Zunami Protocol: The first decentralized cross-chain Stablecoin yield aggregator

TechFlow Selected TechFlow Selected

Zunami Protocol: The first decentralized cross-chain Stablecoin yield aggregator

During its development, Zunami has sought to bridge the gap between traditional finance and DeFi, aiming to create more beneficial solutions for stablecoin holders.

Overview

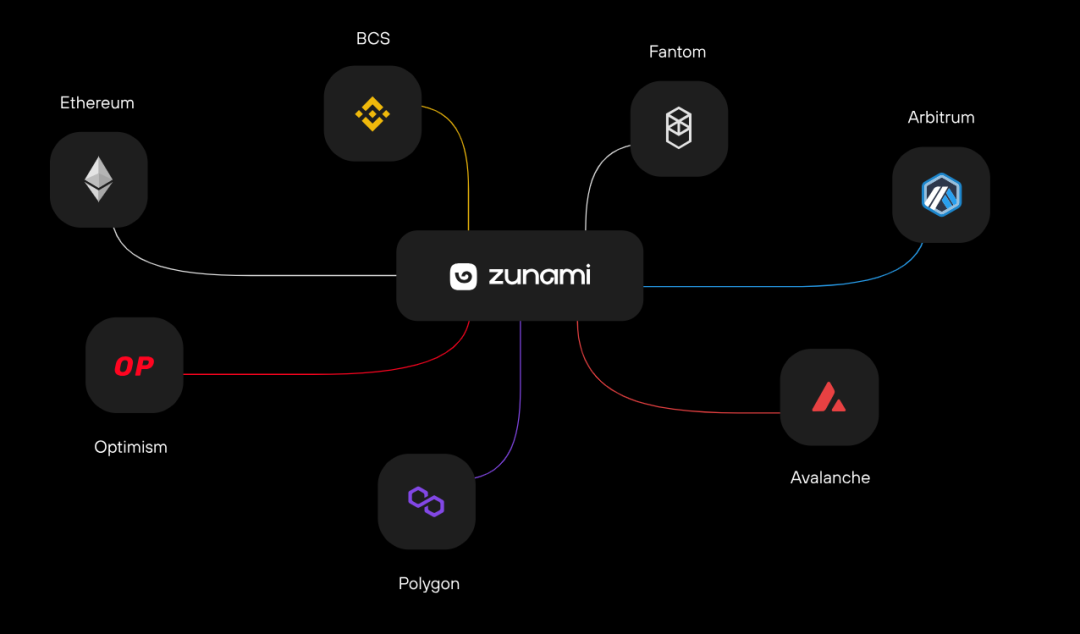

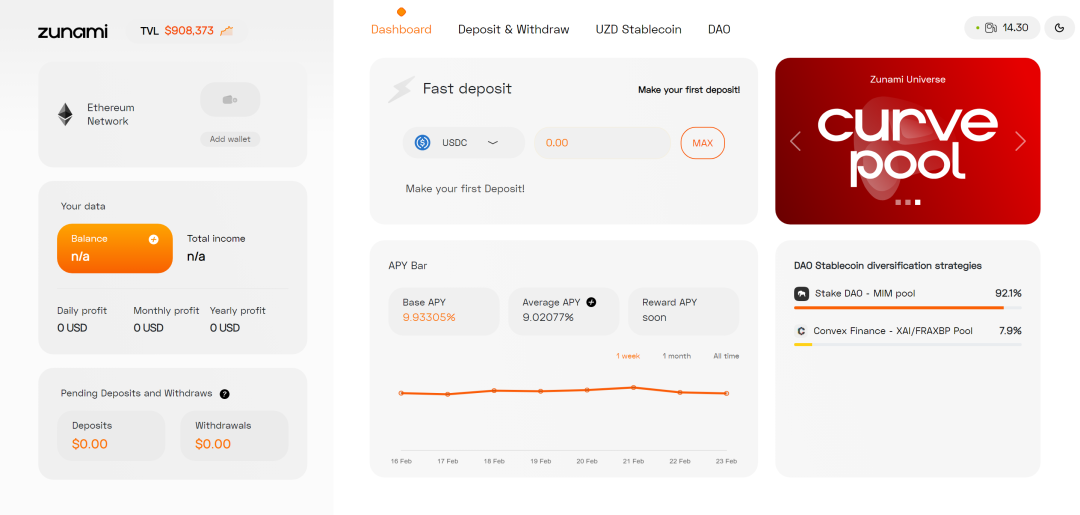

The Zunami Protocol is a DAO collaborating with stablecoins that addresses key issues in current yield protocols by simplifying interactions with DeFi—making them easier, cheaper, and more profitable through fund differentiation and rebalancing. With automated revenue mechanisms, transaction batching, and automatic compounding, it lowers entry barriers and reduces gas costs. The Zunami Protocol currently operates on the Ethereum blockchain and also supports BSC and Polygon. Zunami plans to support Avalanche and other popular alternative chains in the future.

Origins

Traditional banking can be a frustrating and inefficient process. Interacting with money should be simple and self-sovereign, granting everyone access to financial freedom. With the rise of stablecoins and DeFi, the financial landscape is rapidly evolving. While liquidity mining is growing in popularity, it remains far from widespread adoption. The Zunami team identified pain points in existing solutions that hinder both new users and experienced participants in the crypto space. Their goal is to bridge the gap between traditional finance and DeFi, creating the ultimate solution for stablecoin holders through the Zunami Protocol.

Applications

Key problems with existing liquidity mining interfaces:

-

Current DeFi interfaces are designed for professionals and are not beginner-friendly.

-

There are numerous functional pools to navigate.

-

Users must interact sequentially with multiple applications to complete operations.

To address these challenges, Zunami designed a smooth and user-friendly UI solution: a single-pool system and a new interface that simplifies interaction with DeFi apps by executing all operations in one step.

Yield Aggregator

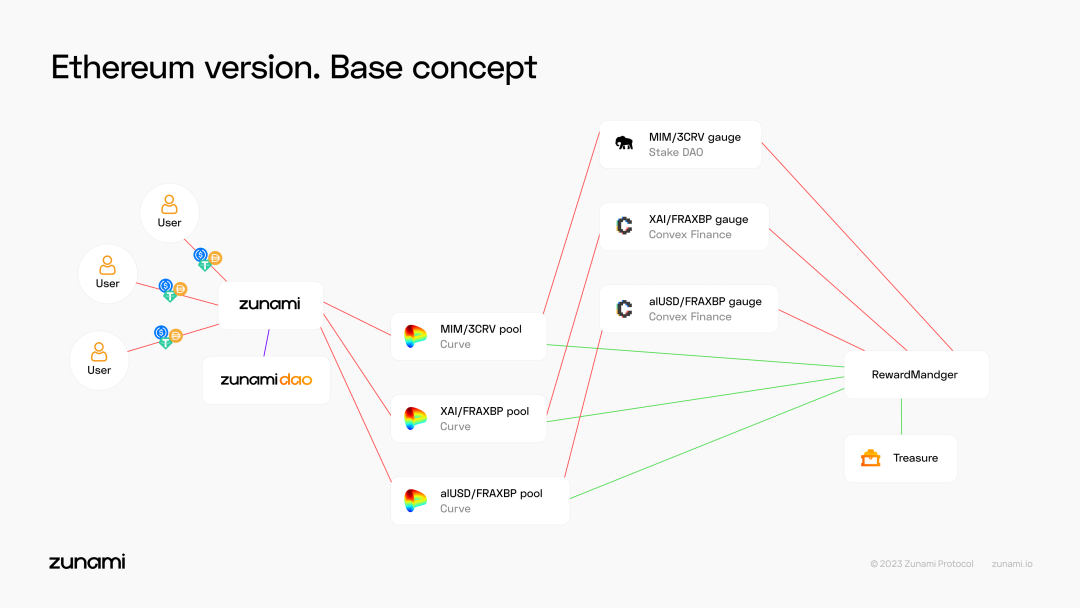

Zunami's global pool allows users to deposit stablecoins (DAI, USDC, and USDT) either directly or via an optimized method, receiving ZLP (Zunami LP tokens) proportional to their investment and earnings within the protocol. Zunami then allocates these stablecoins across a series of strategies—typically 2–3 active at any time—that deposit them as liquidity providers (LPs) into Curve pools, earning Curve LP tokens, which are subsequently staked in reward contracts (Gauges) on Convex or StakeDAO. Direct deposits or withdrawals can be executed immediately but require users to pay high gas fees. Alternatively, optimized deposits or withdrawals allow users to save on gas by delegating their transactions to the protocol, which aggregates and executes them once per day.

Protocol operators periodically invoke Zunami’s auto-compounding mechanism, which collects earned rewards from all strategy contracts and sends them to the reward management contract. A portion of these rewards is sold, and the profits are reinvested into Curve pools and corresponding reward contracts, increasing the value of users’ ZLP tokens and delivering full compounding benefits. Meanwhile, a second portion of rewards—including performance fees and rewards earned by UZD stored in Curve pools—is directed to the treasury. To enable decentralized governance, Zunami DAO oversees all major decisions, including adding new strategies, rebalancing funds, and setting management fees.

The Zunami Protocol leverages a decentralized income aggregator to select the most profitable stablecoin pools and optimally balance funds among them, eliminating the need for continuous market research and manual transfers.

The community and Zunami team continuously analyze the risk/reward ratio of stablecoin positions and use DAO voting to determine strategic allocations and asset rebalancing, ensuring users achieve the highest possible returns while spreading capital across trusted pools and dApps.

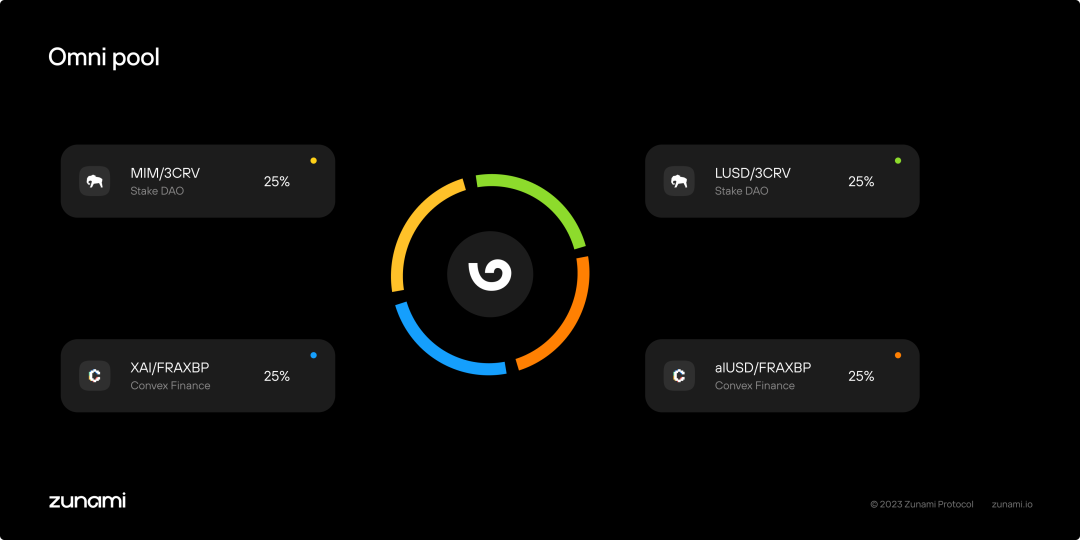

Omni Pool

Zunami offers the Omni Pool—a decentralized position where users can deposit USDT, USDC, and DAI. These funds are then allocated across multiple strategies, with 2 to 10 strategies active at any given time. Strategy selection and rebalancing are determined by DAO votes.

The DAO’s role is to identify new strategies, submit them for voting, and ensure timely rebalancing and diversification of funds. Regardless of which strategies receive funding, every depositor in Zunami receives ZLP tokens proportional to their contribution to the protocol. All profits generated by the Zunami Protocol are distributed to ZLP holders, except for a performance fee, which is allocated to the treasury.

Transaction Batching Mechanism

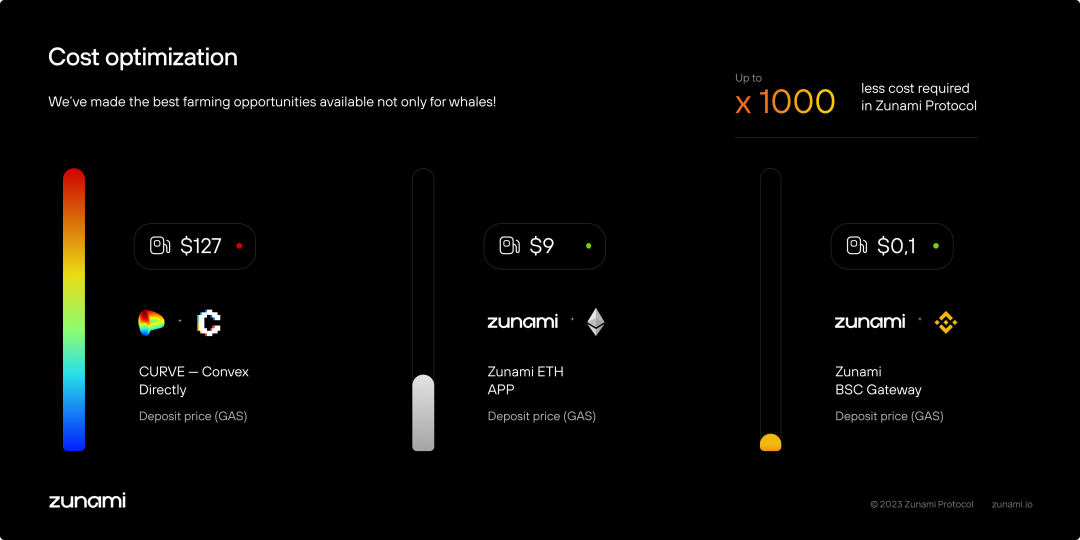

High transaction fees on the Ethereum network remain a significant barrier to DeFi progress and scalability. To address this, the Zunami Protocol team developed a Transaction Batching Mechanism (TBM) to optimize costs.

This multi-layer smart contract system allows users to deposit funds into an initial contract using the delegateDeposit() function. Then, once daily, the completeDeposit() function automatically distributes user funds to strategies without incurring additional fees.

This reduces costs by up to 10x compared to directly using Curve and Convex. Users can opt into delegated deposits and withdrawals with a single checkbox in the app. Users on alternative networks can access Zunami via gateways on BSC and Polygon, interacting with smart contracts for less than $1 in fees.

Strategies and Auto-Compounding

The DeFi ecosystem is becoming increasingly complex. To maximize yields, users typically need to deposit funds into Curve to obtain LP tokens, then stake those in StakeDAO or Convex. Zunami Protocol simplifies this by creating multiple strategies and automating the entire process in a single transaction, greatly enhancing user convenience.

In StakeDAO or Convex, users earn token rewards, but for small depositors, selling these rewards may not be worthwhile due to high commission costs or insufficient time. Zunami handles the sale of these rewards on behalf of users, enabling them to fully benefit from compounding.

DAO

Zunami values user and community input in protocol development, which is why it launched a DAO voting system allowing early project participants to influence its direction. By depositing funds into Zunami, users receive ZLP tokens proportional to their contributions. These tokens grant voting rights in the Zunami DAO, where all major decisions—such as selecting and adding new strategies and rebalancing funds—are made. Holders of GZLP (Zunami BSC gateway users) also have voting rights. Before proposals go to vote, they are discussed in the Discord community, giving everyone a chance to voice their opinions.

Treasury

Zunami Protocol has established a treasury system to accumulate funds for covering potential losses in emergencies and supporting protocol development and expansion.

Treasury funding sources include:

-

A 15% performance fee taken from the earnings of depositors using auto-compounding.

-

A 15% performance fee taken from the earnings of APS depositors using auto-compounding.

-

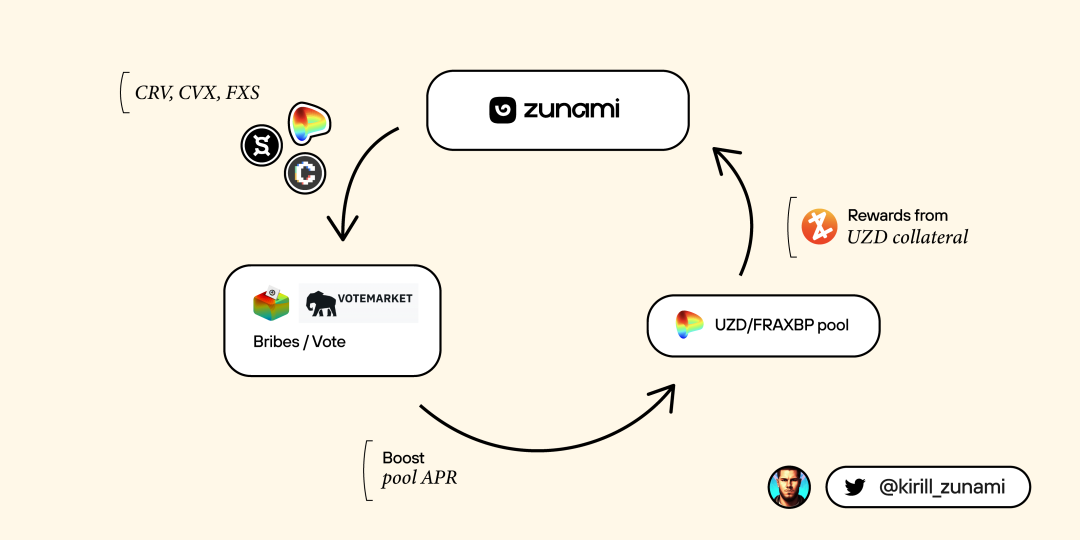

Additional tokens (CRV, CVX, FXS) accumulated from the rebase halt of UZD stablecoins stored in the FRAXBP pool on Curve.

DAO tokens are locked and used to enhance the profitability of the UZDFRAXBP pool. Stablecoin-generated revenue enables Zunami to maintain market leadership, mitigate risks during volatile periods, and provide funding for development and operational expenses. Overall, the treasury aims to reduce risk, fund growth, and cover operating costs to ensure the long-term sustainability of the Zunami Protocol.

Tokenomics

UZD is collateralized by stablecoins held in Curve pools, generating yield. UZD is also a rebase-enabled token whose value increases proportionally with the APY of the Zunami Protocol. It is overcollateralized by stablecoins allocated in Curve Finance pools and minted using ZLP. UZD does not depeg because it can always be redeemed for USDT, USDC, or DAI. Users can obtain UZD by minting it through the Zunami interface or swapping for it on Curve.

Within the Curve pool, UZD’s rebase functionality is disabled, and rewards in CRV, CVX, and FXS are directed to Zunami’s treasury rather than being sold to increase UZD supply. The UZD economy is designed so that generated rewards are sufficient to pay for the next round of bribes and sustain pool incentives, creating a self-sustaining cycle where bribes essentially pay for themselves.

Summary

The Zunami Protocol is a platform for allocating stablecoins, built on the core idea of creating a simple, highly profitable, and absolutely secure alternative to bank deposits. At the same time, Zunami eliminates the challenges of self-managing assets, making it easier for users to focus on growing wealth within the decentralized finance ecosystem. Throughout its development, Zunami strives to bridge the gap between traditional finance and DeFi, aiming to deliver more rewarding solutions for stablecoin holders.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News