Metaverse Sector Outlook for the Next Bull Market (Part 1)

TechFlow Selected TechFlow Selected

Metaverse Sector Outlook for the Next Bull Market (Part 1)

This article explores the current state and challenges of the VR metaverse, providing a detailed analysis of several popular projects by comparing their differences in implementation difficulty, speed of realization, and technological complexity. It also offers readers an in-depth examination of specific segments within the VR metaverse sector and presents outlooks on its future development.

【Introduction】This article explores the current state and challenges of VR metaverse projects, with a focused analysis on three representative projects — Highstreet, MixVerse, and Ceek. It compares them in terms of implementation difficulty, speed, and technical complexity, while offering readers an in-depth look into niche segments within the VR metaverse sector and its future outlook.

The metaverse was once the "brightest star in the night sky" during the previous bull market:

-

After watching *Ready Player One* multiple times, enthusiasts excitedly imagined strapping on golden VR gear and dueling each other with lightsabers within five years;

-

Investors watched Sandbox under Animoca surge from $0.05 at the start of 2021 to $8 by year-end — a staggering 160x return that sent adrenaline rushing;

-

The climax came at the end of October 2021 when Facebook rebranded itself as “Meta,” announcing it would fully commit to building the metaverse. Markets erupted. Ten days later, on November 10, 2021, Bitcoin hit its all-time high of $69,000, and Meta’s stock price soared past $350. The entire crypto and investment world celebrated wildly.

Yet history repeats itself — after reaching its peak, collapse is never far behind. Since late 2021, the crypto industry has plunged into a prolonged bear market, which continues today. A report last October exposed the “metaverse scam”: Meta's Horizon Worlds had only 9% of its scenes attracting 50 or more users, with most areas completely deserted. Meanwhile, two leading metaverse projects in crypto — Decentraland and The Sandbox — reported daily active users of just 38 and 522 respectively, despite both being valued around $1.3 billion. Then ByteDance abruptly shut down its metaverse project “Party Island.”

Is there something fundamentally wrong with the metaverse? Definitely not. Zuck isn’t dumb. Plus, Roblox and Minecraft continue generating steady revenues of $500–600 million annually, with around 50 million DAUs — solid performance by any standard.

The issue lies in how early this space still is — infrastructure remains underdeveloped, narratives overly ambitious, and potential development paths too numerous, making it hard to know where to begin. Roblox succeeded because it identified a clear niche early: educational play and social interaction for kids — a value proposition parents can easily support.

Today’s metaverse struggles resemble the early days of personal computers over two decades ago. A 486 PC cost as much as a typical family’s annual income. Going online required dialing through a landline using a modem (“cat”). For most users, the only practical uses were browsing news websites and checking email. I vividly recall criticisms from print media back then: “Can’t you read news in newspapers? Can’t you write letters instead of emails?” Had people dismissed home computers due to poor initial user experience and limited utility, they might have missed the entire internet revolution.

The future hides in devilish details. I remember how one wealthier classmate convinced his parents to buy him a 486 PC. Initially refused — “I know you just want to play games! And it’s so expensive! Learning programming? Can’t you use the school computer lab? Or read books?” So he borrowed a friend’s computer for three days during summer break, placing it in the living room. He spent daytime hours pretending to study coding, played Minesweeper during breaks, and even taught his parents how to play. On the first night, he woke up and peeked through the door — his parents were still awake, locked in a heated Minesweeper battle… A few days later, a brand-new computer became the centerpiece of their home.

The metaverse is no different. Today’s youth grow up playing Roblox and Minecraft, developing path dependencies toward UGC and in-game socialization. When kids hang out together now, putting on VR headsets to play games is already normal. To the new generation, the metaverse is what Minesweeper was to early PC adopters two decades ago. My conclusion: the metaverse concept itself isn’t flawed — it’s simply that foundational infrastructure hasn’t caught up yet. In another five to ten years, the evolution of metaverse applications will exceed everyone’s imagination.

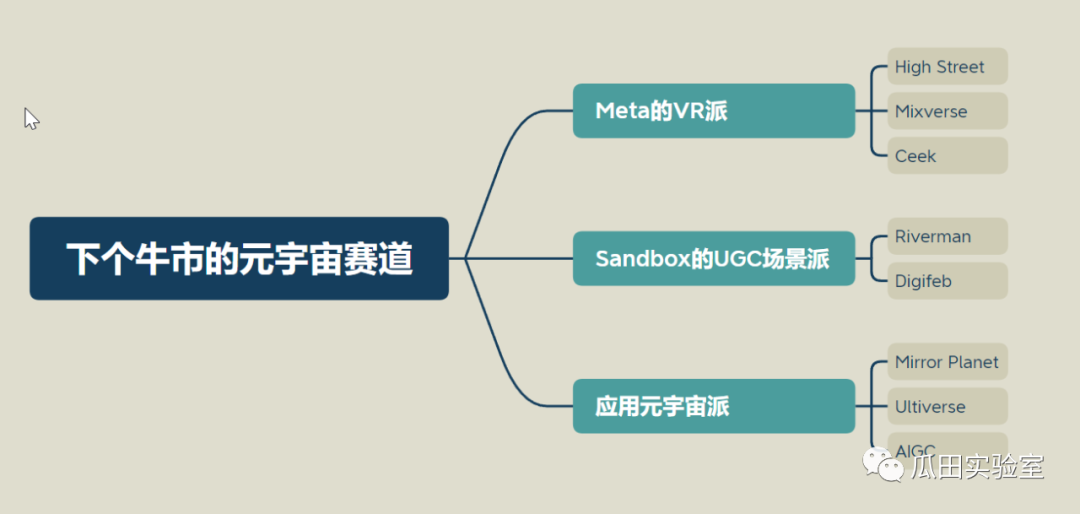

But as a great man once said, “Five or ten years is too long — we must seize the day.” Hehe. Retail investors love miracle stories — buying today and pumping 10x overnight — though such tales usually only happen in dreams. Still, if you position yourself wisely during a bear market, catching a 10x gain when the bull returns is possible. With the next bull run in mind, let’s take a player’s perspective to categorize and analyze the metaverse landscape, identifying promising areas worth watching or planting early seeds. I refuse to believe that next year’s metaverse scene will still revolve solely around Sandbox and Decentraland.

(1) Meta’s VR-Centric Approach

Among players, this category of metaverse experience enjoys the strongest consensus — the path championed by Zuckerberg himself — hardware-driven ecosystem growth.

Unfortunately, it remains in a transitional phase. Meta’s Reality Labs division, responsible for VR hardware, lost $13.72 billion in 2022 — a 35% increase from $10.19 billion in losses the prior year. Wow, Zuck is truly going all-in financially.

Reality Labs sells Quest VR devices. The high-end Quest Pro retails at $1,500 — prohibitively expensive. And experiences in Horizon Worlds quickly become repetitive, resulting in declining retention rates. Over half of Quest users abandon the device within six months, leaving it to gather dust.

Despite burning billions, Zuck continues pushing forward. Recently, Meta introduced two new features: an AI-powered “discovery engine” and short-form video via Reels. Looking ahead, we should watch how Meta integrates AI with its metaverse ambitions.

Within the crypto space, we’ve identified three representative VR metaverse projects:

-

Highstreet

-

Mixverse

-

Ceek

Let’s examine each in detail:

Case A: Highstreet

Highstreet’s most eye-catching moment came earlier this year. On January 30, CZ, CEO of Binance, mentioned in an AMA that he was considering investing in VR or metaverse gaming projects — expressing particular interest beyond existing options. At the time, Highstreet capitalized on this momentum through a marketing partnership with Jay Chou (Jay Zhou).

On that very day, the HIGH token surged from $1.3 to nearly $3.6 — almost tripling. The next day, prices cooled to $2.6, but then came another bombshell: Jay Chou officially signed with Highstreet, pulling the falling token back up to ~$3.6. Over the following week, the price hovered between $3–4, peaking near $4.5.

What kind of product is Highstreet? What gives it the edge to skyrocket and become a darling of the VR metaverse sector?

Let’s start with the team and funding background. Highstreet’s parent company, Lumiere VR, was founded in 2015 by Canadian-Chinese entrepreneur Travis Wu (CEO) and co-founder Jenny Guo. The company focuses on VR monetization of physical spaces, SDK development, and VR data analytics. Core team members come from DeFi, VR, and art industries, with past roles at McKinsey, Sotheby’s, and others. The team appears professionally solid.

The project has completed three major funding rounds. The first, in June 2021, raised $5 million led by Mechanism Capital, NGC Ventures, Palm Drive Capital, Cherubic Ventures, Jump Trading, GBV, Panony, and Shima Capital. The second was a $2 million strategic investment from Binance Labs and Animoca Brands. The third round included strategic investments from Crunchyroll, Twitch, Kabam, Rotten Tomatoes, and Fitbit. Backed by heavyweights like these, especially securing Binance and Animoca in round two, the project gained strong capital and platform support — giving it the muscle to pull off stunts like signing Jay Chou.

What kind of metaverse world is Highstreet trying to build? Simply put: open-world MMORPG + Shopify — colloquially, an e-commerce metaverse.

Highstreet issues NFTs in Phygital format — also known as physical-digital NFTs. Players can redeem blockchain-purchased items as real-world physical goods, enabling O2O (online-to-offline) functionality in crypto. This model allows brands to turn existing products into in-game assets, boosting marketing reach. For players, bringing virtual purchases into reality blurs the line between digital and physical worlds, enhancing immersion and trust in the metaverse experience. Rumor has it the platform may integrate Amazon and other e-commerce giants later, positioning itself as a true gateway to the metaverse economy.

However, we believe traditional e-commerce giants won’t stay idle. Once VR technology matures, these companies will inevitably launch their own metaverse commerce platforms. How Highstreet will compete against such behemoths remains a major uncertainty. Just recently, Amazon signaled it may enter NFTs — likely an early probe. Will Highstreet ride that wave for another hype cycle?

Highstreet Market serves as the exchange for limited-edition products within Highstreet World, with every item having a physical counterpart. It employs bonding curves (similar to AMM automated market makers) to ensure liquidity. Prices float dynamically based on purchase activity. Bonding curves guarantee counterparty availability, and brands can customize their own curves to incentivize transactions or offline redemptions.

Currently, Highstreet World consists of six explorable regions: Highstreet City, Binance Beach, AVAX Alps, Asteroid 325, Animoca Archipelago, and Republic Realm. Gameplay includes leveling up, purchasing homes, battling, raising pet NFTs, and more. Binance plans to build a “Binance Beach” in-game, offering access to its services and DeFi products. Animoca Brands will bring in various well-known IPs and brands to expand the ecosystem’s influence.

Economically, Highstreet uses a dual-token model. The primary token HIGH is used for staking, governance (proposing and voting), and in-game transactions (real estate, limited editions). Total supply is capped at 100 million, with 33 million currently circulating. HIGH is listed on Binance, Coinbase, Crypto.com, and other centralized exchanges; DEX users can trade on PancakeSwap and Uniswap. The secondary token, STREET, is an inflationary in-game currency with no fixed cap, minted as players progress. Users earn STREET by slaying monsters, completing quests, treasure hunts, or by swapping HIGH tokens.

On the surface, Highstreet looks impressive — ticking all the boxes of a top-tier project. Its secondary narrative of “metaverse e-commerce” is particularly compelling. But is this truly the most efficient development path for the metaverse today? What’s the actual experiential difference between wearing a VR headset to shop versus tapping on淘宝, JD, or Amazon? Converting thousands of brands and product lines into metaverse-compatible formats will be a long, resource-intensive journey. Can Highstreet really win this marathon?

These questions are partly answered by the project’s roadmap execution. Last year, the team confidently declared 2022 would be a “harvest year,” unveiling an ambitious release schedule:

Highstreet Project 2022 Roadmap

Yet visiting the official website today, only a basic web-based indoor space is available — no character skins, limited interactivity, and laggy performance. Fellow retail investors, try it yourselves. Our impression? Huge disappointment. Given all the hype and favorable conditions, this is it? Hehe. Guess we’ll just have to wait longer.

Case B: MixVerse

We first noticed MixVerse in early November last year when the project launched its Mint Pass cards. At the time, deep in a brutal bear market, activity across sectors was stagnant. The NFT market was dead silent. It was rare to see any project brave enough to launch NFTs against the trend.

As retail investors, we follow price action. Starting February this year, we observed increased activity from the team and volatile price movements, prompting us to dive deeper. Over recent weeks, the Pass card price has fluctuated significantly — rising from 0.01 ETH before the February campaign to nearly 0.1 ETH by early March, though it has since pulled back, possibly due to Blur ending double points and cracking down on manipulators. Next month, the project will mint land NFTs and officially open public game testing. Whether this triggers another rally remains to be seen — definitely worth monitoring.

Unlike Highstreet, MixVerse lacks flashy investors or celebrity endorsements. From several AMAs, we learned it’s built by a long-standing Web2 VR gaming team determined to transition into Web3. Their goal is to create a VR gaming metaverse platform, leveraging open ecosystems and distribution channels to drive traffic and establish a sustainable metaverse gaming economy.

The MixVerse team has already developed several VR mini-games. Their flagship title, *Fantasy Skiing 3* (available on Pico stores), will be upgraded and integrated into the MixVerse platform. Other completed VR mini-games will also be brought onto the platform, and they plan to invite more developers to publish games here.

The team has been working on VR since 2016 — eight years of hands-on experience. During a Binance Live AMA session, they invited numerous VR experts and academics. The *Fantasy Skiing* series was once the top-downloaded sports title on Steam VR, with nearly three million downloads globally, and was featured as an official game during the Beijing Winter Olympics.

Core team members hail from the U.S., Hong Kong, and mainland China, giving them solid international exposure. CEO David frequently appears in AMAs. According to official disclosures in November last year, MixVerse completed its first funding round with an undisclosed investor, valuing the project at $20 million.

What kind of metaverse world does MixVerse envision? Beyond integrating existing platform games, MixVerse has its own core gameplay loop. Players engage in survival, career progression, construction, collaboration, and competition. They can build homes on land, form communities, establish councils, guilds, and associations, and participate in treasure hunting, trading, and competitive events. Early stages focus on PGC content, gradually introducing third-party developers (PUGC), and eventually enabling full UGC through robust map editing tools.

According to the official site, the first publicly accessible continent is called Edenia (the Free Continent). Based on demo videos, the game’s maturity level is already quite high, featuring key locations such as the MixVerse Metaverse Pedestrian Street, skiing zones, bars, conference halls, and exhibition centers.

In terms of tokenomics, MixVerse also adopts a dual-token model. MIX serves as the deflationary governance token, while CHAOS is the infinitely inflatable utility token. Neither token has launched yet, meaning the project remains in early stages.

For players, a standard VR setup costs around $300–500, making the entry somewhat heavy. To lower barriers, the team is simultaneously developing an H5 version playable on mobile phones. The nightclub gameplay is already accessible on the website (and farmable). This multi-platform design allows users to log into the MixVerse metaverse anytime, anywhere, across devices.

Compared to Highstreet, MixVerse resembles a Web2 VR gaming platform expanding into the metaverse. We highlight this project because among today’s Web3 metaverse offerings, very few provide actual playable content. Most are just showcase platforms where users walk around aimlessly or complete simple tasks. MixVerse, however, already has functional gameplay — including a nightclub mode now live, with skiing scenarios coming soon. Compared to Highstreet’s web-based vision, MixVerse wins hands-down in product completeness.

Our biggest concern? Can a Web2 team successfully adapt to Web3’s operational and marketing norms? We’ve seen many capable Web2 teams fail in Web3 simply because they stuck to old playbooks.

Case C: Ceek

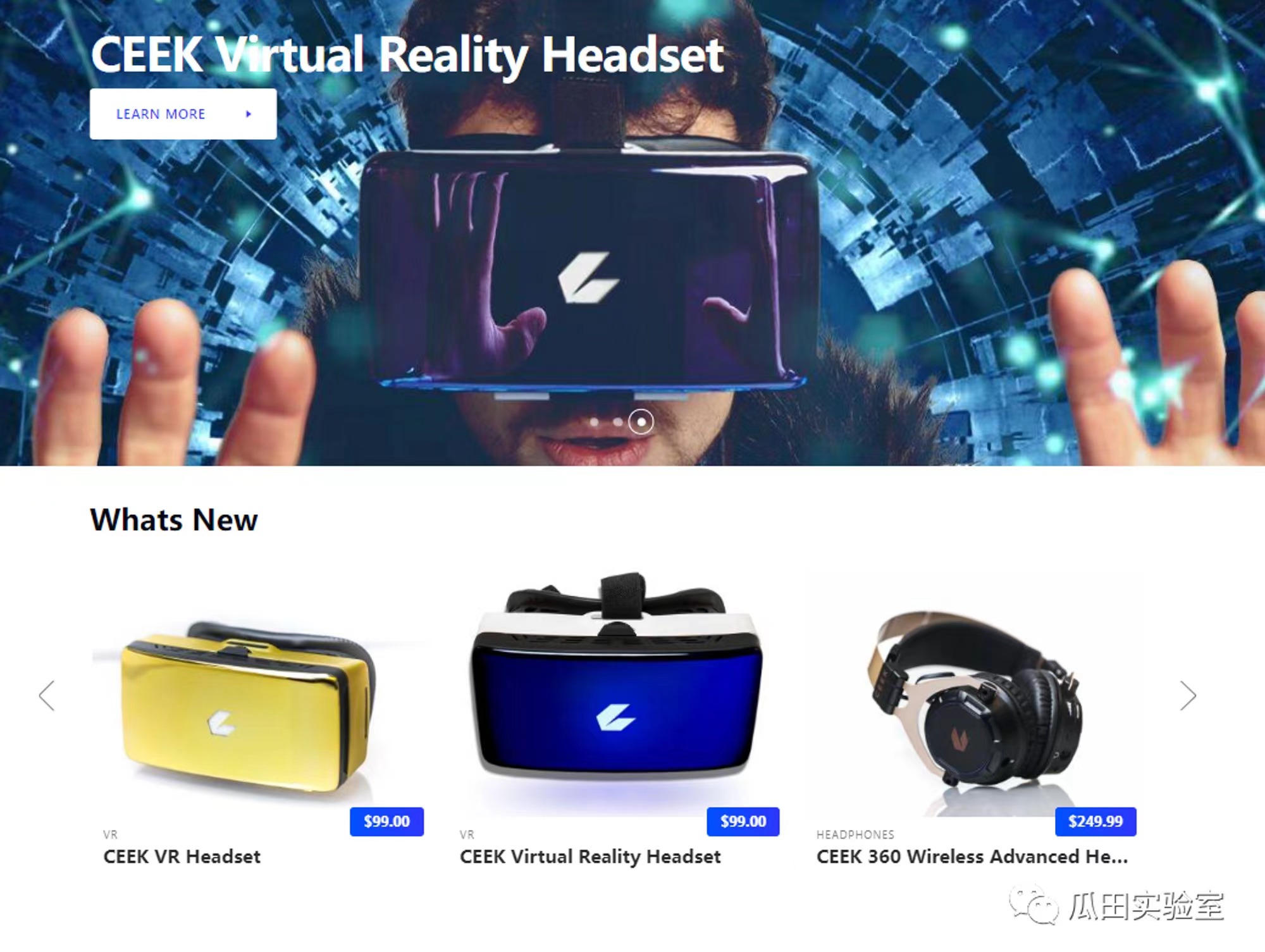

While researching Web3’s VR metaverse landscape, we discovered another contender — Ceek. CEEK is a company building AR/VR wearable devices, while also operating as a distributor and media platform for virtual experiences. Artists can share albums or music via blockchain-powered platforms on CEEK wearables, or establish VR/AR studios to create fan-favorite branded content. Powered by Ethereum smart contracts, users can tip, vote, attend events, and trade virtual items seamlessly within the platform.

CEEK has attracted prominent figures from global music, sports, and entertainment, with elite partners including Universal Music, Apple, and T-Mobile. Thanks to its star power, the project enjoys relatively high visibility in the crypto space. CEEK enables creators to patent and monetize content through virtual streaming platforms, reaching global audiences. It opens new revenue streams for musicians and artists, offering a direct way to connect with fans and profit from that relationship.

Visiting the platform’s website, beyond selling VR headsets and headphones tied to music content, there’s a large library of celebrity livestream videos and virtual land sales priced in several ETH — luxury pricing indeed. Such star appeal makes the idea of becoming neighbors with celebrities in Ceek’s virtual world highly enticing.

In short, Ceek’s metaverse is a small,精致, celebrity-driven “luxury” platform. While it offers virtual land, its overall metaverse architecture remains underdeveloped. Focusing narrowly on music and media, the platform struggles to host diverse, expansive metaverse content, suggesting Ceek will cater to a niche audience of celebrity fans — essentially functioning as a private traffic domain.

Summary of This Article

This article marks the first installment in our recent deep dive into the Web3 metaverse sector, focusing on the sub-segment of hardcore VR metaverse projects. We analyzed three representative cases — Highstreet, MixVerse, and Ceek — exploring their current states and challenges.

When comparing Highstreet’s e-commerce metaverse with MixVerse’s gaming-focused approach, which represents a better path forward today? These two models reflect the two dominant trajectories in metaverse development:

-

In terms of implementation difficulty, compared to the complex integration of physical and digital goods required by e-commerce metaverses, gaming metaverses operate entirely in virtual environments, leveraging established game development frameworks — making them inherently easier to execute;

-

In terms of implementation speed, transforming a limited number of games is far faster and more efficient than digitizing millions of physical products;

-

In terms of technical difficulty, e-commerce metaverses require extensive infrastructure to fully mirror and display real-world goods in virtual space, whereas gaming metaverses only need to horizontally expand and enrich existing game platforms and content.

Clearly, from all three perspectives, gaming metaverses are more feasible in the current stage. Meanwhile, Ceek’s celebrity-driven model could unlock massive potential if it successfully brings in significant Web2 private traffic.

In upcoming articles, we’ll explore two other metaverse subcategories — UGC metaverses and application-oriented metaverses. Stay tuned!

Reposting is welcome. Original work requires attribution to “W Labs, Melon Field Lab”

W Labs Website: http://www.wlabsdao.com/

W Labs Discord: https://discord.gg/wggdao

W Labs Twitter: https://Twitter.com/GuaTianGuaTian

W Labs Long-form Research on Mirror: https://mirror.xyz/iamwgg.eth

W Labs on Medium: https://guatianwgg.medium.com/

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News