Velodrome V2: Becoming DeFi's Most Capital-Efficient Liquidity Hub

TechFlow Selected TechFlow Selected

Velodrome V2: Becoming DeFi's Most Capital-Efficient Liquidity Hub

Velodrome wants to attract projects to the L2 and become the ultimate marketplace for liquidity on the Superchain.

Author: Velodrome

Translation: TechFlow

TLDR

-

Velodrome has launched V2 to solidify its position as DeFi’s most capital-efficient liquidity hub, laying the foundation for concentrated liquidity pools (clAMM) and automated voting management (Relay).

-

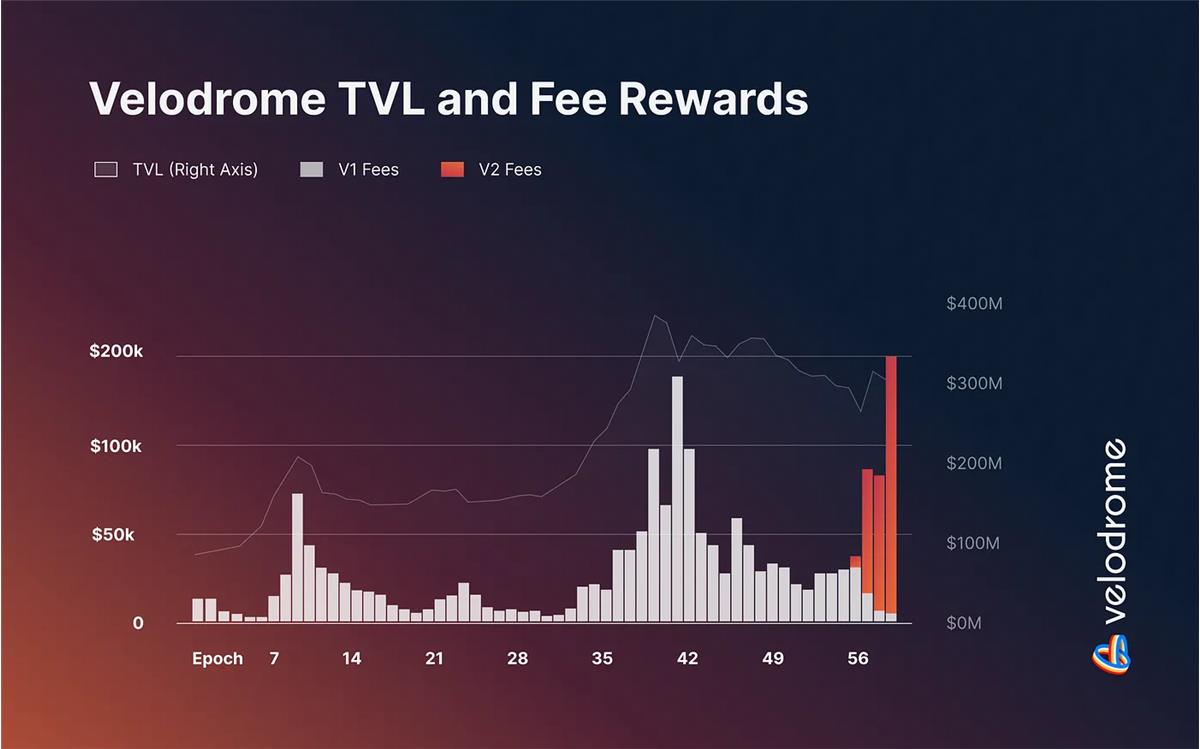

Velodrome V2 has already set new records, generating more weekly fees in its third cycle than ever before—nearly six times faster than V1.

-

The implementation of clAMM on Velodrome will improve trade execution and reduce slippage, bringing benefits such as increased fee rewards for veVELO voters, low-cost liquidity for partner protocols, and greater diversity across LP pools.

-

Velodrome’s governance system grants veVELO voters full control over emissions. Relay will further enhance user experience and system efficiency through automated voting, strengthening the governance foundation.

-

Velodrome is committed to advancing the Optimism ecosystem and Superchain vision by building a leading, efficient, and user-centric platform on Ethereum L2.

Introduction

The launch of V2 marks the beginning of Velodrome’s accelerated development phase. As a full-stack protocol redesign, V2 lays the groundwork for powerful new features, including customizable fees, concentrated liquidity pools (clAMM), and automated voting management (Relay). These enhancements will solidify Velodrome’s role as DeFi’s most capital-efficient liquidity hub, support a growing number of tokens and protocols, and drive the expansion of the Optimism Superchain. The impact of V2 is already evident through significantly increased rewards for veVELO voters and a seamless user experience on the Nightride UI.

Powering Digital Products

Despite recent challenges in the crypto industry, the potential of digital goods and decentralized applications remains immense. The DeFi landscape continues to evolve, with an expanding ecosystem of services, low-cost and fast transactions on Layer 2 networks, and increasingly intuitive user interfaces. As the online economy grows, use cases for cryptocurrency and decentralized, transparent financial services will multiply.

Velodrome aims to simplify the process of attracting liquidity for an increasingly diverse range of digital goods, offering a user-friendly interface and flexible incentive mechanisms that allow teams to retain control over their incentives.

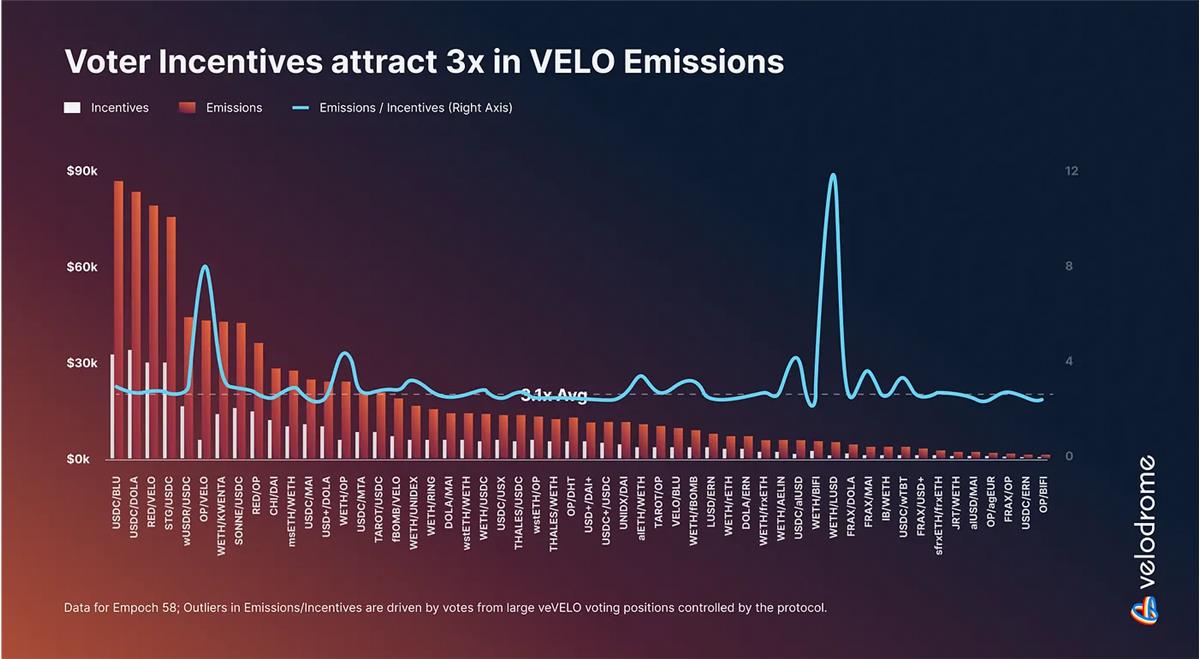

Velodrome distributes VELO to liquidity pools based on veVELO votes received each epoch. Projects can attract votes to their pools by depositing incentives in any token. Partner protocols gain access to Velodrome’s growing community, while their token holders find reliable, user-friendly opportunities to provide liquidity.

V2 emissions amount to approximately 1.5% of total supply. Compared to V1, this represents a 20% increase over four years, designed to drive a new wave of growth ahead of the clAMM launch and integration into the Superchain.

This scalability enables Velodrome to serve a growing number of projects. Liquid staking protocols, stablecoins, lending platforms, yield aggregators, gaming projects, and even other decentralized exchanges are leveraging this flywheel to build liquidity across more than 120 unique trading pairs, accumulating rewards for veVELO voters.

Scaling Through Capital Efficiency

The implementation of concentrated liquidity pools (clAMM) will represent another major leap forward for Velodrome’s economic engine. By focusing VELO emissions on liquidity provider (LP) positions within the active price range of trading pairs, clAMM will significantly improve trade execution, enabling Velodrome to capture more volume with the same total value locked (TVL) and effectively providing protocols with a powerful precision tool for liquidity bootstrapping. This enhanced capital efficiency will benefit all aspects of the flywheel.

Partner Protocols

-

Enhanced Liquidity and Reduced Slippage: Velodrome will concentrate more emissions within tighter price ranges, incentivizing liquidity providers (LPs) to maintain active positions and thereby supporting better trade execution. This allows protocols to offer low-slippage trading and expand incentives across more liquidity pools.

-

Self-Sustaining Liquidity Pools: Lower slippage will attract more trading volume and fees. Fee-generating pools can become self-sustaining, reducing the need for partner protocols to provide additional incentives. This not only improves pool efficiency but also lowers costs for partner protocols, enhancing overall operational sustainability.

Liquidity Providers

-

Consistent Rewards: A time-based mining approach will provide liquidity providers with more stable rewards. Unlike other clAMM implementations where LPs rely on market conditions to generate fees, Velodrome will allow LPs to continuously earn rewards for providing liquidity within their chosen range.

-

Flexible Reward Accumulation: During market volatility, liquidity providers can choose to unstake and accumulate transaction fees earned by their liquidity. This approach ensures liquidity pools remain liquid during volatile periods and compensates LPs for higher risk. Fees accumulate with every trade, allowing LPs to maximize short-term gains. A higher baseline of activity will appropriately reward both veVELO voters and liquidity providers.

veVELO Voters

-

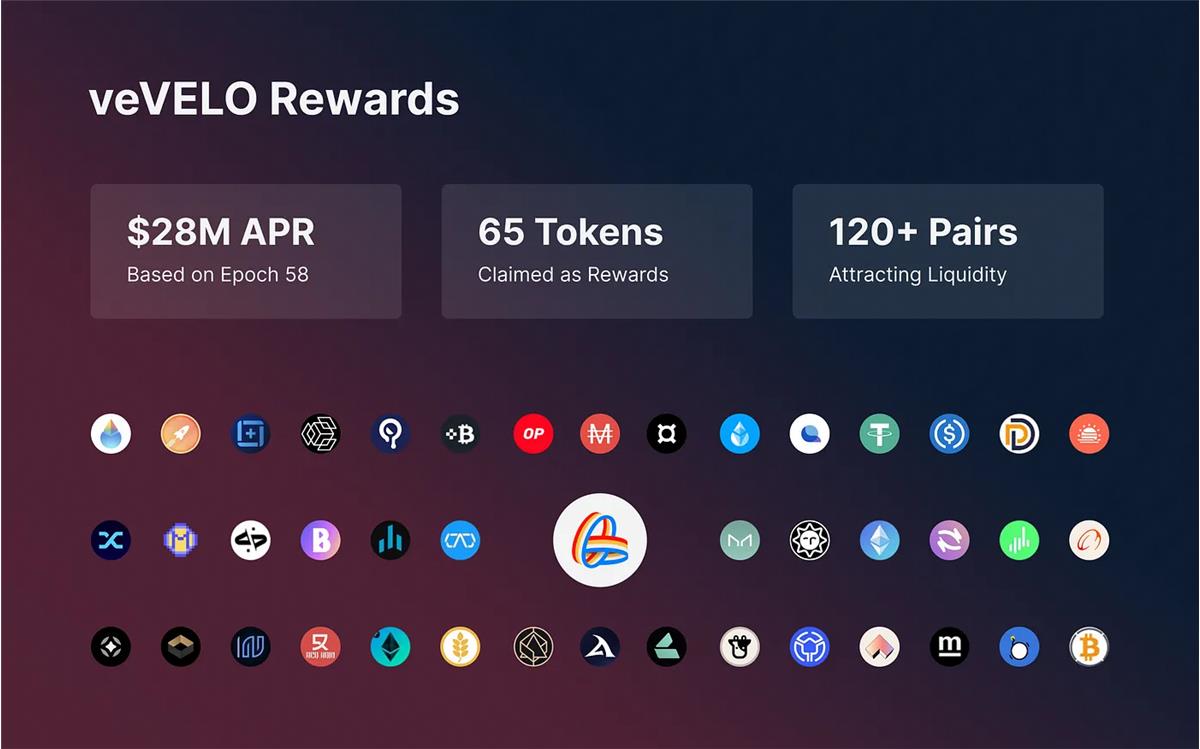

Increased Fee Rewards: clAMM liquidity pools will dramatically boost trading volume through improved execution. Combined with dynamic fees adjustable according to market conditions, clAMM will significantly increase rewards for veVELO voters, incentivizing them to vote for the most productive pools.

-

Growing Reward Streams: Increased protocol utility will help attract more projects, resulting in higher incentives for voters. More projects using Velodrome will diversify voter rewards and enhance the appeal of locking veVELO.

Strengthening the Foundation

Velodrome’s veVELO governance system may be one of the most innovative and comprehensive in DeFi. With over 14,000 participants, veVELO voters control 100% of the protocol’s emissions and receive 100% of fees and voting incentives, establishing fully aligned incentives.

With V2, Velodrome will enhance user experience, strengthen governance processes, and give veVELO voters greater control over protocol mechanics through Relay. Relay is an automated veVELO manager that allows veVELO voters to delegate their NFTs for optimal voting. Users can choose to automatically allocate voting power or maintain active voting in specific liquidity pools while accumulating rewards.

Velodrome is also committed to actively participating in Optimism’s governance and collaborating with the Optimism Foundation. Currently, Velodrome has proposed developing govNFTs—a new token standard designed to streamline the management of vested OP tokens. Future projects could leverage govNFTs to distribute vested OP grants, ensuring recipients’ incentives remain aligned with the broader ecosystem. And like veVELO, govNFTs could eventually enable new governance functions, such as granting additional voting power to OP lockers.

Velodrome V2 exemplifies the protocol’s resilience and long-term commitment to building an efficient, user-centric platform—one designed to attract projects to L2 and become the ultimate marketplace for liquidity on the Superchain.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News