Bankless: 5 ETH Staking Opportunities to Watch

TechFlow Selected TechFlow Selected

Bankless: 5 ETH Staking Opportunities to Watch

This article will introduce five staking protocols most suitable for beginners.

By: William Peaster

Compiled by: TechFlow

As the Ethereum ecosystem continues to grow and expand, more and more people are considering staking their ETH assets to earn returns. However, for many unfamiliar with ETH staking, becoming an ETH validator remains overly complex.

Now, liquid staking derivatives (LSDs) offer beginners a simple way to stake ETH—simply by buying an LSD token. This article introduces five of the most beginner-friendly liquid staking protocols, offering varying return potentials and diversified options to suit different preferences and risk tolerances.

An ETH liquid staking token is an ERC-20 token representing a claim on staked ETH. The idea is that you purchase or mint such a token, your underlying ETH gets pooled into staking pools, and then you simply hold your LSD, accumulating staking rewards over time.

The key point here is that these tokens provide a simple "buy-and-hold" approach to ETH staking. You don't need to run your own hardware or maintain individual staking infrastructure over time—you can simply sell your LSD holdings when ready to withdraw your stake.

So where should you start? The good news is that Ethereum’s liquid staking narrative is more vibrant than ever, giving you multiple options, each offering different yields. Below, let’s focus on five of the most beginner-friendly liquid staking opportunities!

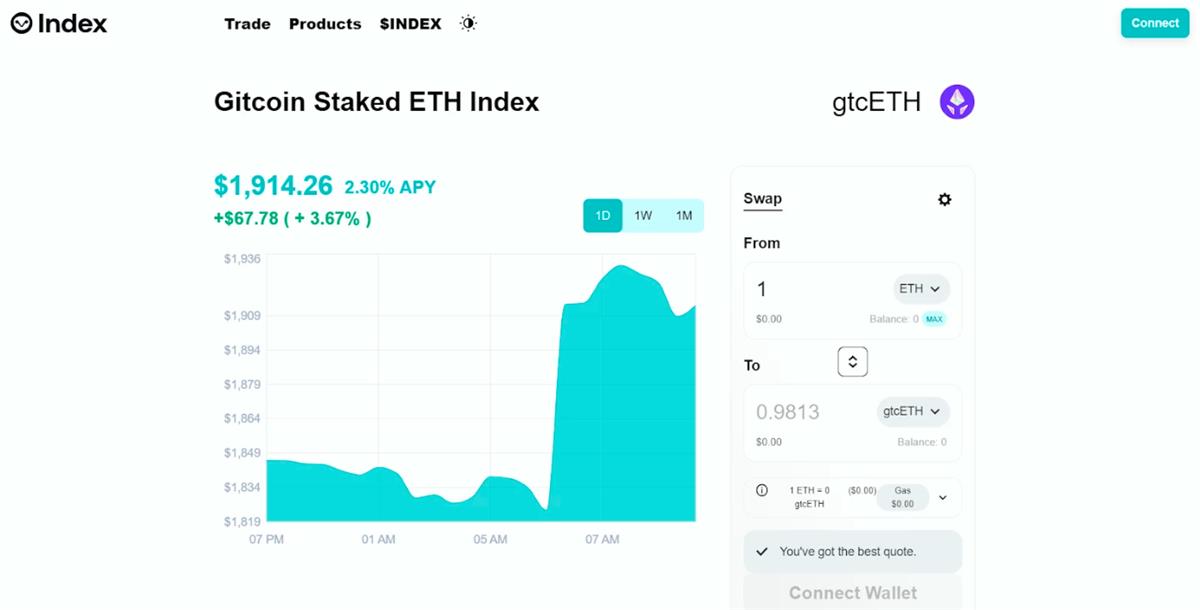

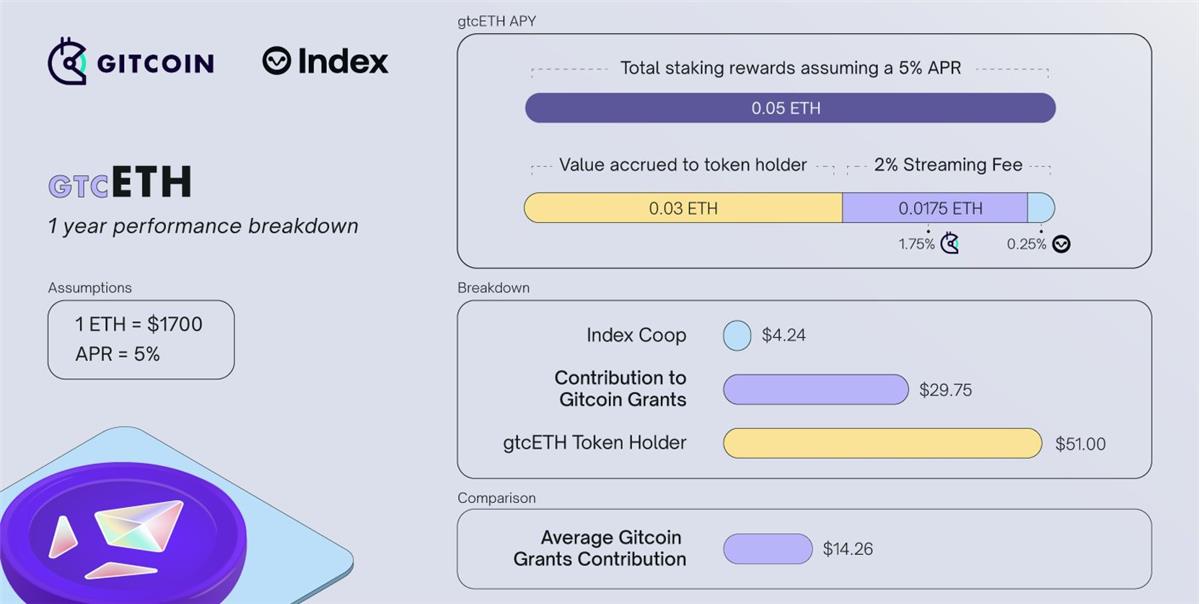

1. Gitcoin Staked ETH Index

Current estimated annual yield: 2.3%

The Gitcoin Staked ETH Index (gtcETH) is an index token composed of Ethereum liquid staking tokens, designed to support public goods funding on Ethereum.

Built using Index Protocol, gtcETH leverages the same infrastructure as other Index Coop products. The token is currently composed of 44.1% rETH (Rocket Pool), 29.9% Wrapped stETH (Lido), and 26% sETH2 (StakeWise). It generates revenue through a 2% annual fee, most of which flows to Gitcoin, providing a steady funding source for public goods as a “regenerative” supplement to Gitcoin Grants.

While gtcETH’s yield is not as high as some other liquid staking projects currently offer, it allows users to simultaneously fund Ethereum public goods, earn staking returns, promote decentralization across LSD protocols, and gain diversified exposure to these tokens through a single, simple index.

Currently, 1 ETH exchanges for 0.9813 gtcETH. Note that gtcETH is not a rebase token; staking rewards are designed to be reflected in its gradually increasing price over time.

2. Diversified Staked ETH Index

Current estimated annual yield: 4.3%

Like gtcETH, the Diversified Staked ETH Index (dsETH) is also an index token powered by Index Protocol, tracking Ethereum liquid staking tokens. The difference is that dsETH drops the public goods funding component, thus offering higher returns to holders—currently yielding about 2% more annually than gtcETH.

Currently, dsETH tracks rETH, wstETH, and sETH2, and may include other tokens if new LSDs meet the index criteria. As such, dsETH promotes decentralization and offers holders reduced price volatility compared to holding individual liquid staking tokens. Note that dsETH is also not a rebase token; staking rewards are reflected through gradual price appreciation over time.

Currently, 1 ETH can purchase 0.9787 dsETH.

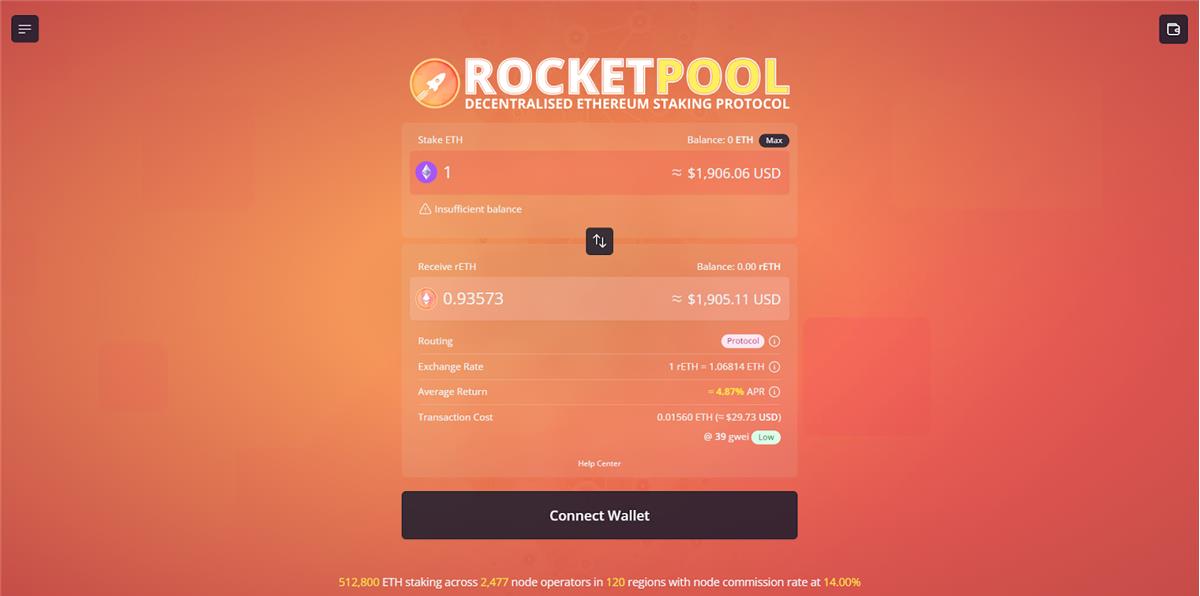

3. Rocket Pool: rETH

Current estimated annual yield: 4.87%

Among the many Ethereum liquid staking protocols, Rocket Pool stands out as one of the most reliable and decentralized.

As a rising player in the Ethereum staking space, Rocket Pool’s current 4.87% annual rate also makes it one of the highest-yielding ETH staking protocols available today.

Driving this return is rETH, the project’s tokenized representation of staked ETH, which increases in value over time by earning staking rewards.

Currently, 1 ETH yields 0.9357 rETH, though this exchange rate fluctuates as the Rocket Pool protocol accrues more staking rewards.

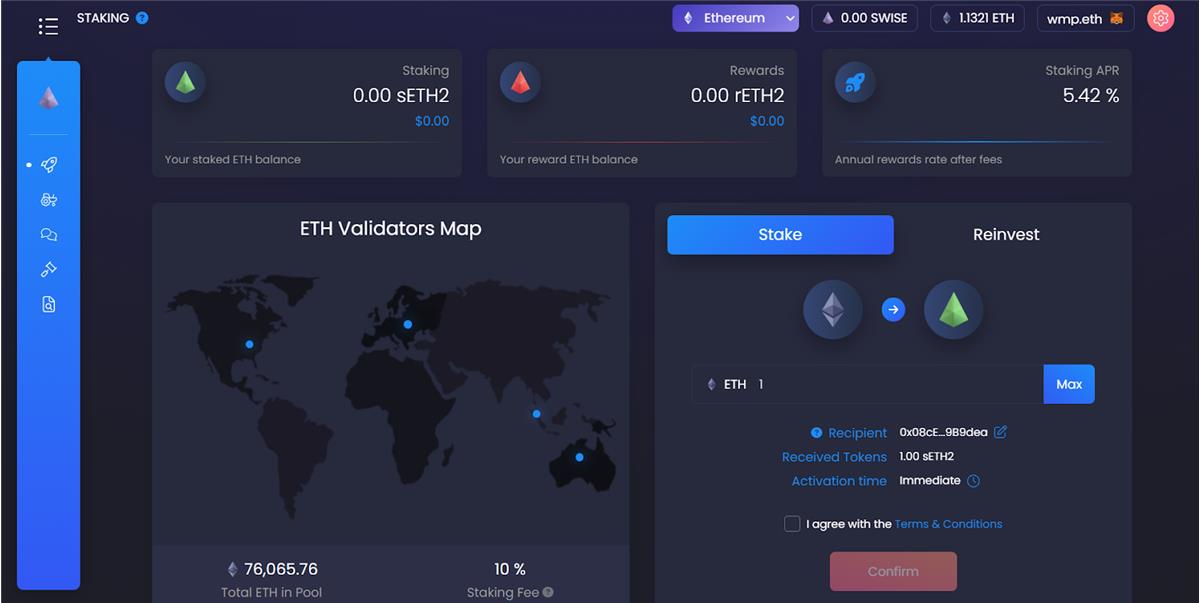

4. StakeWise: sETH2

Current estimated annual yield: 5.4%

StakeWise is another user-friendly Ethereum staking service. Its flagship product is the StakeWise Pool, a non-custodial staking solution allowing users to pool their staked ETH together.

Deposits into the system are tokenized 1:1 as sETH2, a tokenized representation of staked ETH. Since there's no dynamic exchange rate here, StakeWise uses a separate “rETH2” token to represent staking rewards, which begin distributing 24 hours after the initial staking deposit.

Following the upcoming release of StakeWise V3, users will be able to directly burn their sETH2 and rETH2 within the StakeWise app to claim their underlying ETH and rewards.

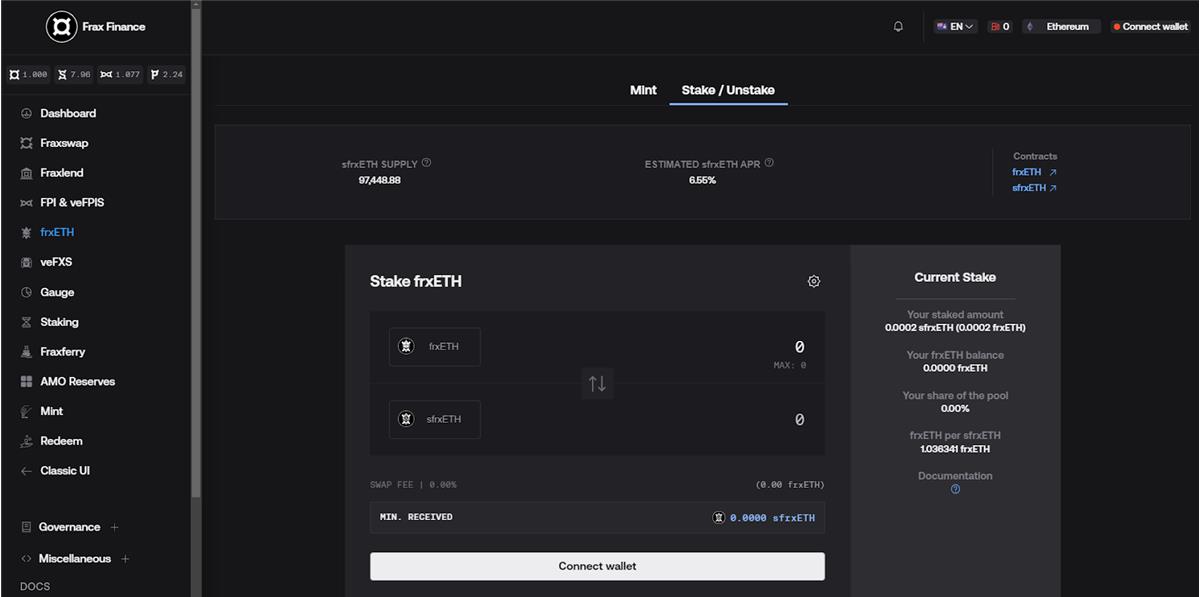

5. Frax Ether sfrxETH

Current estimated annual yield: 6.55%

Frax, the issuer of the FRAX stablecoin, has entered the liquid staking arena with its Staked Frax Ether (sfrxETH) token. Since launch, sfrxETH has rapidly gained market share, capturing 1.99% of the LSD market, making it the fourth-largest token in the category.

Frax ETH is designed similarly to StakeWise V2, where stakers receive two tokens: frxETH represents their underlying ETH deposit, while sfrxETH accumulates staking rewards. This approach enhances capital efficiency by allowing Frax ETH stakers to use frxETH in DeFi protocols to generate additional yield.

Currently, sfrxETH offers an estimated annual yield of 6.55%, making it the most profitable liquid staking token available today. 1 frxETH can currently be exchanged for 0.9646 sfrxETH.

Summary

Overall, as Ethereum staking and the expanding liquid staking landscape evolve, beginners now have access to a range of convenient and profitable options to put their ETH to work.

The five Ethereum staking projects listed above offer simple, high-yield, and diversified options designed to accommodate different preferences and risk profiles.

Whether you want to fund public goods, promote decentralization, or maximize returns, these beginner-friendly staking solutions provide a seamless way to participate in Ethereum’s thriving ecosystem while earning rewards from your assets.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News