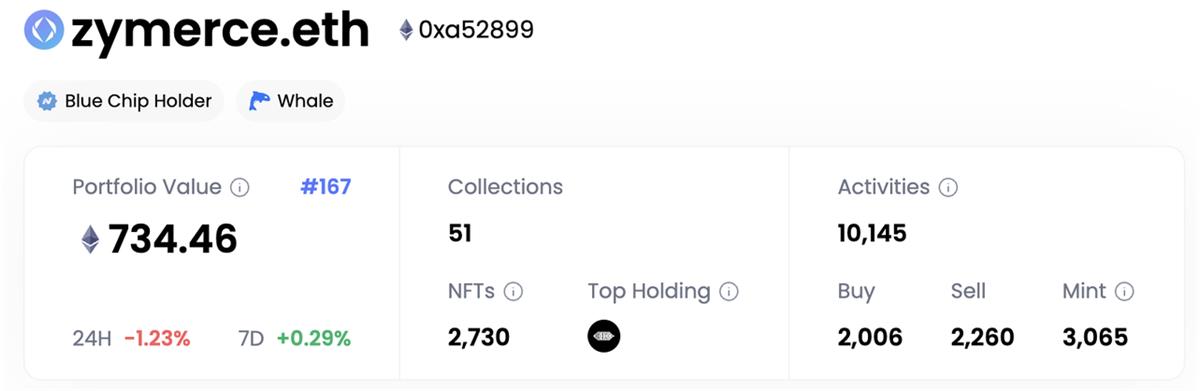

Zymerce.eth follows a long-term holding strategy, accumulating NFTs heavily during downturns and retaining them within a diversified collection.

Currently, he owns 2,730 NFTs from 51 different collections. Recently, he purchased 15 Ether Avatars and 75 Ether Capsules.

Moreover, this address appears deeply involved in the LOTM game, evident from his extensive minting of Otherdeed Expanded and Otherside Vessels—he holds 757 Otherdeed Expanded and 729 Otherside Vessels.

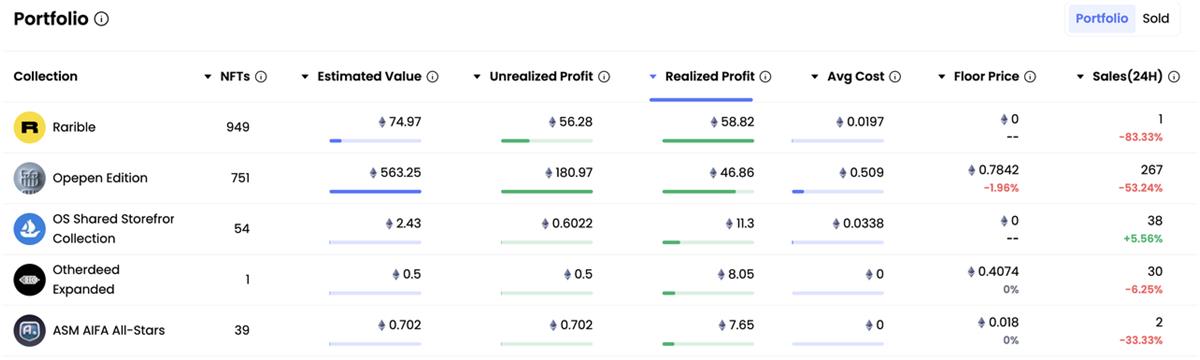

Bored.eth's strategy involves closely following trends and uncovering the potential of various NFT projects.

The Opepen Edition serves as an example—this investor has been consistently buying for two months, accumulating a large position of 751 Opepens, resulting in a 3x return.

His trades span numerous NFT projects, including Metropolis World Passport Official, Sappy Seal, and Nifty Portal, indicating a diversified investment approach aimed at discovering hidden gems in the NFT space.

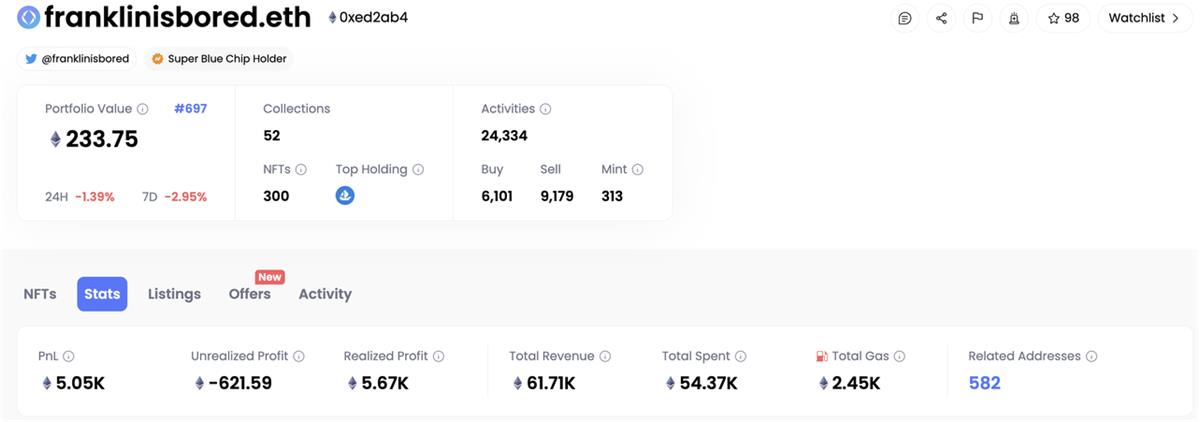

@franklinisbored is known for flipping NFTs, primarily trading BAYC and other Yuga Labs series. Therefore, holders of Yuga Labs collections can benefit from monitoring his activity to better understand timing and dumping trends.

He has generated over 1K ETH in profit from three collections: BAYC (2.55K ETH), Wrapped Cryptopunks (1.78K ETH), and Otherdeed for Otherside (1.08K ETH).

We also observe that most of his transactions occur via Blur Blend.

Interestingly, franklinisbored is currently buying heavily while selling very little.

The trader behind @machibigbrother is also renowned for flipping NFTs, focusing primarily on BAYC, MAYC, Azuki, Azuki Elementals, Ether, and DeGods.

Most of this address’s NFTs are traded on Blur Blend, and it ranked in the top five of Blur Season 2 leaderboards.

Publicimage.eth primarily focuses on prominent collections such as CryptoPunks, BAYC, and V1 Punks.

Additionally, he excels at capitalizing on market downturns. He also uses multiple trading addresses, frequently transferring NFTs to 0xbbaec56b725a0b9501a655d7d1b48555af637b70, while the original address holds no NFTs.

Using multiple addresses suggests a sophisticated strategy, potentially optimizing transaction execution, asset management, privacy, and security.

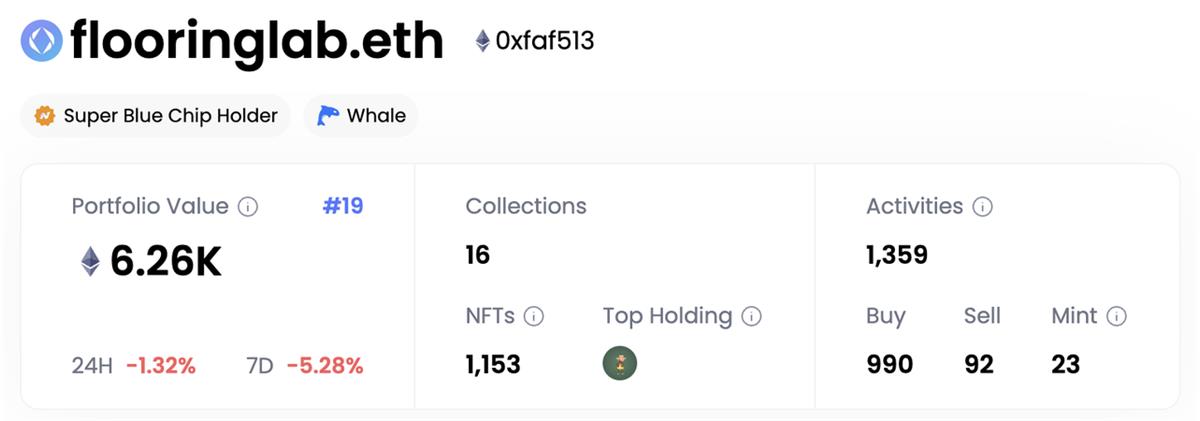

Flooringlab.eth is a major whale and active participant in the NFT market, with a portfolio including 197 Azuki Elementals, 166 Azukis, 89 BAYCs, 82 MAYCs, and 35 Pudgy Penguins.

Over the past three months, this investor acquired 990 NFTs from well-known collections such as Dinks, Azuki Elementals, Azuki, BAYC, and MAYC, while selling only 92 NFTs.

Even during the bear market, he continues to accumulate, indicating a long-term growth investment strategy.

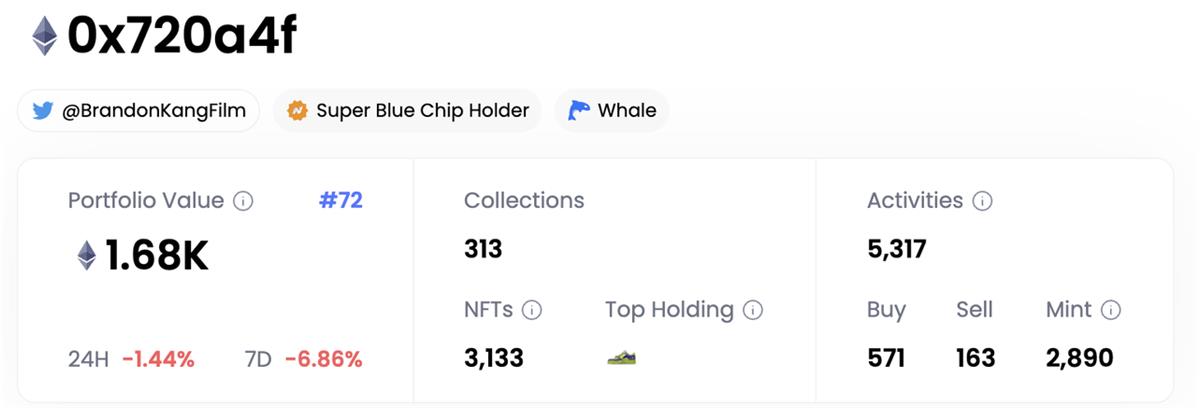

The whale known as @BrandonKangFilm holds 92 Otherside Vessels, 92 Otherdeed Expanded, 41 MAYCs, and 31 BAYCs.

Recently, he sold 17 BAYCs for over 200 ETH, with the highest-priced BAYC #2342 fetching 888 ETH.

The address associated with @dingalingts is famous for having “diamond hands” in Azuki. He owns 121 Azukis, 245 Azuki Elementals, and 34 BEANZ.

Recently, this investor has shifted focus toward exploring emerging NFT projects. Over the past three months, he has minted 870 NFTs.

From these successful traders, common strategies emerge: bulk buying during price drops, strategic selling, multi-platform operations, targeted NFT minting, and holding assets throughout bear markets. If whales can spot opportunities early, GoAlerts empowers both new and experienced investors to track their real-time activity, anticipate market trends, increase the chances of discovering potential opportunities early, and ultimately maximize gains while minimizing risks in the volatile NFT market.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News